aimintang

Earnings of Prosperity Bancshares, Inc. (NYSE:PB) will most probably remain flattish this year relative to last year. Decent loan growth and slight margin expansion will likely drive the top line. On the other hand, an increase in expenses proportional to loan growth will keep earnings flattish. Overall, I’m expecting Prosperity Bancshares to report earnings of $5.64 per share for 2022, up by just 0.6% year-over-year. Compared to my last report on the company, I’ve slightly increased my earnings estimate mostly because I’ve tweaked upwards my loan growth estimate. The year-end target price suggests a small upside from the current market price. Therefore, I’m maintaining a hold rating on Prosperity Bancshares.

Loan Portfolio’s Good Performance in 2Q Likely to Recur

After seven consecutive quarters of decline, the loan portfolio finally turned around in the second quarter of 2022 and grew by 2.4%. Now that the paycheck protection program forgiveness is almost over, the loan portfolio will likely continue to grow in the coming quarters. As mentioned in the conference call, the management is positive that it can achieve mid-single-digit loan growth for 2022. As historically too loan growth, excluding acquisitions, has remained in the mid-single-digit range, the management’s target for 2022 appears reasonable.

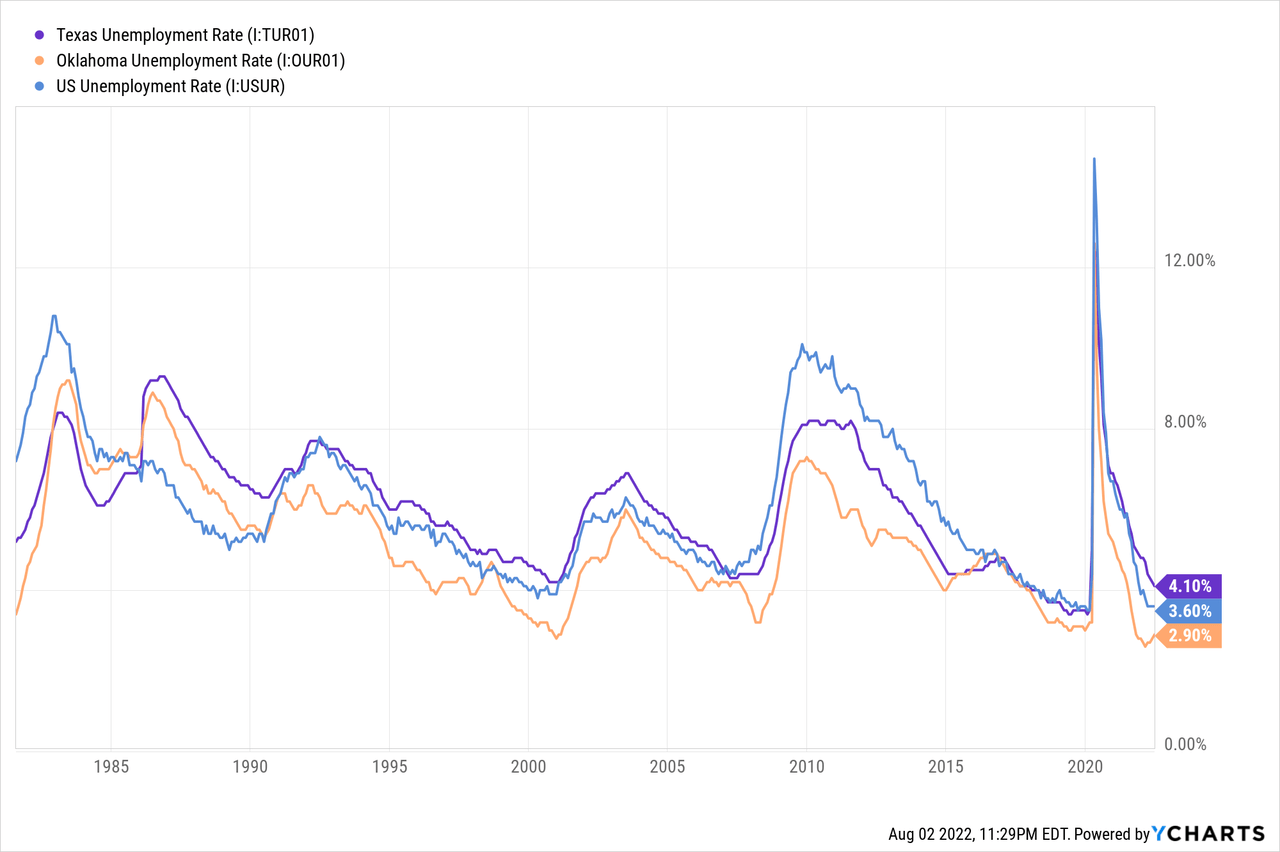

Further, Prosperity Bancshares operates in the states of Texas and Oklahoma, where strong job markets bode well for loan growth. While Oklahoma has a remarkably strong job market with an unemployment rate much below the national average, Texas’ labor market isn’t that strong. Nevertheless, both states have unemployment rates near multi-decade lows, as shown below.

Overall, I’m expecting the loan portfolio to grow by 3.4% in 2022. In my last report on Prosperity Bancshares, I estimated the loan portfolio to decline by 2.3% this year. I’ve revised my loan growth estimate due to the second quarter’s good performance and an improved outlook.

Rising Interest Rates to Hurt the Securities Portfolio

Rising interest rates will have a negative impact on securities, and consequently equity. Prosperity Bancshares has a big investment securities portfolio, which made up 40% of total assets at the end of June 2022. As most securities carry fixed rates, their value will fall as rates rise. This means the book value per share is set to take a material hit from rising interest rates this year.

Overall, I’m expecting the securities portfolio to grow by 4% and common equity to grow by 2% in the second half of 2022, (earnings and dividend estimates, which also drive the equity balance, are discussed below). The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | |

| Financial Position | |||||

| Net Loans | 10,284 | 18,758 | 19,931 | 18,330 | 18,944 |

| Growth of Net Loans | 3.5% | 82.4% | 6.3% | (8.0)% | 3.4% |

| Other Earning Assets | 9,439 | 8,571 | 8,590 | 12,826 | 15,515 |

| Deposits | 17,257 | 24,200 | 27,360 | 30,772 | 31,072 |

| Borrowings and Sub-Debt | 1,316 | 1,807 | 390 | 449 | 813 |

| Common equity | 4,053 | 5,971 | 6,131 | 6,427 | 6,650 |

| Book Value Per Share ($) | 58.1 | 81.2 | 65.9 | 69.7 | 72.5 |

| Tangible BVPS ($) | 30.4 | 36.2 | 30.4 | 34.0 | 36.6 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Margin is Only Moderately Sensitive to Rate Changes

Prosperity Bancshares’ loan book is quite responsive to rate changes. This sensitivity is attributable to the floating and variable-rate loans that altogether made up 59.5% of total loans at the end of June 2022, as mentioned in the earnings presentation.

Unfortunately, the deposit book also re-prices quickly because of the concentration in interest-bearing transaction deposits. Money market, savings, and non-interest-bearing demand deposits altogether make up a hefty 71.2% of total deposits at the end of June 2022. Moreover, the large securities portfolio is mostly based on fixed rates, which will drag the average earning asset yield in a rising interest-rate environment. The average duration of the securities portfolio is quite long at around 4.6 years, as mentioned in the earnings presentation.

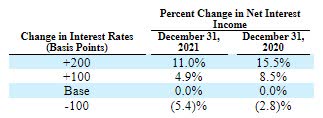

The results of the management’s interest-rate sensitivity analysis given in the 10-K filing showed that a 200-basis points hike in interest rates could boost the net interest income by 11% over twelve months. (Prosperity Bancshares has not provided any quarterly updated results for the rate-sensitivity analysis so far this year). This analysis assumed an interest rate shock. In reality, the interest rate hike has been gradual. Therefore, the impact of the rate hike will be much lower than 11%.

2021 10-K Filing

Considering these factors, I’m expecting the margin to grow by six basis points in the second half of 2022 from 2.97% in the second quarter of the year.

Normalized Provisioning Likely for the Remainder of the Year

Prosperity Bancshares has not booked any net provision expense in the last seven consecutive quarters. This tradition will most probably break in the second half of 2022 mostly because of the heightened interest rates. Some of the borrowers on floating rates who are already stressed because of high inflation may be pushed into default by elevated borrowing costs. Moreover, banks may want to bolster their loan loss reserves ahead of a possible recession.

Overall, I’m expecting the provision expense to return to a normal level in the second half of 2022. However, due to zero provisioning reported for the first half, the net provisioning for the full year will likely remain below normal. I’m expecting Prosperity Bancshares to report a net provision expense of 0.04% of loans for 2022. In comparison, the net provision expense averaged 0.09% of total loans in the last five years.

Expecting Flattish Earnings for This Year

I’m expecting Prosperity Bancshares to report flattish earnings for 2022 as higher net interest income will likely cancel out greater provision and non-interest expenses. Overall, I’m expecting the company to report earnings of $5.64 per share in 2022, up by just 0.6% from last year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | |

| Income Statement | |||||

| Net interest income | 630 | 696 | 1,031 | 993 | 1,008 |

| Provision for loan losses | 16 | 4 | 20 | – | 8 |

| Non-interest income | 116 | 124 | 132 | 140 | 147 |

| Non-interest expense | 326 | 397 | 497 | 474 | 485 |

| Net income – Common Sh. | 322 | 333 | 529 | 519 | 518 |

| EPS – Diluted ($) | 4.61 | 4.52 | 5.68 | 5.60 | 5.64 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

In my last report on Prosperity Bancshares, I estimated earnings of $5.48 per share for 2022. I’ve revised upwards my earnings estimate mostly because I’ve increased my loan growth estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

Current Market Price is Quite Close to the Year Ahead Target Price

Prosperity Bancshares has a long-standing tradition of increasing its dividend in the last quarter of the year. Given the earnings outlook, it’s likely that the company will maintain the dividend trend this year. Therefore, I’m expecting the company to increase its dividend by $0.03 per share to $0.55 per share in the fourth quarter of 2022. The earnings and dividend estimates suggest a payout ratio of 37% for 2022, which is close to the five-year average of 35%. Based on my dividend estimate, Prosperity Bancshares is offering a dividend yield of 2.9%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Prosperity Bancshares. The stock has traded at an average P/TB ratio of 2.17x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 30.4 | 31.1 | 30.4 | 34.0 | ||

| Average Market Price ($) | 71.5 | 69.6 | 59.7 | 72.7 | ||

| Historical P/TB | 2.35x | 2.24x | 1.96x | 2.14x | 2.17x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $36.6 gives a target price of $79.6 for the end of 2022. This price target implies a 9.3% upside from the August 2 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.97x | 2.07x | 2.17x | 2.27x | 2.37x |

| TBVPS – Dec 2022 ($) | 36.6 | 36.6 | 36.6 | 36.6 | 36.6 |

| Target Price ($) | 72.3 | 76.0 | 79.6 | 83.3 | 87.0 |

| Market Price ($) | 72.9 | 72.9 | 72.9 | 72.9 | 72.9 |

| Upside/(Downside) | (0.8)% | 4.2% | 9.3% | 14.3% | 19.3% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 13.6x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 4.61 | 4.52 | 5.68 | 5.60 | ||

| Average Market Price ($) | 71.5 | 69.6 | 59.7 | 72.7 | ||

| Historical P/E | 15.5x | 15.4x | 10.5x | 13.0x | 13.6x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $5.64 gives a target price of $76.6 for the end of 2022. This price target implies a 5.1% upside from the August 2 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 11.6x | 12.6x | 13.6x | 14.6x | 15.6x |

| EPS 2022 ($) | 5.64 | 5.64 | 5.64 | 5.64 | 5.64 |

| Target Price ($) | 65.4 | 71.0 | 76.6 | 82.3 | 87.9 |

| Market Price ($) | 72.9 | 72.9 | 72.9 | 72.9 | 72.9 |

| Upside/(Downside) | (10.3)% | (2.6)% | 5.1% | 12.9% | 20.6% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $78.1, which implies a 7.2% upside from the current market price. Adding the forward dividend yield gives a total expected return of 9.9%. As this expected return is not high enough for me, I’m adopting a hold rating on Prosperity Bancshares.

Be the first to comment