Editor’s note: Seeking Alpha is proud to welcome Pragmatic Value Investing as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Vladimir Zakharov/iStock via Getty Images

Smith & Wesson Brands, Inc. (NASDAQ:SWBI) designs, manufactures, and sells firearms, but through the years has ventured into other segments that are somewhat related to their main business, like outdoor products and security services. But since the spinoff of the Outdoor division on August 24, 2020, the company its back to its roots in the firearms industry.

Understanding The Cycle

I have read many articles about the company here, and in my opinion, most do not tackle the main characteristic of SWBI: That is a deeply cyclical business and any bullish or bearish take on it should start and end with analyzing the stage of the cycle in which the company is at any given moment.

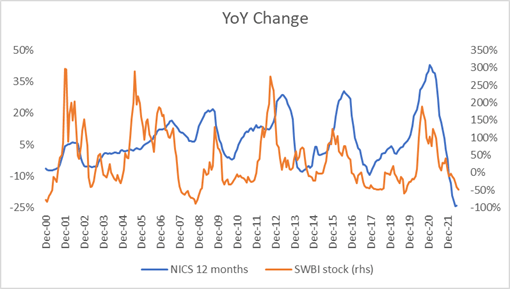

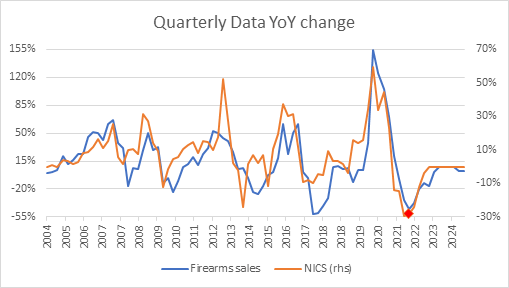

The next chart tracking the dynamics between the stock performance and NICS Firearms Background Checks published by the FBI is a good way to visualize this cyclicality. And it shows that right now the stock is much closer to the bottom of the cycle.

FBI

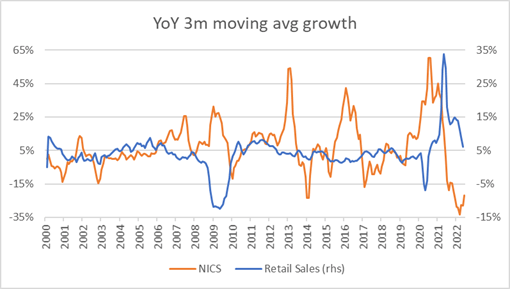

The company is classified in the Consumer Discretionary Sector, but the good news is that its cycle is pretty much unrelated to the consumer cycle that you can track with Advanced Retail Sales. And given the current macro backdrop, that is a critical issue.

FBI and U.S. Census Bureau

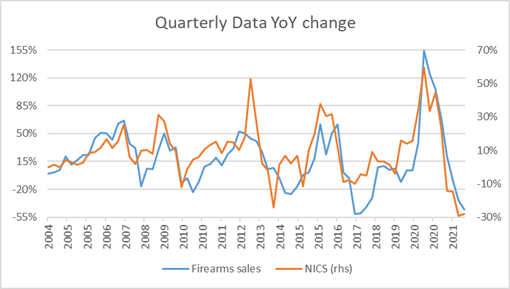

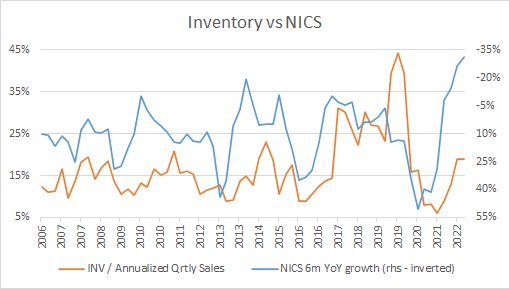

Another important point to consider is the fact that these cycles affect the company through an inventory cycle in two different stages of the distribution chain. The one that you can track by looking at the inventory figures that the company reports, and another that you cannot see (or maybe you can, and I don’t know how) that relates to the inventory of the distribution channel. With the company’s inventory going one or two months behind the inventory of the distribution channel, the changes in Firearms sales (excluding all non-firearm sales) tend to be higher than the change in NICS statistics in what might be explained by some form of bullwhip effect as you can see in the next chart.

FBI and SWBI financial releases

This chart also serves the purpose of showing that the raw NICS statistics published by the FBI are a pretty good proxy to track the cycle, even though I am aware that the company tracks the adjusted NICS reported by the NSSF.

All those charts shows that SWBI is not a stock to just buy and forget about, it’s a deeply cyclical company in an industry that has sufficient industry data to make those cycles somewhat predictable and you should try to buy the stock near the bottom of the cycle as measured by NICS statistics and sell or even short near the top.

The question now is if we are at the bottom of the cycle or not. My view is that we are close to it, but if I was trying just to time the cycle, I should have waited to put this out after the next quarterly results encompassing the months of May through July. But there is a catalyst that may manifest itself in the next few weeks. More on that later.

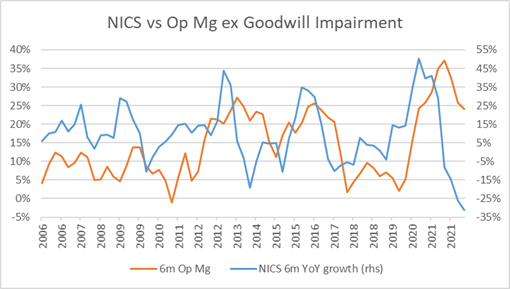

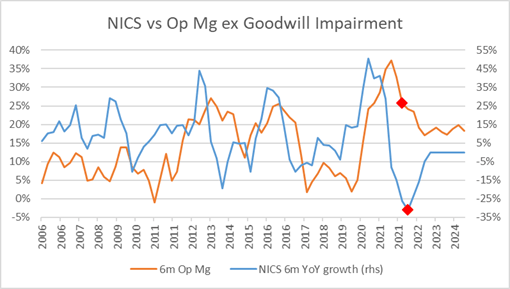

First, let’s look at how well has the company done during the current downturn in the NICS cycle with respect to past episodes. For that, I used 6 months metrics to isolate the last two quarters that incorporate literally the worst 6 months decrease in NICS figures in the history that the FBI reports (starting December 1998).

FBI and SWBI financial releases

I would say it has done pretty well. The reduction in margins has been moderate considering the level of reduction in NICS figures.

A critical point relating to their ability to maintain margins is the management of inventories.

FBI and SWBI financial releases

And regarding this point they have performed in line with previous cycles, but much better than during the last downturn. Anyway, I expect inventory to quarterly annualized sales to increase and probably peak on the next quarter considering that two of the months (may/June) that make that quarter are showing a reduction of 21.7% versus last year and for the fact that the next quarter tend to be the weakest in terms of seasonality. So again, if you just want to time the bottom of the cycle, you should wait for the next quarterly results.

Solid Balance Sheet and Compelling Valuation

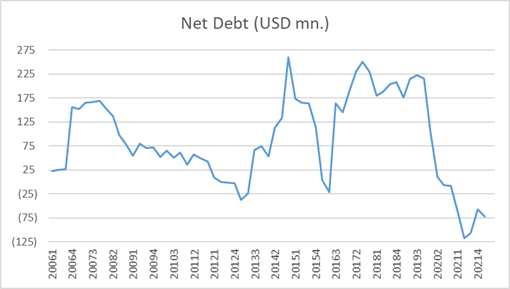

Changing subjects, it’s important to point out that the company is in one of its better positions historically speaking in terms of indebtedness, with negative net debt and $120 million in cash.

SWBI financial releases

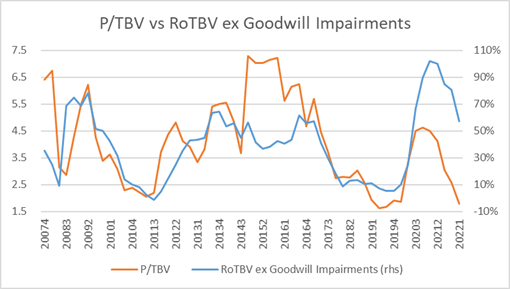

Another point is that the stock is trading very close to the bottom range of Price to Tangible Book Value at less than 2 times. And that, for a company that on average has printed a Return on Tangible book value close to 40% seems quite attractive.

SWBI financial releases

I know that I am subtracting goodwill and long-lived asset impairments to get to that return, so let’s check the historical impairments that the company has reported in the past 14 years to check if that is reasonable.

The first one occurred in the quarter ending October 2008, at the peak of the 2008 financial crisis, when they reported a $98 million impairment. This was the only impairment related to their main firearms business.

The second one occurred during the quarters ending October 2010 and January 2011 for a total of $90 million relating to the security services segment that they exited a couple of years later.

The third one occurred during the quarter ending January 2019 for $10 million relating to part of their business that was later integrated into the outdoor segment that was spun out on august 2020.

And the final one occurred during the quarter ending April 2020 during the peak of the COVID outbreak for $99 million also relating to the outdoor division that they later spun out.

So, I think it’s valid to look at RoTBV ex those items as long as the company stays focused on their main line of business. And of course, if at any time management starts branching out into somewhat related new businesses, I would be the first to sell my position, their track record is not the best one outside of their niche.

But let’s look forward a little bit to see how the company should look after the next two quarters when the whole impact of the downturn should be reflected. In the last call management pointed out to calendar year 2019 as a framework for the coming months, so I am assuming the next 6 months (July – December) of the NICS figures are going to be the same as they were in 2019 and then I repeat 2022 month by month in 2023 and 2024 without any upturn in demand to be extra conservative (and going against historical patterns).

On the next few charts, the red dots mark the last real data and after that are projections.

FBI, SWBI financial releases and author estimates

That would translate (in the next chart) into a reduction of more than 5 percentage points in Operational Margin even though the last two quarters already faced a reduction in sales bigger than what I expect for the next two.

FBI, SWBI financial releases and author estimates

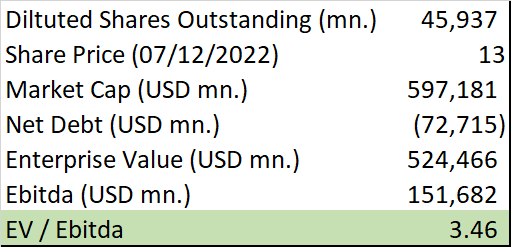

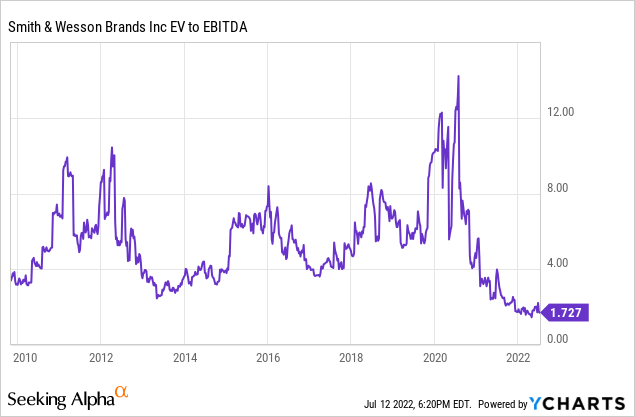

And that in turn would translate into a 12-month EBITDA falling from $282 million to $151 million at the absolute bottom of the cycle. Under those assumptions, with today’s EV will leave the company trading at a valuation level of 3.46 times EV/EBITDA, which does not seem demanding and its way bellow historical averages.

SWBI financial releases and author estimates

During the last 7 years on an aggregate basis the company has turned around 65% of EBITDA into FREE CASH FLOW. So, if you assume that the company stays at that bottom of the cycle forever (that is more than conservative in my opinion), the company should be able to generate $99 million of FCF which puts the stock at a decent 16% FCF yield and a dividend yield of 3% that is covered with less than 20% of FCF.

But there is one unfortunate situation, the company has been forced by the risk of state legislation in Massachusetts that would prohibit the manufacturing of certain firearms, to move its headquarters and part of its manufacturing to Tennessee. This process would require $120 million in capex and around $12 million in one-time expenses, so FCF for the next 12 months should be close to zero or slightly negative.

Apart from that, if you agree with what I consider to be conservative assumptions I don’t see any other significant issue to point at.

Buybacks

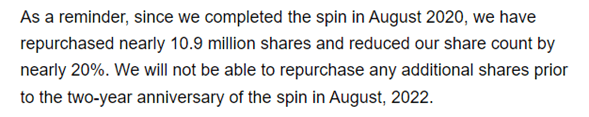

So, let’s go back to that catalyst: stock repurchases. The company completed its latest stock repurchase authorization during the quarter ending January 2022 and they are not allowed to continue with more stock repurchases until the second anniversary of the spinoff of the outdoor segment into what is today American Outdoor Brands, Inc. (AOUT).

The following is a comment from the CFO taken from the transcript of the latest quarterly earning call.

Seeking Alpha Transcript

And that critical two-year anniversary date is August 24, 2022, six weeks away and prior to the release of the next quarterly results. So, let’s do some numbers: the company now holds $120 million in cash with zero financial debt, that alone should be sufficient to fund the extra capital expenditures. That in turn should leave the roughly $99 million of FCF to return to shareholders, $18.5 of those should go to dividends, making a $50 million (8% of the market cap) repurchase authorization a very realistic prospect.

Risks

Gun legislation is always a possibility, in fact, their relocation to Tennessee is related to it, but considering the prospects for the coming mid-term elections, it’s not something that I am overly worried about.

There is also the possibility of execution problems with their new facilities in Tennessee that might lead to expenses going over their guidance.

I think my assumptions for the NICS cycle are overly conservative and well-grounded in historical patterns, but there is always the possibility of something disrupting those patterns for the worst.

And finally, I think it’s important to mention that there are many macroeconomic risks on the horizon, with authorities significantly constrained by inflation. So, if the future brings anything close to a 2008 event, none of these arguments will matter and the stock probably will go down with the market.

Conclusion

Smith & Wesson Brands, Inc. is a very cyclical company closer to the bottom of the cycle and its stock is trading at very compelling multiples even when considering bottom of the cycle financials. The company has the cash and balance sheet to face its capex requirements, it pays a decent 3% dividend yield covered multiple times by FCF and there is a very realistic potential of buybacks in relation to a specific event (the two-year anniversary of the spin-off of AOUT).

And just to finalize, it is important for me to point out that I am not married to this view, and I welcome any constructive criticism and new information that may help me improve my understanding of the company.

Thanks for reading and good luck with your investments!

Be the first to comment