Stefan Rotter

EIA-914 report came out today and US oil production came in at 11.975 million b/d, up from 11.873 million b/d in July. Texas and New Mexico (Permian) provided the main source of growth, but that’s about it. US shale isn’t what it used to be, not even close.

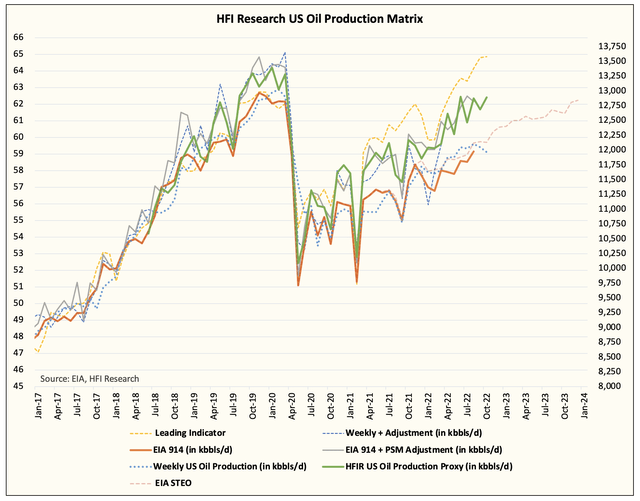

Here’s a snapshot of our US oil production matrix. What you will notice is that the leading indicator (the yellow dotted line) is well above any of the oil readings. That’s because the leading indicator is associated gas production, and it has now surpassed the previous high in 2019. The only issue this time is that the crude oil production element of this has not kept up.

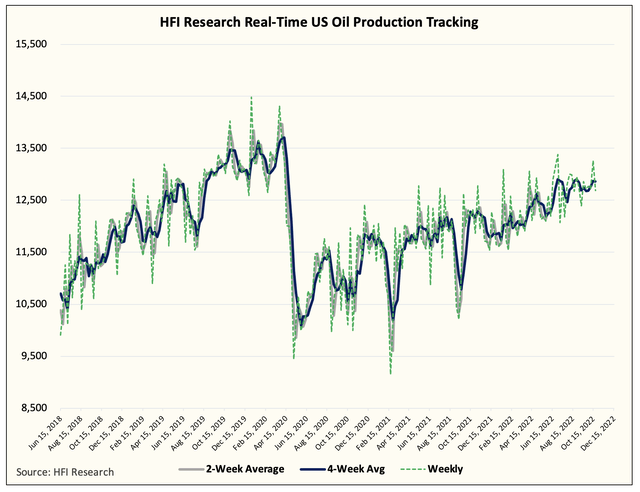

We can double verify that US oil production has not surprised to the upside by tracking our weekly production tracker.

As you can see, US oil production remained relatively flat since August. As of today, US oil production is coming in at ~12 to ~12.1 million b/d. With October and November usually the peak for the year, it’s highly unlikely that we see US oil production finish the year around ~12.4 to ~12.5 million b/d.

Given the latest August figure, we think US oil production finishes year-end at ~12.15 million b/d. This would represent an exit-to-exit production growth rate of ~600k b/d. This would be a growth rate of just ~50k b/d per month versus the ~200k b/d per month we saw in 2018.

Based on this, readers should reach the two following conclusions:

- US shale companies are doing exactly what they said they would. They are focused on returning capital back to shareholders via dividends and share buybacks. And they are remaining disciplined.

- US shale oil companies are seeing newer wells getting gassier. The crude oil weighting is decreasing, while the NGL weighting is increasing.

As a result, US shale will likely never return back to its old glory. In fact, we would almost go as far as saying that most companies can’t produce all out even if they wanted to. For starters, shareholders would revolt if they even attempted to, and second, the inventory depletion rate won’t be sustainable.

Setting aside the equipment constraints, lack of workers, and other restraints, it’s safe to say by now that US shale won’t be back to the way it grew in 2018. For oil bulls, that’s one less headache you have to worry about going forward.

HFI Research, #1 Energy Service

For energy investors, the 2014-2020 bear market has been incredibly brutal. But as the old adage goes, “Low commodity prices cure low commodity prices.” Our deep understanding of US shale and other oil market fundamentals leads us to believe that we are finally entering a multi-year bull market. Investors should take advantage of the incoming trend and be positioned in real assets like precious metals and energy stocks. If you are interested, we can help! Come and see for yourself!

Be the first to comment