Lacheev/iStock via Getty Images

A Quick Take On Bumble

Bumble Inc. (NASDAQ:BMBL) went public in February 2021, raising approximately $2.15 billion in an IPO that priced at $43.00 per share.

The firm operates social networking and dating apps for individuals in numerous countries.

I’m concerned about the effects of a general growth slowdown or outright recession in major countries in which the firm operates.

So, I’m on Hold for BMBL for the near term, but like its recent progress in reaching operating breakeven.

Bumble Overview

Austin, Texas-based Bumble was founded to develop the Bumble and Badoo apps for dating, networking and expanding personal relationships for individuals worldwide.

The firm’s business model is a “freemium” model, whereby the apps are initially free to use, but a subset of users pays a subscription and also makes in-app purchases for premium features.

Management is headed by founder and Chief Executive Officer Whitney Wolfe Herd, who was previously co-founder of Tinder, a dating application.

The firm markets its mobile apps via major mobile app platforms, social media, online advertising and word of mouth.

The Bumble app was designed to encourage women to ‘make the first move’ to connect with other members.

Bumble’s Market & Competition

According to a 2019 market research report, the global dating services market was an estimated $6.7 billion in 2018 and is forecast to reach nearly $10 billion by 2026.

This represents a forecast CAGR of 5.2% from 2019 to 2026.

The main drivers for this expected growth are the increasing usage of online media for personal requirements and improving technologies and convenience by new dating services and apps.

However, the industry contends with continued fake account generation and spam activity, reducing trust among genuine users.

Major competitive or other industry participants include:

-

Grindr

-

Love Group Global

-

Eharmony

-

The Meet Group

-

Spice of Life

-

Match Group (MTCH)

-

Spark Networks

-

Zoosk

-

Other smaller players

Bumble’s Recent Financial Performance

-

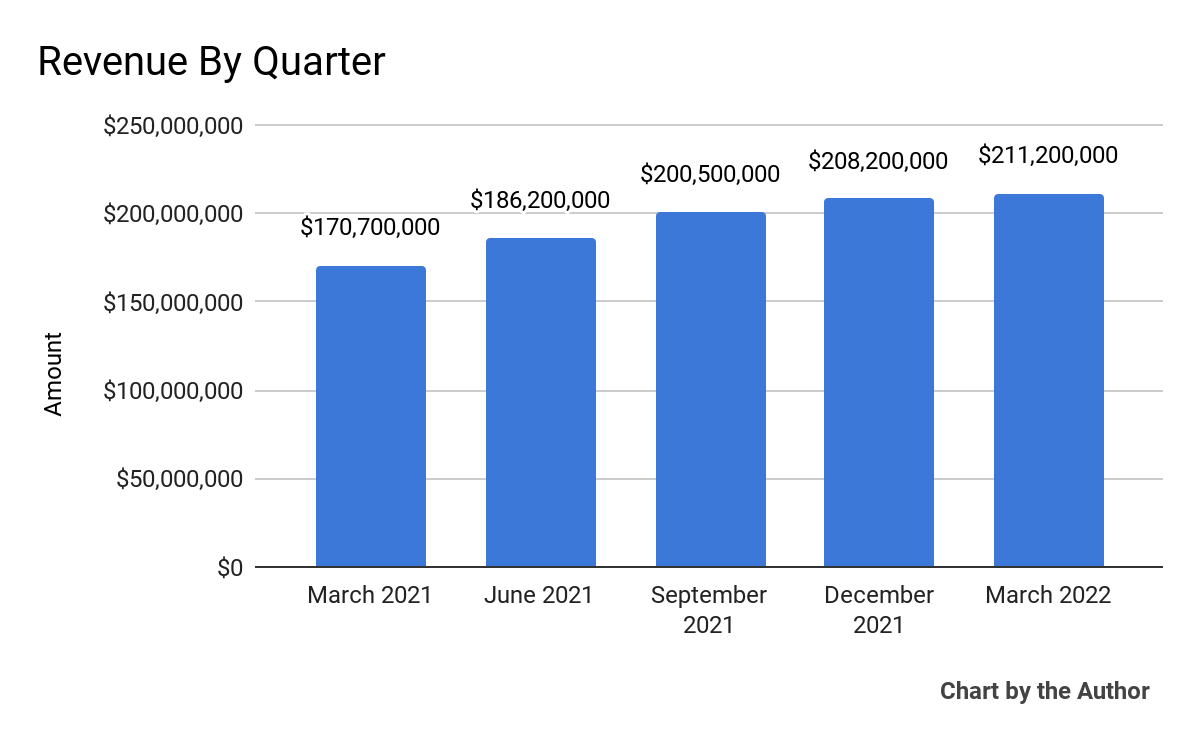

Total revenue by quarter has grown steadily in recent quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

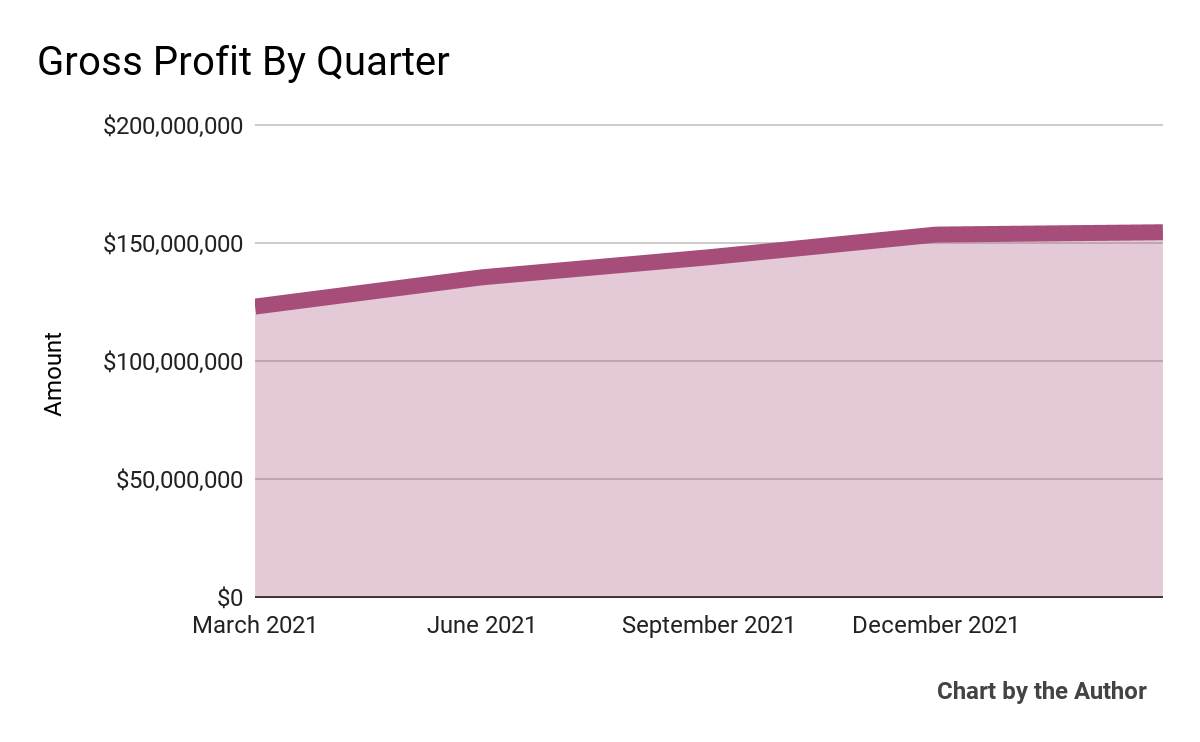

Gross profit by quarter has also grown and begun to plateau:

5 Quarter Gross Profit (Seeking Alpha)

-

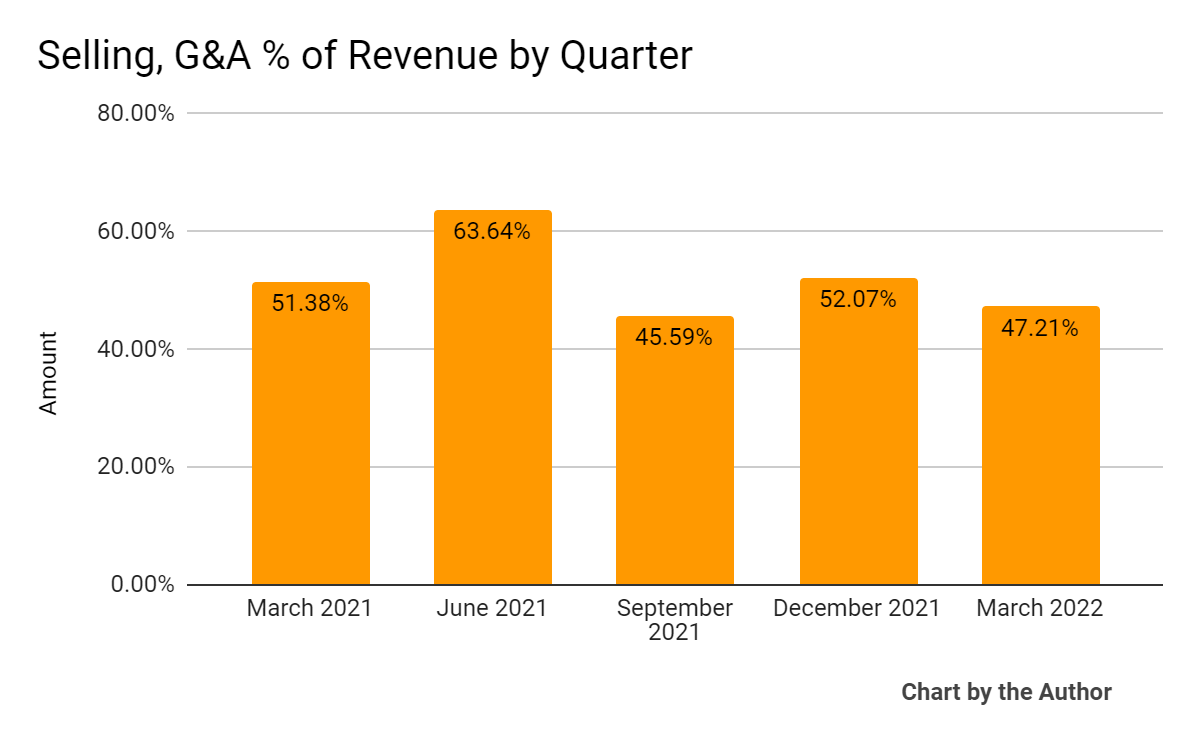

Selling, G&A expenses as a percentage of total revenue by quarter have trended slightly lower:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

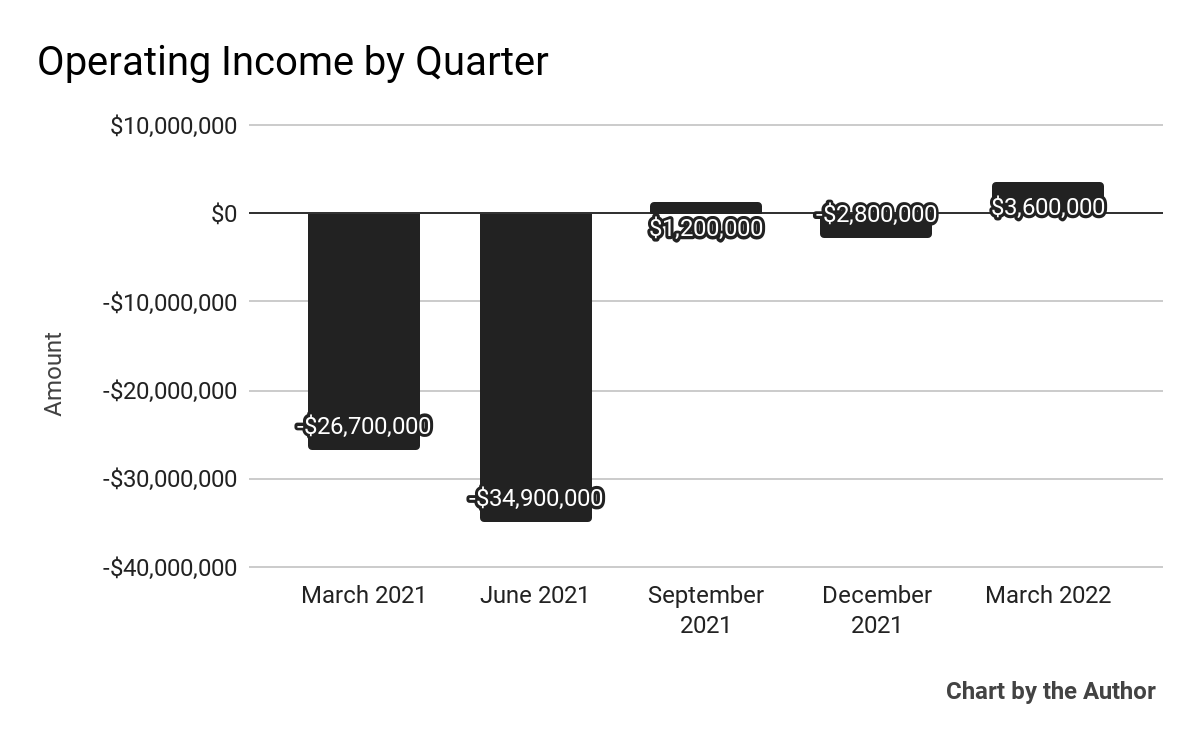

Operating income by quarter has turned slightly positive:

5 Quarter Operating Income (Seeking Alpha)

-

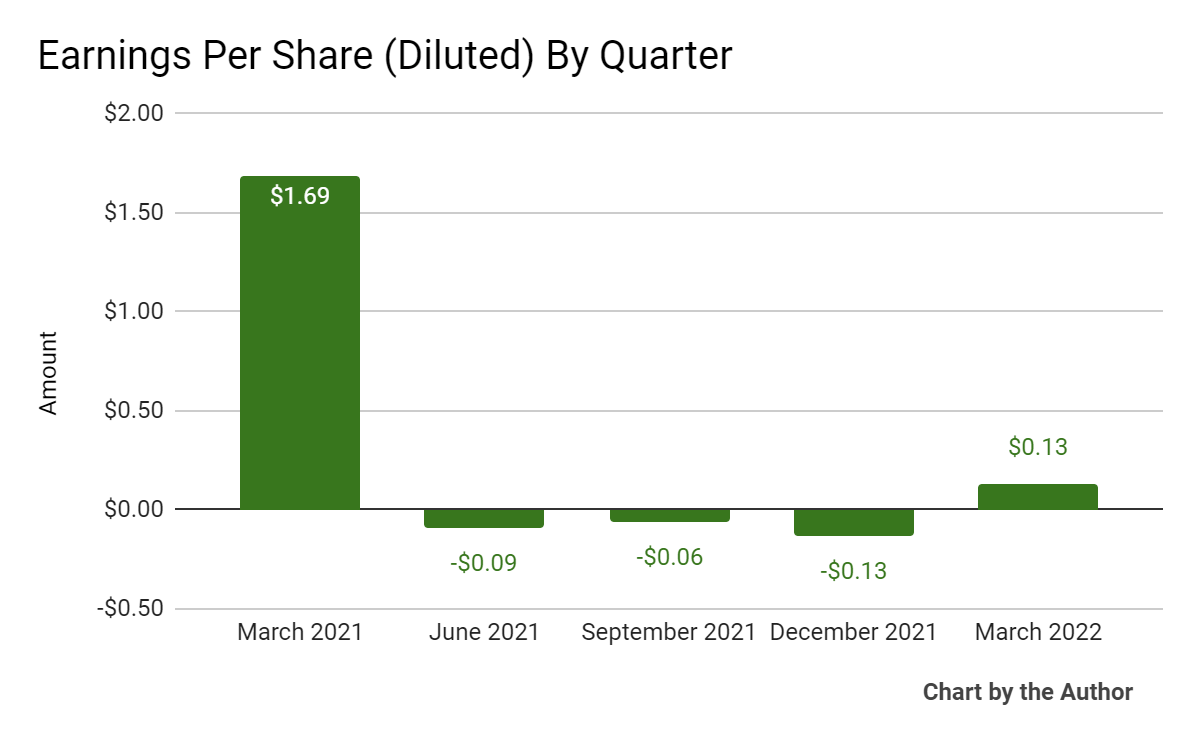

Earnings per share (Diluted) have also turned positive in the most recent quarter after three negative quarters prior:

5 Quarter Earnings Per Share (Seeking Alpha)

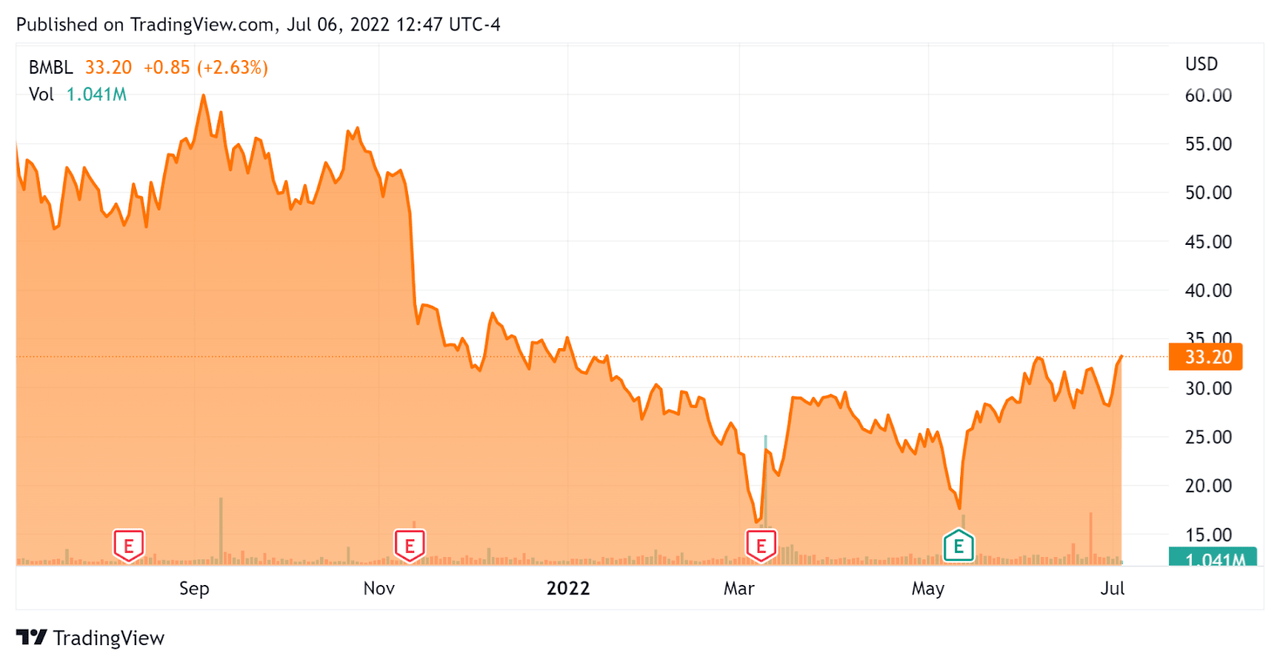

In the past 12 months, BMBL’s stock price has dropped 39.5 percent vs. the U.S. S&P 500 index’ fall of around 11.9 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Bumble

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$5,930,000,000 |

|

Enterprise Value |

$5,390,000,000 |

|

Price / Sales [TTM] |

5.01 |

|

Enterprise Value / Sales [TTM] |

5.76 |

|

Operating Cash Flow [TTM] |

$169,780,000 |

|

Revenue Growth Rate [TTM] |

27.20% |

|

CapEx Ratio |

10.68 |

|

Earnings Per Share |

-$0.15 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Match Group; shown below is a comparison of their primary valuation metrics:

|

Metric |

Match Group |

Bumble |

Variance |

|

Price / Sales [TTM] |

6.64 |

5.01 |

-24.5% |

|

Enterprise Value / Sales [TTM] |

7.56 |

5.76 |

-23.8% |

|

Operating Cash Flow [TTM] |

$1,040,000,000 |

$169,780,000 |

-83.7% |

|

Revenue Growth Rate |

23.9% |

27.2% |

14.0% |

(Source – Seeking Alpha)

Commentary On Bumble

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the addition of 134,000 paying subscribers in the quarter, with the Bumble app now exceeding 3 million users.

The company decided to discontinue its Russia operations during the quarter. Its Badoo App experienced a 4% revenue decrease during the quarter. The App has a significant presence in Central and Eastern Europe and the Russia discontinuation combined with removing the paywall in Ukraine contributed to the revenue drop.

As to its financial results, total revenue grew year-over-year due to both domestic growth and international market growth.

International bright spots include Germany, India and Latin America.

Management sees “substantial opportunity to grow in the US” and believes user engagement will improve as “markets continue to reopen and COVID becomes endemic.”

The firm appears to be focusing on what it calls “hybrid experiences” starting in the U.S. and combining the app with real-world events it calls Bumble IRL (In Real Life) that it launched with partners including SoulCycle, Topgolf and the James Beard Foundation.

For the balance sheet, the company ended the quarter with $309 million in cash and generated free cash flow of $14 million versus a use of cash of $48 million in 2021.

Looking ahead, management reiterated its revenue guidance despite foreign exchange and Ukraine headwinds, both of which are volatile.

Margins will be lower due to the ‘enforcement of Google Play billing, which is approximately a two percentage point negative impact’ to margins.

Regarding valuation, compared to competitor Match Group, the market is valuing BMBL at lower valuation metrics despite a slightly higher revenue growth rate.

The primary risk to the company’s outlook would be a resumption of Covid-19 conditions as the fall and winter months approach, reducing or delaying consumer meeting behaviors. Also, a potential recession or growth downturn would also likely negatively impact its subscription payment cycles.

A potential upside catalyst would be a slowdown in interest rate hikes, lowering the increase in cost of capital that has hurt technology stock valuations so much in recent quarters.

With Bumble reaching positive operating income results in Q1, I’m impressed.

However, I’m concerned about the effects of a general growth slowdown or outright recession in major countries in which the firm operates.

So, I’m on Hold for BMBL in the near term, but like its recent progress at reaching operating breakeven.

Be the first to comment