Charnchai/iStock via Getty Images

Local Bounti’s (NYSE:LOCL) financials have been heavily discombobulated by consecutive quarters of net losses and high cash burn against a dwindling cash and equivalents position. Whilst the company remains on track to commence operations next month from its new facility in Georgia, the current market conditions have made the current trajectory of its liquidity position unsustainable.

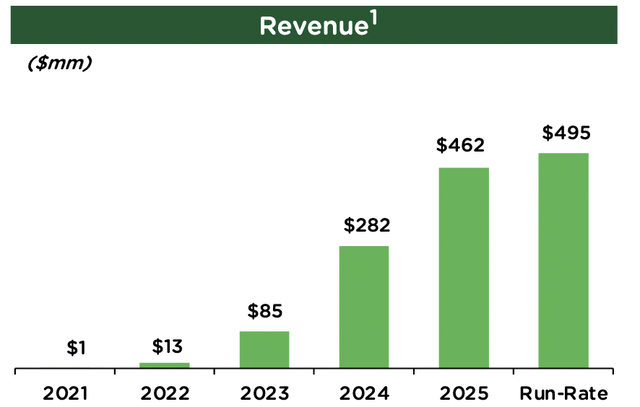

Let’s be clear here, Local Bounti is developing sustainable farming methods that offer material benefits over traditional conventional farming methods. The company, founded in just 2018, produces sustainably grown herbs and loose-leaf lettuce in large indoor environments where all parameters for plant growth are fine-tuned and optimized. The company uses a combination of vertical farming and hydroponic greenhouse farming methods to grow its produce with significantly less land, less water, and without pesticides and herbicides. Further, by growing food locally, Local Bounti ensures lower travel distance for its products which helps increase freshness. Management has stated that they are chasing an estimated $30 billion U.S. market by 2025 and are targeting revenue of $462 million in fiscal 2025.

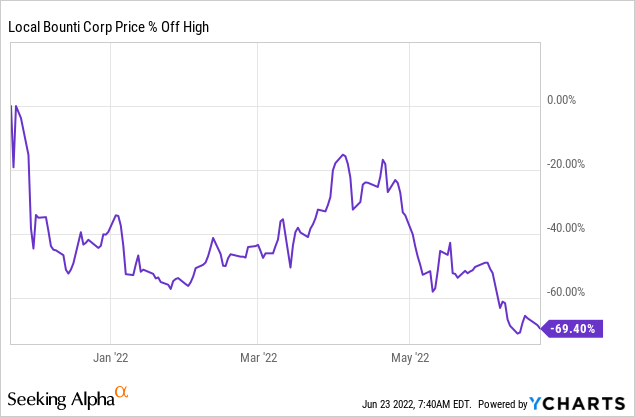

But common shares are down around 70% from their 52-week high as the pull-back in growth stocks picked up momentum on the back of high inflation, recession fears, and an aggressive FED ramping up interest rate hikes to try and control inflation.

Sustainable Farming, Unsustainable Financials

Local Bounti last released earnings for its fiscal 2022 first quarter which saw revenue come in at $282,000, an increase from $57,000 in the year-ago period but a miss of around $70,000 on consensus estimates. The company started full commercial operations during the third quarter of 2020 with its Montana facility but remains in the early stages of its growth plans.

The acquisition of Pete’s, a California-based indoor farming company, happened post-period end and is meant to radically expand Local Bounti’s food production and retailer footprint. The $122.5 million acquisition comprised a $92.5 million cash payment and a $30 million equity component. It should see Local Bounti have two fully operational greenhouse facilities in California and one under construction in Georgia. The buyout is incredibly transformative as Pete’s is set to help Local Bounti grow its US market presence to reach approximately 10,000 retail grocery doors.

Pete’s financial results for its fiscal 2021 were also comparatively better than Local Bounti’s with sales of $22.7 million, an increase of nearly 3% from its preceding quarter with adjusted gross profit margins of 45% which brought in gross profits of $10.2 million. The company also generated positive EBITDA. This formed the backbone of Local Bounti reaffirming guidance of full-year 2022 revenue of at least $20 million, $7 million more than the initial guidance provided when the company announced it was going public.

It is also important to note the divergence in valuation. Pete’s was acquired at 5.4x 2021 revenue whilst Local Bounti with fiscal 2021 revenues at a single fraction of this was trading at a market capitalization north of $500 million and a 76x revenue multiple on announcing its fiscal 2021 annual results. This places current shareholders in a somewhat of a predicament. Is Local Bounti overvalued relative to its acquisition of Pete’s or did management get a really great deal? The answer is likely the former, as at the previous 52-week high, the valuation was still riding the wave of excess euphoria that characterized the rapid rise and eventual collapse of SPACs.

Once the Georgia facility reaches full production, Local Bounti expects revenue to rise further to $30 million a year and for cash flow break-even to not be too far off after this milestone is reached. The company was able to finance the $92.5 million cash payment for Pete’s through stock sales which meant cash and equivalents of $76.4 million at the end of its first quarter should have been relatively unchanged on the back of the acquisition closing. With a cash burn of $25 million as of the end of its last reported quarter, Local Bounti’s runway is around three quarters. This will likely be extended when management raises more money through an equity offering.

Consecutive equity offerings in the same year will lead to further pressure on an already collapsed stock price. Further, with the specter of a recession hunting the U.S., the company might find itself unable to fully tap the capital markets for financing.

A Great Acquisition

Before Pete’s Local Bounti would have struggled to reach its fiscal 2022 revenue guidance. Hence, this acquisition is transformative to the company’s prospects. And whilst the cash burn is to be expected as the sole Montana facility pre-Pete’s has been unable to scale revenues to expectations, the current cash position opens Local Bounti up to operational risk.

The long-term need for more sustainable farming methods remains and Local Bounti is a publicly-listed pioneer in this regard. But the attractiveness of its common shares is limited by the valuation predicament opened up by the Pete’s buyout.

Be the first to comment