Quils

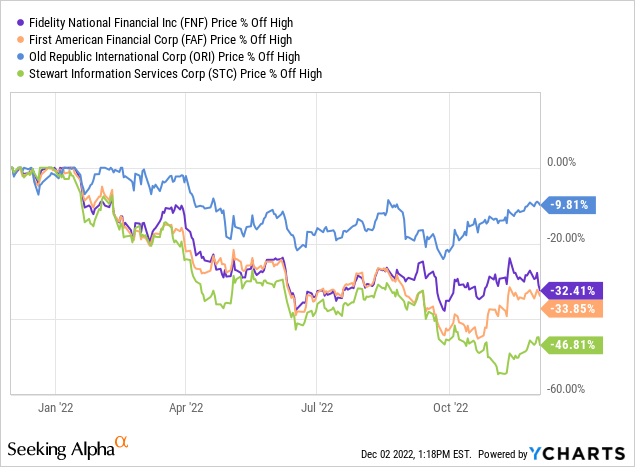

Title insurance businesses have been hit hard in the past year. Fidelity National Financial (NYSE:FNF) is my favorite pick, since the stock is undervalued and returns a 9% annual yield. The returns on invested capital have been best in class as the management’s M&A activity is unmatched. The business is sturdier than ever with FNF’s subsidiary F&G (FG.WI) growing sales in the rising interest rate environment.

Business Cycle

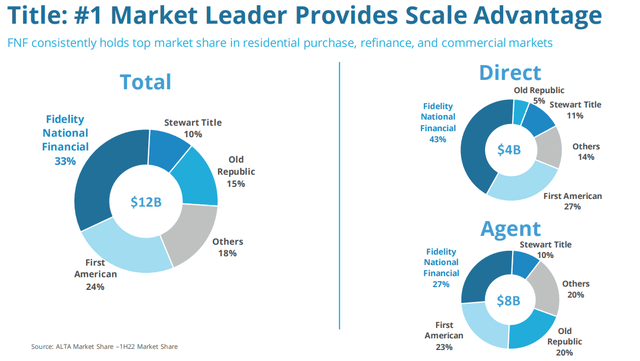

Fidelity National Financial is a title insurance and settlement services provider for the real estate and mortgage industry. The company is not just any title insurance company, a 33% market share makes it the largest in America. They claimed this position by doing outstanding acquisitions over and over again. So far, Fidelity acquired 30 companies, including 11 in the last 5 years. As a result, their business scale and moat have been growing rapidly.

Fall 2022 Investor Presentation FNF’s footprint (Fall 2022 Investor Presentation)

However, the housing market is currently experiencing some serious headwinds. The Fed has been raising interest rates from 0% back in 2020 to 3.75%, consequently mortgage rates have been spiking as well. If the Fed increases interest rates, the banks pay more interest and need to increase base rates for loans to maintain a profitable business. Therefore, buying a house is less attractive with a mortgage rate sitting at 6.5%. Accordingly, Fidelity’s revenue stream in title insurance has been lower, due to a weaker mortgage origination industry. The company is experienced in operating through market cycles and has already reduced headcount by 20% in the title business.

30 Year Mortgage Rate (Trading Economics)

Although there are some clear headwinds for the industry, there is always a light at the end of the tunnel. On the 30th of November, Jerome Powell talked about the possibility of lower interest rate hikes as soon as December. The impact of the Federal Reserve tightening can already be seen in the decrease of inflation growth and the latest ADP employment report. The addition of new jobs is decreasing at a fast pace, which is good news for fighting inflation. The wage-price spiral is finally showing some signs of an end.

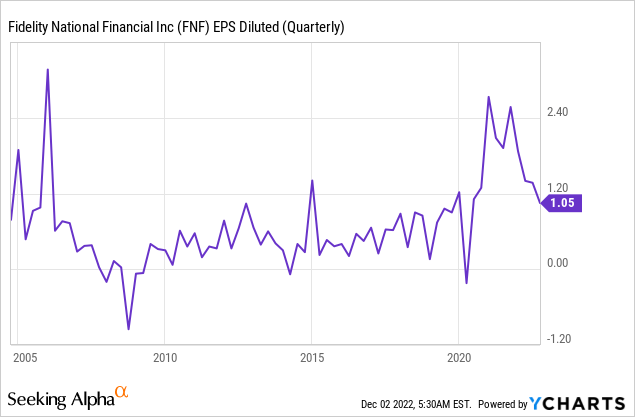

Fidelity National Financial has survived the 2008 housing crisis and came out stronger than before. EPS is back to pre-pandemic levels and could decline further toward negative EPS, like in 2008. Nevertheless, different from 2008, Fidelity does now own a counter cyclical business, F&G Annuities & Life. As the name explains, the subsidiary offers annuity and life insurance products. These products have seen increased demand from rising rates, 3Q22 sales were up 15% year-over-year and assets under management (AUM) have increased 21% year-over-year. Hence, EPS has a good chance to stay stronger than in the previous housing market crash, as FNF business is now more diversified than ever before.

Valuation

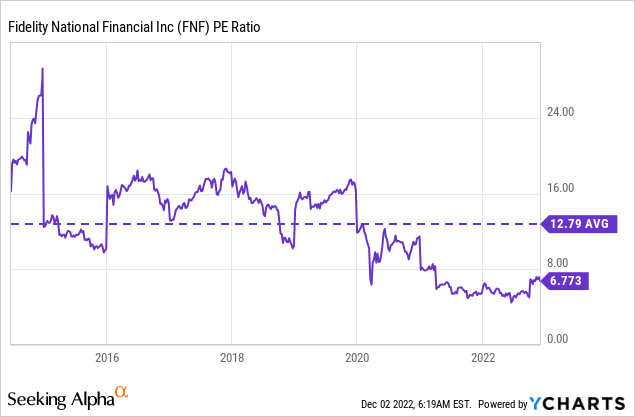

Historically, the stock is trading at a significant discount compared to the average price-to-earnings ratio. Earnings have been substantially higher in 2020 and 2021. Nevertheless, EPS has decreased in the last quarters as we saw in the previous graph. Yet, the stock price is also falling, which maintains the 47% discount compared to the average price-to-earnings ratio.

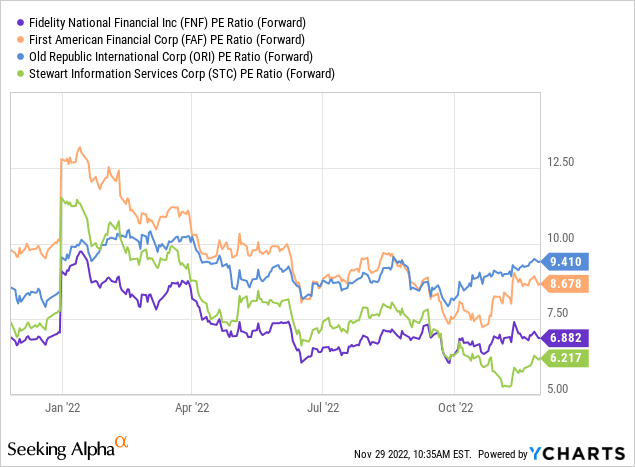

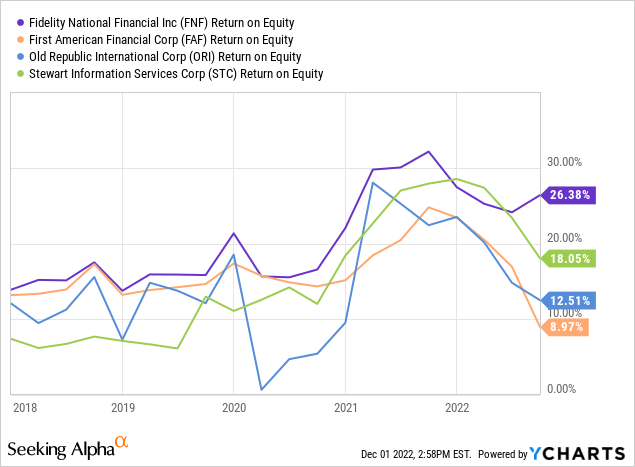

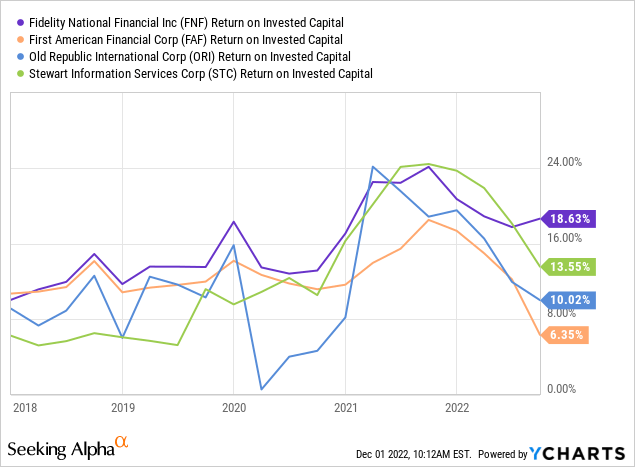

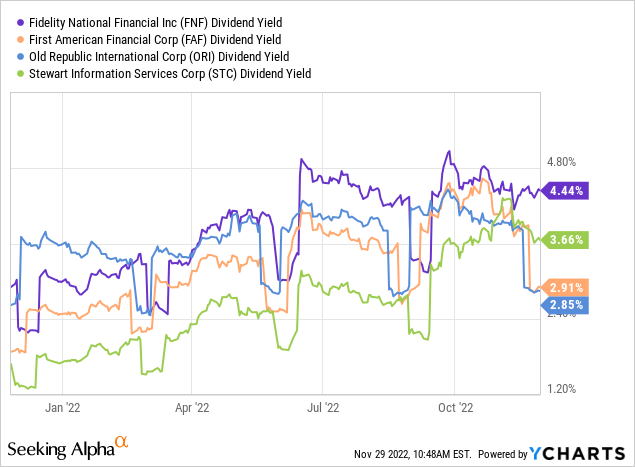

The whole title insurance industry is getting cheaper as investors run for the hills. We, intelligent investors, should be mindful of these actions and prepare to go bottom fishing. At the moment, Fidelity National Financial and Stewart Information Services (STC) look more attractive than First American Financial (FAF) and Old Republic International (ORI).

Both return on equity (ROE) and return on invested capital (ROIC) confirm that Fidelity should be trading at a premium. Still, the market has mispriced this well-executing company.

A Secret Dividend Contender

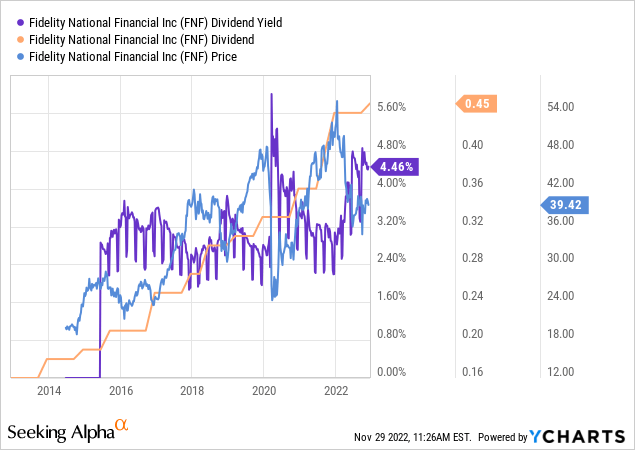

Every time, the dividend yield of Fidelity hit a new high, it meant that you should buy the stock. After every downturn the stock reached new highs and this time should not be any different. The 4.46% dividend yield is tempting at present valuation. FNF is a very safe dividend stock with a 27% payout ratio and a 6-year dividend growth.

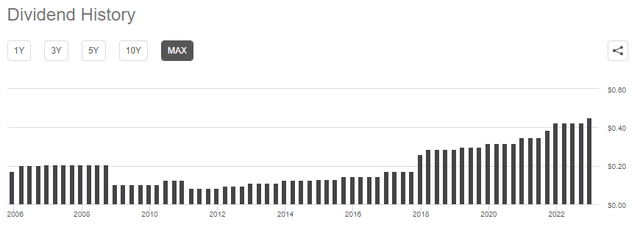

In 2016, the company had 5 quarters of no dividend growth after an earlier dividend increase (after 3 quarters) in 2015. While zooming out for the whole picture we could say the dividend has been growing steadily for the last 11 years, which is quite impressive and makes it a dividend contender candidate.

In addition, Fidelity’s dividend yield is significantly higher than its peers. Further, the dividend payout ratio of the company is the second lowest next to Stewart Information Services, which means there is more room for dividend increases along the way.

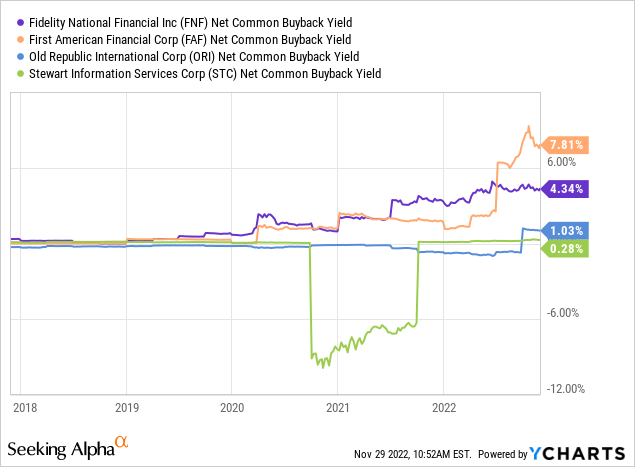

On the other hand, investors are also rewarded with share buybacks. The net common buyback yield is 4.34% and has been on an upward trend in the last 4 years. The dividend yield combined with the net common buyback yield offer investors a very attractive investment at today’s price and volatile environment.

F&G Annuities & Life – Spin off

On the 1st of December, Fidelity National Financial completed the distribution of the 15% stake in F&G to shareholders as a dividend. Fidelity still owns 85% of the F&G after the spin off and keeps benefitting from the growth and counter cyclical behavior of the company. F&G is a prime example of the good executing performance of the management team.

The spin off is likely the reason why Fidelity did only increase their dividend by 2% in November. Next year, investor could expect dividend growth to be closer to the 5 year average of 19%. Even more, F&G is also expected to pay out a dividend in early 2023 of approximately $100 million per year. Overall, a lot of value created for shareholders.

Takeaway

More downside pressure on Fidelity National Financial is not yet out of question. Investors need to keep a close eye on the mortgage rates. However, the stock looks undervalued at 7x earnings. The 9% yield in dividends and buybacks give a peace of mind, while averaging down in the bottom of the market. Additionally, F&G is countering the cyclicality of Fidelity’s business.

I rate FNF a strong buy at $38 a share.

Personally, I will take advantage of more dips in the stock and increase my annual yield. The management team is outstanding and gives me a good feeling about this compounder for the long term. I would say: accumulate and prosper.

Be the first to comment