PM Images

It is a popular refrain of dividend investors that they plan to “live off of the dividends” in retirement. Make no mistake, a generous and growing income stream is a wonderful benefit for retirees. The dividends can reduce sequence of returns risk. For many stocks, living off of the dividends leaves a lot of money on the table. At times there can be more value trapped in the share prices, compared to the dividends that are being paid. I will use BlackRock, a stock that demonstrates the incredible benefit of receiving a generous and growing dividend while also selling shares. Living off the dividends in retirement? There is likely a much better approach.

You’ll see that you can still enjoy a growing dividend, even when taking account the selling of shares (and share count reduction) to create additional retirement income. In the case of BlackRock (NYSE:BLK) the dividend growth is so robust that it eventually covers the income needs at a 5% spend rate. The need to sell shares disappears.

For the record I own BlackRock in our U.S. stock portfolio. That is one of two growth picks along with Apple (AAPL). Berkshire Hathaway is a pick held for defensive purposes.

Creating retirement income with BlackRock

Out of the gate, BlackRock is a wonderful company that operates in a near-oligopoly arrangement in the world of ETFs. To my eye, that is a wonderful economic moat. As the investment world continues to move away from high fee mutual funds to lower-fee passive and active ETFs, the future looks bright for BlackRock.

As I wrote in 2017 …

BlackRock is a leader in both the active and passive investing for institutional and retail investors. They are well positioned to take advantage of that massive move to passive and smart beta investing. They are on the right side of the most undeniable trend in the investing landscape. Apple and BlackRock fit in well with my penchant for dividend growth stocks.

While a retiree will hold a well-diversified portfolio that includes many stocks, I will use BlackRock as a poster child for not living off of the dividends.

Related read: The all-weather stock portfolio for retirees.

Forget that 4% rule

Many investors and advisors will use the 4% rule as a guideline for a safe spend rate in retirement. Of course, an investor who is living off of the dividends is letting the dividends decide on the spend rate. The dividends would have no idea of what is a financial plan, and would not allow for the greatest in tax efficiency, or the most optimal order of asset harvesting that would include spending from taxable accounts, retirement accounts, pensions and other income.

And with BlackRock, we would forget that 4% rule as the company has blown the 4% rule out of the retirement waters (think wonderful lakeside retirement retreat).

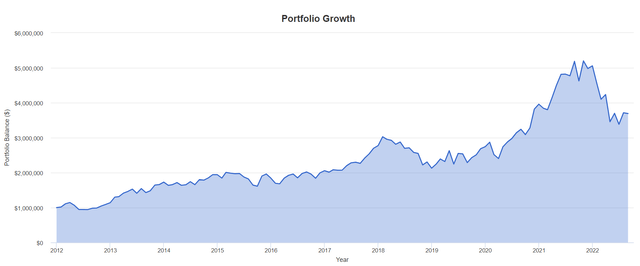

Here’s BlackRock at a 5% spend rate over the last 10-plus years. To generate 5% in annual income (inflation-adjusted) the retiree sells shares and collects the dividends.

BlackRock at 5% spend rate, January of 2012 to August of 2022 (Author, Portfolio Visualzier)

The ‘problem’ is the portfolio value increased to $3,692,183 over the time frame. The retiree could have spent at a much greater rate, and that would mean selling more shares on a much more aggressive basis.

From the above, we can see the incredible amount of value (lesser lifestyle) left on the table by the retiree who succumbs to “I’ll just live off of the dividends”.

Yes, 2012 is a fortunate start date. But many did retire in 2012, and during many other very fortunate start dates. A retiree might have signed themselves up for a durable 12%, 13% or 14% spend rate. In 2019, I suggested that retirees should not say no when the market offers a nice bonus. Make hay when the sun shines. You might then cut back in the years when markets and your stocks are under pressure – see 2022. That’s called a variable withdrawal strategy. Think of it as guardrails for retirement funding.

BlackRock retirement funding – under the hood

Let’s have a look at a very simple demonstration that might reduce your fear of selling shares. Many dividend investors will suggest that you are “killing the goose” that lays the eggs when you sell shares.

Nothing could be further from the truth.

In the following evaluation, we will create a $1,000,000 portfolio value. We will then spend $50,000 per year or at a 5% portfolio spend rate. I will increase the spend rate, though in lumpy fashion as I am not an “excel guy”.

We will start the retirement funding in 2012 and move forward for several years. That’s all it will take to make the retirement case.

Retirement income will be created by selling shares on the last trading day of the year, previous to the retirement year that is being funded. For example, we will sell shares in late December of 2011 to fund 2012. That will reduce the share count. We will then calculate the dividend based on that reduced (goose killing) share count.

$1,000,000 portfolio value

We start with 5610 shares at a $178.24 share price. The dividend is $1.50 quarterly, or $6 annual.

I have rounded some figures to make the post cleaner and easier to read.

2012 Income:

$33,090 in dividends (5,515 x $6.00)

$16,932 in share sales – 95 shares

$50,022 total income

2013 Income

Share count 5,445

Dividends per share = $6.40

Dividend total = $34,348 (5,518 x $6.40)

$15,261 in share sales – 70 shares

$50,109 total income

2014

Share count 5,418

Dividends per share = $7.72

Dividend total = $41,826 (5,491 x $7.72)

$8,530 in share sales – 27 shares

$50,356 total income

2015

Share count 5,398

Dividends per share = $8.72

Dividend total = $47,070 (5,398 x $8.72)

$7,252 in share sales – 20 shares

$54,322 total income

2016

Share count 5,373

Dividends per share = $9.16

Dividend total = $49,377 (5,398 x $8.72)

$8,423 in share sales – 25 shares

$57,800 total income

2017

In 2017, the dividends alone, even with reduced share count, could deliver over $50,000 in annual income.

Dividend total = $53,373 (5,373 x $10.00)

That said, let’s continue increasing the annual income.

Share count 5,358

Dividends per share = $10.00

Dividend total = $53,373 (5,373 x $10.00)

$5,968 in share sales – 15 shares

$59,343 total income

2018

Share count 5,358

Dividends per share = $12.86

Dividend total = $68,903 (5,358 x $12.86)

No share sales required

$68,903 total income

|

Year |

Dividends |

Share Sales |

Total Income |

|

2012 |

$33,090 |

$16,932 |

$50,022 |

|

2013 |

$34,348 |

$15,261 |

$50,109 |

|

2014 |

$41,826 |

$8,530 |

$50,356 |

|

2015 |

$47,070 |

$7,252 |

$54,322 |

|

2016 |

$49,377 |

$8,423 |

$57,800 |

|

2017 |

$53,373 |

$5,968 |

$59,343 |

|

2018 |

$68,903 |

$0.00 |

$68,903 |

The retirement income increased 38% from $50,000 to $68,903.

Dividends per share increased 114%.

Killing the golden goose recap

157 shares were sold representing only 2.8% of the original share count. In fact, your goose was fattened in ridiculous fashion. Your ownership of earnings and revenues increased dramatically. Revenue and earnings almost doubled to 2018 while the share count required a tiny cut.

The boost from 2018 to 2022

The annual dividend then increased to $19.52 in 2022. That’s an additional 51.7% dividend and income increase over 4 years. Of course, an aware retiree would continue selling shares from 2019 through 2021 while also collecting dividends. The retiree will assess 2022 and may decide to reduce or eliminate the share sale harvest heading into 2023.

The living off of the dividends lost opportunity cost

In the above example $62,366 was created from share harvesting – making homemade dividends. The total share harvesting could have been in the hundreds of thousands of dollars. What a bounty.

Why leave tens to hundreds of thousands of dollars on the table?

At times, with dividend growth stocks, there is more value in the share prices compared to the dividend stream. When managed in sensible fashion, a retiree can sell shares to greatly increase income – WITHOUT increasing risks. In fact you might even use the share sale strategy to decrease risk. You might not need that money to spend, you could choose to move the funds to cash and short term bonds. You might move the capital gains profits to more secure dividend payers. You might shore up the defensive sector stocks or ETFs.

It’s called rebalancing.

Lost opportunity

We talked about making hay while the sun shines, but that hay could go up in flames. We are seeing a significant correction in 2022. BlackRock has not been spared. BlackRock is down nearly 30% year to date. Value is disappearing in a hurry, but that would be of little concern to a retiree who has already bailed the hay over the last decade or more. They already took the money and ran. Or maybe flew to the Greek Islands or French Riviera.

Don’t exclude low yield high dividend growth stocks

Investors who are looking to live off of the dividends will often gravitate towards a greater current yield. They will avoid these superior low or modest yielding stocks. The benefit and opportunity is twofold.

1. Buy these lower yield high dividend growth stocks to begin with in the accumulation stage.

2. Use these stocks properly in retirement. Know that you can sell shares and manage the risks.

The optimal mix of income and growth for retirement

I am a big fan of generous dividends. They bring joy and warmth when they arrive. A big dividend payment is like a financial hug.

And I like the idea of the ‘best of both worlds’. I enjoy some very generous dividends from our (for my wife and my own accounts) Canadian Wide Moat Stocks. Our U.S. stock portfolio holds more of the BlackRock’s. It’s a most advantageous mix. And as per the all-weather posts (linked to above in this article) I pay attention to sector arrangement and weights.

For inflation protection we hold commodities (DBC) and Canadian energy stocks. We hold bonds and cash in the area of 10% to 25% in accounts.

I am prepared for the uncertain times. We are in a period of economic transition. And we don’t know where we will land.

What’s your retirement plan?

Thanks for reading. Please hit that Like button (but only if you liked the post).

And please do visit the comment section. They are usually better than the articles. Are you planning to live off of the dividends? What’s your take on creating superior income with lower yielding dividend growth stocks?

Of course this article is not advice.

I am just asking the question – why sell yourself short?

Read. Investigate. Decide. Invest.

Be the first to comment