ipopba

Keeping with my typical focus on the financial industry, I’d like to discuss Mitek Systems, Inc. (NASDAQ:MITK). Mitek is – in short – every investor’s dream. It has relatively high returns on capital, is extremely capital light (basically requires no capital reinvestment to grow), and has a strong customer base that provides recurring revenue. On top of that, it has high margins, great cash conversion, and grows revenue at a double-digit rate.

On the other hand, the majority of its revenue comes from mobile check deposit. If you’ve every deposited a check through your banking app on your phone, you know what I’m talking about. And, chances are, you’ve probably used Mitek Systems as well. It serves roughly 7,500 customers, and almost all of the major banks. There are basically no competitors

Make no mistake, the mobile deposit business is a good business. But it is somewhat of a cash cow/melting ice cube. The rate of paper check deposits is only going to decrease, though in the short run Mitek could benefit from the rate of former in-person check depositors now choosing to deposit over their phone. But the point is, sooner or later, the mobile check deposit business will probably be dead.

The good news for Mitek is that it has a base of loyal, steady customers that would probably be willing to buy other products from it. And Mitek has taken advantage of this – selling other fraud prevention products to help with mobile deposit and banking in general. But what Mitek is really aiming to break into the is the large (multi-billion dollar) biometrics market.

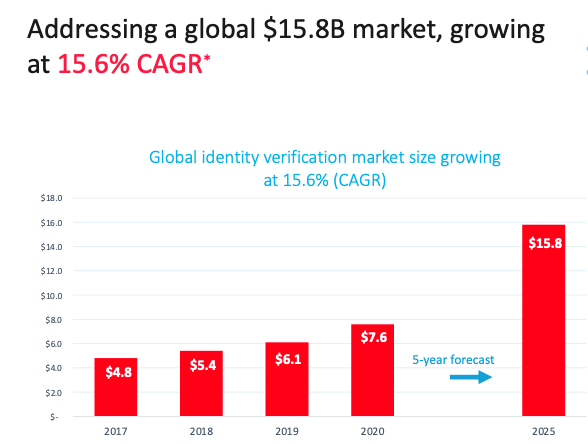

The biometrics market is large and growing fast. You know what I’m talking about: online compliance with bank “Know Your Customer” (KYC) and “Anti-Money Laundering” (AML) laws, online biometrics to identify new customers, to prevent identity theft, to monitor for underage users, etc. The use cases are growing every day. For instance, imagine if you never need a notary public again. Imagine if all digital signatures can be authenticated biometrically at the time of signing.

This is the market that Mitek is going after. And it’s already made pretty good progress. Mitek’s ID verification revenue is growing by anywhere from 25%-30% annually. And, if it can capitalize on it, it has a great opportunity to cross-sell ID verification software and services to its large and stable banking customer base. It also plans to and already has expanded into markets outside of finance. For instance, it provides its platform to channel partners – i.e. Adobe, DocuSign, etc. – who use it in their offerings to customers. It is also going after the sharing economy – with companies like Airbnb and Turo using its service to authenticate users who have no contact with each other in real life.

To some degree, Mitek has been growing through acquisitions. While Mitek has a pretty hefty R&D department, it has made a decent number of acquisitions in recent years just to acquire IP. This strategy seems to be working for it, but I don’t know how well it can be extrapolated into the future. To succeed in the biometrics market, Mitek needs to have great technology – technology that I don’t understand and can’t evaluate the competitiveness of. For instance, Mitek had to basically write off its 2018 acquisition of A2ia Group 2. The company provided intelligent data extraction tools, and Mitek paid about $48.9 million for it in total. By 2020, Mitek had begun winding down the company, citing concerns about the small market size and product issues.

On top of that, Mitek is facing some legal troubles that stem from a string of patent lawsuits filed by USAA (its former collaborator and only other real competitor in the mobile deposit space).

Acting as a caveat to all this, however, is the price. At around $10 a share, Mitek is currently trading at a single digit multiple of expected 2022 free cash flow – a price that is almost unbelievable for a company generating 15-20% ROEs, growing at 20% a year, and requiring almost no cash reinvestment to grow.

Mitek Systems’ History

Mitek, as it stands today, was effectively created in 2007. Mitek has been around since 1986, but 2007 is when it entered the mobile deposit business. Mitek later went public in 2011, and after a few years of success and growth in the mobile deposit area, acquired ID Checker in 2015 to expand into the identity verification market.

When it got into the mobile deposit business, Mitek initially signed up 161 financial customers for its platform. By 2022, it had over 7,500 customers for its Mobile Deposit program.

From 2003-2017, James DeBello served as Mitek’s CEO. So he was there for the creation of the mobile deposit technology, which took Mitek from 32 full-time employees in 2011 to over 400 employees in 2021. He was also there during one of Mitek’s strongest growth periods. In 2011, Mitek had total revenue of $10.2 million. By the time Mr. DeBello stepped down as CEO in 2018, Mitek had total revenue of $63.6 million. That’s a CAGR of just under 30%.

He and his team also made the critical decision, in 2015, to expand the company into ID verification. The foresight here is impressive. They could have just coasted on Mobile Deposit. In fact, they had been benefiting from its monopoly position for less than ten years when they made the decision to diversify.

By 2018, however, long-time CEO James DeBello stepped down. Mitek spent the remainder of the year without a CEO or CFO, and it was obvious that the company needed leadership. While the company grew revenue by 40% in 2018, for the first time in recent memory it lost money (on a net income basis). Mitek still generated positive FCF, but at a measly 2.1% margin.

Gross margins fell from 91.1% to 86.3%, with Hardware and Software falling from 96.2% to 92.5% and Services and Other falling from 81.4% to 75.4%. As a result, EBITDA margins plummeted from 20% to 9.1%, leaving little actual profit for shareholders.

By 2019, however, Max Carnecchia had become CEO. Carnecchia seems like more of a career CEO type, serving as CEO for several tech companies over the years, a few with annual revenue over $100 million. All-in-all, though, he seems like a good fit to lead Mitek into its next stage of growth.

Since he started in 2019, Mitek’s revenues have essentially doubled, growing by 33% in his first year (2019) and ~20% and 18% in the two years after that. Profitability has also improved as well. EBITDA margins are now over 30%, compare to below 10% – where they had dropped to in the year before Carnecchia joined.

Now, the ID Verification business is growing faster than ever (and increasing its growth rate every quarter), while the Mobile Deposit business has retained strong growth rates that are starting to show signs of slowing growth.

Carnecchia and his team don’t own much of Mitek’s stock – which is typically something you want to see in a management team. But this isn’t something that will make me write Mitek off. It still appears to be a great business, and its management team has executed well.

Mitek Systems’ Operations

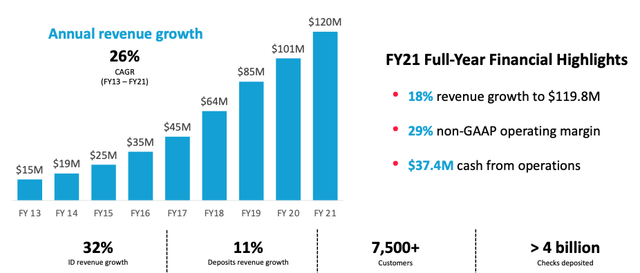

The first thing you should know about Mitek Systems is that it is a company that can sustain growth. Over the last eight years, it has grown its top-line revenue at a CAGR of roughly 26%.

Mitek Systems Q2 2022 Investor Presentation

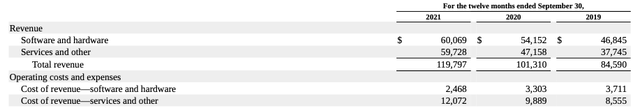

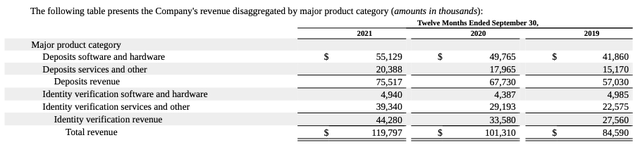

As of fiscal year-end 2021, Mitek’s total revenue stood at $119.8 million. What’s more important than the overall growth, however, is how this revenue is generated. Mitek traditionally breaks its revenue into two categories – (1) Software and Hardware, and (2) Services and Other. In 2021, the revenue was split about 50/50 between the two areas, with Software and Hardware making up the slight majority in years past.

As you can probably see, the problem with this kind of reporting is that you still can’t really see what business segments the revenue is coming from. Mitek separates its business into two areas – (1) Mobile Deposits and (2) ID Verification. As we’ll discuss, it only makes sense to view Mitek as two distinct businesses – Mobile Deposits and ID Verification.

Luckily, Mitek breaks its revenue into the two segments in its 10-K footnotes. Unfortunately, it only does this stretching back to 2017. In addition, Mitek doesn’t break down the costs of revenue associated with Mobile Deposits and ID Verification like it does for Software and Hardware and Services and Others, making it more difficult to get a handle on the economics of each business.

Source: Mitek Systems 2021 10-K

Mobile Deposits comprises roughly 63% of Mitek’s total revenue while ID Verification makes up about 37%. This split has stayed relatively the same since 2017, with Mobile Deposit jumping up to about 71% in 2017. This is interesting, in itself, because you would expect ID Verification to begin to comprise a larger component of overall revenue since it is growing pretty fast (over 30% last year).

But it’s not. This means that Mobile Deposits is actually growing pretty fast itself – faster than the consensus opinion makes it out to be. My assumption is that this consensus opinion is the result of Mitek’s failure to break out the revenue into Mobile Deposits and ID Verification on its actual income statement. Nevertheless, you can see that Mobile Deposit revenue grew by ~11% overall in 2021 and ~18% in 2020 (pretty impressive for a saturated/soon-to-be-dead business).

Like I said before, the gross margins for the business are separated based on Software and Hardware revenue and Services and Other revenue.

Mitek describes Software and Hardware revenue as revenue generated from software licenses to customers and sales of digital scanners. The vast majority of this is likely SaaS revenue from the Mobile Deposit business. In fact, in 2021, Mitek brought in just over $60 million in Software and Hardware revenue. 91.7% of this revenue was generated by Mobile Deposits. The gross margin associated with this revenue was 95% in 2021. This means that the vast majority of Software and Hardware revenue (aka traditional SaaS revenue) is basically high-margin royalties from U.S. financial companies.

So, even though Mitek doesn’t break out the gross margins of the Mobile Deposit and ID Verification businesses separately, we basically know the margins of each. Since over 90% of the Software and Hardware revenue is generated by the Mobile Deposit segment, we know that margins in the mobile deposit segment are much higher than ID Verification. In fact, 88% of Mitek’s 2021 ID Verification revenue was classified as Services and Other revenue. Since we know that Services and Other revenue as a whole had a gross margin of 79% in 2021, we can say with confidence that Mitek’s ID Verification business generates gross margins that are closer to 80% than 90% – lower, for the most part, than the Mobile Deposit business.

When I say SaaS though, I should clarify what I mean here. Mitek’s Mobile Deposit business doesn’t just license their software for a monthly subscription and collect a steady MRR. It’s actually transaction-based (See Mitek’s Q3 2020 Earnings Call). Mitek’s bank customers basically pay in advance for a tranche of check transactions processed using Mitek’s technology. Mitek gets paid based on every check deposited using their software. So, it is typically pretty steady, but on the upside (for now at least) Mitek directly benefits if the number of checks deposited through a mobile app increases.

Mitek’s Services and Other revenue basically consists of transactional SaaS revenue and consulting and maintenance revenue. What does this actually mean, though? It’s hard to say. Most of it is transactional SaaS which, if you read earnings calls, management seems to have a hard time defining. As far as I can tell, transactional SaaS involves the subscriber paying the SaaS provider based on the number of transactions that the software enables. This is opposed to traditional SaaS revenue that is paid as an annual or monthly fee. My assumption is that, in the ID Verification business, the transactional SaaS revenue is (much like the Mobile Deposit business) generated based on the number of images that the end-customer “verifies” using Mitek’s technology.

When most people think of SaaS businesses, they think of a hands-off app or platform that businesses download and integrate into their tech stack. But I don’t think that’s what we’re dealing with here. That’s what the Mobile Deposit business is (to some extent), but the ID Verification Business likely still involves selling, setting up, and running ID Verification software on a short-term (or maybe as-needed in some cases) basis. It’s not necessarily a subscription-based revenue stream, more like a traditional on-premises IT revenue stream (though a little less hands-on).

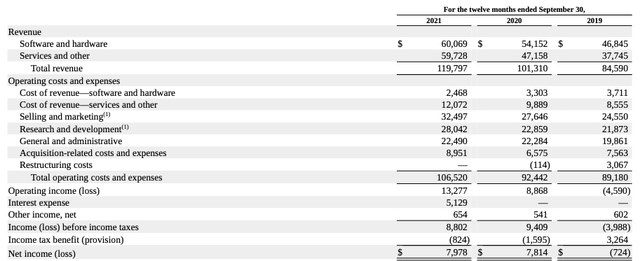

As I’ll discuss below, Mitek is a business that you want to analyze primarily based on its income statement. There’s not much to its assets, and the income statement (for the most part) can tell you Mitek’s story better than the balance sheet.

But, there’s a caveat here too. Mitek’s income statement can be misleading. Mitek actually generates a lot of cash (it doesn’t have to buy any inventory or make a lot of capital expenditures), but that can be masked by non-cash expenditures on the income statement.

Mitek’s main expenses are (1) Sales and Marketing, (2) R&D, (3) General and Administrative, and (4) Acquisition-Related Costs.

Dispersed throughout these costs are non-cash expenses like stock-based compensation, amortization of intangibles, D&A, amortization on debt securities, etc. I know some people don’t like to add back stock-based compensation and things like that, but, in my opinion, you can calculate things on a cash basis and just take into account the increase in shares every year.

Mitek’s operating income just doesn’t provide a good picture of how much cash it really generates. For instance, its operating margin was 11.1% in 2021, and it varies pretty wildly over the years. Mitek’s EBITDA margin, however, was at 32.9% in 2021, 26.1% in 2020, and 15.8% in 2019. Essentially, as it has grown as Mitek has gained some operating leverage over time. Though I will note that it was around 20% in 2017 and 2016. 2019 and 2018 were kind-of outlier years, with Mitek’s expenses growing a little faster than normal.

Free Cash Flow has grown in much the same way as EBITDA. This makes sense considering Mitek doesn’t really spend any money on capex. Changes in working capital also barely make a difference year-to-year. Mitek doesn’t deal with inventory, and its receivables stay pretty steady.

So, Mitek’s FCF margin looks a lot like its EBITDA margin. 2021, 2020, and 2019 showed FCF margins of 30%, 23%, and 15.6% respectively. Its FCF ROE is also pretty impressive, especially considering most of its equity is made up of goodwill and intangibles that – because they are acquired for IP and not cash flow – usually aren’t immediately accretive to revenue or profitability. Nevertheless, Mitek’s FCF ROE over the last three years was 18.6%, 17.6%, and 12.3% in 2021, 2020, and 2019, respectively. In 2018, FCF ROE stood at a measly 1.9%, while in 2017 and 2016 it was closer to normal at 16.2% and 19.3% respectively.

Besides what I consider Mitek’s “investments” – R&D and Marketing & Sales (which I’ll discuss below), the majority of Mitek’s expenses are going towards its personnel. As of 2021, Mitek had 400 employees, and over half of these are outside the U.S. 221 of Mitek’s employees are sales and marketing, document review, and professional personnel; 176 are research and development personnel; and 51 in are in executive, finance, network administration, etc. positions.

These, along with Mitek’s IP, are its assets. As it currently stands, Mitek employs a decent amount of people to help its technology determine what something (like a check or a face) actually is. Over time, this could change. Mitek’s technology could improve to such an extent that it doesn’t have to employ nearly as many people. I’m not going to bake this into my future expectations (Mitek is pretty clear that it needs actual people to assist its technology), but it’s something to keep in mind.

Mitek is also, for the most part, focused on the U.S. market. But a surprising 20% of revenue comes from foreign customers. In Mitek’s most recent earnings call, they even talk about how they are a provider of identification services for a UK government agency. That kind of trust is impressive. It’s one thing for a U.S. software provider to be used by foreign companies, but use by foreign governments shows another level of trust. Mitek’s recent acquisition (it’s largest to date) also probably played a hand in this. HooYu is a leading UK KYC ID verification company.

Considering Mitek already has pretty much every U.S. financial company as a customer, growth abroad could be a path it could take (even for the Mobile Deposit business). I think, more than other avenues, this is a viable option for Mitek – as it has shown through its foreign acquisitions.

A. Mobile Deposit Business

Since 2017, Mitek has grown its Mobile Deposit revenue at a compounded rate of 23.6% a year. That’s a very healthy growth rate, honestly – something that the market would value pretty highly at some other well-known tech company.

So, it’s a revenue stream that should be valued pretty high, especially considering the gross margins associated with it. Around 73% of Mobile Deposit revenue is Software and Hardware revenue (and has stayed within that range since 2017). We don’t know what the gross margins associated with Mobile Deposit revenue are, but we do know that company-wide Software and Hardware gross margins were 95% in 2021, and have stayed in the mid-to-low 90s as long as the business has been around. Services and Other revenue’s gross margin stand at about 80%.

So, there’s a good chance that the Mobile Deposit revenue stream is generating about 90% gross margins. Mitek’s 2021 Mobile Deposit revenue stood at $75.5 million. Mitek is keeping about $68 million of that as gross income. It’s difficult to say how the other expenses are split up, but I’d be willing to be that the majority of the R&D expenses ($28 million in 2021), Acquisition-Related Costs (over $8 million in 2021), and maybe even the Sales and Marketing ($32.5 million in 2021) – considering Mitek is probably spending more time and money to convince customers to adopt ID Verification solutions than Mobile Deposit Solutions – are allocated towards ID Verification.

It’s probably true that Mitek’s Mobile Deposit business is a pretty great cash cow. The real question for that segment revolves around sustainable growth. How does it grow, and how long can it keep growing?

I’d argue that the growth in the Mobile Deposit segment is one of the best kinds of growth. Think about it. Mitek already has the majority of the Mobile Deposit customers it’s ever going to get (unless it expands overseas). It’s still growing, however, because (1) more people are depositing checks over their phone, (2) it is raising the prices it charges banks, and (3) it is offering add-on services.

You would think there would be good numbers on the check deposits, but there aren’t. Mitek, no doubt, knows what the market for this looks like, and even reported on it in 2017. By 2020 Mitek released a study showing that 52% of banking customers said mobile deposit was a necessity for their banking experience (keep in mind that those are customers that responded to a survey).

Mitek also said, in its Q2 2021 Earnings Call, that pre-pandemic adoption of mobile deposit technology by its customers banks was anywhere from 17%-19% of retail checks that are deposited. The CEO said that he doesn’t have exact numbers for 2021, but noted that it’s probably in the low-to-mid 20s. He also said that he doesn’t see any reason why the adoption rate won’t grow to at least half of all retail checks deposited, and I agree.

For future growth, I don’t know the total numbers, but Statista reported that, in 2021, 95% of Gen Z used mobile banking, while roughly a quarter of seniors used mobile banking. That’s obviously a dichotomy, but I assume somewhere in the middle is about 50% or 60% of the population who primarily uses the banking system in the U.S. Once Gen Z users get a little older and start using banking products more, I’m sure the number of checks deposited by phone could increase.

The caveat to this is that most deposits in the future will be done by direct deposit, so this may negate the need for Mitek’s services. So, the problem with this entire growth thesis is that the number of checks written will probably continue to decrease, even as the percentage of checks deposited by mobile phone increases.

Mitek can, probably quite easily, continue to slightly increase prices for its services. It basically has a monopoly on the mobile check deposit business. And the costs of using its software is such a small percentage of a bank’s (especially large banks) overall cost structure, that a few percentage increases will not matter much for the banking customers in the end.

In the third quarter of 2022, Mitek really failed to generate Mobile Deposit growth like it has in the past. Mobile Deposit revenue grew by 5% YOY, and Mitek attributes this to reorders (which I assume means re-orders at a higher price) and Check Fraud Defender. I don’t know if this is a harbinger of things to come, but it’s my best bet of what the future of Mobile Deposits looks like.

Overall check writing volume will, at some point, start to decline, and Mitek will then likely grow (probably slowly) by raising prices and pushing add-on services like Check Fraud Defender.

It owns almost the entire market, and it’s a market that probably won’t attract too many new competitors. So, Mitek will likely be able to keep most of its customers and keep coming up with new add-on ideas to sell to the banks.

Like I said, this is a pretty good cash cow, and what will matter for Mitek in the future is how it chooses to funnel this cash. Obviously, I’m no expert, and I’m not running the company, but I think a modest investment into Mobile Deposit R&D will allow Mitek to continuously come up with new add-ons. The rest of the money will probably be funneled into ID Verification, and this will decide where the company goes over the next decade.

B. ID Verification Business

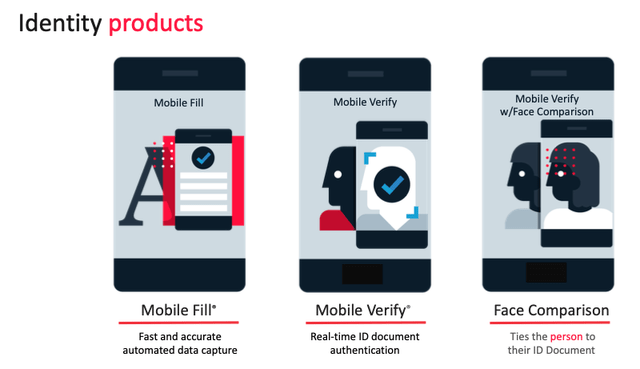

The ID Verification business is a little harder to pin down. What does ID Verification entail? Everything apparently. Just look at the list of customers Mitek presents in its Q2 2022 Investor Deck.

Mitek Systems’ Q2 2022 Investor Presentation

Some of these are obviously banking partners (and Mitek wants to expand ID Verification to them first and foremost), but others are businesses like Turo, Airbnb, Adobe, DocuSign, etc. Basically, they are the remote businesses of the future.

It’s obvious that one big beneficiary of mobile identity verification software is platform businesses. Specifically, businesses like Airbnb and Turo, where users transact with people they don’t know. This is a big and growing market, and it’s pretty impressive that Mitek is already serving companies that are this big in the space. It’s also interesting that no one seems to care, which goes a long way to show that this business may provide pricing power and a moat.

Consider the position Mitek is in. You can already see from its Mobile Deposit business that this “small but integral software” business is a winner-take-all kind of industry. Once B2B customers find someone they can trust to provide the technology, they don’t really want to switch. Also, the cost of doing something like allowing for a mobile check deposit or confirming someone’s identity digitally is such a small part of their costs structure that any competitor offering better rates really won’t win them over. This is especially the case if they would have to integrate some new company’s software with their own if they switch (remember, these are big companies, many of them in slow-moving sectors like banking).

All this is to say that, while Mitek may face competitors in the ID Verification market, it may turn out to be very much like the Mobile Deposit business. Better technology doesn’t matter if Mitek’s technology can get the job done and all of its Mobile Deposit customers already trust it.

And if Mitek can execute, what a market this is. Mitek itself is predicting the overall market to grow by a CAGR of 15.6% and be worth $15.8 billion by 2025.

Mitek Systems’ Q2 2022 Investor Presentation

Mitek’s own ID Verification revenue has grown at a CAGR of 35.8% since 2017 (the first year it was broken out from Mobile Deposit). In FY 2021, Mitek generated $44.3 million in ID Verification revenue, an increase of just under 32% compared to 2020.

In Q3 2022, Mitek’s ID Verification revenue increased 58% YOY. And, impressively, Mitek thinks it is just getting started here. Consider that over the last three years, Mitek’s ID Verification revenue growth has been increasing. It grew by ~32% in 2021, by ~22% in 2020, and by around 25% in 2019. To bolster its claims, Mitek launched MiVIP in the third quarter of 2022.

Before, MiVIP, Mitek’s ID Verification solutions were separate products.

Mitek Systems’ Q2 2022 Investor Presentation

Now, it has launched what it calls the first end-to-end identity verification platform on the market. The Mitek Verified Identity Platform (MiVIP) basically rolls all of Mitek’s identity software and services into one platform that can be integrated into a business’s tech stack.

Mitek has said that MiVIP will significantly expand their addressable market and boost an already fast-growing ID Verification business. And this may be true – it’s definitely working as of the third quarter. But really only time will tell.

Another thing to point out is that Mitek’s ID Verification revenue is just different than the majority of its Mobile Deposit Revenue. The vast majority of ID Verification revenue falls into the Services and Other section of Mitek’s revenue funnel. We’ve stated above that this means that Mitek’s ID Verification business is (or, at least, has been) lower margin than the Mobile Deposit business.

Most of Mitek’s ID Verification revenue is transactional SaaS revenue. As I’ve mentioned above, it’s hard to nail down one definition of this. But what I’ve gathered from Mitek’s earnings calls leads me to believe that customers are charged based on usage. Traditionally, Mitek’s ID Verification offering was not a subscription service where customers can just pay a monthly or annual fee to have access to a cloud-based verification service. Customers have paid based on the volume they expect – basically, how many of their end customers are going to be using Mitek’s service.

I can’t say for sure why the ID Verification revenue has a lower gross margin, and I’m definitely not an expert in the cost structure of AI or ML businesses. But this article from Andreessen Horowitz seems to provide the best explanation.

The central premise of the article is that AI businesses have lower gross margins than traditional SaaS businesses because they are sort-of a hybrid service and software company. Basically, this confirms what Mitek has hinted at in its filings and earnings calls. This doesn’t necessarily mean that Mitek is a service company in the traditional sense. No, Andreessen Horowitz explains it best when they say:

Most AI applications look and feel like normal software. They rely on conventional code to perform tasks like interfacing with users, managing data, or integrating with other systems. The heart of the application, though, is a set of trained data models. These models interpret images, transcribe speech, generate natural language, and perform other complex tasks. Maintaining them can feel, at times, more like a services business – requiring significant, customer-specific work and input costs beyond typical support and success functions.

The article notes that two big contributors to lower gross margins are (1) higher cloud infrastructure costs – because of the compute costs to train complex AI models and the range of distinct forms of media (like images) that the models are trained on – and (2) human input into the prediction loop.

In Mitek’s case, these are both probably part of the reason why the ID Verification business has lower gross margins. Mitek notes that it needs and, in fact, has a large dataset to train its AI models on for its ID Verification business. If you think about it, the images used in the ID Verification business obviously require more compute power than in Mobile Deposit. They are images of multiple different faces, after all, rather than static images of checks (something that is basically standardized).

In addition, Mitek doesn’t break down exact numbers, but notes that over half of its 400-person workforce is involved in sales and marketing, document review, and professional support. Document review is likely the one personnel cost (maybe IT support as well) that is factored directly into the cost of revenue. And, judging by the growing volume Mitek is experiencing (remember, its revenue is transactional SaaS), it will need more compute power and more document review personnel to help with its AI models.

While all of this does lead to lower gross margins, they aren’t the kind of 30%-60% gross margins mentioned in the article. ID Verification’s gross margins are much close to the normal SaaS gross margins of 80%. The point still remains, though, that they are lower than the Mobile Deposit business, but I doubt that they will decrease. In fact, there is probably room for the ID Verification gross margin to expand as the AI models get better. I wouldn’t bet on this completely (people will probably always be in the loop to some extent), but the use of document review personnel will probably decrease as Mitek’s AI models improve over time. But, I could be wrong. The growing complexity of the volume Mitek processes may mean that more personnel are required or that new models have to be created that must be, in turn, trained again.

Balance Sheet and Reinvestment

Before 2021, Mitek didn’t have much of a balance sheet. The vast majority of its assets are goodwill, which is the result of its acquisitions. Besides that, there aren’t any real traditional assets, as most people think of them.

Mitek’s total assets are just over $385 million as of Q2 2022. At the end of its fiscal year 2021, Mitek had roughly $419.7 million in total assets. Before 2021, however, Mitek’s total assets were consistently below $200 million.

There’s one simple answer for why Mitek’s assets essentially doubled in 2021 – they took on new convertible debt. That added about $150 million in short-term investments to their balanced sheet. Combined with the $30 million in cash at 2021’s year end, Mitek had roughly 42% of its total assets in cash and short-term securities.

Before 2021, Mitek still – pretty consistently – had 40% of its assets in cash and short-term investments. What has changed? Two things. One, Mitek made some more acquisitions recently (HooYu and ID R&D) that increased the amount of goodwill and long-term investments on its balance sheet. And, second, Mitek took on the debt to increase its cash load, primarily to make acquisitions.

Besides the IP on its balance sheet, Mitek’s P&E is almost non-existent. And its accounts receivable stay pretty steady in the mid-teens ($14-$16 million).

On the liability side of the balance sheet, Mitek has, for a long time, avoided debt. It has had some pretty minor lease liabilities, but, for the most part, no debt. The big story on the liabilities side, then, is the addition of about $120 million in convertible debt.

Since taking on the debt, Mitek has made a couple of acquisitions. The first was ID R&D, which it acquired for $49 million total ($13 million in cash) in May of 2021. Added to this, gradually, are earnouts: (1) $12.3 million one year after the closing date and (2) $9.8 million and 15% of original earnout one year after that. So, it didn’t expend a significant amount of its cash on this acquisition.

In 2022, it has already acquired HooYu for about $130 million in March (though the acquisition was made in British pounds, I just converted using the rate on the date of the acquisition). This was an all-cash offer, so a significant portion of Mitek’s cash balance was used on this deal (more than it actually took on in debt). After the acquisition, Mitek had about $61.8 million left in cash and short-term investments, compared to roughly $180 million at the end of the last fiscal year. A discussion of the nature of the debt (which is misunderstood by some investors) is in the Risk section below.

When we think about a company’s balance sheet, we should think about reinvestment (and investment of capital in general – be it debt, etc.). But Mitek is a little different. It doesn’t really have to reinvest any of its cash flow into any physical assets. But it does (sometimes) have to reinvest cash to grow. And where does the majority of this go? A few places.

First, I think it is fantastic that Mitek generates so much FCF, but it would be helpful to think of its cash for reinvestment as its gross profits. Maybe you can think of them as gross profits after G&A expenses, since those are the expenses required to maintain revenue. But the R&D expenses and the Sales and Marketing expenses are the two largest “investments” that Mitek makes into its future.

As of FY 2021, Mitek funneled about $60.5 million into Sales and Marketing and R&D.

That’s 57.5% of its gross profit for 2021. As an overall percentage of gross profit, the number has fallen slightly over the last few years. 2020 was pretty much the same as 2021, but 2019 showed the number at 64% and in 2018 it was at 68% (in 2017 it was back at 60% though).

Obviously, these assets aren’t all capitalized on Mitek’s balance sheet, but it’s good to see how Mitek’s “investments” are fluctuating related to its gross profit. Are they becoming larger in relation to gross profit, or smaller? It’s not necessarily a bad thing if they are larger, but you’d ideally want to see at least Sales and Marketing and G&A expenses decrease as a percentage of gross profit.

The good news is that sales and marketing has decreased from roughly 35-39% of gross profit in 2016-2018, to about 30% of gross profit in 2021. At the same time, Mitek’s ID Verification business is growing faster than ever. As far as sales and marketing go, you want to see that decrease (in relative terms) as a company grows. What’s great about operating leverage is that Mitek’s sales and marketing can increase in absolute terms – driving revenue growth and capitalizing on name recognition – without having to increase at the same pace as revenue.

Similarly, G&A has decreased from 27-31% of gross profit in 2016-2018 to ~21% of gross profit in 2021. Since G&A is really just maintaining the ship, that’s the kind of operating leverage you ideally want to see.

Finally, R&D hasn’t really changed much in relative terms. It has stayed near 25% of gross profit since 2017, but has increased in absolute terms at roughly the same rate as Mitek’s revenue growth. Ideally, if an expense is going to be growing, this is the one you want to see. R&D is (supposed) to deliver real value in the future. Out of the two investments we’ve mentioned, it’s probably the truest long-term investment, so it’s growth will hopefully benefit Mitek. Impressively, Mitek was spending less on R&D in 2017 than it was spending on G&A. Now, it’s past that point – it can funnel more into investments than what it funnels just into keeping the lights on.

While Mitek’s balance sheet has changed over the past year, as you can see, it’s still pretty simple. Mitek’s main assets are those that you can’t see (either on its balance sheet or in real life). Obviously, as we’ll talk about in the USAA Litigation section below, Mitek’s IP is an important asset that it needs to protect. But these assets, for the most part, don’t require any reinvestment in order for Mitek to grow.

Where Mitek funnels the majority of its money is into sales, marketing, and R&D. All three are needed to fuel growth. The good news is that Mitek doesn’t just funnel all of the cash it has into these expenses to fuel growth. Quite the opposite is true, actually. Mitek generates a ton of cash, even after spending enough in all three areas to generate growth of over 20% per year.

Valuation

Mitek’s valuation is relatively straightforward. It generates a FCF ROE of mid to high teens (maybe even over 20% some years), it is growing at over 20%, it has no real capital requirements, it has high margins, and it’s got a P/FCF of around 10-13x FY 2021’s FCF and probably in the single digits for FY 2022.

To me, Mitek looks like a great buy if you understand the business and are comfortable with the risks. It’s really that simple – Mitek appears to be undervalued. It doesn’t even really matter that much that Mitek generates a relatively high FCF ROE. Mitek doesn’t use the excess cash to fuel growth, it can growth without it (but it does use the cash to make occasional acquisitions).

If you really want to get comfortable with the valuation, you need to figure out if Mitek can continue to grow in the future. Even though it has performed well in the past, you can’t count on Mobile Deposit to continue to grow. It only grew by 5% in Mitek’s 2022 3Q. It could stop growing soon. The real question is do you believe that Mitek can successfully transition to an identity verification business? Can it successfully convert all of its Mobile Deposit customers (and others) to its MiVIP platform? If it can do that, I’m pretty confident that it can grow at least as fast as it has in the past.

If that’s the case, it really looks like a great buy at this point. Even if, for argument’s sake, Mitek only grows revenue by 20% this year, its FCF margin decreases to 28% (because ID Verification revenue is lower margin), and it doesn’t get any operating leverage with growth (which would be unusual for Mitek) you would still be buying at roughly a 10x FCF multiple. I think that’s a good bet to make on a company that has consistently grown revenue at over 20% a year, is very profitable, and has a strong customer base. That’s a 10% (maybe more, maybe less, depending on where you think FCF will end up this year) FCF yield that is growing at over 20% (FCF has traditionally grown at a much faster rate because of improving operating leverage).

If it does perform like we think it can (which isn’t really priced into the market), then the only real drag on performance could be share dilution. Mitek has been compensating its executives with pretty heft share packages, and it has been using shares to acquire other companies.

Mitek’s diluted shares outstanding have grown at roughly a 6.2% CAGR from 2015-2021. If you buy 1 million shares this year, and the growth continues at this rate for five years, your stake would decrease from ~2.2% of the company to ~1.6% by the end of that period. For example, say you have $100 in FCF in year one and there are 2000 shares outstanding. This means that you’re getting $.05 in FCF per share. Over the next five years, the number of shares outstanding increases by 6.2% annually. At the end of year five, the company would have 2,702 shares (rounding up). If FCF grew by 20% over the next five years, the company would be producing ~$249 in FCF (again, rounding up). At the end of year five, you would have $.09 in FCF per share. That’s annual growth of only 12.5% FCF per share, compared to 20% FCF growth overall. That’s what consistent share dilution can do to your returns.

But, if you’re comfortable with that, then that seems to be the majority of the downside if Mitek can execute. And this downside isn’t that bad. I’d be happy with 12.5% FCF per share growth when I buy at around 10% FCF yield. If Mitek can execute like it has been doing, then it will probably grow FCF at more than 20% per year.

The USAA Legal Issue

I think one of the issues that could be weighing on Mitek’s valuation is the USAA legal issue. Like most patent lawsuits, this one is pretty opaque, and there is a lot of misinformation out there.

It’s hard to nail it all down in a simple summary, but I’ll give it a try. It all started in 2018, when USAA brought a patent infringement lawsuit against Wells Fargo. Mitek itself was not named in the suit, but, essentially, USAA alleged that Wells Fargo infringed on its mobile deposit technology by using Mitek’s own mobile deposit technology.

USAA also filed a similar claim against PNC bank in 2020. The good news is that USAA did not name Mitek in either suit. What’s worrying, however, is that both Wells Fargo and PNC Bank sent letters to Mitek asking them to indemnify any potential damages that they would have to pay to USAA as a result of the possible infringement. Indemnification basically means that Mitek would have to reimburse PNC Bank and Wells Fargo for damages they would be forced to pay USAA as a result of what the banks consider to be Mitek’s responsibility for their liability. Mitek also stated, in its declaratory judgment action (described below) that USAA sent roughly 1,000 letters to financial institutions across the country (many of them Mitek customers) claiming that the companies were infringing on USAA patents.

As a result of the litigation, Mitek filed a declaratory judgment action in California to clarify the issue of its infringement on USAA’s patents. For those who aren’t familiar, a declaratory judgment action is basically a lawsuit that is filed to ask a court to decide a certain issue – not necessarily ask for damages. A lot of the time, these kinds of actions involve one party asking a court to interpret a contract between the parties. The cause of action doesn’t allege that the other side breached the contract, it just asks to court to interpret the contract so the parties can deal with a dispute.

In this instance, Mitek asked the court to decide whether its technology infringed on USAA’s patents. The case was originally brought in California but was removed to the Eastern District of Texas (federal court). The Texas district court dismissed the suit, holding that there was no case or controversy and, as a result, Mitek did not have standing to bring a claim. Mitek appealed to the Court of Federal Claims, and the appellate court has since remanded the suit back to the district court – keeping it alive for now.

This may all sound like procedural jargon (and it mostly is). But what is really going on here is that the court is trying to decide whether Mitek can bring a claim to clarify its possible infringement if USAA never brought a claim against Mitek for infringement in the first place.

First, I should say that this is just a strange scenario in general. USAA deliberately chose not to bring any infringement suits against Mitek, instead bringing suits against Mitek customers essentially stating that they infringed USAA’s patents by using Mitek’s technology. Mitek is inadvertently dealing with the ramifications of this because its customers that have been sued have asked it for indemnification. This probably worries Mitek because USAA could, in theory, sue all of Mitek’s customers, who would in turn want indemnification from Mitek (and also may be weary of using Mitek technology in the future – though I don’t know what alternatives there are).

When Mitek finally brought a claim to clarify its potential infringement of USAA’s patents, USAA said that Mitek doesn’t have any standing to bring a claim. Basically, USAA is saying no one alleged that Mitek infringed anything. Using common sense, you would think that Mitek would be happy with this statement. But, in a roundabout way, they are not because their customers are saying they are liable. So, what you have here is a weird situation where everyone is litigating positions that they don’t actually believe. USAA is saying that Mitek’s technology is not infringing its patents while at the same time bringing suits against Mitek customers that basically say the opposite. Mitek, in turn, is mad that USAA is saying that Mitek is not a party to the suits. Instead of being happy to not be involved in a lawsuit (as most companies and people would), Mitek started one to basically say it should be involved.

It’s not all as crazy as that, though. Mitek obviously believes it is not infringing and wants a decision from a court that it can take to its customers and say, “Look, a court says our technology does not infringe on USAA’s patents, so whatever lawsuit they are bringing against you over your use of mobile deposit technology is not on us.” Also, Mitek is obviously hoping that a decision in the declaratory judgment action will also stop USAA from suing its major customers.

The Federal Claims Court, for its part, said that the Eastern District of Texas basically has to look more closely at whether Mitek actually has standing. Basically, Mitek may have standing to bring a DJ action because (1) it could be liable for the claims brought against the banks as supplier and (2) the parties subject to the lawsuits made demands for indemnity from Mitek.

The Eastern District of Texas originally held that Mitek did not have standing because it did not deem the Wells Fargo litigation serious enough to intervene, and because in the Wells Fargo case, there was testimony that the MiSnap product only infringed USAA’s patents when it was altered by Wells Fargo. The appellate court took issue with this decision because the district court did not elaborate enough. Basically, the appellate court held that the district court needs to consider, in-depth, the role of Mitek’s technology in the banks’ infringing software and its role in USAA’s infringement claims.

And that’s where we’re at right now. It’s a weird situation, but it seems like a good thing that USAA never actually initiated litigation against Mitek or alleged that its technology infringed its patents. It’s also probably a good thing (although Mitek is fighting it) that USAA is trying to get the declaratory judgment action dismissed, essentially saying that Mitek doesn’t have standing because its technology never infringed any of USAA’s patents.

You may be asking why USAA hasn’t sued Mitek. And I can’t say that I know for sure. Maybe they truly believe that Mitek’s technology did not infringe on any of their patents – it only infringed after the customers “altered” it to some extent. It could be that USAA is going after deeper pockets by suing large companies like Wells Fargo and PNC Bank. It could also be the case that USAA is just trying to attack direct competitors like Wells Fargo and PNC Bank. Mitek is not a direct competitor to USAA – at least not in any meaningful way (USAA has a tiny percentage of the mobile deposit technology market, and the market isn’t necessarily a target for growth in the future). A much larger part of USAA’s business is banking, and Mitek’s customers are the direct competitors there.

Risks

A. Competitors

Mitek may say it doesn’t have any real competitors (it doesn’t name any in its 10-K), but that’s almost never the case. It may be true that there aren’t any real competitors at scale in the mobile capture part of the authentication market. But there are large players in the identity authentication market.

The biggest threat right now is probably Okta. If you haven’t heard of it, Okta is an authentication darling, offering cloud-based authentication products to companies both for use in workforce authentication and customer authentication.

Based on market cap, it’s much larger than Mitek, at just under $10 billion currently (though that’s down from its peak of roughly $45 billion in 2021).

Okta’s workforce identity cloud segment doesn’t really compete with Mitek. But what’s concerning is its expansion in the customer identity cloud area. Okta recently acquired Auth0, a company that specializes in providing customer identity solutions to software developers. Basically, through Auth0, Okta is trying to provide a way for software developers to include customer ID verification technology inside the apps, platforms, etc. that they create.

Besides Okta, there are a few other workforce authentication companies in the market. Some large tech companies – like Microsoft – are even in the mix. But the vast majority of these are not focused on the same market as Mitek, nor do they have the customer base.

On the other hand, there are smaller competitors – like Intellicheck and Aware Inc. – that do some of the same things that Mitek does. They aren’t as large and don’t have the same entrenched customer base. And while they’re still potential threats to Mitek (for all I know their technology could be better), for the most part, Intellicheck and Aware are just future acquisition targets.

I’m not saying that you shouldn’t worry about them, but I am saying that spending too much time worrying about them would defeat the purpose of investing in Mitek. Part of the reason I’m investing in Mitek is because it is able to acquire smaller competitors to improve its service. And it is able to offer complementary services to its large, loyal customer base. I have a hard time believing that a few smaller competitors will be a serious problem. The more likely scenario is that Mitek acquires them.

B. Customer Concentration

This will just be a brief note. But Mitek noted in its 2021 10-K that 17% of its FY 2021 revenue came from just one customer. The number was at 16% in 2020. With 7,500 customers this honestly sounds like a lot.

I don’t know if this customer is purchasing from the Mobile Deposit business or the ID Verification business (or both). If they are in the Mobile Deposit business, I would probably be less worried. It would be unexpected, but it could be the case that (for some reason) a large U.S. bank just has a very large amount of mobile checks being deposited by its customers.

If the customer is on the ID Verification side, I may be a little more worried. They would most likely be a channel partner like Adobe, Airbnb, or DocuSign. Basically, they would using Mitek’s technology as a primary way to drive their main source of business.

If this is the case, then they may have a little more bargaining power over Mitek than I imagined. They may also be growing and therefore have more bargaining power in the future. Also, if they are in the ID Verification, I worry how many other of Mitek’s channel partner customers control a large part of Mitek’s revenue. The company doesn’t mention any more (though it does say that in 2019 the largest customer controlled 17% and the next largest controlled 10% of Mitek’s revenue. That dynamic may not have changed, but there could be some other customers who have a share approaching 10% as well.

Because of the transactional nature of Mitek’s SaaS business, there could be a scenario where Mitek’s growth is coming from a few large customers that are growing the number of transactions on their platforms. This could make Mitek more reliant on them, but it could also make them more reliant on Mitek. The larger they grow, the costlier and more difficult it could be to switch ID Verification providers. Either way, this is something to watch.

C. Convertible Debt

The convertible debt has been cited by some as a serious risk facing Mitek. After all, it is already diluting shareholders at a pretty steady rate (as discussed above), and the conversion of $120 million in debt wouldn’t help any.

But if you actually take the time to read Mitek’s SEC filings and look into the debt arrangement, you can see that Mitek has insured that its shareholders will be taken care of. Make no mistake, the debt-holders will still be able to take their stake in Mitek upon a conversion. It’s just that Mitek has initiated a policy that allows it to essentially offset the dilution.

The debt, a convertible note with a 0.75% coupon that expires in 2026, is expected to convert into ~7.4 million shares of Mitek Systems. Mitek already has 45 million shares outstanding as of 2021. 7.4 million extra shares would be 14% of the total new share count, and this would increase the share county by 16%.

Mitek, however, has, by entering into warrant agreements with several banks, positioned itself to acquire 7.4 million of the shares outstanding to offset the dilution. These warrant agreements expire at the same time as the convertible debt, so there isn’t any real threat of dilution from the debt conversion. Obviously, Mitek could just choose to not purchase the shares and scrap the agreements, but it seems unlikely.

D. Stale Technology

A bet on Mitek Systems is essentially a bet on Mitek’s ability to transition to a successful ID Verification business. It’s also a bet that the core technology doesn’t really matter that much. That may sound strange, but bear with me.

Mitek basically acquired its way into the ID Verification market. Obviously, it had transferable skills – it already had a successful image capturing technology and probably some pretty good AI. But to pivot to the ID Verification market Mitek has had to make acquisitions.

It wasn’t very clear, and still isn’t entirely clear that they can make the transition better than any other company. There is a good chance that some VC-backed company or some other tech giant can make better ID Verification AI technology than Mitek. And there is also a good chance that Mitek could just let their technology lag behind the rest of the industry.

But, to me there are two main reasons why that doesn’t necessarily matter. The first is that Mitek is relatively agnostic when it comes to ID Verification technology. What I mean by this is that Mitek doesn’t just put total trust in its technology, it goes out and acquires other companies that may have better tech or tech that can be easily rolled into Mitek’s existing system. This signals, to me, that Mitek is always looking for ways to stay competitive and acknowledges that it may not have the best technology out there.

What Mitek does have, though, is the strong customer base. Other competitors have to come in and convince the leading financial institutions (and, let’s not forget, companies like Airbnb and DocuSign) to adopt their tech. Mitek doesn’t really have to do that. Its customers already trust that it can provide good image capture and analysis software because it’s been the leader in Mobile Deposit for over a decade.

Also, since it has a customer base and has now achieved some form of scale (it looks like the largest ID Verification player in the market), it can continue to acquire bolt-on technology to meet the needs of its strong and loyal customer base.

Overall, I do worry about Mitek’s technology. I don’t know too much about it, and I don’t know whether it will become stale. But I have more confidence in its ability to transition, its head-start, and its large and proven customer base. If I wasn’t more confident in these traits, I wouldn’t be investing in the company.

Conclusion

Mitek Systems is an impressive business. Not just from a conceptual standpoint – it also has the numbers to back this up. Essentially, it operates two separate businesses – both with good economics – that are actually complementary to each other. They have both grown pretty well over the years, but one is in a dying market and one in a rapidly growing market. Mobile Deposits will fund the growth in ID Verification in the future. This means that, while Mitek has a great cash cow on its hands, any real analysis has to focus on and acknowledge that Mitek has to succeed in ID Verification for an investment to be worthwhile.

The good news is that the market isn’t really pricing this in. Mitek requires essentially no reinvestment to grow, has a proven management team, and is doing pretty well in a market that it’s relatively new to. This could all obviously change as the biometrics market evolves. And, in addition, its Mobile Deposit business could be prematurely cut short by the USAA litigation (as small as a chance as that may be). Overall, I think Mitek is a cheap stock with great growth potential, a history of good performance, and several structural reasons why it can perform well in the ID Verification industry.

Be the first to comment