nycshooter/iStock Unreleased via Getty Images

Uber Technologies, Inc. (NYSE:UBER) has been part of the model growth portfolio at Leads From Gurus since its inception almost two years ago, and the reason is simple: Uber has what it takes to dominate the global ridesharing industry in the long run, which should open doors for the company to be consistently profitable. By profits, I mean real, hard profits – not positive EBITDA. Before dominating this market segment, Uber will have to overcome the challenges posed by rising inflation in every corner of the world. It is safe to say that Uber does not have any experience in dealing with sky-high inflation as the world did not encounter an inflation problem in the last decade, and Uber was founded in 2009. In this article, I will dig deep into how inflation impacts Uber’s ridesharing business – both from a demand and supply perspective – to determine whether the company has what it takes to survive this high inflationary period.

Demand-side analysis

Will rising prices negatively impact the demand for ridesharing? This is the question that I will try to answer in this segment of the analysis. To form a rational conclusion, we must find answers to a few key questions.

- Which income group uses ridesharing the most?

- What are the primary use cases of ridesharing?

- Is there evidence to suggest Uber has pricing power?

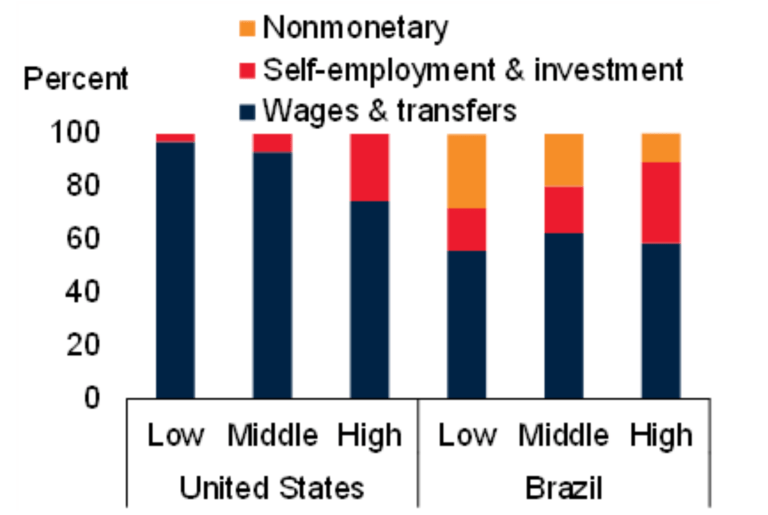

Inflation will have an impact on the spending decisions of both low-income earning and high-income earning households, but high-income households are better prepared to weather the onslaught. Rising prices often eclipse the growth in wages, and low-income households generally earn the bulk of their income from wages and transfers. On the other hand, high-income households earn a meaningful portion of their income through self-employment and investment income, and these income sources are more likely to keep pace with inflation in comparison to wages. For this reason, low-income households generally feel the heat much earlier than high-income households in an inflationary period. As illustrated below, this is true for both developed and emerging markets.

Exhibit 1: Sources of household income

Brookings Institution

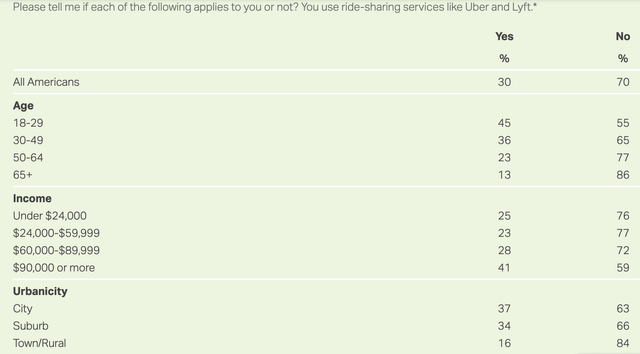

Uber, according to multiple survey results conducted in 2017, 2018, and 2019, primarily caters to high-income households although its ridesharing services are used by users representing all income brackets. A survey conducted by Pew Research Center in 2019 found that individuals with a household income of $75,000+ are twice as likely to use Uber in comparison to individuals with a household income of lower than $30,000. A survey conducted by Gallup in 2018 found that individuals earning more than $90,000 or more annually are using Uber’s ridesharing services much more frequently than lower-income earning individuals.

Exhibit 2: Gallup survey results (2018)

Because high-income households represent the primary target market for ridesharing services, there is reason to believe that the demand for ridesharing services will not be immediately impacted by high inflation. Things, however, can change dramatically depending on the severity of the fall from grace. If we enter a deep recession that lasts a few years, the demand for ridesharing will take a meaningful hit. To form a rational conclusion, we should not solely rely on the income bracket of Uber users. Rather, we need to find answers to the other two questions highlighted earlier.

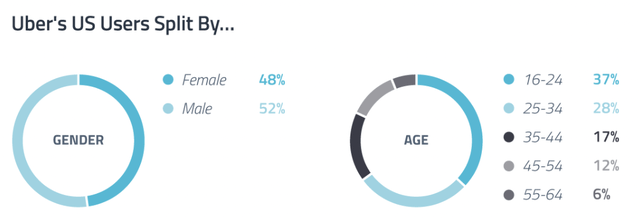

Now that we have established that high-income households use Uber the most, let’s move forward to understand the primary use cases of ridesharing. Before that, it helps to understand some more granular demographics of Uber users. According to findings of Global Web Index in 2017, the young generation is using ridesharing services the most in the United States. Although this survey was conducted five years ago, I believe these results are still valid as several other surveys have found that people over 50 are still hesitant to use ridesharing services as frequently as their younger peers.

Exhibit 3: The demographics of American Uber users (2017)

Since young users dominate the ridesharing industry, we can assume that a meaningful number of riders use ridesharing services for social outings. A couple of surveys confirm the validity of this assumption.

- According to KeyBanc Capital Markets, social outings are the primary use case for ridesharing. Commuting to work and airport travel are the two major use cases behind social outings.

- A Statista survey conducted in 2016 found that social hangouts such as parties and dinner outings accounted for 43% of all Uber rides in the United States.

Going by these stats, it would be reasonable to conclude that inflation might have an impact on the demand for ridesharing in an inflationary environment as consumer spending on social outings will take a hit as consumers prioritize essential spending.

At the beginning of this segment, I highlighted three questions. So far, we have found answers to two questions and these answers give us varying signals of what the future holds for Uber. Let’s now move on to discuss the third factor: does Uber have any pricing power?

In the early days of Uber’s business, the mission of the company was very simple to understand: drive taxis out of business by charging ultra-low prices for rides. The objective of this analysis is not to comment on this strategy, so I will leave it for my readers to figure out whether that strategy worked well. Today, Uber is looking at profits. The company operates in almost all the major cities across the world and is by far the leading ridesharing company in the world. The company has achieved scale, but profits have not followed. One major reason could be the perceived inability of ridesharing companies to set prices. Charging higher prices from riders was never a popular decision among ridesharing companies since higher prices were thought to take riders away from these platforms. Inflation, however, seems to be changing the playing field.

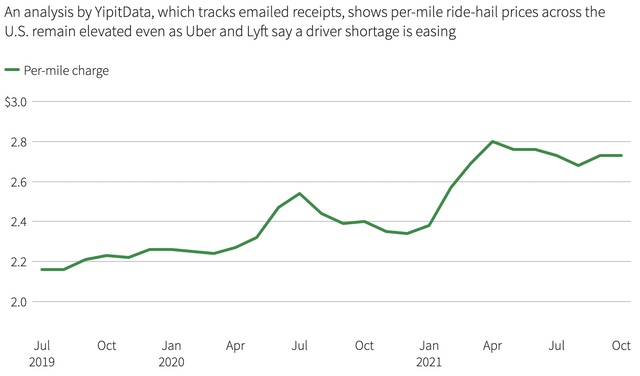

Now that consumers are getting used to paying higher prices for almost everything, Uber has found the freedom to charge higher prices. According to data from Rakuten Intelligence, the cost of an Uber ride has increased by a staggering 92% between January 2018 and July 2021. The below chart by Reuters also confirms that the per-mile cost charged by ridesharing companies in the U.S. has trended upwards in recent years.

Exhibit 4: Per-mile ridesharing cost in the United States

Amid these higher prices, let’s look at how Uber performed in the second quarter. Gross Bookings hit an all-time high of $291.1 billion in Q2, MAPCs reached an all-time high of 122 million, adjusted EBITDA came well above the guidance at $364 million, and the company reported a record $382 million in free cash flow. Uber seems to be firing on all cylinders despite consistent price hikes in the last few quarters, which is a testament to the pricing power the company is enjoying today. I am not even remotely suggesting that Uber can continue to raise prices without losing customers, but the company, for many years, did not enjoy any pricing power at all, which seems to be changing amid high inflation.

Based on the findings of this segment of the analysis, I believe inflation at this rate will not be a major concern for Uber’s ridesharing business. In fact, I believe Uber is well-positioned to thrive in the coming quarters with people wanting to cut back on transportation expenditure by carpooling.

Supply-side analysis

Leaving the demand-side impact of inflation behind, let’s look at how inflation is impacting the supply of drivers. Ever since the start of the pandemic, ridesharing companies faced massive challenges in onboarding the required number of drivers to cater to the demand for rides. The below news headlines from 2021 and 2022 should give you a clear idea about the driver issues Uber was facing until now.

Exhibit 5: News headlines on Uber’s driver shortage

Uber, despite many efforts to resolve this problem by incentivizing drivers to get behind the wheel, failed to achieve this objective until the natural order of things came up with a solution. With inflation reaching new highs, many people are looking for additional income sources today. With the increasing cost of living deteriorating the lifestyles of many people, Uber drivers are coming back to work. Andin record numbers. In the second quarter, the number of drivers on the Uber platform reached a record high. Commenting on this, Uber CEO Dara Khosrowshahi said:

We continued to add more drivers onto the Uber platform, with our global driver and courier earner base at an all-time high of almost 5 million, up 31% year-over-year, exiting Q2. (That’s right: more people are earning on Uber today than before the pandemic).

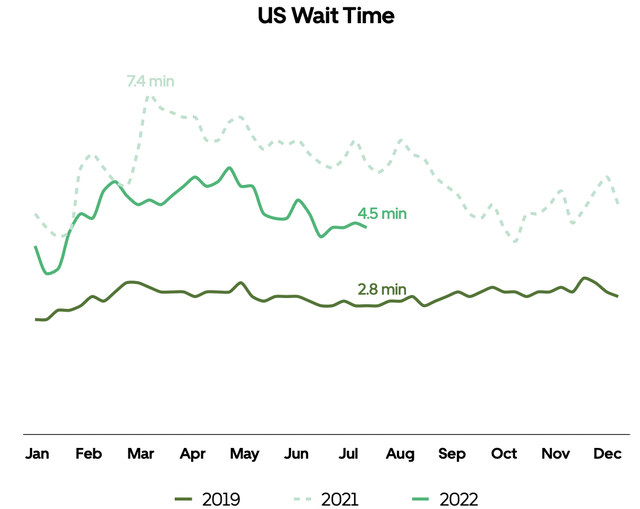

With a record number of drivers partnering with Uber in Q2, the wait time for trips in the U.S. declined meaningfully in the second quarter, which is welcome news as many riders were not satisfied with the wait times in the previous quarters.

Exhibit 6: U.S. wait time for an Uber ride

Speaking to CNBC a couple of days ago (September 13), Uber CEO had this to say about the record number of drivers signing up with Uber:

72% of drivers in the U.S. are saying that one of the considerations of their signing up to drive on Uber was actually inflation.

From a supply-side perspective, Uber is well and truly benefiting from high inflation for the time being.

Takeaway

Inflation is making its way into the wallets of many Americans. This, however, does not seem to be a problem for Uber for the time being. The company is making the most of consumers’ need to go out and enjoy the world after being confined indoors for the better part of the last two years because of mobility restrictions and fear of Covid. I do not want to consider Uber as a winner of high inflation, but I certainly do believe the company can deal with inflation and see light at the end of the tunnel. I do not plan to make any changes to my stake in Uber today.

Be the first to comment