Olemedia

Livent Corporation (NYSE:LTHM) has been manufacturing and marketing lithium products for nearly 80 years. Livent is the seventh-largest lithium battery company in the world by market capitalization. The company produces a set of diversified products able to satisfy customers from the most varied industrial sectors. The company is also characterized by a strong vocation for sustainability to contribute to a cleaner and healthier world.

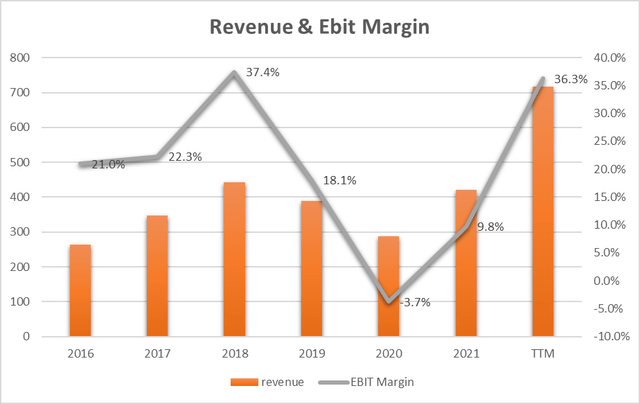

In 2022, two main exogenous factors helped Livent deliver an extraordinary performance: growing market demand despite rising prices and insufficient global production capacity to meet demand. These factors translated into a revenue growth performance of 70% compared to 2021 and an EBIT Margin of 36.3%.

Added to this reality is a forecast of strong double-digit market growth up to 2030, and the company has defined an important growth plan for production capacity. This complex plan could represent on the one hand a great opportunity while on the other an element of strong risk in terms of the economic sustainability of the business in the long term. The other strong element of risk is determined by the volatility of the lithium price. In the event of a sharp price drop, Livent Corporation, having large production plants started up and also large investments in progress, could suffer in terms of growth and profitability.

The management is confident that the price and demand can remain strong and with a share price that seems to be able to offer a return of 28.3% per annum, at current EPS growth rates, my rate is Buy.

General overview

Livent Corporation manufactures and markets lithium through a diversified portfolio of products capable of serving the market in a broad, diversified, and even customized way.

Its history begins in 1944 in Minnesota and passes through acquisitions and production relocations all over the world (including South America, Europe, and Asia). The company takes the name Livent in 2018 with an IPO on the NYSE. In 2020 a phase of important investments in the expansion of production capacity began (mainly in Argentina and Canada through Nemaska Lithium Inc. where the company has, 2022 a 50% stake).

The products range from rechargeable batteries for electric vehicles to batteries for renewable energy, but their lithium is also used in “green” tires, medical devices, some components for aviation, the pharmaceutical sector, and also in the air purification sector. The Livent products are truly used in the most varied industrial and consumer fields.

The main raw material and research areas are:

• Lithium Hydroxide and Carbonate (energy storage – EV)

• Butyllithium (tires, pharmaceuticals)

• High-Purity Lithium Metal (long-lasting batteries used in pacemakers and aviation).

Lithium Market Demand forecast

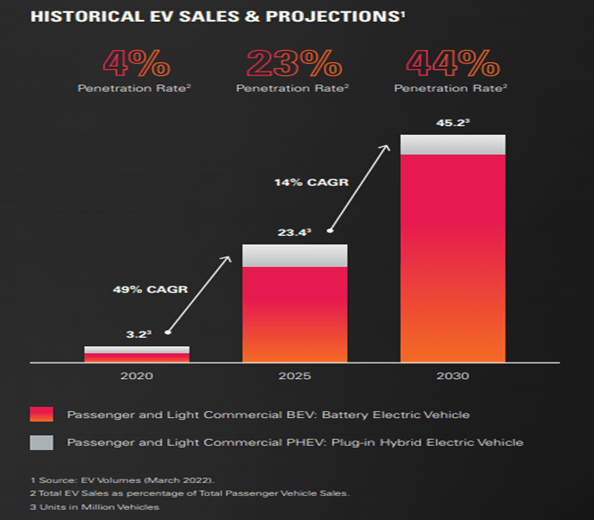

According to Statista, the Projection of worldwide lithium demand referred to 2030 will be with a total estimated demand of 2.114B metric tons. In 2022, the same demand is 0.559B metric tons. The compound annual growth rate is equal to 20.9%.

Entering the merits of the most explosive sector, electric vehicles (“EVs”) according to EV-Volumes up to 2025, the demand for lithium batteries is expected to increase by 49% annually and subsequently by 14% every year until 2030.

Livent 2021 Sustainability Report

Looking at the market from two different perspectives (specialized EV and global lithium), we can state that, in all likelihood, future growth will be double-digit for an important number of years. To date, Livent’s production capacity is fully occupied, and 70% of sales have already been fixed in advance with predefined prices. On the other hand, 30% of sales are sold on the market with a spot price.

Will Livent be able to accomplish this important market growth?

Livent expansion project

The company has put on the table a plan to expand production capacity based on expansions of existing plants and also on acquisitions of other companies (Nemaska Lithium Inc.).

Going deeper:

Lithium Carbonate

Argentina: production capacity target of 100,000 metric tons by the end of 2030. The scheduling is divided into 3 phases: 20,000 metric tons in 2023 another 30,000 in 2025 and another 30,000 after 2025. If this plan is implemented, production capacity should double by 2023 and subsequently increase by about a further 60% in two years or by 2025 and by a further 40% in the following 5 years.

Lithium Hydroxide

Actual production capacity: 25,000 metric tons. The target is to reach 55,000 metric tons in 2025 with the following steps:

Bessemer City expansion of 5,000 metric tons (2022) + new location in China (by the end of 2023) with another 15,000 metric tons. This means that by the end of 2023, production capacity should increase by 80%

By the end of 2025 new production capacity of 10,000 metric tons with a new plant in North America or Europe. This means that by the end of 2025, production capacity should increase by 22%

By 2026, the production capacity will be potentially up to 90,000 metric tons with Nemaska production.

The Livent 2021 Sustainability Report about Nemaska:

“Nemaska is a fully integrated mining and lithium chemical manufacturing development project located in Québec, Canada, with 34,000 metric tons of targeted Lithium Hydroxide annual production capacity. well-positioned to serve the developing EV battery industry in North America and Europe. Nemaska is nearing the completion of its engineering work and we expect Nemaska to begin lithium chemical production by the end of 2025.”

If the production capacity extension plan is respected, Livent could become the largest producer of lithium hydroxide in the U.S.

The industrial development plans appear to be clear and defined. The carbon part is purely internal, i.e., it involves developing existing plants. The hydroxide part, on the other hand, is more external, i.e., it involves finding new locations or suppliers and entering into new agreements. This is a very ambitious plan and difficult to implement. The timing is also demanding. However, the targets are in line with the forecast for global lithium demand.

The next question is whether Livent has the financial and operational capabilities to bring this ambitious industrial plan on target.

Financial

Revenue and Profitability

Livent Form 10-K + Author Graph

The graph shows the revenue trend (orange bars) and we can see if we exclude 2020, an increasing trend. Notably, 2022 ((TTM)) saw revenue at $716M, up 70% year-over-year, and EBIT Margin at 36.3% or $260M vs $41M in 2021.

As we can hear from the last Q3 Earnings call in terms of profitability:

Third quarter adjusted EBITDA was 70% higher than the prior quarter and over seven times higher than the prior year. This was due to continued strong pricing across all products, and our ability to take advantage of a favorable market conditions… Additionally, we saw a small improvement in sequential costs. As we sold the bulk of our remaining higher cost third-party carbonate materials from inventory in the second quarter.

The main effects are due to the high selling price of the product.

Back to 2020 from the Form 10-K:

The decrease in gross margin was primarily due to lower average prices, lower sales volumes and increased costs due to the financial impact of increased third-party lithium carbonate usage and incremental COVID-19 costs to implement safety protocols.

Also in this case the negative effect on the margin is mainly due to the selling price factor. Both extreme cases give us a very important indication: the sales mix and the final price of lithium can determine the company’s high profitability.

It should be emphasized that Livent is also an integrated and direct producer and this puts it in the privileged position of not depending on third-party costs concerning competitors who have to buy the raw material on the market.

The management also believes that market prices can remain resilient also in 2023 and, if this were to happen, the incremental part of production capacity (see the previous paragraph) would be free to be sold on the market at the best price (as there was no contract with a fixed price as was the case in 2022)

This hypothetical scenario should allow Livent to further improve the EBIT Margin and also the cash flow which is very necessary to allow further investments in the expansion of production capacity.

Free Cash Flow, EPS, and CapEx

Livent Form 10-K + Author Graph

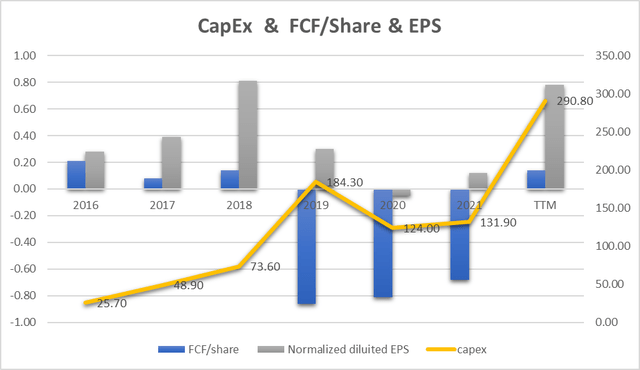

The blue bars represent the FCF/Share and we can see a positive trend from 2016 to 2018. In 2018 the important increase in profits (grey bar) was immediately transformed into operating cash flow and immediately into Capex for $184M in 2019 (yellow line) more than double in comparison with $73M in 2018 and this led to a negative Free Cash Flow. In other words, the company is using all the cash generated by the profits in investments (CAPEX) and the trend (yellow line) is particularly growing. Only in 2022 were the profits generated so high as to allow very high investments and also a positive FCF.

The CapEx forecast for next year is also growing as we can hear from the last earnings call:

We’re projecting capital spending in 2023 to be higher than 2022. This is not a change to our previous expectations, as we continue to execute on our roughly $1 billion investment plans from 2022 through 2024, excluding the Nemaska. We will begin to see the initial benefits of these efforts in early 2023, when we ramp up our first 10,000 metric ton phase of carbonate expansion in Argentina, something we can do relatively quickly given the unique nature of our daily based processes.

And the results of these heavy investments should only begin to be seen in 2024 when the first major increase in production capacity will be operational.

Remaining in 2022 and 2023, to finance the investments, the company will also be able to count on the funds received in advance from the contract signed with General Motors (for the supply of batteries from 2025)

Valuation

EPS Growth Model

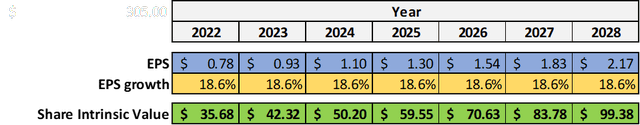

Since the company is showing growth in terms of Revenue and EPS, I decided to use the EPS growth parameter tracked from 2016 ($0.28) to 2022 ($0.78) as an estimate of future growth. 18.6% is the growth rate (CAGR) of EPS.

The Formula is (by popular investor Benjamin Graham):

Intrinsic value per share = EPS x (8.5 + 2 g)

Where

EPS = earning per share

g = EPS growth rate = 18.6%

Example of calculation for 2023:

Intrinsic value per share = EPS x (8.5 + 2 g) = 0.93x(8.5+2×18.6) = $42.32

The last intrinsic value of $99.38 for 2028 underlines an annualized return of 28.1% as the current share price is $22.5.

28.1% is the annualized expected return for the investment in Livent. It’s a great figure in absolute value but it requires great confidence that the EPS growth rate can remain at 18.6% for the next 7 years and this represents an element of risk especially if we look at the production capacity plan.

Peer Comparison

To compare LTHM with similar companies in terms of market capitalization in the Materials sector in the Specialty Chemicals Industry I have defined the following peers:

• H.B. Fuller Company (FUL)

• Balchem Corporation (BCPC)

• Element Solutions Inc (ESI)

• Albemarle Corporation (ALB)

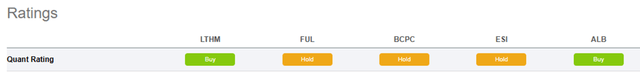

Using Seeking Alpha’s Quant Ratings, we have a “Buy” verdict related to the “Hold” rating, or also “Buy” of Albemarle Corporation, which is the leader in the Lithium market. This could also underline the strong trend of the underlying market

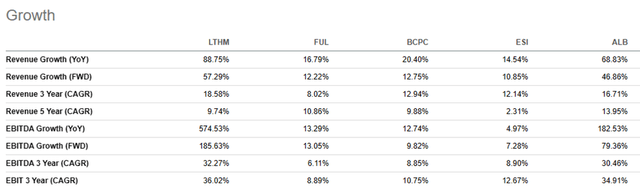

In terms of growth, we can see how LTHM achieves the best result on Revenue (YoY) with 88.75% while ALB has 68.83%, and even on a three-year basis it’s 18.58% always stands out compared to ALB (16 .71%). The average EBIT figure is also the best at 36.02%. In terms of growth, Livent represents the best alternative.

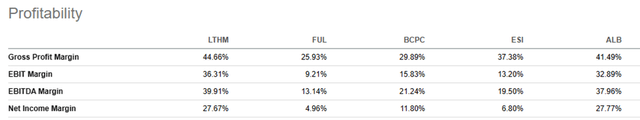

As far as profitability is concerned, Livent’s gross profit and EBIT are also the best parameters when compared with other peers.

Risks

Productivity expansion plan

the production capacity expansion projects that have been hypothesized by the company are technically complex and refer to a very limited timing in line with market forecasts. To date, we have a certainty of an increase of 5,000 metric tons of carbonate lithium but the remaining part of the increase in production capacity is limited to paper.

This aspect represents an important element of risk as a delay in the implementation of projects or an increase in cost could cause a strong loss of profitability in the long term.

Lithium price

The prices of lithium on the market are and will be volatile and this, as happened in the past, can determine the company’s profitability in the reference period. To date, the company has 70% of its sales based on fixed price contracts while the remaining 30% is sold on the market with a spot price. Soon, it is increasingly expected that prices will no longer be contractually fixed in advance but will follow market trends.

Should the price rise, Livent will be able to benefit from the contingent situation and increase its profits by having a cost base not indexed to the price of lithium. In the opposite case in which the price was to fall, the company will have to face an adverse effect on its business with heavy contractions of margins, operations, and cash flow necessary to support investments for growth. The latter condition represents an element of high risk especially if commensurate with future expenditure in terms of CapEx.

Conclusion

Livent records in 2022 (TTM) revenue growth of 70% with $716M and an EBIT Margin of 36.3%. The remarkable results of Q3 are also and above all attributable to growing market demand for lithium and an increase in the selling price on the market. These elements, together, form an explosive mix to lead the company not only to record high profits but also to be able to face huge investments for future growth. The valuation of Livent Corporation share price is potentially cheap by projecting an expected return of 28.1% on an annual basis. Forecasts for double-digit growing demand up to 2030 lay the further foundation for an open road ahead of Livent. My rating is Buy.

Be the first to comment