RomoloTavani

Looking back at 2022 one can conclude it has been an eventful year. Against a back drop of runaway inflation, geopolitical tensions and volatile energy prices, Celanese (NYSE:CE) has been working to fund a US$11Bn acquisition. Now the dust has settled and the company provided pro-forma figures detailing the effect of the acquisition, it is time to make up the balance.

Larger M&A

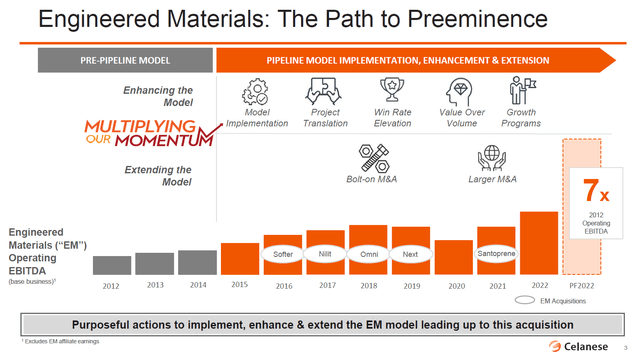

At the time Celanese announced the acquisition of Dupont’s (DD) Mobility and Materials division, it also presented an overview of the previous acquisitions, see figure 1. As can be seen some relatively minor acquisitions have been done to which management refers to as ‘bolt-on M&A’. Come 2021 and management decided it was time to turn the acquisitions up a notch.

In 2021 Santoprene was acquired from ExxonMobil (XOM) for a sum of US$1.15Bn. The estimated contribution to EBITDA (pre-synergy) was US$115 million, basically gaining US$100 million in earnings per billion paid.

Figure 1 – Celanese acquisition overview (investors.celanese.com)

The latest acquisition of DuPont’s M&M division was announced in February 2022. The goal of the US$11Bn acquisition was to generate an additional US$0.9Bn in EBITDA. One could argue this deal is less favorable than the Santoprene acquisition as the M&M deal generates less earnings power with US$82 million of earnings per billion paid.

The current status is the envisaged earnings are expected to deteriorate, meaning the deal will likely be less accretive to earnings than expected. Rightfully so, investors have been concerned with the increased leverage and reduced earnings of the company.

Earnings perspective

The acquisition of M&M was supposed to add approximately US$0.9Bn in EBITDA (pre-synergy) to the bottom line of Celanese. This expectation was shared in February when the acquisition was made known. Unfortunately, several months later in June, Celanese stated the following in an 8K form filed in June:

The M&M Business’s first quarter adjusted EBITDA declined by approximately 20% in 2022 as compared to the first quarter of 2021, which may result in lower than anticipated financial performance of the M&M Business for 2022.

This is quite an adjustment in earnings as EBITDA reduces from US$0.9 to US$0.7Bn and this potentially needs to be adjusted further given a looming recession. Or, in the words of CEO Ryerkerk when she presented the outlook in the 3Q22 press release:

Current order books validate our belief that the remainder of 2022 and the start of 2023 will be challenged by typical winter seasonality in addition to continued demand weakness in certain end-markets and customer destocking.

Accounting for this downward revision of the EBITDA and the latest outlook, I’ll work with a revised EBITDA of US$0.6Bn coming from the M&M acquisition.

When the results of Celanese are considered, the company generated US$2.1Bn in EBITDA up to 3Q22. As the CEO announced the fourth quarter is traditionally slower, I estimate the full year EBITDA will not meet the 2021 number of US$2.8Bn. Instead I’ll work with a value of US$2.6Bn, assuming the company can generate US$0.5Bn in the fourth quarter. Combining the Celanese and M&M numbers, my pro-forma EBITDA estimate becomes US$3.1Bn for the full year 2022.

Cash flow perspective

Based on the information Celanese provides on non-US-GAAP metrics, it appears the company on average converted half of EBITDA into free cash flow since 2013. This ratio declined over the last two years, but the assumption is made that a FCF to EBITDA ratio of 0.45 can be achieved.

With an estimated US$3.1Bn of EBITDA to be generated, this translates to a free cash flow of US$1.4Bn. As 2021 free cash flow amounted to US$1.26Bn, this may seem disappointing considering the company just spent US$11Bn on an acquisition. In the end however, the question is how the acquisition will work out for shareholders in the long run. But, before looking at shareholder returns, debt development will be assessed first.

Debt development

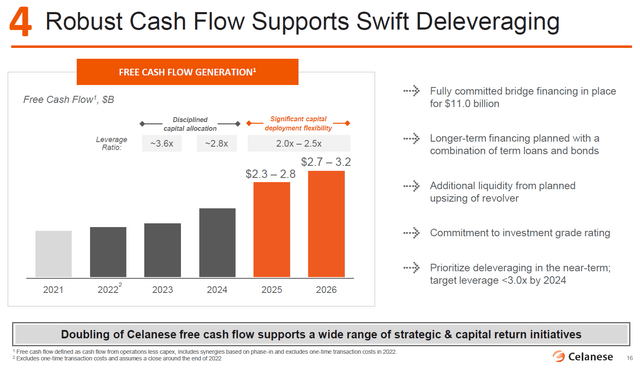

With the earnings potential covered, it is time to follow-up on the expectation of management the acquisition would ‘drive significant expansion of free cash flow and swift deleveraging with total debt below 3.0x EBITDA within two years of closing’, also see figure 2.

Figure 2 – Deleveraging and cash flow generation (investors.celanese.com)

Based on the 3Q22 press release, total debt currently stands at US$12.3Bn if long term debt and short term borrowings are combined. If the company wants to bring this down to 3x times EBITDA, it should be lowered to a value of US$9.6Bn based on aforementioned estimate. This implies an amount of US$2.7Bn, or US$1.35Bn annually, needs to be paid off over the next two years.

Taking the estimated free cash flow of US$1.4Bn, the company can potentially retire US$1.1Bn in debt if the dividend is kept constant. The difference is caused by the annual dividend payments of approximately US$0.3Bn. So, if potential divestments, synergies and other actions by management are not taken into consideration, it will take the company two-and-a-half years to reduce debt to the level required.

The target of debt equaling 3x EBITDA can be achieved either by increasing earnings, lowering debt or a combination of both. So far the calculations in this article have assumed debt will be lowered, but a meaningful increase of EBITDA was not considered. This assumption may be too conservative based on the outlook of the company, from the 3Q22 press release:

Amid these dynamics, we are taking a series of controllable actions across our global supply chain to deliver fourth quarter adjusted earnings per share of $1.50 to $2.00, inclusive of the currently expected impact from the M&M acquisition in November and December, and to simultaneously prepare for recovery as we progress beyond the first part of 2023.

To emphasize, when Celanese announced the M&M acquisition in February this year, the world looked a whole lot different than it does today. For example, Russia had not yet invaded Ukraine and the Fed hadn’t started hiking the interest rates.

Yet, based on my estimates, Celanese has the potential to achieve the total debt target in a vastly different rate environment while the developed economies are on the verge of a recession. The confidence management has achieving the targets was shown when it recently raised the quarterly dividend to US$0.70.

The dividend

In hindsight, the timing of the M&M acquisition was unfortunate. As a result, investors turned away from the stock, leading to a price decline of 40% after reaching a high of US$176 in January of this year. The decline stopped when management announced a dividend raise in October.

Executing a major acquisition in a deteriorating macro-economic environment could have prompted management to freeze or even reduce dividend payments, but instead it was decided to actually raise the dividend. This move exudes confidence especially as a reduction or cancellation of the dividend is not logical after the recent raise.

The slight 2 cents raise in October makes the 2022 dividend US$2.74 in total (2021: US$2.72). Note the quarterly dividend in 2022 was raised from US$0.68 to US$0.70 in the last quarter of the year. This explains why the 2022 dividend does not match the total of US$2.80 one would expect based on the current US$0.70 quarterly dividend.

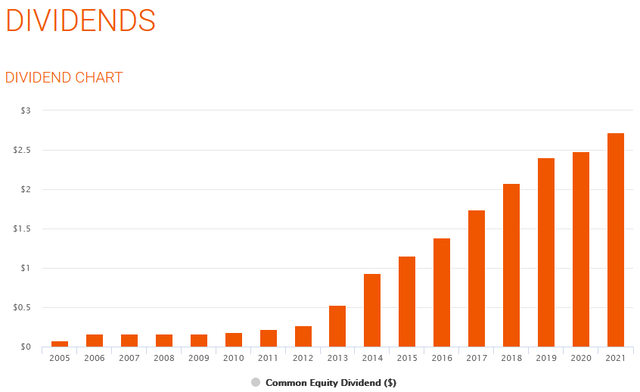

Figure 3 shows the annual dividends paid since 2005. In 2010 the dividend started to grow after it had been kept constant for a number of years. Between 2010 and 2022 the dividend grew at a compound annual growth rate of more than 25%. Given the debt reduction target this rate will most likely not be achieved over the next two years, but given this track record and the recent dividend increase, it is clear management remains committed to dividend growth.

Figure 3 – Celanese dividends since 2005 (investors.celanese.com)

As the company is building a dividend track record, I expect the dividend increases to remain, although these will be modest in size. My base case is the dividend will be increased by 8 cents annually in 2023 and 2024. This number is based on the recent announcement where the quarterly dividend was raised 2 cents. The estimated increase of 8 cents (annually) translates into an 3% increase based on the current 2022 dividend of US$2.74.

In 2021 Celanese recorded a US$304 million cash outflow due to dividends paid. In 2022 the dividend was raised by 3%, and as mentioned my base case is the same will happen in 2023 as well. This implies the amount spend on dividend distributions in 2023 is approximately US$322 million. A similar 3% raise in 2024 will bring the total to US$332 million. These are all very manageable numbers which imply the company does not have to forego the dividend while paying down debt.

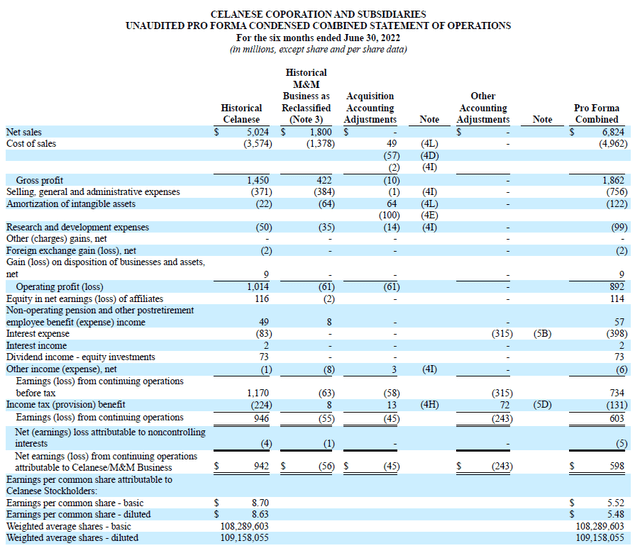

This is further supported by the low dividend pay-out ratio. To determine the pay-out ratio, a look is taken at the 8K form which Celanese filed on November 1st. Considering 1H22 pro-forma earnings per share as stated in figure 4, one could argue full year earnings will be approximately double, giving US$11 earnings per share. This means the dividend payout ratio is approximately 25% meaning there is ample room to grow the dividend once total debt has been reduced.

Figure 4 – Pro forma statement of operations (investors.celanese.com)

Stock price

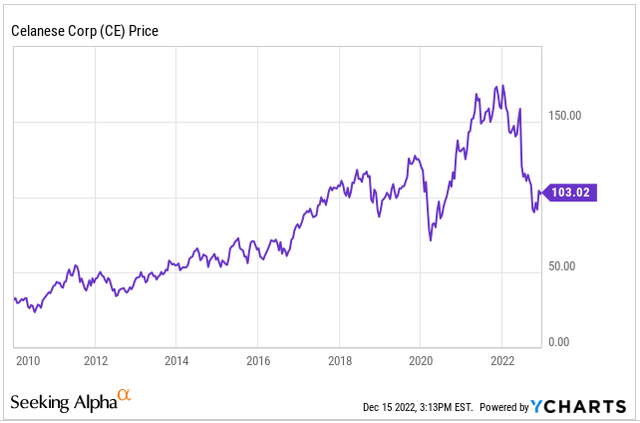

Returns are not merely measured in dividend distributions, testimony to this is the year-to-date performance of the stock. If the long term view is taken however, the stock price has shown an CAGR of 10% considering it traded at US$33 at the beginning of 2010 and increased to a level of US$103 at the time of writing, see figure 5. Note this growth rate has been determined with the current stock price, i.e. after the stock lost 40% this year from its January high.

Figure 5 – Celanese stock price since 2010 (Seeking Alpha, Ycharts)

Now, every investor knows past performance is no guarantee for future results, but I believe management will need a year to show they are on track executing their plan. Waiting for this may give more certainty, but it also means the stock will trade higher by that time.

Investors may wait for the turn of the year as December traditionally is a good month, and with a recession on the horizon, one can potentially purchase Celanese stock at a lower level in 1Q23. Yet, irrespective of the exact timing of buying this stock, I am convinced Celanese is a sensible long term investment.

Risks

The performance of Celanese has been solid over the last decade and it’s tempting to extrapolate this into the future. A big difference however is the interest rate environment has changed compared to the last decade. The result being the net effective borrowing rate for the loans taken out to fund the M&M acquisition is 5.4%. Following the merger announcement several banks downgraded the stock, often citing the increased leverage.

More concerning may be the impending recession as it will affect the income of the company. A wider downturn for the chemical industry would be especially cumbersome for Celanese given the high leverage. On the other hand, these concerns should have been priced in by now and it remains to be seen how deep the recession will be. At least in Europe, governments are spending massively to cushion the effect of the energy crisis and as a result, they hope a potential recession will not be as deep. So far the performance of for example BASF (OTCQX:BASFY) has been better than many would have expected when the gas prices skyrocketed in July this year.

Looking beyond the first half of 2023 a bigger concern may be subdued economic growth for a prolonged period of time. The current state of affairs in the world may point to a reversal of globalization which will not bode well for companies, such as Celanese, who operate on a global scale. Foregoing an elaborate discussion on this topic, the eventual effect on Celanese will be lower earnings implying deleveraging will take longer and shareholder returns will be lower.

Conclusion

Celanese stock lost 40% since January as the US$11Bn acquisition of DuPont’s M&M division is being executed in a deteriorating macro-economic environment. The current status is the envisaged earnings are expected to deteriorate, meaning the deal will be less accretive to earnings than expected.

Looking at the numbers, a pro-forma annual free cash flow of US$1.4Bn can be achieved by the company. This amount will allow the company to fund the dividend while deleveraging total debt to 3 times EBITDA in approximately two-and-a-half years.

With an estimated pro-forma dividend pay-out ratio of 25%, Celanese has ample room to grow the dividend after the deleveraging target has been achieved. In addition, I think shareholder returns will be supported by an appreciation in the stock price once the company can prove the merits of its latest acquisition. The 2022 decline of the stock therefore offers an attractive entry point in my view.

Be the first to comment