BalkansCat

Investment Thesis: I take a bullish view on this stock on the basis of strong sales growth, a potential boost to Makeup sales with the “reopening” of China, as well as an attractive P/E ratio and cash position.

In a previous article back in 2019, I made the argument that Estee Lauder (NYSE:EL) could have significant upside ahead in spite of concerns over the stock potentially being expensive as well as concerns over a slowdown in sales across China at the time.

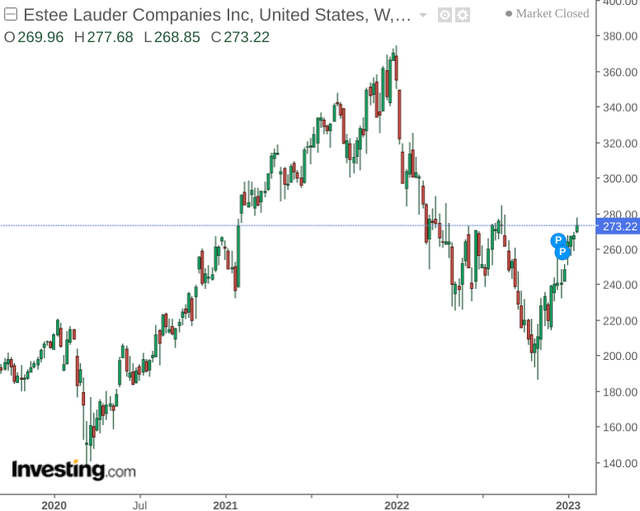

In spite of the macroeconomic pressures that have followed since with respect to COVID and inflationary pressures – the stock is still up by over 60% in the past four years – notwithstanding a significant decline in 2022:

Since late last year, we have seen Estee Lauder start to rebound. The purpose of this article is to investigate whether the stock can continue to regain upside from here.

Performance

When looking at sales performance for the most recent quarter (three months ending September 2022) as compared to that of September 2019 – we can see that overall net sales came in higher during the most recent quarter.

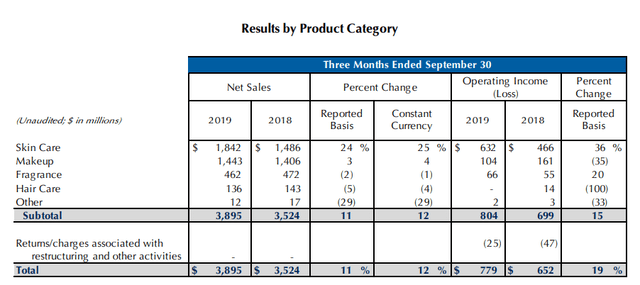

Sales (Three Months Ended September 2019)

Estee Lauder Q1 2020 Earnings Release

With that being said, we can also see that Makeup sales for the most recent quarter are significantly lower than that of September 2019.

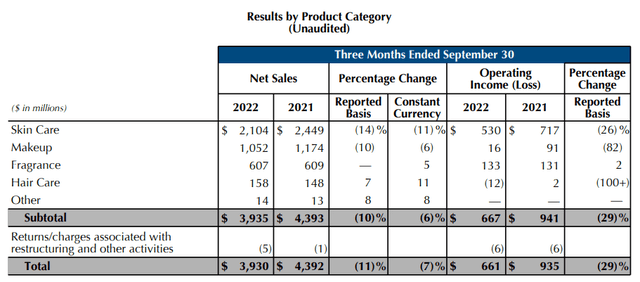

Sales (Three Months Ended September 2022)

Estee Lauder Q1 2023 Earnings Release

With that being said – the company argues that given the large exposure of this segment to the Chinese market – the COVID restrictions that have been in place across China up until now have significantly hindered sales growth. However, we have seen net sales across this segment continue to see double-digit growth across Southeast Asia and Europe, the Middle East & Africa.

From a balance sheet standpoint, we can see that over the past three years – the company’s quick ratio (calculated as total current assets less inventories and prepaid expenses all over total current liabilities) has remained virtually constant – albeit slightly lower that previously at 0.97 in September 2022:

| September 2019 | September 2022 | |

| Total current assets | 7022 | 8866 |

| Inventory and promotional merchandise | 2055 | 3018 |

| Prepaid expenses and other current assets | 414 | 754 |

| Total current liabilities | 4590 | 5271 |

| Quick ratio | 0.99 | 0.97 |

Source: Figures sourced from Estee Lauder Q1 2020 and Q1 2023 Quarterly Earnings Releases. Figures provided in millions of USD, except the quick ratio. Quick ratio calculated by author.

Given that the quick ratio has remained close to 1 in spite of the macroeconomic pressures that Estee Lauder has faced over the past three years has been impressive and indicates that the company is in a good position to service its current liabilities using existing liquid assets.

With that being said, we have seen that the company’s long-term debt to total assets ratio has increased over the past three years – with macroeconomic pressures having necessitated a higher debt load for Estee Lauder to cope with pressures on sales growth – which was particularly the case during the lockdown period of the COVID-19 pandemic.

| September 2019 | September 2022 | |

| Long-term debt | 2895 | 5107 |

| Total assets | 15431 | 19989 |

| Long-term debt to total assets ratio | 18.76% | 25.55% |

Source: Figures sourced from Estee Lauder Q1 2020 and Q1 2023 Quarterly Earnings Releases. Figures provided in millions of USD, except the long-term debt to total assets ratio. Long-term debt to total assets ratio calculated by author.

Looking Forward

Going forward, I take the view that Estee Lauder can continue to see significant sales growth from here. With China having abandoned its zero-COVID policy, sales across the Makeup segment could have substantial room to grow from here.

Moreover, while inflationary pressures have placed broad pressure on consumer demand – the fact that overall sales are above levels seen in 2019 is encouraging.

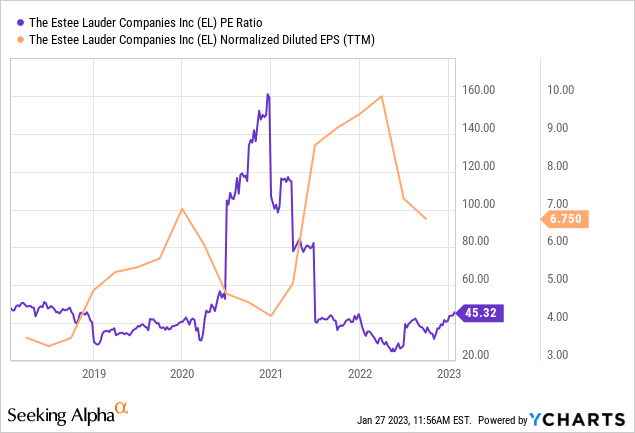

Additionally, when looking at the company’s P/E ratio over the past five years – we can see that the ratio has descended back to levels seen pre-2020, while earnings per share (notwithstanding the recent decline) continues to remain at the upper end of the range seen at the beginning of 2020.

ycharts.com

From this standpoint, I take the view that Estee Lauder is still attractively valued from an earnings standpoint, and the stock could have potential to reach the prior high of $380 that we saw in 2021 as the stock recovered post-COVID.

Conclusion

To conclude, Estee Lauder has continued to see strong sales growth in spite of macroeconomic pressures. I take a bullish view on this stock on the basis of strong sales growth, a potential boost to Makeup sales with the “reopening” of China, as well as an attractive P/E ratio and cash position.

Be the first to comment