pederk

Investment Thesis

Livent Corporation (NYSE:LTHM) stands near the Big Bang explosion of the EV supply chain, given the push for carbon-neutral vehicles in the US by 2030 and the EU by 2035. As a result, we expect massive insatiable demand for lithium ahead, given the popularity of the raw material for many battery producers and automakers. Be it a Lithium-Iron-Phosphate (LFP) battery for safety and cost reasons or a Lithium-Nickel-Cobalt Aluminum-Oxide (NCA) battery for performance reasons, Lithium remains the common denominator for it all. Therefore, ensuring the long-term success of companies such as LTHM for the next decade.

Based on Tesla’s (TSLA) designed production capacity in Fremont and Texas, we are looking at 1.2M EVs per annum by 2023, assuming the recovery of supply chain issues. GM (GM) also just signed an MOU with LTHM to secure lithium supply for up to 1M EVs by 2025. This is on top of the latter’s existing agreement with BMW (OTCPK:BMWYY) announced in 2021.

Therefore, investors would be well advised to add LTHM to their portfolios, given the relatively attractive risk/reward ratio over the coming decade. The stock remains a value pick over Albemarle Corporation (ALB), given the formers’ cheaper valuations and projected exponential growth. Though LTHM’s trading is at a slight premium, we believe it is an excellent entry point for speculative investors looking for long-term growth. In contrast, conservative investors may want to wait for another retracement below $20 – a comfortable support level that would provide a wider margin of safety ahead.

LTHM Is Set For Massive Growth Ahead

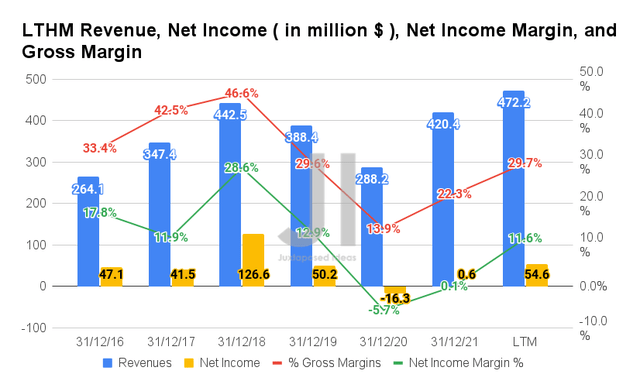

Despite the brief dip during the COVID-19 pandemic, it is evident that LTHM’s revenue and net income have come roaring back thus far. By the LTM, the company reported revenues of $472.2M and gross margins of 29.7%, representing notable improvements of 21.5% and in line with pre-pandemic levels in FY2019, respectively. In addition, LTHM also reported net incomes of $54.6M and net income margins of 11.6%, indicating an increase of 8.7% though a minimal decline of 1.3 percentage points from FY2019 levels, respectively.

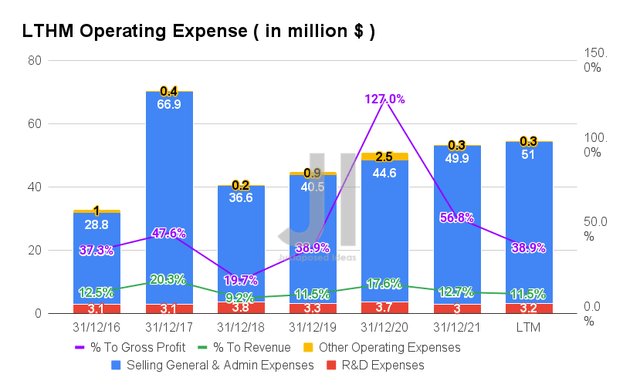

It is evident that LTHM has been improving its capabilities in the past few years, given the YoY increase in its operating expenses. By the LTM, the company reported $54.5M of operating expenses, representing an increase of 21.9% from FY2019 levels. Nonetheless, there is little to be concerned about, since the ratio to its growing revenues remained relatively stable at 38.9% in the LTM, in line with FY2019 levels.

Moving forward, we expect to see a slight increase in LTHM’s R&D expenses due to its new partnerships, such as that with Lilium (LILM), for the development of high-performance lithium batteries. However, we are not concerned since these investments would eventually be top and bottom lines accretive – further boosting its future stock performance.

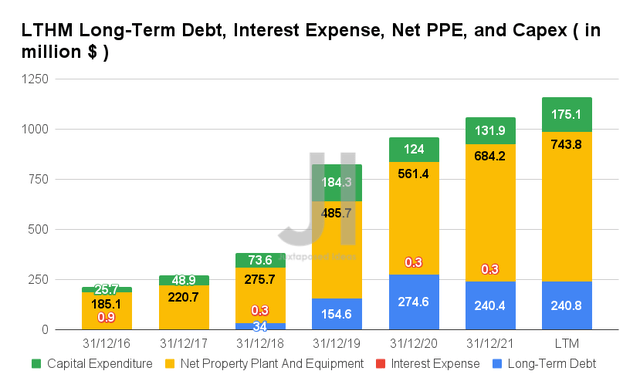

From the chart above, LTHM has also been expanding its capacity outputs at an aggressive rate, given the total net PPE assets of $743.8M in the LTM, which represented a tremendous increase of 53.1% from FY2019 levels. In the meantime, the company continued to invest in existing and new locations, given the capital expenditures of $175.1M in the LTM. Therefore, due to its limited profitability, it made sense that LTHM had relied on long-term debts of $240.8M in the LTM. Since these convertible notes would be due in 2025, we speculatively expect to see a dilutive effect of up to 27.58M shares, based on the original conversion price of $8.73 if not redeemed.

LTHM Projected Capacity By 2030

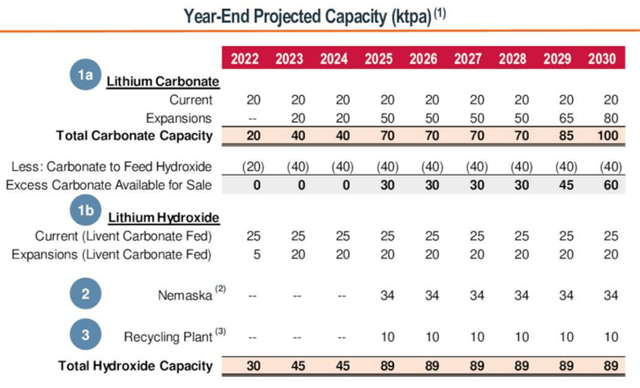

We expect these investments to start paying off by FY2023, due to the addition of 20K metric tons of lithium carbonate capacity in Argentina and 15K tons of lithium hydroxide in China. Furthermore, we speculatively expect to see significant success for lithium recycling in its future facilities in North America and/or the EU – further boosting its revenues in the intermediate term. In the long-term, LTHM aimed to increase its Lithium Carbonate output by five-fold and Lithium Hydroxide by nearly three-fold, which would speculatively boost its revenue and profitability to beyond $3B and $0.8B by 2030, respectively.

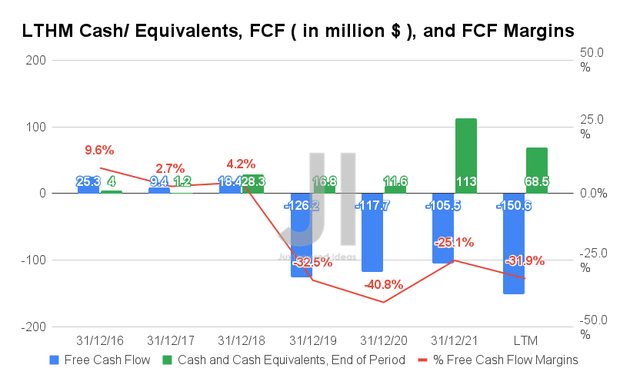

Therefore, given its aggressively expanding expenses, we can understand why LTHM has yet to report positive Free Cash Flow (FCF) generation thus far, since the company is currently at a growth-at-all-cost stage. However, due to its deepening cash burn, we expect the company to continue relying on long-term debts or capital raises, due to its depleting cash and equivalents of $68.5M on its balance sheet in the LTM.

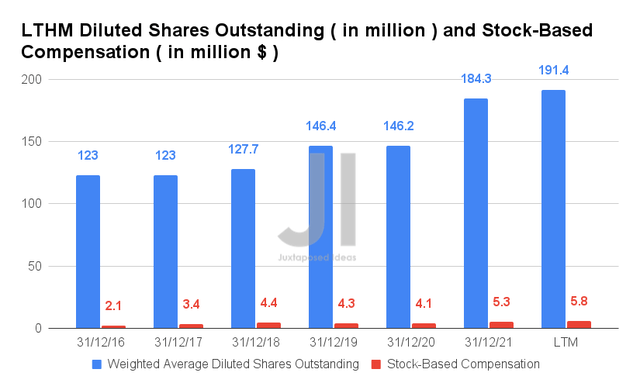

In the meantime, we expect LTHM to continue relying on Stock-Based Compensation (SBC) and share dilution to fund its expansion for the next few years. By the LTM, the company reported SBC expenses of $5.8M and a share count of 191.4M, representing an increase of 34.8% and 30.7% from FY2019 levels, respectively. The $219.4M capital raised in 2021 had partly contributed to the share dilution, which was “used for growth capital expenditures, including lithium capacity expansion, for general corporate purposes and to repay outstanding amounts.” In addition, in the event of 2025 Convertible Notes, we may see a further dilutive effect of up to 14.4% by 2025, based on current share counts. We shall see.

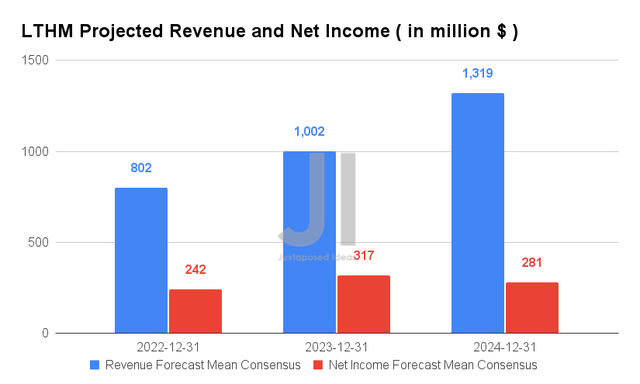

For the next three years, LTHM is expected to report revenue growth at an impressive CAGR of 46.40%, while experiencing an adj. net income growth of 72.65%, due to the potential normalized lithium prices by FY2024. For FY2022, consensus estimates that the company will report revenues of $802M and net incomes of $242M, representing tremendous YoY growth of 90.7% and 40333%, respectively. This is due to higher realized prices and robust customer demand for lithium in FY2022.

In the meantime, analysts will be closely watching its FQ2’22 earnings call with consensus revenue estimates of $209.42M and EPS of $0.29, representing YoY growth of 104.91% and 629.85%, respectively. Since LTHM has continued to deliver stellar performance for the past five consecutive quarters, we expect to see a decent stock recovery in the short term as well.

So, Is LTHM Stock A Buy, Sell, or Hold?

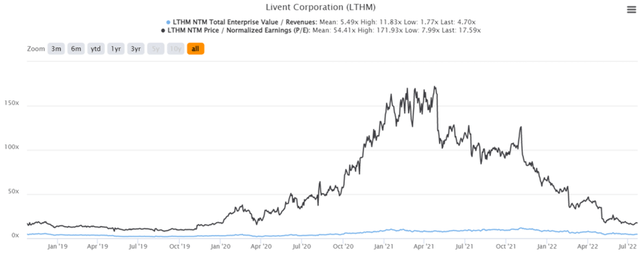

LTHM 3Y EV/Revenue and P/E Valuations

LTHM is currently trading at an EV/NTM Revenue of 4.7x and NTM P/E of 17.59x, lower than its 3Y mean of 5.49x and 54.41x, respectively. The stock is also trading at $23.03, down 33.4% from its 52 weeks high of $34.61, though at a premium of 27.8% from its 52 weeks low of $18.01.

LTHM 3Y Stock Price

Consensus estimates also rate LTHM stock as an attractive buy, with a price target of $31 and a 34.61% upside. In the long-term, there is a strong possibility for a 10-fold upside, once the company hits an inflection point in revenue/ profitability growth and trades nearer to the big boys. In the short term, since the company’s FQ2’22 earnings call is near, we prefer to wait it out and glean more information about its performance thus far.

Nonetheless, those with a higher tolerance for volatility and long-term outlook may want to nibble LTHM at this level, since the rally post FQ1’22 earnings call has been digested by now, giving interested investors a wider margin of safety. Analysts also predict a “perpetual deficit” in lithium, consequently triggering an extreme rally ahead. In the meantime, given the historical support level, we generally prefer a safer entry point of $18 to $20.

Therefore, we rate LTHM stock as a Buy only for speculative investors.

Be the first to comment