Lorado

Investment Thesis

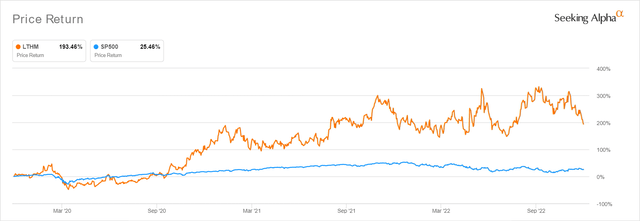

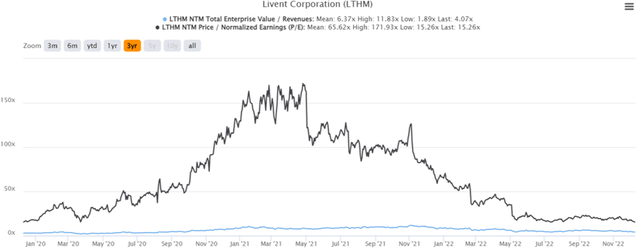

LTHM 3Y Stock Price

The Livent Corporation (NYSE:LTHM) stock has experienced a remarkably volatile year in 2022 indeed, with 76.48% price swings both ways, ending with a sad -6.74% performance YTD. However, we reckon that this has only provided patient investors with the chance to load up, due to the improved margin of safety current prices offer for next decade’s portfolio growth and investing. Naturally, only suitable for those with higher risk tolerance and long-term trajectory, since more volatility is on the horizon over the next few days.

The November labor report and activity in the services industry have proved overly bullish to market analysts, heavily digesting Powell’s previous dovish commentary. Thereby, indicating Mr. Market’s growing conviction that terminal rates could potentially be raised to over 6%, since the November CPI report on 13 December may come in hotter than expected, attributed to the Thanksgiving and Black Friday festivities. Though the majority of market analysts are optimistically projecting a 50 basis points hike, there is still a 25.3% chance that the Feds may push for the fifth consecutive 75 basis points hike by 14 December. Only time will tell.

One thing is clear for sure, if the Feds indeed pivot earlier than expected, we may see the whole market rally in a tsunami of optimism, temporarily lifting up all boats at the same time. Especially since the demand for Lithium will go through the roof, due to China’s unexpected reopening cadence. The country’s GDP is expected to rebound tremendously to 5% by 2023, compared to the projected 3% in 2022 and the historical 6% in 2019. This will be triggered by the flurry of ‘revenge’ spending from the immense pent-up demand over the past three years of lockdown, which was also previously witnessed in the US during the reopening cadence in 2021.

As a result, it is apparent that Powell faces an uphill battle, since China’s fast and furious reopening may factor into the persistent inflation for longer than 2023, perhaps even into 2024. Thereby, sustaining the elevated lithium prices ahead of LTHM’s stock price, as China continues its EV subsidies through 2023 as well.

LTHM Continues To Execute Brilliantly While Expanding Margins

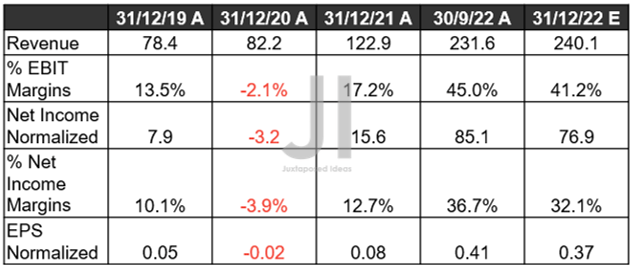

LTHM Revenue, Net Income ( in million $ ) %, EBIT %, and EPS

S&P Capital IQ

Despite the tougher YoY comparison and the -$18.3M missed revenue estimates, LTHM continues to exceed expectations, with FQ3’22 EPS of $0.41 against the consensus of $0.39. The company continues to boast excellent GAAP EBIT margins of 45.3% and GAAP net income margins of 33.5% by FQ3’22 as well, in spite of the 28.57% YoY growth in its Stock-Based Compensation to $1.8M.

Therefore, it is no wonder that market analysts expect LTHM to outperform with FQ4’22 revenues of $240.1M and EPS of $0.37, significantly aided by the higher realized pricing across the board. These numbers indicate an impressive 95.36% and 462.5% YoY growth, respectively, despite the relatively flat volumes sold on an LCE basis YoY.

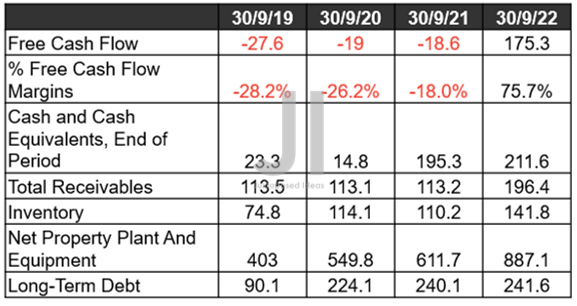

LTHM FCF ( in million $ ) % and Balance Sheet

S&P Capital IQ

While LTHM has committed $1B for its output expansion over the next few years, we are not concerned about its immediate liquidity at all, since it continues to boast an excellent balance sheet thus far. The company reports immediate liquidity of up to $408M and inventory of $141.8M in FQ3’22, further strengthened by the $500M in an undrawn credit facility only due by 2027. Excellent indeed, as LTHM has also deftly more than doubled its net PPE assets since FQ3’19, while keeping its reliance on long-term debts stable at $241.6M by the latest quarter.

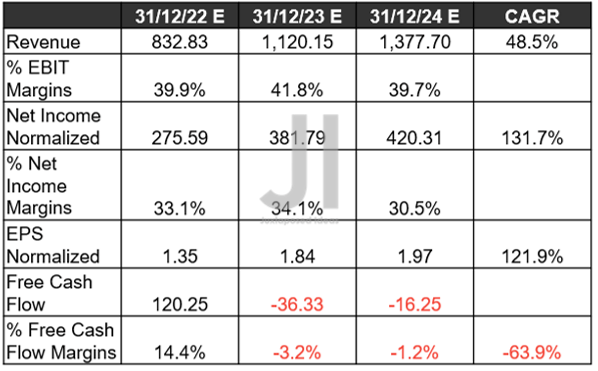

LTHM Projected Revenue, Net Income ( in million $ ) %, EBIT %, and EPS, and FCF %

S&P Capital IQ

What is more impressive is that LTHM’s top and bottom line growth has been further upgraded by Mr. Market since our previous analysis in October 2022. We are now looking at an impressive CAGR of 48.5% and 131.7%, respectively, over the next three years as opposed to previous estimates of 43.15%/110.65%, pre-pandemic levels of -12.2%/-53.9%, and hyper-pandemic levels of 4%/-25.7%. Impressive indeed, despite the supposed 2023 lithium oversupply feared by many analysts.

LTHM’s minimal FCF generation through 2024 is insignificant as well, since the company is not paying dividends at the moment. Furthermore, these are attributed to its aggressive annual capital expenditure of up to $340M in North America, Argentina, and China. Thereby, qualifying the lithium production for the US IRA’s EV tax credits while being bottom-line accretive in China at the same time, which accounted for 35.4% of the company’s revenue compared to the US at 18.78% in FQ3’22.

In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- Livent: Lithium Deficits And Elevated Prices Are Here To Stay Through 2024

- Livent Stock: Riding On The Hyper Growth Wave

So, Is LTHM Stock A Buy, Sell, Or Hold?

LTHM 3Y EV/Revenue and P/E Valuations

LTHM is currently trading at an EV/NTM Revenue of 4.07x and NTM P/E of 15.26x, lower than its 3Y mean of 6.37x and 65.62x, respectively. Otherwise, still undervalued based on its YTD mean of 5.97x and 29.09x, respectively. Going by its FY2024 EPS of $1.97 and current P/E valuations, we are looking at a moderate price target of $30.06, mirroring consensus estimates of $34.10. Otherwise, an ambitious $59.36 based on its FY2026 EPS of $3.89. Thereby, indicating an excellent 59.90% upside from current levels.

Combined with the multiple factors discussed above, we cautiously rate LTHM stock as a Buy. Consecutively, portfolios should also be sized appropriately in the event of volatility.

Be the first to comment