Justin Sullivan

Wells Fargo (NYSE:WFC) has been one of the banking sector’s longest-running turnaround stories. The bank was well run and held up much better than peers during the 2008 Financial Crisis. No less than Warren Buffett was a huge fan of the company and had held WFC stock dating back to 1989.

This all changed with Wells Fargo’s unauthorized accounts scandals in the late 2010s. Wells Fargo went from a premium valuation to one of the lowest ones in the industry. The management team was removed, and many key employees left. Buffett sold out of his stake in the embattled bank. And, most troublingly for the bank, it has been a magnet for regulatory action and oversight since then; Wells Fargo continues to face substantial headwinds both from legacy legal costs and regulatory roadblocks to renewed growth.

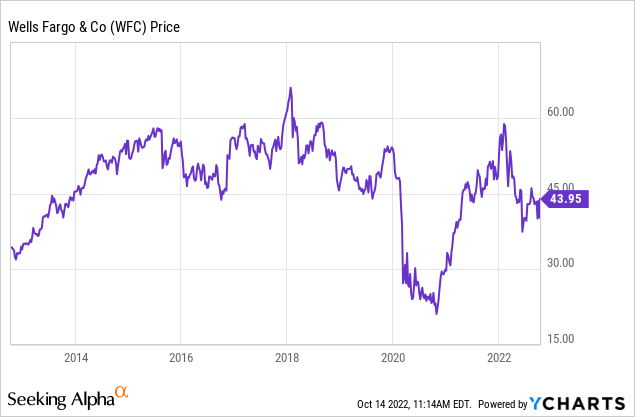

All this has added up to a stock price that has not made any progress for the better part of the last decade:

Waiting For Wells’ Core Earnings To Emerge

I’ve been bullish on Wells Fargo for awhile and had hoped that 2022 would be the inflection point for the bank as it moved on from the scandal-filled late 2010s. So far, returns haven’t been incredible by any means. However, there’s more here than first meets the eye. Year-to-date, including dividends, WFC stock is down 10%. That’s compared to an 18% decline for the Financial Select Sector ETF (XLF) and a 22% decline for the S&P 500.

I believe this gets at the broader point. Wells Fargo has been dramatically underearning vs. its core earnings power in recent years. This is primarily due to its higher overhead and legal costs to clean up past scandals. Limitations, such as the asset cap, also have stopped Wells Fargo from growing beyond its current size and scope.

For investors who can look past the current mess and see where the bank will be in two or three years, however, a clear bullish case appears. Trim the excessive overhead costs and Wells Fargo should earn more than $6/share in earnings based on its current balance sheet assets. Put a 10-12x P/E multiple on that and you have a $60-$72 stock. Some share buybacks could add considerably to potential upside.

However, this case has been delayed several times. First the coronavirus stopped Wells Fargo from executing on its turnaround. Dealing with the aftershocks of that sudden economic stoppage became the order of the day. Remote work also greatly affected business at traditional banks, slowing down internal processes. The government also put limits on too-big-to-fail banks, such as temporarily preventing share buybacks, which stopped banks such as Wells Fargo from fully capitalizing on their unusually low stock prices.

At the end of 2021, Wells Fargo appeared to have considerable momentum and shares were up near five-year highs. However, the macroeconomic developments in 2022 have been less than favorable.

Wells Fargo is known as a Main Street bank and has a strong deposit base and retail footprint compared to its direct peers. The resurgence of the American consumer was a strong positive for Wells Fargo. Wells Fargo traditionally has had one of the largest mortgage businesses of the big banks, and thus was positively levered to the sizzling housing market that we saw in 2021 and early 2022.

These good times may be coming to an end, however. Housing prices seem set to decline given the unprecedented surge in mortgage rates over recent months. If nothing else, transaction volumes will decline, which will slow down the mortgage banking business. The decline in activity in consumer durables such as autos and appliances will hit demand for consumer credit. And Wells’ capital markets activities also will see a slower period given dropping valuations for both bonds and stocks.

As always, just when Wells Fargo’s turnaround is picking up steam, something comes along to disrupt the momentum. That said, I’d argue Wells’ position is stronger than people are currently giving it credit for. The company’s upbeat Q3 earnings add significant weight to that view.

Core Earnings Are Encouraging

Wells Fargo reported its Q3 ’22 earnings on Friday, and the numbers were largely ahead of expectations. Some bears will say it was a soft report since the company’s GAAP earnings came up short of consensus. However, GAAP earnings included a $2 billion hit (45 cents per share) for litigation and customer remediation issues.

These one-time expenses are real costs and certainly hit the bottom line for now, but they’re not a key consideration for valuing the bank going forward. Wells Fargo has replaced its management team and shifted its business strategy since the prior infractions occurred. The company is still paying for its past misdoings, but these legacy costs have little bearing on what the franchise will be worth in, say, 2025.

Excluding the scandal-related costs, Wells Fargo earned $1.30 per share this quarter which was way ahead of the analyst consensus at $1.09. Adjusted earnings were also up dramatically from just 82 cents per share in Q2.

What’s driving the big improvement in earnings? There are two primary factors: more loans and higher net interest margins.

The company’s average loan book grew to $945 billion, which was up 11%. While the slowing housing market and economy should hit loan volumes sooner or later, it’s important to realize just how strong the economy has been in recent quarters. Wells Fargo was able to grow its loan book considerably in recent quarters, and that should continue to pay off for the company even as forward conditions become less promising.

The second factor is higher net interest margins. Throughout 2021, we frequently heard about how higher interest rates were going to lead to dramatically higher income for the banking sector. With the economic complications we’ve seen in 2022, this rising profitability tailwind has seemingly gotten lost in the noise.

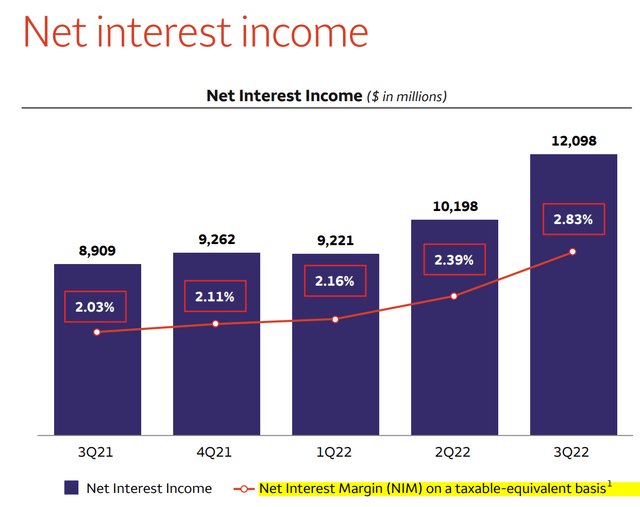

The higher interest rates, however, are delivering bigger profits for lenders like Wells Fargo. For Wells specifically, the growth has been tremendous:

Wells Fargo net interest margin (Q3 earnings presentation)

The bank’s net interest income is up more than $3 billion per quarter over the past year. That’s simply incredible growth. And the bank has gotten to keep most of that rising interest as profit. Thanks to the bank’s strong deposit franchise, it hasn’t had to increase interest rates on deposits nearly as quickly as it has been able to charge more for lending. With that favorable spread, the bank’s NIM has soared from 2.03% to 2.83% over the past year.

Needless to say, when you can make an extra 80 basis points on your loan book and you have a loan book of $945 billion, there’s some significant favorable operating scale there.

Take the bank’s Q3 core earnings number of $1.30 and annualize it, and that would be $5.20 of earnings. Analysts had a consensus number of $5.16 for Wells’ fiscal year 2023 coming into this print. I assume we’ll see some positive revisions in the coming week, which should boost that 2023 outlook further. With that in mind, if the bank makes $5.20 per share next year, that puts shares at less than 8.5x forward earnings.

Given Wells Fargo’s incredibly strong deposit franchise and strong leverage to higher interest rates, I reiterate my view that this bank should be worth at least 10x earnings and perhaps valued as highly as 12x. That leads to considerable upside from today’s price.

And 2023 isn’t the end of the earnings growth story, either. The bank’s efficiency ratio, which measures costs compared to revenues, is still up at 73%. For large American banks, we usually see figures in the 55%-60% range. Like golf, a lower score is better. Wells Fargo is highly inefficient compared to peer banks today because it has so much overhead related to cleaning up its past scandals. In coming years, as Wells Fargo is able to normalize its operating costs, we’ll see another lever for unlocking additional profitability.

Wells Fargo Stock’s Bottom Line

I’ve long held that this bank should make at least $6/share in earnings once it’s done dealing with its legacy scandal-related costs. We appear well on the path toward this outcome following the bank’s suprisingly strong Q3 earnings report.

Even with a still-bloated efficiency ratio, Wells Fargo is now set to earn at least $5/share in the coming year. This surge in earnings is coming primarily due to higher interest rates. There’s no sign of any immediate reversal in these higher rates, so this positive momentum on net interest margin should continue for quite some time.

When I was originally penciling out Wells’ $6 per share earnings thesis, it was more reliant on cost-cutting and share buybacks. Share buybacks have been limited by government oversight and now macroeconomic conditions. However, I believe there’s still ample room for Wells to buy back stock given its improving operating results and undervalued share price. Meanwhile, there’s still a ton of room for improvement on the operating cost side. Getting the bank’s efficiency ratio back to in-line with peers should add something close to $1.50/share of additional earnings.

That would take us from the current runrate in the low $5s to more than $6.50 per share. At that point, shares would be worth at least $65 even on a conservative 10x P/E multiple.

I understand why investors are frustrated with Wells Fargo. Every quarter seems to bring some new snag or headwind to the bank’s turnaround story. And the share price has seemingly been trading in the $40s forever now.

However, look under the surface and key metrics such as loan volume and net interest margin are pointing strongly in the upward direction. WFC stock may remain stuck in the mud a little longer due to unfavorable macroeconomic headwinds, but the core fundamental story here is showing strong improvement. Long-term investors should be amply rewarded as soon as broader market sentiment turns.

Be the first to comment