Phynart Studio

The inflationary wave we’ve seen over the past two years has shaken a lot of things up. Certain industries that had been left for dead, such as energy, have come roaring back. Commodities and hard assets have done well. The surge in demand has let generally low-margin producers, such as steelmakers, earn record profits.

U.S. Steel (NYSE:X) has enjoyed windfall results over the past year on the back of a huge surge in demand for cars, homes, and appliances among other durable goods. With U.S. Steel generating huge operating earnings today and shares down sharply from their 52-week highs, this might seem like a buying opportunity. Here’s the bull argument for U.S. Steel, and why I’m not convinced shares a buy despite those points.

The Bull Argument For U.S. Steel

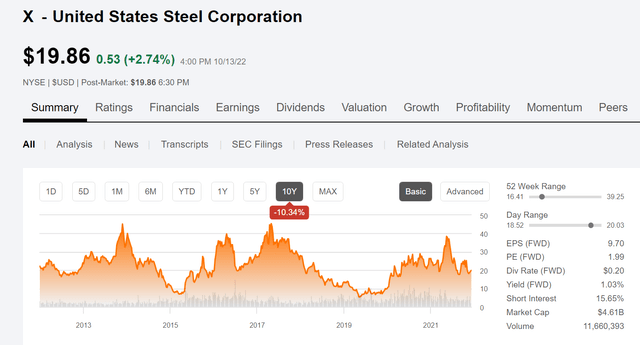

The argument for owning United States Steel stock starts with valuation. Just glancing at its financial results, U.S. Steel looks like a huge deep value opportunity:

X ticker page (Seeking Alpha)

Your eyes aren’t lying. The forward earnings estimate is $9.70 per share, which would put the stock at just 2x forward earnings. If U.S. Steel produced its current rate of earnings for a mere two years, it would earn back its entire market capitalization. Pretty compelling, right?

However, Wall Street isn’t known for giving out free lunches. When you see a stock that appears to be this cheap, there’s usually some sort of catch.

In this case, there are a couple of major issues with U.S. Steel despite the cheap valuation. These are that the company’s earnings are highly cyclical, a downturn is coming for the steel industry, and that the company’s balance sheet remains less than pristine.

Steel: Not A Great Buy And Hold Sector

In a 2015 article, I highlighted a study which showed returns of American stocks between the 1930s and early 2010s. The author broke down the returns on 30 key sectors over that more than 80 year stretch. Tobacco, alcohol, and energy were the #1, #2, and #3 performing sectors, respectively. Meanwhile, at the bottom was steel, which came in dead last. Steel even trailed other weak sectors like apparel, coal, and construction materials.

What has accounted for steel’s historic weakness? For one, it’s a commodity product with limited differentiation between vendors. Companies don’t have many levers to pull in terms of adapting their business plans to earn consistent profits. That became doubly true with the rise of globalization, as the American steel market started to be flooded with cheaper foreign imports.

There’s also a great deal of volatility inherent in the business. Steelmakers are highly exposed to fluctuations in input costs such as iron ore, coal, and electricity prices. The sector has historically struggled with strikes and high labor costs. Meanwhile, the end market is unpredictable. Key steel users, such as the automotive industry, can go from record sales to a bust in a short period of time. We appear to be in such a period now, as the auto industry is going from shortages in 2021 to what appears to be a potentially significant glut going forward.

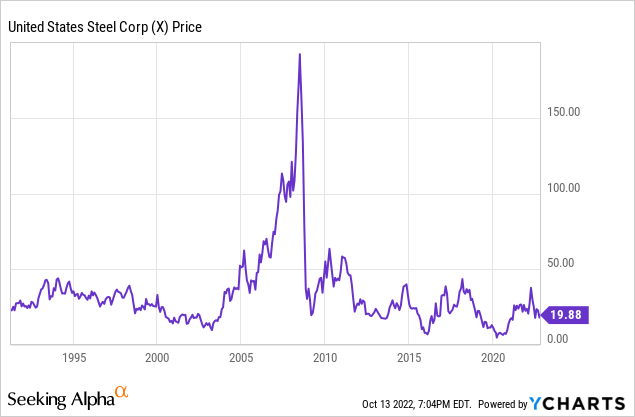

All this makes it hard to navigate business as a steelmaker. Some firms, such as Nucor (NUE), have had more success than others. But U.S. Steel hasn’t been one of the more fortunate:

Shares are essentially flat over the past 30 years. Aside from one big run-up during the 2008 commodities boom, U.S. Steel has offered investors little to cheer about in recent decades.

Steel Profits Set To Slide

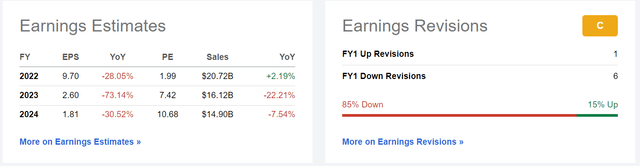

It’s true that U.S. Steel is set to earn almost $10/share in FY’ 22. That’s incredible stuff. However, this profitability is expected to be fleeting:

U.S. Steel earnings estimates (Seeking Alpha)

Analysts see U.S. Steel’s earnings plummeting 73% in 2023 to $2.60 per share. As if that weren’t enough, analysts forecast another 31% decline in 2024, with projected earnings falling to $1.81 per share. That would put X stock at a much more understandable 11x earnings ratio. I doubt that there would be nearly so much excitement about U.S. Steel stock if people were thinking about it from the perspective of its likely 2024 earnings and double-digit P/E ratio rather than its apparent 2x P/E ratio today.

I’d also note the earnings revision box on the right. Most analysts have been downgrading their outlooks for U.S. Steel in recent months. This suggests that the risk is to the downside, that U.S. Steel might not hit those current 2023 and 2024 estimates. It’s not hard to see why there might be additional risk to earnings estimates given the slowing economy, high inflation situation, and rapid slowing in big-ticket items such as housing and automobiles.

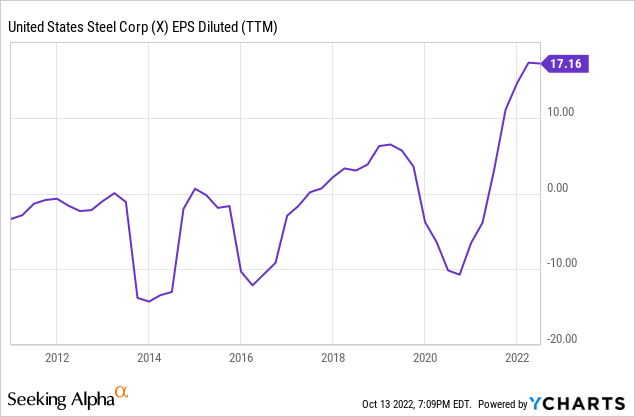

Dating back to the financial crisis, U.S. Steel has been unprofitable as frequently as it has made profits. In fact, it has run large losses on several occasions over the past decade:

Investors should keep that in mind when thinking about the current windfall earnings. U.S. Steel has made a fortune in 2021 and 2022, and that’s wonderful for the firm. However, it’s far from representative of U.S. Steel’s normal state of affairs.

Debt Limits Near-Term Options

With the company earning close to $10/share of earnings in 2022, however, can’t U.S. Steel buy back a ton of stock or pay a huge special dividend to reward shareholders for the tremendous profitability?

Not so fast. Coming into the current industry boom, U.S. Steel’s balance sheet was in tenuous shape. This summer, for example, Fitch upgraded U.S. Steel’s credit rating. However, the upgrade was merely from “BB-” to “BB” which leaves the firm below the cut-off for earning an investment grade rating.

U.S. Steel has been tendering to retire some of its outstanding bonds. And that makes sense, as this is high cost debt. The company has 2029 debt outstanding, for example, at a 6.875% coupon rate. This debt is currently trading around 90 cents on the dollar with a last trade yield of 8.9%.

Understandably, U.S. Steel is using its current earnings to strengthen its balance sheet and attack this high-cost debt straight-on. However, as long as debt is the priority, U.S. Steel isn’t going to shower shareholders with huge cash return policies. And, as noted, analysts expect earnings to drop sharply into 2023 and 2024, so there likely won’t be excess earnings to distribute to shareholders for all that long.

X Stock Verdict

U.S. Steel stock may seem cheap on the basis of its trailing earnings forecast. However, that view changes dramatically when you consider forward earnings rather than what the company earned during the 2021 boom. Long story short, we probably aren’t going to see record sales for automobiles, houses, appliances and so on going forward, and thus the steel market should cool off considerably.

U.S. Steel has historically had a rather unappealing financial track record, and thus is unlikely to support a high valuation once its earnings slide back to more typical levels. I’d note that X stock was selling for less than $10/share immediately prior to the onset of the pandemic. Shares may seem discounted at $20 today, down sharply from their recent peak. However, $20 is not actually that low of a price for U.S. Steel when you use a broader perspective.

I believe this burst of excess profitability has been enough to considerably improve the company’s intermediate-term outlook. U.S. Steel has strengthened its balance sheet and is better positioned to endure a recession than it was previously. However, to be a long-term believer in this business, I’d need to see some significant structural changes.

Something such as much higher tariffs on imported steel, widespread automatization which lowers labor costs, or new inventions or consumer trends which significantly increase the demand for steel. Those would be the sorts of catalysts that could make me less downbeat on the steel industry.

Until we see a sign of that sort of fundamental change, however, steel stocks are better for trading than long-term investing. And right now, steel is an awfully hard trade given the falling earnings outlook and rough economic conditions on the horizon.

As such, I rate U.S. Steel stock a sell here. The fundamentally poor long-term returns for the steel industry combined with the difficult near-term outlook and sharply falling earnings trajectory make this is a tough situation today. X stock may or may not decline significantly from here, regardless, the risk/reward profile seems poor compared to other stocks that have also sold off sharply during this bear market.

Be the first to comment