simonkr

Investment Thesis

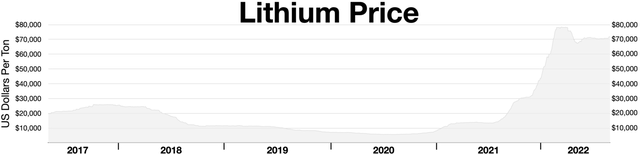

Lithium batteries are ubiquitous, and demand for them is likely just getting started, as demand for EVs is just taking off. These require many times the amount of lithium of small tech devices. Lithium supply is very tight in the best case and not enough in the worst case, which could drive up the already soaring prices even further. One of the stocks that will benefit from this is Lithium Americas (NYSE:LAC), which has excellent long-lived assets in Argentina and the US.

Lithium market overview

I wrote an article about the Global X Lithium & Battery Tech ETF a few days ago. It addresses many general questions about the lithium market, which are also relevant to this article. How supply and demand and, therefore, the lithium prices could develop is one of the most important questions for investors in lithium producers. Furthermore, it is about questions like:

- What percentage of global lithium goes to EVs?

-

Will there be a lithium shortage?

Lithium Americas´ projects

At the moment, they are working on three projects, two of them in Argentina and one in the USA:

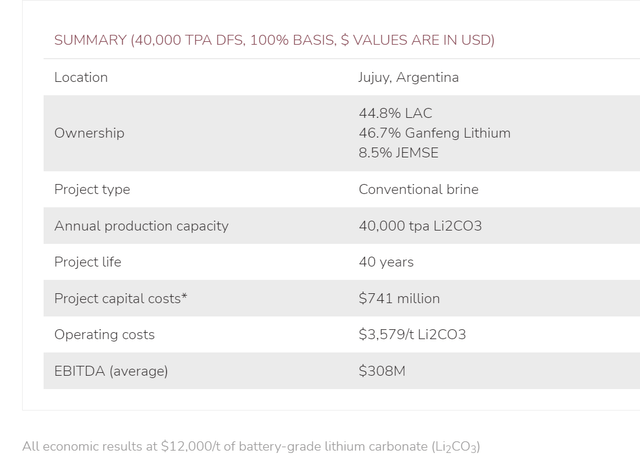

- $741M Capex with over 88% already spent

- $3,600 costs per tonne for battery-grade lithium carbonate (LCE)

- 40,000 tons LCE per annum initial production

- 20,000+ tpa planning for stage two expansion

However, it should be noted that only 514k tons are given as proven reserves and 3.1M tons as probable. Together this would be 3.6 million tons which at a selling price of $12,000/t (which LAC uses in its calculations but is much lower than the current market price) would be worth $43.6B. The share of LAC is 44.8%, and, of course, production costs have to be deducted.

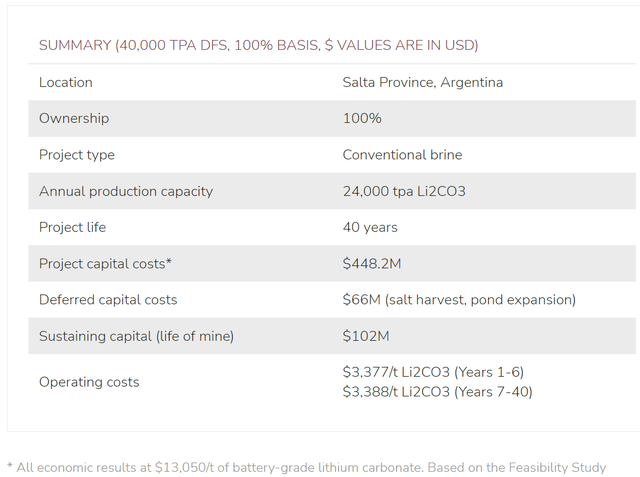

- Ownership 100%

- Project capital costs $448.2M

- $3,400 costs per tonne for battery-grade lithium carbonate

- 24,000 tons per annum initial production

The proven and probable reserves are even higher than in the first project, with 4.12M tons LCE. The planned annual production of 24k tons results in a yearly revenue of $312M at a selling price of 13k per ton.

3. Thacker Pass

Thacker Pass, the largest known lithium resource in the United States and the next large scale lithium mine.

- Ownership 100%

- $581M Capex for phase one production

- $4,000 costs per tonne for battery-grade lithium carbonate

- 40,000 tons per annum initial production

- 80,000+ tpa planning for stage two expansion

The mine has all the necessary permits for construction, which is expected in 2023. The proven resources are 2.3M tons of LCE and the probable additional 777k. In total about 3.1M tons that have a value of $40B at a selling price of $13,000.

Valuation

The market capitalization is $3.14B, and the enterprise value is $2.93B. Accurate valuation analysis is impossible because the company is still constructing its facilities, and actual sales are expected to start next year. Given the high-quality mines with enormously long lifetimes due to high reserves, the share seems to be rather attractively valued. However, this assumes that everything will go as planned. This means that production will be as high as currently indicated, prices will remain at least halfway stable, and demand will be sustained.

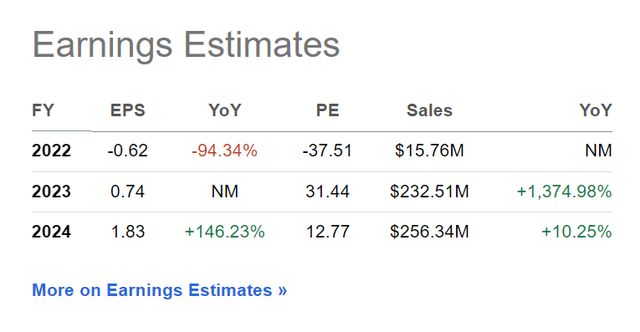

According to Seeking Alpha’s earnings estimates, the company will already generate EPS next year and double it again in 2024. If these estimates come true, the stock would be a bargain at this point.

Share dilution and insider selling

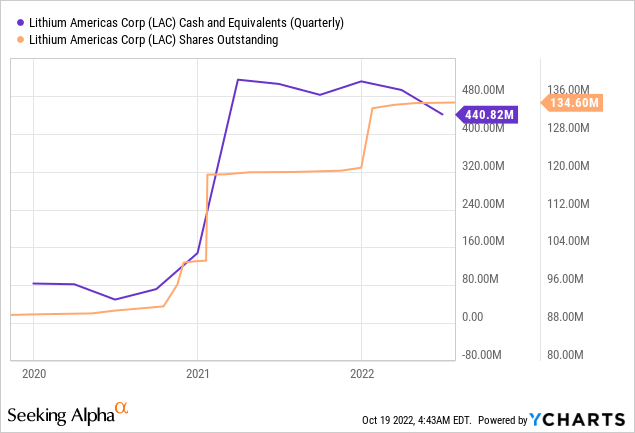

I always want to look at stock dilution and whether there is insider selling. We can see that the number of shares outstanding has risen sharply in recent years. Currently, the company still has a cash reserve of more than $400M. For the Caucharí-Olaroz project, most of the expenditures have been completed. As soon as this is completed, it will generate initial revenue that can be used for the other projects. I have not found anything on insider sales which is a good sign.

As of June 30, 2022, 88%, or $653 million, of the $741 million capital budget has been spent. The Company continues to monitor the high inflationary environment in Argentina but does not expect any impact on the Company’s funding requirements for the project to reach production.

Risks

Of course, there are also numerous risks. These relate, on the one hand, to lithium in general and, on the other hand, company-specific. Regarding the general risks of the lithium market, I would like to refer again to my article on the Global X Lithium ETF.

Company-specific risks mainly include problems and delays in the construction and operation of the mines and lower production than previously expected. And from my perspective, you should generally attribute a higher risk to companies that are not yet generating cash flows. They don’t have the track record of older companies. Another risk is that the probable reserves are not as high as indicated at the moment. So we can see that the overall risks are quite significant. In the long term, I think the biggest risk could be the emergence of new battery technologies that do not require lithium.

Conclusion

LAC has fantastic assets, and they own two of them 100%. As electric cars are pushed politically and, in general, electricity storage possibilities are needed with regard to the construction of renewable energies, it seems to me that the demand for lithium will only increase at least in this decade. And it also seems likely that demand will be higher than supply starting around the middle of the decade. Therefore, the sales prices I used in my revenue examples (these are the numbers that the company used) could also be much higher. If the company can prove next year that the production is as high as expected, this could be a potential multi-bagger. The risk-reward ratio seems very good from my point of view.

I give the share a buy rating and not a strong buy rating. This is mainly because the company still has to prove that production is as high as stated. Everything sounds fantastic, but the real proof is not here yet. From my point of view, it is always better for a shareholder to see actual cash flows first. I think a good approach is to start a position now and possibly add to it later.

Be the first to comment