Just_Super

Investment Thesis

Lithium Americas (NYSE:LAC) is a Canada-based company. But LAC recognizes that the US could be a massive market for the company and so it’s looking to increase domestic production and capabilities, with a base in Nevada at the Thacker Pass Lithium Mine.

Furthermore, one near-term catalyst for this lithium producer could be the Inflation Reduction Act, as the bill includes a $7,500 tax credit for electric vehicles that extract or process critical battery materials in the US.

The one detraction from the bull case is that LAC is little more than a story stock, as the business still doesn’t generate significant revenues.

That being said, I believe that given the significant amount of insider ownership, which we’ll soon discuss, passive shareholders are investing alongside a highly incentivized management team.

There’s a lot to like here.

A lot of Excitement, But Where are the Revenues?

To date, LAC hasn’t generated significant revenues. The business relies on diluting shareholders to raise capital to chase a very compelling story.

However, given that the overall lithium-demand story is simply so attractive, LAC’s management has not had to be too aggressive with their equity dilution to raise capital.

More specifically, LAC ended 2020 with 92 million shares outstanding, while its latest Q2 2022 results point to 135 million shares outstanding, a 47% shareholder dilution in 18 months.

However, when we see that LAC’s share price is up more than 700% in the same time frame investors should clearly not be complaining too loudly!

What’s more, insiders own just over 5% of the company. This means that there’s more than CAD$250 million on the line here, which will continue to positively incentivize management to do what’s best for the long-term shareholder.

Altogether, I believe that this is a nice setup for passive investors to be in, knowing that management will do what’s right for the long-term value of the company.

What’s Next for Lithium Americas?

LAC September presentation

Anyone that’s even remotely interested in lithium stocks knows the bull case already. There’s a massive demand for lithium that’s going to be needed to support the upcoming explosion in EVs.

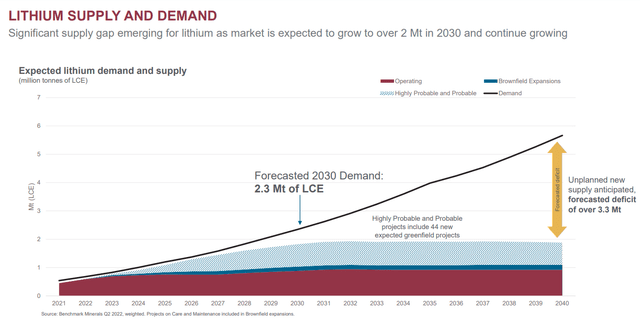

As you can see above, there’s forecast to be a 2.3 million ton deficit between supply and demand by 2030. With the bulk of the demand coming from EVs.

And one country that’s going to see a massive jump in demand is expected to be China. And that’s why Chinese company Ganfeng Lithium (OTCPK:GNENY) holds more than a 10% position in LAC.

LAC September presentation

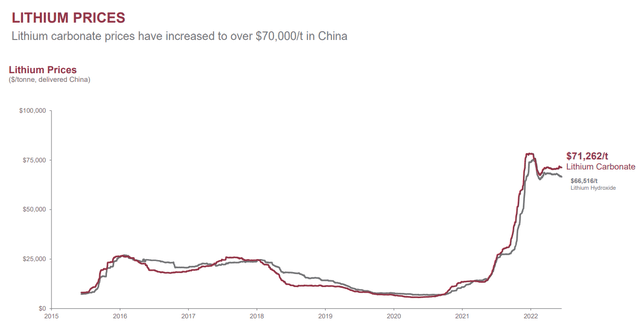

Given the widely reported shortfall between supply and demand, you can see that lithium prices are high.

But not only high but up 10x in 2 years!

No other commodity to my knowledge has increased this much and stayed at this level in 2022. Indeed, most other commodities have traded lower in the second half of 2022, as investors believe that demand destruction is underway.

Profitability is an Issue

One aspect that could weigh on the stock is that the business is unprofitable at present. That being said, its cash burn isn’t so bad, and I estimate that its free cash flow use will probably be no higher than $150 million over the next twelve months.

Given that LAC holds more than $400 million of cash on its balance sheet, that will give LAC enough firepower to continue to move forward with its goal to supply approximately 5 million electric vehicles per year.

The Bottom Line

As of right now, LAC is a story stock. The same as it has been for a really long time. However, one could argue that LAC was probably just too early for the space.

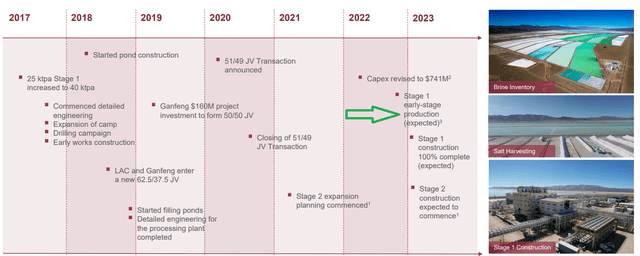

LAC September presentation

As you can see from the green arrow above, LAC believes that it’s 90% of the way through the completion of the largest lithium carbonate brine under construction in over 20 years, Stage 1 at Caucharí-Olaroz, Argentina.

And LAC’s focus now is on prioritizing production rather than construction.

Also, the recently passed Inflation Reduction Act is a significant catalyst for this sector as it provides substantial support to build a domestic EV supply chain, something that EV makers, the biggest customers of lithium welcome.

Altogether, I believe that LAC is priced as a long-term option. If LAC does succeed in ramping up production in 2023, we could see LAC rapidly go from a story stock to one of the big league lithium producers.

Watch this space closely.

Be the first to comment