VioletaStoimenova

Dear readers,

The time has come to look yet again at the Principal Financial Group (NASDAQ:PFG). My last stance on the company was a “BUY”, and I extended my position in this financial once again in the hope of a reversal. Little did I realize with what sort of vengeance that reversal would present itself, and in what short a time.

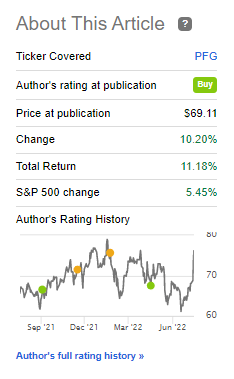

PFG Performance (Seeking Alpha PFG Article)

As you can see from my history, I have a pretty specific price range when I shift from “BUY” to “HOLD” and vice versa. I’ve found that these ranges and targets help me to pinpoint when to buy, and when to sell effectively. That is why my position is currently up nearly 23% in total, and we’re back close to peak valuation for this quality company.

Let’s review what we have here.

Reviewing Principal Financial Group

I went positive on PFG due to valuation and forecasts back in May. Since then, the company has advanced a not inconsiderable amount in its share price, with a massive increase in conjunction with its earnings.

PFG is a superb business with an eye to the fundamentals. The company has over $1.7B in available capital and liquidity, with an RBC ratio of 400% and a debt/cap ratio of below 25%. In short, the company is exceptionally well-capitalized moving into a difficult period. With the world moving towards ups and downs and volatility, PFG goes for stability. The reason for this development is the company’s overall reliance on interest income. This means that during times of extreme interest pressure, such as the last few years, PFG actually performs worse than when rates rise.

Interest rates are now rising – so PFG is guiding for a very positive period, at least beyond 2022 fiscal, which is forecasted to see a slightly negative development on a YoY basis.

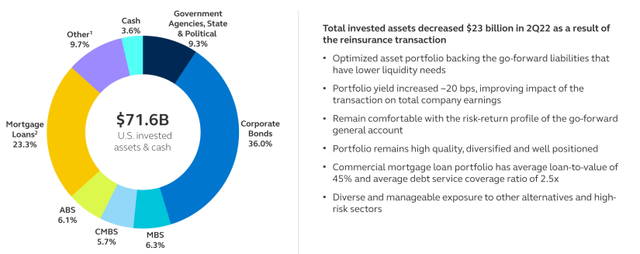

Other metrics for the quarter were exceedingly positive. The company saw another quarter-billion USD of share repurchases, a dividend of 2% increase, and a $630B+ AUM with an RoE of 14.1%, which is up 200 bps on YoY, reflecting strong interest increase trends. The company’s investment portfolio and assets continue to show strong trends.

And the company’s investment performance continues at high levels, with a continued 69% of the funds at 4-5 star ratings by Morningstar measurements.

The company also saw continued stable earnings in its various segments, including Retirement/Income solutions from good revenues and expense management. Results were down slightly due to unfavorable equity and some fixed income headwinds but saw strong client retention and strong continued deposits. 2022 revenue changes are still positive, and the company manages close to 25% pre-tax RoR on net Revenue in the segment.

For Principal Global Investors, PFG was positive in terms of revenues despite higher operating expenses, but in a very slight, 2% negative due to those aforementioned expenses, slightly offset by the higher fees the company managed to push.

Not even PFG is completely immune to the trends we see here. Also, Principal international saw significant improvements, with revenues up 14% during the quarter, and EBIT up 93% (though flat if we exclude some more significant variances). Net cash flow for the company was only flat, weighed down by overall outflows in Brazil.

Meanwhile, specialty benefits saw growth due to favorable claims, and Individual life saw a significant decrease driven by reinsurance – but this was guided for during previous segments.

Macro is the name of the game at this particular time. PFG is a diversified insurance business and asset manager, which gives the company the flexibility to handle most business environments. With volatile markets and high inflation, the company still saw strong customer growth across all businesses. This together with increased interest rates and optimization of its accounts drives the positive potential for the company here during this quarter. It’s all about the mitigation of negative effects.

The focus should be on continually generating earnings, and this is certainly an area where PFG shines. This is also part of the reason the company’s share price is certainly rising here. The company reported around $1.7/share excluding variance for the quarter, which is up 3% YoY. The strong company YTD net cash flow in PGI highlights how the company’s business model works in various business environments, including the current one.

The company also recently launched an actively managed real estate ETF, combining two strengths of PFG, which are active management as well as real estate investing.

PFG is also seeing increased interest in its employer solutions. All of these trends, coupled with strong sales retention, are what drive the company’s positive net cash flows. The company keeps winning accolades, including being one of the top 5 retirement plan providers with a mobile focus, and acknowledging what the company has done to simplify things in order to switch to the company’s solutions.

The company is moving into 2H22 with great momentum despite a risky and volatile macro. PFG is a good example of why you should invest in quality, size and history. There are few insurance companies of its kind (or any of the other business sectors the company is involved in) as good as this one. And the recent bounce in share price mostly confirms this. PGI earnings were very strong – especially compared to other asset managers. This is another reason why the company seems to be outperforming here.

Let’s look at what this outperformance will cost you.

Principal Financial Group Valuation

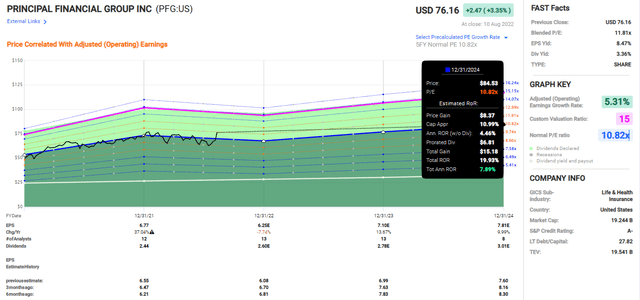

I continue to believe that 2022 is unlikely to see EPS growth YoY on the back of some of the non-recurring GAAP adjustments we’ve been seeing in 1Q22 and likely will continue to see in the later quarters.

I believe that once interest rate increase impacts materialize in full, and the scope of this crisis and all its effect comes into play, PFG’s earnings will grow – which should happen sometime in 2023 and beyond.

However, at the same time, we need to take into consideration that PFG now trades at an extreme premium to most of where it usually trades historically. The company’s typical range is somewhere between the 8-10x mark, it’s now closer to 12x P/E.

That means that if we consider a 5 or 10-year P/E average, the company’s forward estimated RoR on an annual basis is now down to 7.9%, which is below what I would want in order to invest in a business. I’m looking for at least 9-10% per year before I invest. What’s more, the company’s share price is very clearly above a level from where it usually drops again. This also leads me to take a more conservative approach to PFG at this time.

Principal Financial Group is a superb investment. Even in the case of a downside, it would take material fundamental deterioration in the company’s valuation to push you into the red here. I don’t see such a case occurring. It would take the company dropping below 8x to truly turn things negative or into the red here, and this seems unlikely.

At the same time, what once was a 4.5-5%+ yield is now less than 3.4%. What once was an 8-9x P/E is now closer to 12x – all the while, the company is expecting negative YoY results. I think the market is perhaps taking things a bit for granted, and overestimating the fact that PFG has been able to outperform its peers during a different situation. I’m all for highlighting quality, but at a certain point, it becomes a bit too expensive.

If we start looking at forecast accuracy, I’m going to take a stance here and say that there is at the very least potential for disappointment here. S&P Global valuations call for an average PT of around $70/share. This means that analysts consider the company around 7.6% overvalued, and only one analyst has a “BUY” target for the company at this time. The absolute vast majority, over 70%, is at “HOLD”, “Underperform”, “SELL”, or at no opinion, with 10 out of 13 at either “HOLD” or “SELL”.

The analysts for the company are clear in their stance – this company is currently too expensive to consider as an investment.

Should we care?

I argue that we should. Historically speaking, these analysts have been pretty accurate. I would also argue that the company has a pretty well-established tradition of trading between specific price ranges – and once the price goes above the price range we’re seeing here, then it usually comes back down again fairly quickly.

This means that we should wait with investing in the company and take a “HOLD” stance here.

This is what I intend to do – and my targets for PFG remain very clear.

Thesis

I consider my current thesis on PFG as follows:

- Principal Financial Group is an absolutely solid insurance play that’s generated alpha in my portfolio for many years – and was rotated at a time when it had generated that alpha back around the $70/share mark. I would be happy to buy it back when it’s cheap, but not at over 11X P/E.

- The insurance sector is full of solid, global companies offering a 4%+ yield at excellent credit safeties – and PFG is one of the more expensive ones of the bunch.

- PFG is a “HOLD” here. A price target that I would consider attractive for investment based on my goals would be around $65/share – though every investor of course needs to look at their own targets, goals, and strategies. I would also always consult with a finance professional before making investment decisions such as this.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

PFG is currently a “HOLD”

Be the first to comment