MikeDot/iStock Editorial via Getty Images

Lightning eMotors (NYSE:ZEV) tumbled by 40% on Thursday (Nov 17, 2022), and this week it closed at an all-time low of $0.58. ZEV is down more than 90% this year.

In our previous article, we highlighted that ZEV was not yet a compelling buy due to underperforming gross margin, slow revenue conversion, and dilution risk from future capital raises. The dilution just happened.

This article dives into the dilutive event (conversion of debt to equity) that caused a sharp decline in ZEV, as well as an update on the business operations. Additionally, the article provides an update on valuation pre and post dilution, as well as an view on whether the warrants offer a good opportunity.

The conclusion is that ZEV is a compelling buy opportunity. As of this writing, one can justifiably say ZEV is a cheap stock as it is trading near its implied cash per share value.

Let’s dive in.

Business update

Lightning eMotors reported mixed Q3 results. While revenue growth and production improvement were strong, profitability and cash burn were weak.

Revenue growth was strong at 78% Y/Y, improving from a weak Q2 that showed revenue contraction. Showing strong growth in Q3 means that customers are increasingly buying vehicles, which clearly shows positive business momentum. Lightning eMotors reported $11.1 million in revenue, which is a new all-time high for one quarter. New guidance says revenues are going to end 2022 in the $33 to $38 million range.

The executive team highlighted that demand is robust for Lightning eMotors vehicles, and the Inflation Reduction Act of 2022 should result in even stronger demand due to rising incentives towards commercial electric vehicles. It is not the first time this executive team highlights favorable government regulation that should boost revenues.

Considering a new all-time high in revenues, the executive team deserves the benefit of the doubt. We also believe that Lightning eMotors should have a strong 2023 given industry tailwinds coupled with ~$164 million (over 1,500 units) in backlog already.

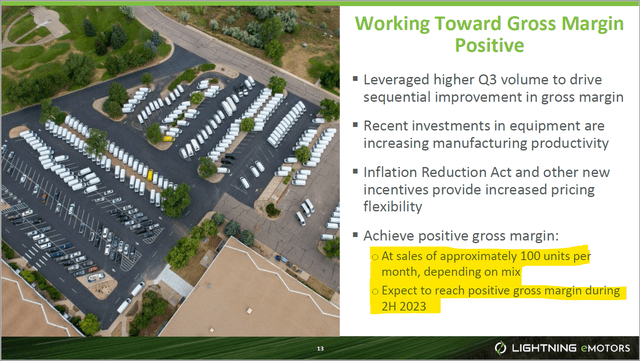

The gross margin was disappointing at -32% in Q3. This was an improvement from the -38% reported in Q2, but worse than the -11% a year ago. The executive team addressed the gross margin issue directly (more on this later), and they expect it to turn positive by the 2H-2023. The new commitment to a positive gross margin path should be welcomed by Mr. Market, as we believe this is a critical first step in turning the company profitable.

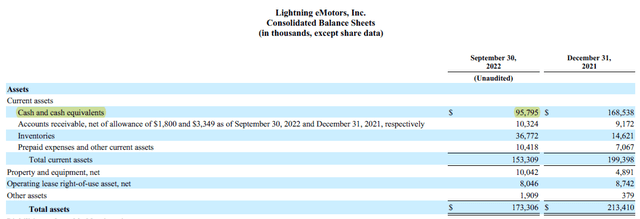

With gross margin is deep in the negative, all other down the line profit metrics also look ugly. Adjusted EBITDA and Adjusted EPS both show steep losses. Cash burn for the quarter was ~$30 million including operations and capex, which is higher than Q2 and higher than our expectations. Cash burn for the first 9 months was ~$73 million. Cash on hand ended the quarter at roughly $96 million.

Production capacity and utilization

During the earnings call and earnings presentation, the executive team addressed the gross margin shortfall specifically, and provided more details on key drivers as well as a timeline for reaching positive gross margin. Basically, production capacity needs to be fully utilized for gross margins to be sustainably positive. While there are many levers to push gross margins higher (such as production efficiencies, price increases, supplier cost reductions, etc.), it seems like higher factory utilization is the driver that can move the needle.

Lightning eMotors needs to produce (and sell) ~1,500 units annually to achieve enough scale to turn gross margin positive. As the manufacturing facility sits today, there is capacity to produce ~1,500 vehicles in one 8-hour shift. Of course, capacity could be expanded with more investment and adding more shifts.

In the most recent quarter, vehicle production was 104 units, up from 43 units last year and 74 units last quarter. Annualizing the most recent quarter leads to 416 units per year. Considering 1,500 production capacity, that’s a 27% utilization rate. At only 27% utilization rate, there is plenty of work to fully utilize the manufacturing facility.

Achieving full facility utilization looks feasible considering there are ~1,500 units in backlog already, along with a strong sales pipeline of ~$1.8 billion.

This utilization rate is useful as it highlights that Lightning eMotors has a lot of potential to convert production capacity into sustainable revenue streams. We would certainly welcome consistent reporting of production units and sales units, as it will provide shareholders and/or potential investors with more insights into the business.

Interestingly, when putting utilization rate in context of the timeline to achieve positive gross margin, it looks like production could hit 300-400 per quarter over the next 12 months. Without giving guidance, the executive team is hinting that 2023 will be a great year, and sales by 2H-2023 could approach 100 units per month. The backlog is there to support it.

Will it happen? Time will tell. If it happens, we believe that Mr. Market will welcome such results, and ZEV should rise. There are reasons to doubt the executive team because they have overpromised and under delivered historically.

Could this time be different? Yes, but Lightning eMotors will need to show the results. With the stock trading at just $0.58 per share, Mr. Market does not believe it yet.

A complex capital structure

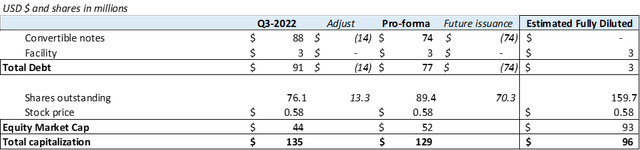

Although the most recent earnings results are important, it wasn’t what caused the sudden drop in ZEV. The major reason for the stock to trade down over 40% on November 17 was due to the news of convertible bond exchange agreement. Lightning eMotors converted $14 million of aggregate principal to 13.3 million newly issued shares.

The stock simply reacted to the dilutive effects of exchanging convertible notes to common equity at highly dilutive pricing. While conversion of convertible notes is a good move, it is the pricing of the conversion that is concerning. By converting $14M of principal into 13.3M common shares, Lightning eMotors is effectively issuing equity at $1.05 per share.

The exchange of notes and the subsequent dilution should not be too surprising considering the cash burn of the company and lack of profitability. This move caused a 17% increase in shares outstanding. As we said in our previous article, ” with serious lack of profitability, coupled with potential dilution from a capital raise on the horizon, Lightning eMotors is a very risky investment at this time. We don’t feel compelled to buy the dip”

Going beyond this issuance, the prospects for future dilution are real. If we extrapolate this conversion into the future and assume that 100% of the convertible notes will be settled for shares at $1.05, then there should be ~70.3M shares to be issued at some point in the future for the remaining $74M of bonds outstanding. Considering there were ~76M shares outstanding before the conversion, the total dilution will be ~109% when all is said and done.

We prepared the following table to show how the capital structure has changed, and how it could change assuming full exchange of convertible bonds to common stock.

This is the key reason for the stock to drop so much following the news. It was not only the realized dilution that scared Mr. Market, but also the potential for more dilution down the line. We’re looking at potentially doubling the share count. We believe dilution is the key reason for the stock to overreact to the news. Generally speaking, Mr. Market does not like to be diluted.

Interestingly, Lightning eMotors also signed an equity line of credit agreement with Lincoln Park Capital about two months ago. This allows for future equity issuance up to $50M in equity (at market prices) to raise funds, which can be a very useful tool to raise capital when the environment is favorable. This line of equity has not been tapped yet, and we’d expect Lightning eMotors to use it opportunistically. This agreement runs for three years, until August 2025. There is plenty of time.

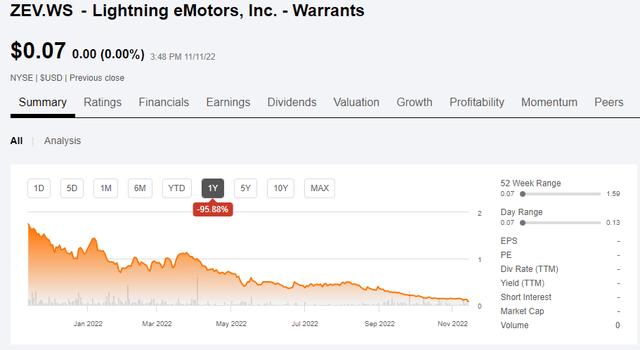

The warrants

Lightning eMotors has warrants outstanding that are publicly traded. Lightning eMotors Warrants (NYSE:ZEV.WS) trades at $0.07 per share as of this writing. The warrants are down significantly as well.

The public warrants amount to 24.4 million shares, but with a strike price of ~$11.5 per share, they are way out of the money (and hence excluded from our capital structure calculation). These warrants expire in May 26, 2026, so there is plenty of time before expiration.

We believe the warrants are quite expensive at nearly 100% implied volatility. The rich price of the warrants is likely because of its long duration and the stock high realized volatility in recent months, including the recent 40% drop in one day.

If you’re buying the warrants, the bet is basically that Lightning eMotors will return to its glory days and get to a mid-teens stock price in about three years. That’s more than $2 billion of implied valuation fully diluted. It’s hard to see that happening given the unattractive operating cost structure and serious lack of profitability, but not impossible.

Because of the high implied volatility and enormous valuation hurdle to overcome, it is hard to see the warrants having much intrinsic value at maturity. Therefore, the warrants don’t look like a compelling buy opportunity, especially compared to owning the stock outright.

Valuation

The stock declined by 40% following the convertible bond news and now trades at $0.58 per share, which equates to a ~$52 million market cap after the dilutive effects of conversion. Valuation now looks quite interesting considering that the company holds ~$96 million in cash or cash equivalents, which amounts to $1.07 per share. Yes, the stock is cheaper than cash on hand.

However, the fully diluted equity market cap stands at $96 million, which is in line with the cash on hand amount. Fully diluted cash per share would be $0.60 per share assuming full conversion of the remaining $74 million of convertible notes.

As of this writing, ZEV trades at a value that roughly equals its cash per share, which implies the market is effectively assigning zero value to the business operations. If a private equity player comes in and offers to purchase the fully diluted business for $0.60 per share (a $93 million check fully diluted), then they would basically get the cash balance of $96 million and the entire operating business. So, the operating business comes basically for free.

ZEV valuation is now approaching the too-cheap-to-ignore zone. If Lightning eMotors was a profitable and stable enterprise, the valuation metric alone would suggest this stock is a no-brainer investment. However, because of the ZEV ongoing cash burn and lack of profits, caution is still warranted. At the most recent run rate of cash burn, Lightning eMotors has about 6-12 months of cash to sustain operations.

Risks

Investing in Lightning eMotors is risky because this enterprise is not profitable and is not expected to produce any profits anytime soon. The company has enough cash on hand to operate for another 6-12 months, and more cash will need to be invested in the business.

As we said in previous articles, investing in ZEV is more like investing in a start-up company (venture capital) than an established publicly traded stock. The company has never produced profits and may never do so. ZEV could go to zero. This is the biggest risk.

In fact, Seeking Alpha is still showing ZEV as a high risk stock and at high risk of performing badly.

In addition to the lack of profits and potentially burning every cent in the bank in the pursuit of zero emission vehicles, dilution risk will continue to linger for the foreseeable future. There are still $74 million of bonds outstanding, coupled with a dwindling cash balance and high burn rate, Lightning eMotors will need to raise equity (and dilute shareholders) in the future.

Investor conclusion

Lightning eMotors is a high-risk investment, and the enterprise is hard to value. But because the stock price has corrected by more than 90% this year alone, valuation is now entering the too-cheap-to-ignore zone, which makes us more optimistic. Buying ZEV at current prices looks like a compelling opportunity. On the other hand, ZEV.WS (the warrants) looks expensive, and we would leave those aside.

ZEV is basically trading close to the cash per share amount, implying that the business itself isn’t worth much. While one can argue a business that never produces profits is indeed worthless, one could also argue that ZEV will produce profits one day and is therefore not worthless.

We don’t believe ZEV is worthless. We believe that at the very least, there is enough value for a third party (e.g. private equity) to buy the entire business. Furthermore, we remain fond of the company’s mission and products, and we believe Lightning eMotors is part of the solution to climate change.

The most recent quarterly results showed progress on both gross margin and total revenue. Importantly, the executive team addressed the gross margin issue and provided a timeline for gross margins to turn positive. This is a huge step forward in the right direction, and one that gives us hopes the enterprise will become profitable one day. If Lightning eMotors can show progress towards a positive gross margin, along with continued revenue growth, then we believe the stock should rebound.

Be the first to comment