cemagraphics

November flash PMI data will be eagerly awaited in the coming week to shed light on inflation, employment trends and risks of recession in the penultimate month of the year. Prior data showed global output contracting for a third straight month and at a faster pace at the start of the fourth quarter. The downturn was underpinned by a sharper contraction in demand in October as business confidence faltered, altogether warranting caution.

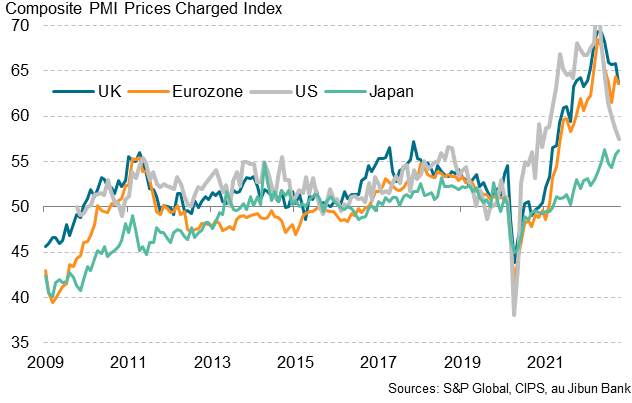

Meanwhile, even though price pressures eased in October, prices remained well elevated by historical standards, placing global central banks at crossroads in determining the pace of tightening from here.

We review the key signals derived from PMI surveys for the US, eurozone, UK and Japan and examine what to look out for in the upcoming November flash releases.

Flash PMI data to reveal the state of economic conditions midway into Q4

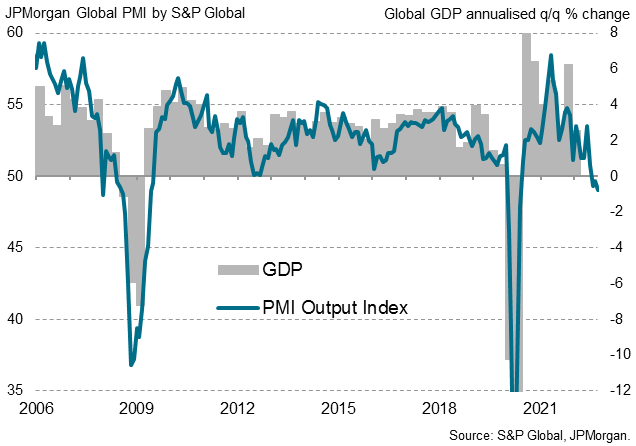

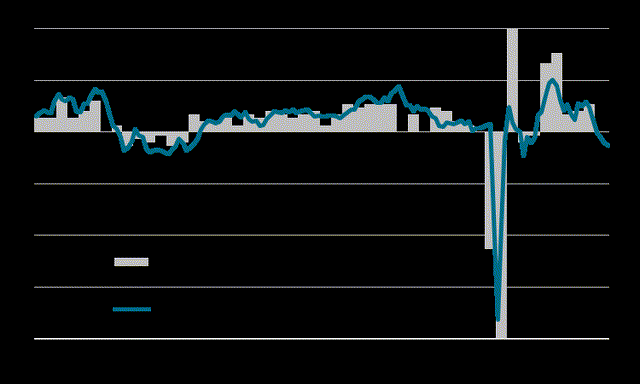

JPMorgan Global PMI and GDP

Following October’s PMI data release, whereby global output was found to be contracting at a faster pace at the start of the fourth quarter, we look to November’s updates for insights into whether economic conditions further deteriorated. October’s PMI data also showed global private sector output moderating at the fastest pace since 2009, barring pandemic-related lockdowns, thus outlining the severity of the latest downturn in economic conditions.

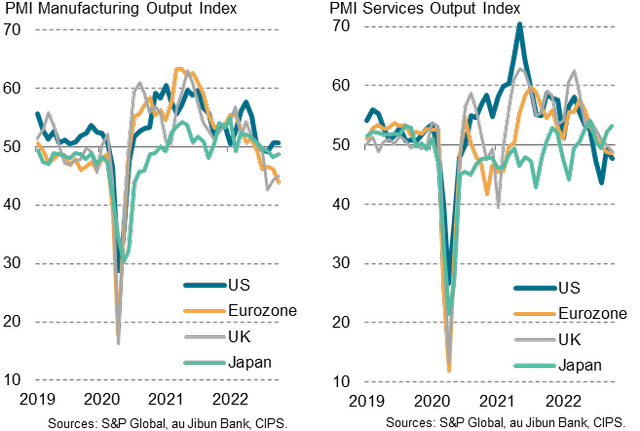

Both the manufacturing and service sectors contributed to the worsening of overall conditions. Manufacturing output fell for the third straight month while services activity saw renewed decline in October, albeit at a marginal rate.

Japan’s services boost versus inflation and external demand woes

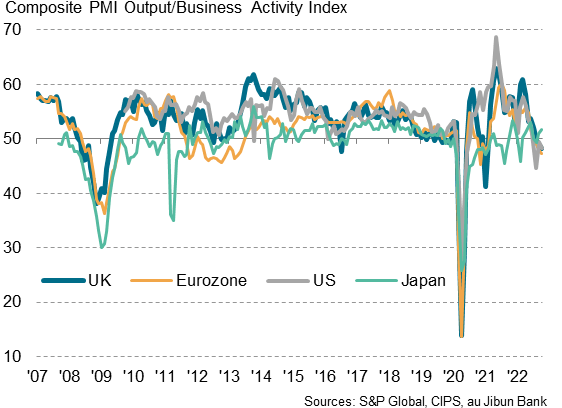

Drilling into the performance amongst the four largest developed economies – the ‘G4’ – Japan remained the only economy in expansion in October. This is while the US, eurozone and UK face heightened risks of recession and whether this deviation still stands will be examined with the earliest available flash PMI data for these economies in the coming week.

G4 output comparisons

Official Q3 GDP data recently revealed that the Japanese economy contracted in the third quarter, corresponding to the spate of weakness we have seen via PMI data, particularly in August. That said, more recent data in October suggested that output growth picked up pace, supported by a marked improvement in service sector growth amid the roll-out of the Nationwide Travel Discount Programme and the lifting of travel restrictions. The more upbeat developments at the start of fourth quarter alluded to the likelihood of better Q4 performance, although the elevated inflation situation and weak external demand remained issues to be monitored.

G4 output comparisons

US inflation and employment trends in consideration for rate hike path

Private sector output in the US contracted for the fourth straight month in October according to PMI data, revealing a weak start to the fourth quarter. Moreover, the pace of contraction hastened as overall new orders saw a renewed drop in October.

While manufacturing sector output managed to eke out marginal improvements, deteriorations in services activity weighed upon overall performance. Anecdotal evidence from the survey unveiled that tighter financial conditions and elevated rates of inflation were widely cited as reasons for weaker demand as postponements and delayed placements of orders were prevalent amongst customers assessing their spendings.

The US Federal Reserve in their latest November Federal Open Market Committee (FOMC) meeting announced a 75-basis points hike, matching the market consensus, but also hinted at a step down in future rate hikes. This was prior to the October CPI release which showed consumer price inflation trended lower in line with PMI indications. While reflecting the policy effectiveness, the weaker inflation also provided some wiggle room for the Fed to weigh other priorities, such as employment. Certainly, the still elevated inflation places the Fed on course for another hike in December, but the sensitivity of the rate hike path towards data may only be heightened in the near term as we await the flash November updates.

G4 output comparisons

UK recession, how much deeper?

UK private sector output fell for a third straight month in October and at the fastest pace since 2009, again excluding lockdowns. This signalled a protracted deterioration in UK economic performance at the start of the fourth quarter with the severity of the downturn also having intensified.

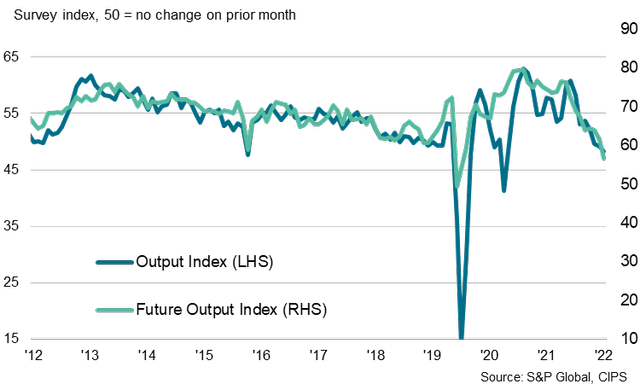

While it remains too early to consider when recovery will come by, we will nevertheless be on the lookout down the road to identify turning points using the PMI data for the earliest signs of respite. Meanwhile, upcoming November PMI releases will be watched for indications of how much deeper the ongoing downturn has traversed. As far as the Future Output Index is concerned, private sector firms are suggesting that the trend remains downwards with business activity performance. This was also confirmed with the latest Accenture / S&P Global UK Business Outlook Report which found UK business confidence at the lowest since 2009.

UK PMI and future expectations

Eurozone downturn: how concerned should we be?

Eurozone PMI and GDP

Meanwhile in the eurozone, output shrank at the sharpest rate in almost two years, underpinned by faster contractions across both the manufacturing and services sectors. High prices and weak underlying demand conditions were also prevalent for the eurozone economy, in line with the global trend. Consequently, the European Central Bank (ECB) will likewise be one to weigh the need to contain the elevated inflation while managing the rapidly deteriorating economic outlook.

Any hastening of the pace of decline in economic activity may garner greater concerns from policymakers in the coming months and potentially turn the dial on the degree of tightening to come.

The winter inflation battle

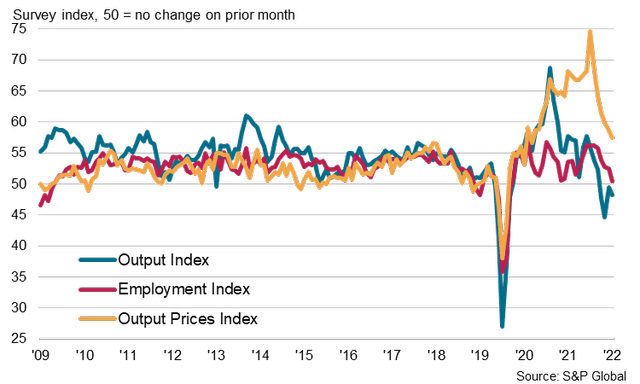

Examining the broader trends, inflation remains amongst the most watched. Recent PMI data have largely reinforced the picture of cooling inflation pressures, though Japan had again been the exception amongst the G4 economies.

With the above said, prices remain largely elevated by historical standards across the G4 economies, particularly in the UK and eurozone where the cost-of-living crisis continues to loom. Heightened energy demand as the colder weather sets in poses further uncertainties alongside festive demands. All of which will have to be carefully weighed by policymakers as they fine tune monetary policy.

Global PMI output price inflation

Undemanding demand, but watch the jobs market

Global PMI output price inflation

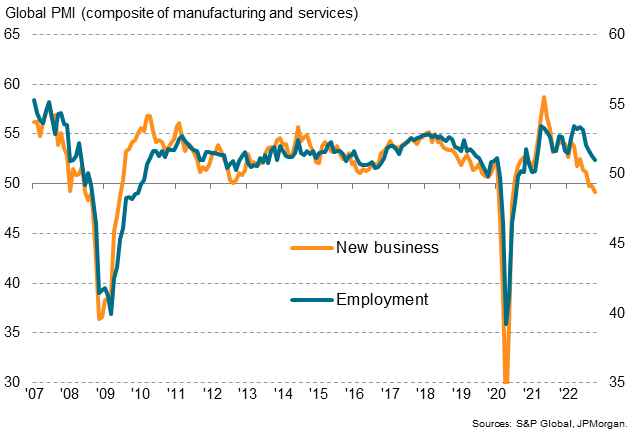

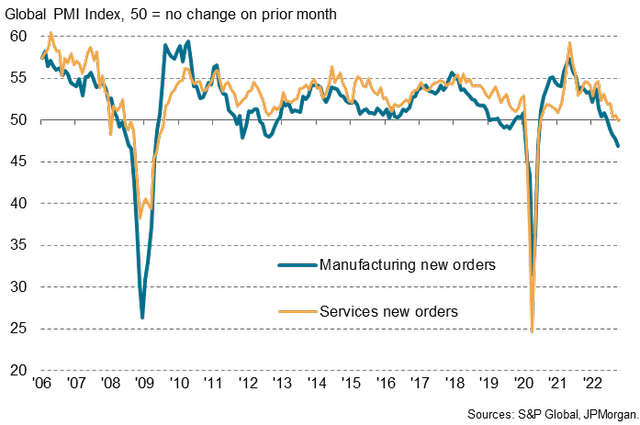

To a large extent, the cooling of demand on the back of monetary policy tightening had been serving its purpose in lowering inflation. However, the pace at which new orders fell is worth monitoring. Global composite new orders fell for a third month running and at the steepest rate since June 2020, albeit mild. Overlooking the pandemic, demand shrank at the fastest pace since the global financial crisis, outlining the heightened risk of recession for the global economy. As such, flash PMI updates from the few largest developed economies will offer clues as to whether the situation has further worsened.

More importantly, it is also the jobs market data that the data-dependent policymakers will be watching to balance their various monetary policy goals, even if recent PMI employment data have yet to flash warnings signs.

Global PMI new business and employment

Low expectations

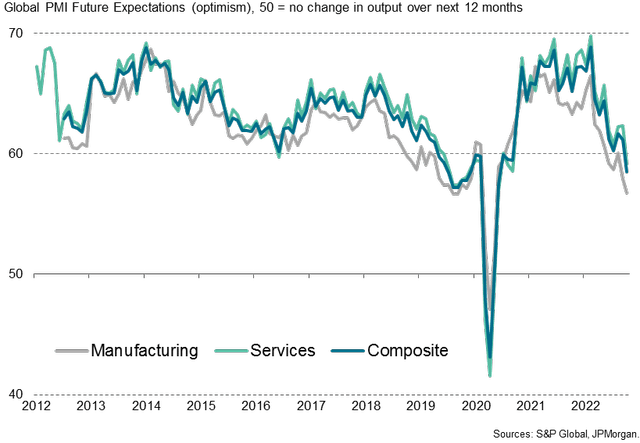

Finally, the PMI Future Output Index is always a useful indicator to track sentiment across businesses as the only sentiment indicator amongst the ‘hard’ data.

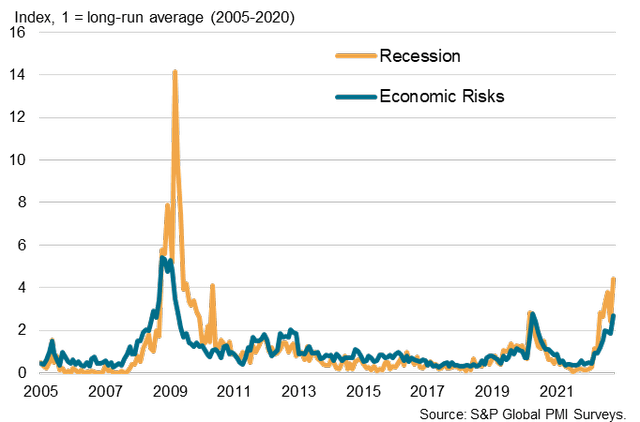

October figures pointed to firms being the least upbeat since the pandemic and across both the manufacturing and service sector. Firms surveyed have also been found with mentions of ‘recession’ at a frequency unrivalled since the global financial crisis, altogether highlighting the likelihood that things may still have to get worse before they get better again.

Global PMI future expectations

Companies worldwide citing growth concerns

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment