mihailomilovanovic/E+ via Getty Images

The communications sector has taken a severe beating in the last year, with the Communication Services Select Sector SPDR Fund (XLC) down ~35% due to overvalued software and entertainment industries which make up a large portion of the sector.

But having been dragged down by their sector peers, the Telecommunications industry now presents several opportunities for investors to grab bargains, right as opportunities become available with the roll-out of 5G networks and technology.

Today we’ll be reviewing Liberty Global plc (NASDAQ:LBTYA), a UK based firm offering broadband internet, video, fixed-line telephony, and mobile. This is an interesting firm worth reviewing given it ranks quite well for its valuation, but there are some concerns around the firm’s future outlooks worth considering.

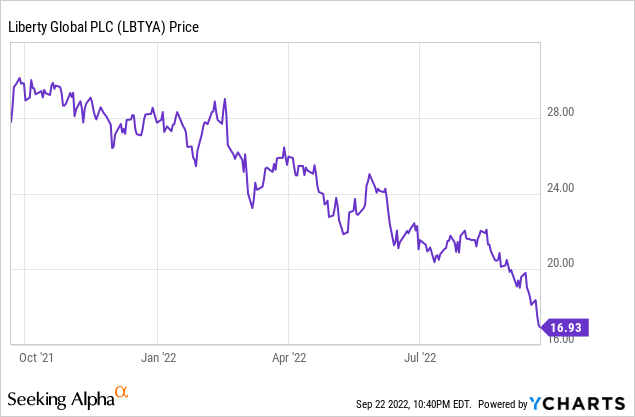

It’s also worth noting that in the past 12 months, LBTYA has fallen some 40%, so the market’s view of this firm is quite negative, so we will be considered a “contrarian” view in the following analysis.

For those unfamiliar with my analysis methodology, you’ll find in-depth explanations for my research in an earlier piece relating to AT&T (T).

Let’s dive in.

(Data & prices correct as of pre-market 20th September, 2022)

(Top Integrated, Wireless & Alternative Telecommunication Services Stocks referred to can be found on this Seeking Alpha screener)

Want to skip the analysis & go straight to finding out who had the best (or worst) valuations in Telecommunication Services? Download my research for free here.

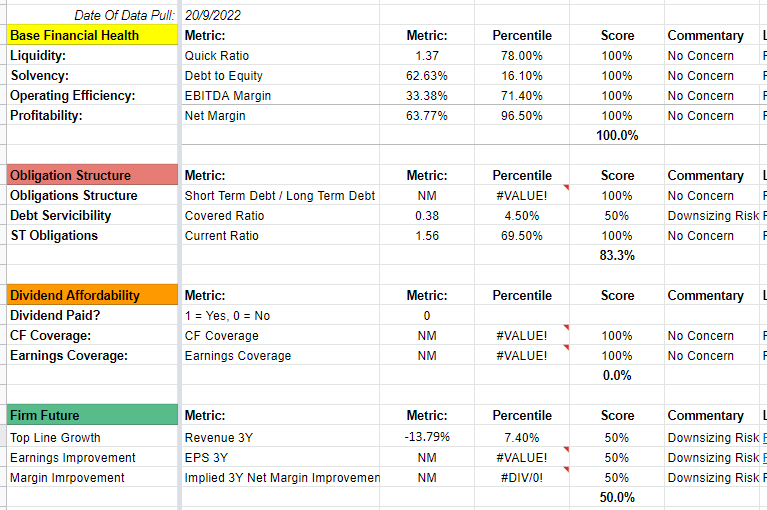

Liberty Global plc’s Base Financial Health

Off the bat, LBTYA looks attractive with a solid base of financial health, especially given the above-average margins and quick ratio scores.

But things start to turn a little sour when we see a very poor covered ratio score of 0.38.

Further along, we see the firm has posted some very poor-looking future revenue and EPS projections, which might need a little more context to them, but we’ll take them at face value for the moment.

Author

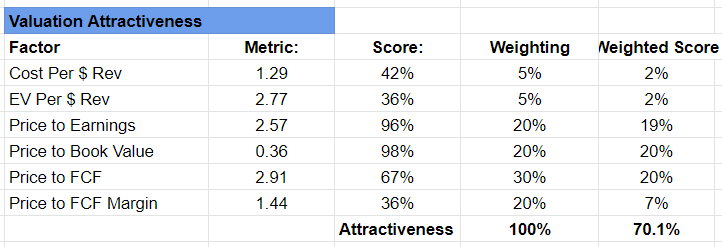

Overall, LBTYA scores an 83.3% financial health rating, with concerns over the firm’s future performance.

Author

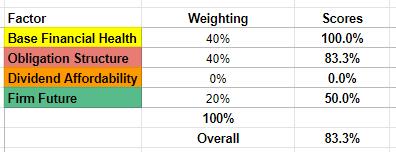

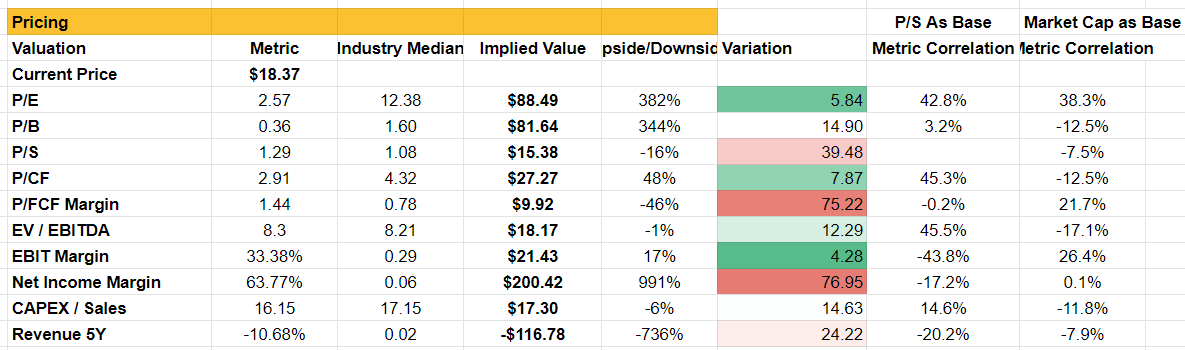

Assessing Liberty Global plc’s Pricing Attractiveness

Taking a glance at how the firm’s valuation metrics stack up against the peer group, there are some very attractive numbers here with P/E and P/B taking the spotlight.

With that said, the firm’s price to sales and free cash flow suggest that it may be fairly valued, while price to FCF margin suggests an over-valuation.

Author

Finding An Appropriate Valuation Method For Liberty Global plc

Now we move on to attempting to find a pricing mechanism for LBTYA, which we can use our previous research into appropriate pricing mechanisms for the telecommunications industry to short-cut our work.

Author

Interestingly, the industry’s pricing metrics suggest a huge upside for LBTYA of $49.41, or 168%. This aligns with the firm’s total shareholder equity / outstanding shared ($24,805.6m / 490.1m = $50.61).

Author

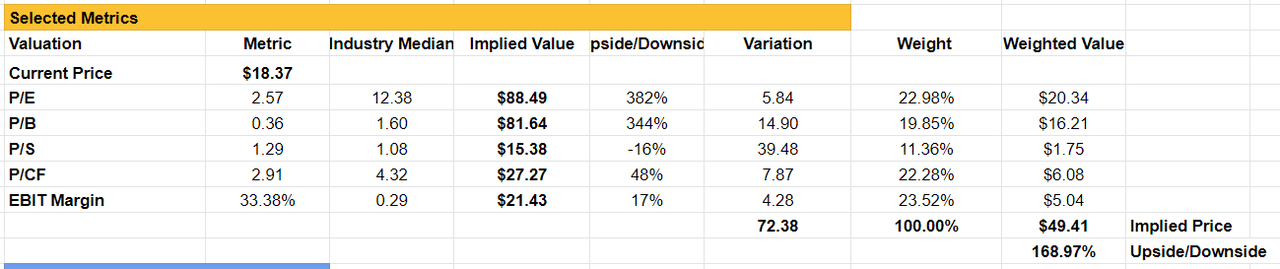

Is LBTYA A Net-Net Trade?

Something I don’t usually cover is assessing if the firm is a potential net-net trade. But given the future outlook for the firm, it might be worth assessing if there is some additional protection for shareholders by looking at what a wind-up would look like for shareholders.

Here we see that there is roughly $11.20 in net assets per share above the current share price, suggesting that LBTYA is a potential net-net trade.

Author

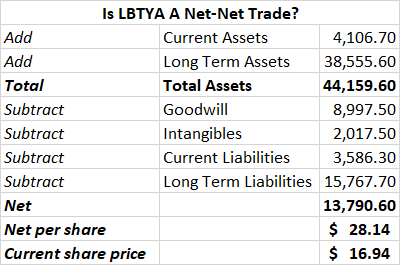

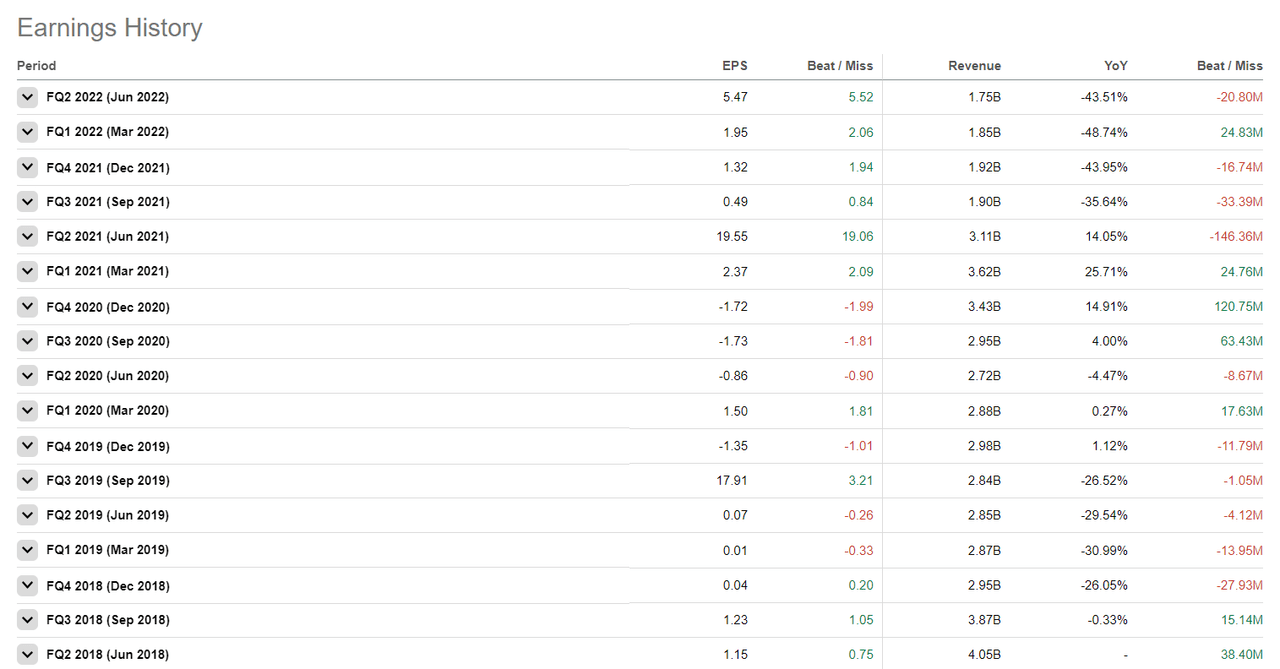

Addressing The Future Outlook

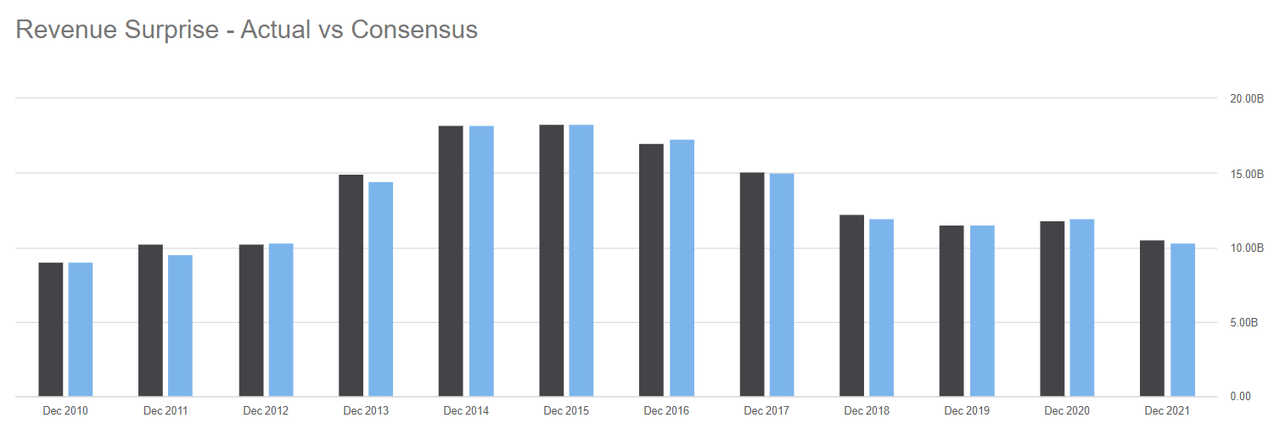

Obviously, we need to consider what risk the forward future outlook presents to investors when we see negative revenue growth and EPS projections, but with that said, looking across the firm’s earnings estimates, LBTYA has a long history of significant EPS beats.

Seeking Alpha

Revenue beats/misses on the other hand are far more accurate.

Seeking Alpha

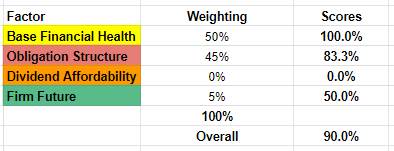

With these in mind, I believe we can choose to discount the severity of the firm’s future outlook and focus on the base financial health and obligations structure.

Rebalancing our weights would give us a 90% score for base financial health, and put a little less concern around historically inaccurate figures for LBTYA.

Author

Closing Remarks

Without fully understanding the context of significant EPS beats and misses, but understanding that these are regular occurrences and revenue projections are much more accurate, I would assign a buy recommendation on LBTYA with a host of other positive factors in mind.

A potential net-net trade, plus an upside valuation based on peer comparison that aligns with a total common equity per share figure of ~$50 per share, presents a solid case for serious consideration.

With that said, it would be irresponsible of me not to point out that this analysis is limited in its scope to just a quantitative peer analysis. While we do look at the firm’s financials, it does not go searching for detail and context that one might find reading earnings transcripts. Further, the analysis is of the industry as a whole but does not consider the market as a whole (ie, the S&P 500) and does not break down a near-peer comparison. Investors should use this analysis as perhaps a base-line for their analysis, but spend time looking at the firm’s qualitative aspects to further inform their thinking.

Author’s Note: The commentary in this article is general in nature and does not consider your personal circumstance. The opinions expressed in this article are opinions only, and data referenced is sourced from third party sources including Seeking Alpha and other publicly available sources.

I make no warranties or guarantees around any of the views expressed in this article and suggest all investors consider my writing to be for interest purposes only and not considered exhaustive investment research or advice.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment