BanksPhotos/iStock via Getty Images

Introduction

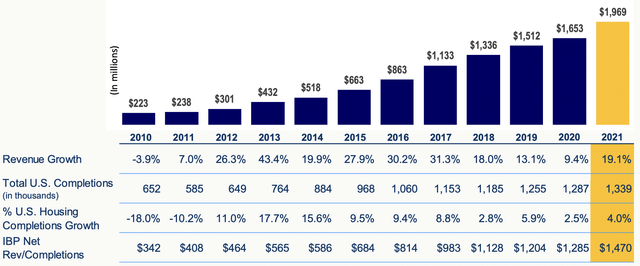

In short, a persistent lack of available housing supply met with a historic backlog of housing units awaiting to be built, low mortgage rates, and a large demographic of millennial first-time homebuyers present an environment that will be beneficial to many historically cyclical companies for the foreseeable future. One of these companies is Installed Building Products (NYSE:IBP), which together with its subsidiaries, has become one of the dominant players in the installation of insulation and complementary building products. Through years of acquisitions and prudent management, IBP has grown into a diversified and resilient business with significant optionality remaining to aid in its continued expansion.

About IBP

Installed Building Products is a diversified installer of insulation and complementary building products for both residential and commercial builders. The company maintains around a 30% share of the insulation market and actively pursues accretive acquisitions to fuel growth with a majority of its capital allocated to this area. The company maintains an asset-light business model, around 2% of revenue is CapEx, with the primary capital expenditure requirement being to fund working capital. IBP has a proven history of successfully acquiring and integrating other businesses with over 160 acquisitions completed to date, substantially increasing its top line and market presence. IBP has been diligent in its acquisitions often completing deals for prices of 1x revenue and under. With each addition, IBP leverages its large national scale of over 210 locations to enable cross-selling and margin expansion of the newly acquired company’s products. The company has expertise in local building codes and practices as well as a network of strong relationships with homebuilders and managers. This local knowledge paired with national scale has allowed IBP to continually grow and increase its overall margin profile.

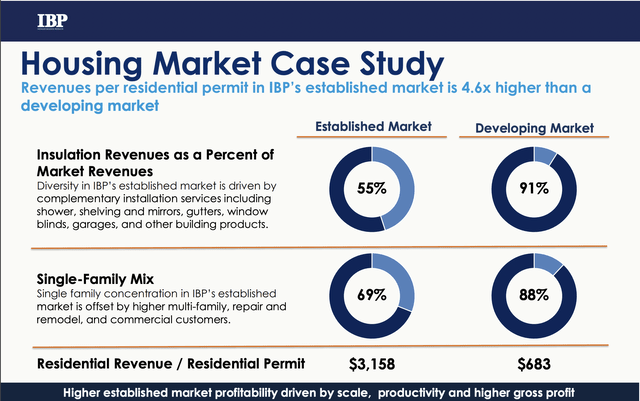

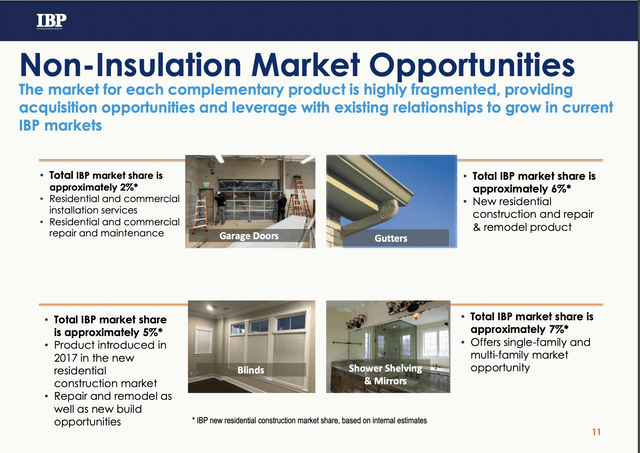

The roll-up model has been incredibly successful in the insulation market and is already being applied in other areas of operation. IBP is pursuing opportunities outside of its core insulation offering with complementary building products and so-called “nuisance” products. The company’s goal is to be a one-stop shop for the builder and enhance the builder’s overall experience. Significant optionality remains for non-insulation products, which IBP has less than 10% market share in, as well as in commercial markets. These areas are highly fragmented and ripe for consolidation, especially by implementing IBP’s expansion techniques. IBP first enters new markets by using its insulation offering to build company awareness and credibility. Once established, it moves to offer its complementary building products. This can clearly be seen by comparing IBP’s revenue mix in established markets to that of developing markets. I expect as the company continues to enter new areas diligently and applies its business model, its market share will steadily increase. Management is highly experienced, knows how to add value, and has already proven its ability to prudently grow the company in a multitude of areas giving me confidence the trend has a high probability of success in other end markets.

Strong Industry Tailwinds

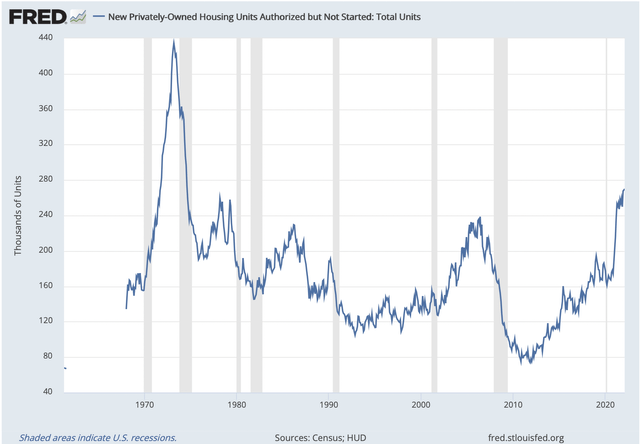

As I briefly touched on earlier, the housing industry has several converging forces currently playing out. The combination of historically low mortgage rates, millennial first-time homebuyers, and a persistent shortage of available housing has culminated in record demand that will take years of consistent homebuilding to meet. This large backlog, estimated to be 3.8 million units short of the level needed at the end of 2020, has removed the cyclicality traditionally endemic to the industry as companies carry the backlog quarter to quarter. This number may also be considerably understating the problem as some estimates put the shortage closer to 5 million units. The backlog of units authorized but not yet started is up ~45% from last year and will take a significant amount of time to work through. Residential new starts, especially entry-level, are a key area of focus as IBP derives the vast majority of its revenue from this segment.

I will add that while current tailwinds create a significant near-term catalyst for IBP, they are by no means the only relevant drivers for IBP. The company was able to grow remarkably well in the poor housing environment that precipitated the shortage we see playing out today. From 2007 to 2012, housing starts averaged approximately 800,000 units per year, well below the average of 1.6 million per year from 1968 to 2006. It has taken a significant amount of time to recover and starts have only just begun to average closer to that historic average. Despite this, IBP increased annual revenue from $238 million in 2011 to almost $2 billion in 2021. This growth is clearly attributable to the nature of the rollup business model and the immediate bolt-on topline growth; however, I believe it showcases IBP’s successful pursuit of increasing free cash flow to continually drive business growth. The widespread implementation of more energy-efficient building standards across the United States has also been a significant boon and will continue to be as codes are updated further every few years.

The Business

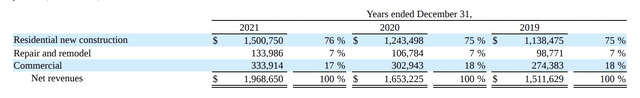

Given the roll-up nature of the business, IBP operates around a stated goal of 2x leverage. The company is currently below that level and recently closed a new term loan to refinance existing debt leaving the company with over $500 million to pursue growth initiatives. IBP derives around 75% of its business from residential new construction, particularly single-family. The remainder of its revenue is attributed to ~17-18% commercial and 7% repair and remodel. The size of the commercial end market business is growing steadily year over year from acquisitions but has experienced more significant delays due to COVID-19. Commercial is an area of long-term focus for IBP’s management and will be a key contributor to growth moving forward.

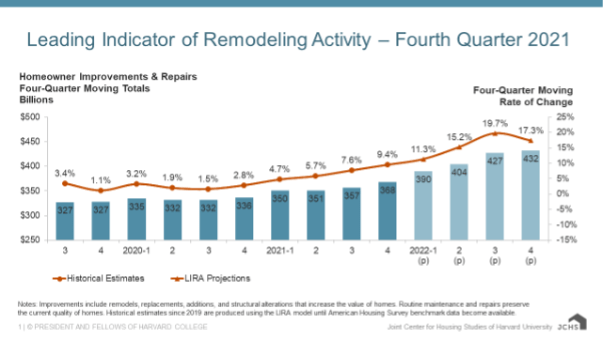

The repair and remodel category is not currently much of a contributor, but I view it as an added option on the business. A lack of new construction met with an aging housing stock having a median year build of 1978 means that many homebuyers will not be purchasing a turnkey property. The uptick in remodeling numbers, especially within the last 2 years, can be attributed to a number of factors including travel restrictions and a lack of discretionary spending outside of the home, however, the general increasing trend was playing out before the pandemic and has shown a significant relative increase in recent quarters. It will be interesting to see how these numbers hold up in the future, but I am optimistic overall given the average age of housing stock. Again, this is by no means a key catalyst for IBP, but it is a nice bonus to have.

JCHS

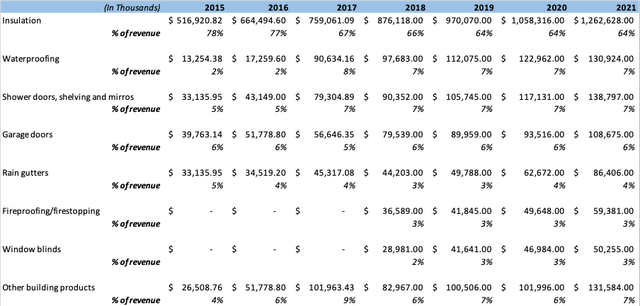

The contribution of each product is listed below with insulation comprising the bulk:

Insulation has proven to be resilient to price increases as it represents a relatively small portion of the total cost to build a home. Given this, IBP has been able to prudently raise prices to maintain margins and the company is planning multiple price increases in 2022.

IBP regularly completes acquisitions of smaller insulation and complementary building products installers. The recent purchase of AMD Distribution is noteworthy as it is one of IBP’s largest to date and its first major acquisition of a distributor. AMD Distribution serves 21 states across the Midwest by offering a wide range of products used in the insulation installation process and will further diversify IBP’s sales mix and end markets. IBP expects this acquisition to improve its supply chain flexibility and cost structure for years to come.

Lastly, management is one of IBP’s greatest strengths with Jeffrey Edwards, Michael Miller, and Jay Elliott each serving for 20+ years. They all bring an enormous wealth of operational knowledge and have been strong decision-makers in growing the company diligently. Edwards, Miller, and Elliott are great examples of management as a whole and I encourage everyone to look through the other team members. Their tenures and industry expertise serve as a testament to the culture and various skill sets within IBP.

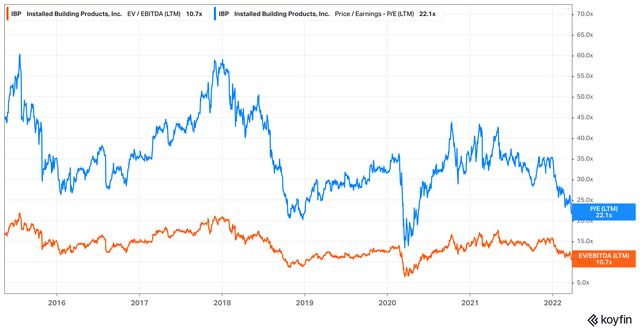

Valuation

IBP is probably closer to fairly valued than it is to exceedingly cheap, although the metrics of the business continue to improve year over year as margins expand. It is by no means expensive relative to history and the company has continued to deliver great returns over the years. A strong market share in its core insulation offering and significant industry tailwinds along with growth and optionality still left in the business afford the company a fair amount of upside that I believe to be worth paying up for.

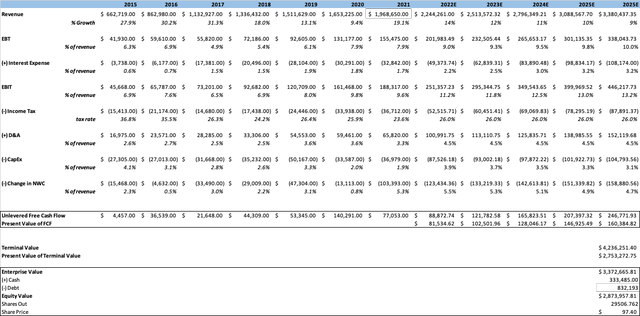

I have modeled rising net working capital requirements along with CapEx as IBP is faced with a persistent inflationary environment. I have assumed debt remains at the stated 2x ratio. As a result, interest expense increases with growth as well as future rate hikes factoring in. I have modeled a step up in operating income as roll-up synergies are realized and margin expansion is continued. Company revenue increased 19% year over year and I believe strong top-line growth should remain elevated through 2022 as the backlog is worked through. Following 2022, I have revenue continuing to grow although below the historical rate and at a decreasing pace as tough comps are lapped and an eventual slowdown in acquisition pace is realized.

As we have entered 2022, vast backlogs and shortages still remain far past when many predicted normal activity would resume. I believe the likelihood that the situation resolves itself quickly is fairly low and that an elevated period of earning will persist for IBP should the company be able to navigate its own constraints and challenges.

Concerns

The two most immediate concerns are labor shortages and supply chain constraints. IBP has navigated potential labor problems well so far and as a result management believes the company is better placed than many of its smaller competitors. Supply chain constraints did force outside of distribution purchases in Q2 2021 in order to meet demand. More inventory has been held to mitigate shortages which has had the negative impact of lowering overall cash flow: “For the full year 2021, the impact from supply shortages was approximately $9 million on gross profit and reduced adjusted gross profit margin by approximately 45 basis points” (2021 Earnings Call). Rising product costs are a potential headwind for the business although these costs have been passed onto the customer. Insulation represents a small portion of the overall cost to build a home, however, it is unknown how much pricing power can continue to be flexed. In general, an inflationary environment will necessitate greater working capital requirements and could place a damper on IBP’s business model.

There is an obvious longer-term spotlight on whether rates will increase to the point of eroding demand for housing. Multiple headlines point to rising prices combined with higher mortgage rates as a cause for concern. Mortgage rates still remain historically low and the housing backlog persists at levels not seen in decades. The future is uncertain, but people have continued to purchase homes throughout various cycles and the current housing shortage is very real. I believe demand will remain strong as a result and IBP is in very capable hands having survived a multitude of housing cycles and rate environments.

Competition

TopBuild Corp (BLD) is a very similar business to IBP, although it is a little over double the size. Both companies dominate the insulation market and represent around two-thirds of all installation. BLD is the leader in both installation and distribution and operates through 411 branches, 235 for installation, and 176 for distribution. BLD’s acquisition of Distribution International in October 2021 has expanded the company’s industrial and commercial end markets and positions TopBuild as a leading supplier of insulation products. Customers of TopBuild’s Service Partners and Distribution International are often smaller players who cannot purchase the amount needed to order directly from manufacturers. TopBuild also has greater exposure to commercial and industrial end markets with around 25% of revenue coming from these two areas. As a result, in a heavier residential building environment, IBP should perform marginally better as it is weighted more heavily to this sector. Overall, IBP and BLD have very similar margin profiles although BLD leverages its larger scale to great effect. This is evident as IBP generates around 60% of the total revenue that BLD does, but with 85-90% of the SG&A expense. TopBuild completes fewer acquisitions than IBP and with less regularity, although the deals are often much larger size in size.

Conclusion

IBP has a proven track record of growth in various market environments. Several tailwinds will benefit the company for the foreseeable future and offer additional drivers to boost an already growing business. It has carved out a strong position as the number two insulation installer and has significant optionality remaining in other product offerings. The company stands a good chance to earn above-average returns as the housing backlog is worked through.

Be the first to comment