Thomas Barwick

Want to skip the analysis & go straight to finding out who had the best (or worst) valuations in Telecommunication Services? Download my research for free here.

In searching for opportunities within the market, I like to consider which sectors of the market have been performing badly over the past 12 months. I try to uncover opportunities for investment-grade firms that have been unfairly dragged down by their peer-group despite solid financial health and performance.

We’ve been analyzing the Telecommunications industry, which has been dragged down by the broader Communications sector (down 40% over the last 12 months) despite solid balance sheets and low earnings multiples.

Today’s research piece considers Frontier Communications Parent, Inc. (NASDAQ:FYBR), which primarily offers data and Internet, voice and video services in 25 states.

For those unfamiliar with my analysis methodology, you’ll find in-depth explanations for my research in an earlier piece relating to AT&T (T).

(Data & prices correct as of pre-market 20th September, 2022. Top Integrated, Wireless & Alternative Telecommunication Services Stocks referred to can be found on this Seeking Alpha screener.)

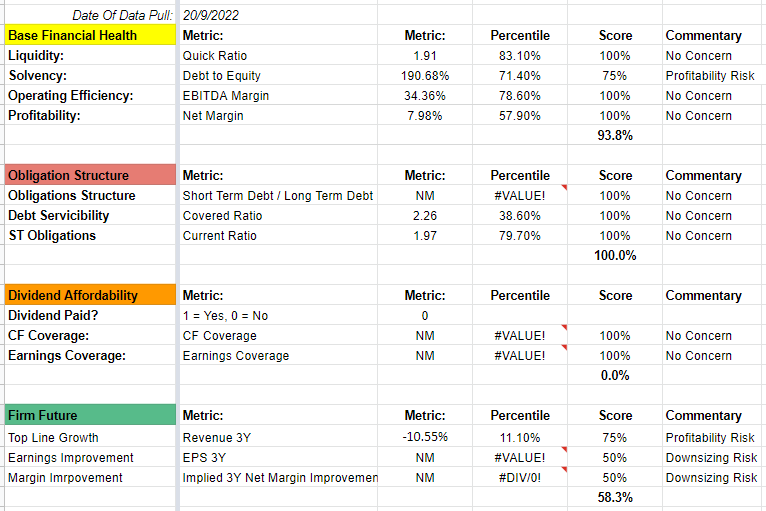

Frontier Communications Parent, Inc.’s Base Financial Health

FYBR’s financial health looks fairly solid on a normal operating basis, with excellent gross profits, average net margins for the industry, and good debt serviceability.

There are concerns in the firm future outlook portion of our health check. However the industry at large is facing a slight downturn in revenue and profitability, so this is not a serious threat at this time.

Author

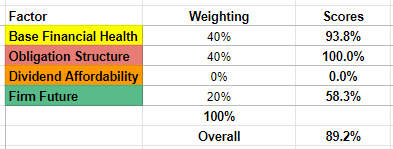

Weighting these scores, we get a fairly comfortable 89.2% overall health score for FYBR. Not bad, but room for improvement on the future outlook side.

Author

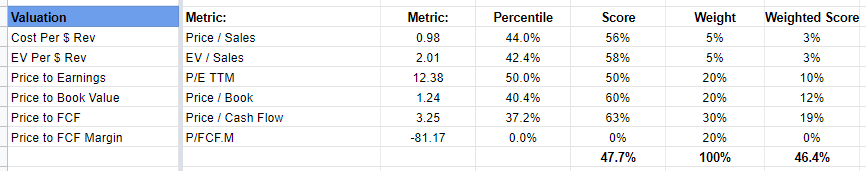

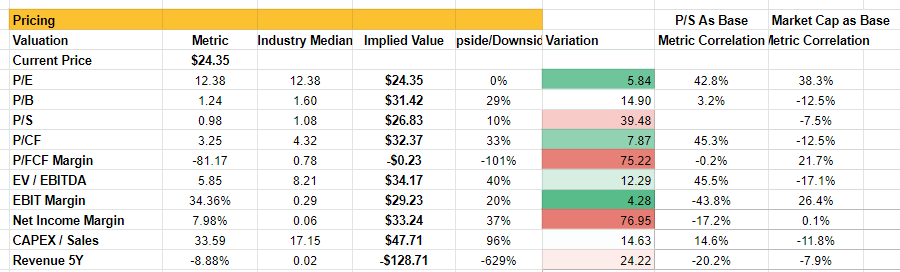

Assessing Frontier Communications Parent, Inc.’s Pricing Attractiveness

While our valuation metrics vs. the industry comparison is sub-50% (meaning potential overpricing), note that there is a negative P/FCF.M metric weighing down the weighted score.

This negative FCF (free cash flow) figure can be explained by an abnormal “Invest. in Marketable & Equity Securities” transaction in the most recent report ($2.3B spent) which allows us to not carry any concern around this metric.

Author

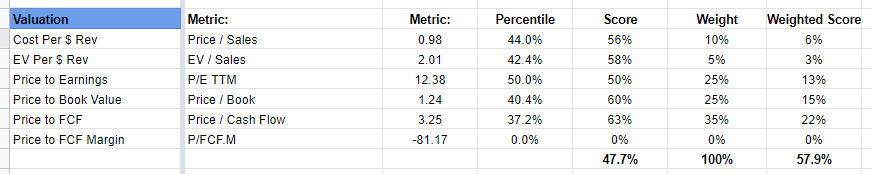

If we re-weight these metrics to ignore the FCF.M metric, then we arrive at a more attractive 57.9% valuation attractiveness score, which I believe is more relevant.

Author

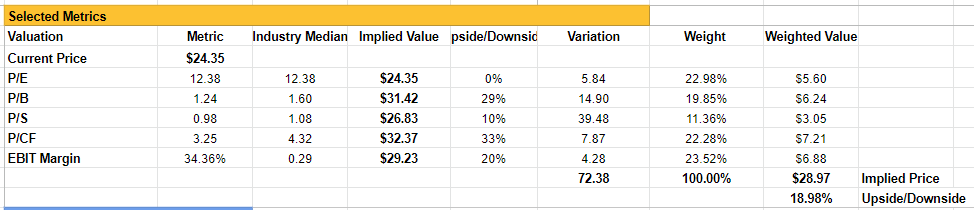

Finding An Appropriate Valuation Method For Frontier Communications Parent, Inc.

As for finding a pricing mechanism that we can use to value the firm, we can rely on our previous workings that helped us determine the most appropriate set of metrics to use for the Telecommunications Industry.

Author

These weighted metrics help us to arrive at a valuation for FYBR of $28.97, representing an upside risk of 18.98%

Author

Closing Remarks

Overall we come to the conclusion that FYBR is relatively fairly valued at its current price, with a little room for an upside swing to the benefit of current shareholders.

With that said, it would be irresponsible of me not to point out that this analysis is limited in its scope to just a quantitative peer analysis. While we do look at the firm’s financials, it does not go searching for detail and context that one might find reading earnings transcripts. Further, the analysis is of the industry as a whole but does not consider the market as a whole (i.e., the S&P 500) and does not break down a near-peer comparison. Investors should use this analysis as perhaps a base-line for their analysis, but spend time looking at the firm’s qualitative aspects to further inform their thinking.

Author’s Note: The commentary in this article is general in nature and does not consider your personal circumstance. The opinions expressed in this article are opinions only, and data referenced is sourced from third party sources including Seeking Alpha and other publicly available sources.

I make no warranties or guarantees around any of the views expressed in this article and suggest all investors consider my writing to be for interest purposes only and not considered exhaustive investment research or advice.

Be the first to comment