Justin Sullivan

Clothing and apparel is incredibly important. How we dress affects how people perceive us and, to many, it impacts how they themselves feel. One of the oldest and most widely known clothing and apparel companies in the US, dating back to the California Gold Rush, is Levi Strauss & Co. (NYSE:LEVI). This iconic brand had done well leading up to the COVID-19 pandemic. But the 2020 fiscal year proved to be rather painful. Fast forward to today, however, and results are much more promising. With management working hard on continuing to grow the enterprise, upside for investors moving forward should be attractive. The bullish case for the company is further strengthened when you consider how cheap shares are on an absolute basis. Having said that, the stock is rather pricey compared to similar companies. And that is certain to put a damper on things. But given how far shares have fallen recently and how cheap the stock is on an absolute basis, I cannot help but change my rating on the business from a ‘hold’ to a ‘buy’.

Strong growth even as shares fall

Back in late December of last year, I wrote an article discussing whether or not it made sense to consider Levi Strauss & Co. an attractive prospect to buy into. In that article, I said that the company’s track record, prior to the COVID-19 pandemic, had been quite positive. I said that the long-term outlook for the enterprise was promising, and I saw that it had recovered nicely from the downturn in sales caused by the crisis. But with shares trading at rather lofty multiples, I ultimately concluded that there were better opportunities on the market. My overall thought at the time was that shares were probably more or less fairly valued. And as a result, I rated the business a ‘hold’. When I assign such a rating, I am stating my belief that share price performance for the company in question will likely match the broader market for the foreseeable future. So far, that rating has not aged well. While the S&P 500 is down 19.1%, shares of Levi Strauss & Co. have tanked by 30.2%.

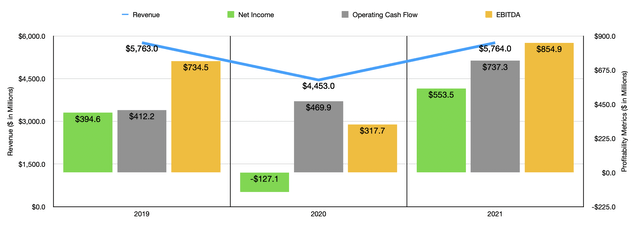

Given this return disparity, you might think that the fundamental performance of the business has been painful and that management’s outlook is negative. But that couldn’t be farther from the truth. To start with, we should touch on how the company ended its 2021 fiscal year. I say this because, when I last wrote about the firm, I only had data covering through the third quarter of that fiscal year. For the year as a whole, revenue came in at $5.76 billion. That’s 29.4% higher than the $4.45 billion reported for the 2020 fiscal year. And it’s essentially flat compared to what the company generated in 2019. On the bottom line, performance was also robust. Net income of $553.5 million represented a significant improvement over the $127.1 million loss the company reported for 2020. It was also the best year, in terms of profitability, for the company on record. Operating cash flow increased from $469.6 million in 2020 to $737.3 million last year. And EBITDA for the business increased from $317.7 million to $854.9 million.

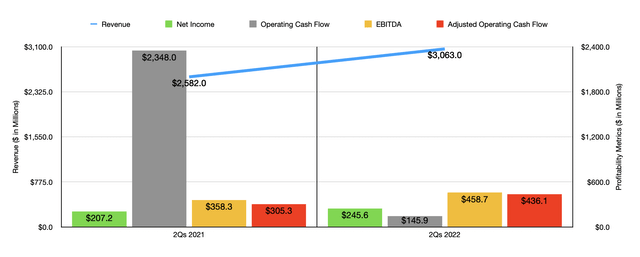

Clearly, the picture for the business has never looked better. But the really exciting thing is that the financial performance achieved in 2021 is not as good as what the company is currently seeing this year. Consider revenue. In the first half of the 2022 fiscal year, Levi Strauss & Co. generated sales of $3.06 billion. That’s 18.6% higher than the $2.58 billion reported the same time one year earlier. Growth during that six-month window is particularly strong across a couple of different categories. For instance, for the Levi’s Brands category in the Americas, sales increased by 21.6% year over year. Management attributed this increase to a combination of factors, including the introduction of more products sold and price increases on those products. Even more impressive was the Other Brands category of products. Here, revenue rose 73.3% from the first half of 2021 to the first half of 2022. The only downside to this is that total revenue associated with Other Brands in that six-month window was just $204 million. In short, it still only represents 6.7% of the company’s revenue. Much of this rise came from the inclusion of Beyond Yoga into its portfolio, a change that added $22.8 million to the company’s top line.

As revenue has risen, profitability has followed suit. Net income in the first half of 2022 came in at $245.6 million. That’s 18.5% higher than the $207.2 million reported just one year earlier. Operating cash flow did worsen year over year, dropping from $248 million to $145.9 million. But if we adjust for changes in working capital, it would have risen from $305.3 million to $436.1 million. Meanwhile, EBITDA for the company also expanded, climbing from $358.3 million to $458.7 million.

Another positive for shareholders is that management has big plans moving forward. The company’s goal right now is to continue to grow sales at an annualized rate of between 6% and 8%. If this comes to fruition, the company anticipates revenue of between $9 billion and $10 billion by 2027. This compares to the $6.4 billion to $6.5 billion that management currently anticipates for the 2022 fiscal year, an increase in revenue compared to 2021 of between 11% and 13%. The company hopes to achieve this sales increase by investing heavily in its key brands and by investing more in its stores, online channels, and other aspects of its direct-to-consumer operations.

This follows a pattern from prior years. For instance, back in 2011, 22% of its net revenue came from its direct-to-consumer activities. By the end of 2021, this number had grown to 36% (with the goal of increasing this to 55% of sales in 2027). Over that same window of time, its e-commerce operations specifically quadrupled from 2% of sales to 8% of sales. The company also expects that profitability will rise nicely, with its adjusted EBITDA margin climbing from 12.4% at the end of 2021 to 15% or higher by 2027. On top of this, management hopes to continue rewarding shareholders in other ways. This was most recently demonstrated by the company’s decision to issue a $750 million share buyback program.

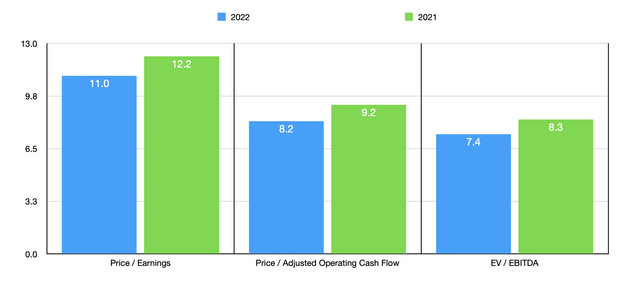

In addition to management having an interesting growth plan, you also had the fact that shares look fairly cheap on an absolute basis. Using 2021 results, the firm is trading at a price-to-earnings multiple of 12.2. Management is currently forecasting earnings per share for this year of between $1.50 and $1.56. At the midpoint, this would bring that multiple down to just 11. No guidance was given when it came to other profitability metrics. But if we assume that they will increase at the same rate that earnings should, we should anticipate a forward price to operating cash flow multiple of 8.2 and a forward EV to EBITDA multiple of 7.4. These compare favorably to the 9.2 and 8.3 figures that we get, respectively, using our 2021 results. To put the pricing of the company into perspective, I did compare it to five similar firms. On a price-to-earnings basis, these companies are trading at multiples of between 4.9 and 8.2. And using the EV to EBITDA approach, the multiples are between 3.1 and 7.2. In both cases, Levi Strauss & Co. was the most expensive of the group. Meanwhile, using the price to operating cash flow approach, the multiples range from a low of 5.9 to a high of 18.9. In this case, three of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Levi Strauss & Co | 12.2 | 9.2 | 8.3 |

| Movado Group (MOV) | 7.3 | 5.9 | 3.5 |

| Capri Holdings Limited (CPRI) | 7.8 | 9.1 | 5.9 |

| Gildan Activewear (GIL) | 8.2 | 9.8 | 7.2 |

| Delta Apparel (DLA) | 6.7 | 18.9 | 5.7 |

| G-III Apparel Group (GIII) | 4.9 | 6.7 | 3.1 |

Takeaway

Although shares of Levi Strauss & Co. are rather expensive compared to similar firms, they do work cheap on an absolute basis. The company is undeniably healthy at this time and management is forecasting attractive growth in the years to come. Given how far shares have fallen and how cheap the company looks on an absolute basis today, I do believe that a ‘buy’ rating is now appropriate.

Be the first to comment