da-kuk

The stock of Office Properties Income Trust (NASDAQ:OPI) has declined 22% this year, along with the broad market. As a result, the stock is currently offering a nearly 10-year high dividend yield of 11.0%. When a stock offers such an abnormally high yield, it usually signals that a dividend cut is just around the corner. However, this is not the case for Office Properties. The REIT has a solid business model and a healthy payout ratio and hence its dividend is attractive, though it is not entirely safe.

Business overview

Office Properties is a REIT that owns more than 170 buildings, which are primarily leased to single tenants with high credit quality. It generates approximately 20% of its rental income from U.S. government agencies and 64% of its rental income from tenants with an investment grade credit rating. Overall, Office Properties has one of the most defensive business models in the REIT universe.

In the last two years, Office Properties has been hurt by the coronavirus crisis, which has led many companies to shift to a “work-from-home” model. This trend, which has significantly reduced the occupancy rate of Office Properties, has resulted in an unusually tenant-friendly environment. Consequently, the trust has lower negotiating power with its tenants than it used to have in the past.

The impact of the pandemic on Office Properties is reflected in the 19% decrease in the funds from operations [FFO] per unit of the REIT in the last two years, from $6.01 in 2019 to $4.87 in 2021. The decrease has resulted primarily from the divestment of many properties, as the REIT has been caught in the coronavirus crisis with a high debt load.

Fortunately, the REIT has begun to stabilize its performance. In the first quarter of 2022, it marginally improved its occupancy rate sequentially, from 91.1% to 91.2%, and grew its FFO per unit by 2% over last year’s quarter, from $1.28 to $1.30. Analysts expect the REIT to post just a 3% decrease in its FFO per unit this year, from $4.87 to $4.70, and begin to recover from next year.

Moreover, Office Properties has begun to observe positive trends in its business in recent quarters. Its new leasing activity has exceeded 230,000 square feet for four consecutive quarters and thus its occupancy has significantly improved during this period. Government agencies have accounted for about 40% of new leasing volume. It is also worth noting that management has a capital recycling program in place. In other words, it divests low-return properties and uses the funds to acquire high-return properties, with lower capital requirements.

Furthermore, as the pandemic subsides and people are claiming back their normal lifestyle, it is reasonable to expect many employees to return to their offices. Office Properties will greatly benefit from the return of employees to their desks. Overall, it is evident that the worse is probably behind Office Properties in reference to the pandemic.

Dividend – Debt

Office Properties is currently offering a dividend yield of 11.0%. The REIT has a payout ratio of only 50% and hence the dividend seems to have a wide margin of safety.

However, it is important to note that Office Properties has frozen its dividend for 14 consecutive quarters. This is a signal that the trust is somewhat struggling to maintain its generous dividend.

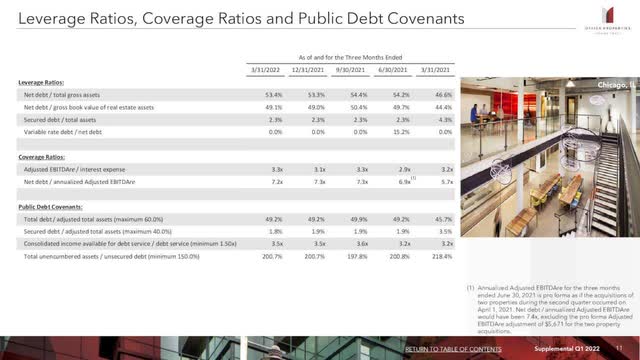

The reason behind the freeze of the dividend is the high debt load of Office Properties. Its net debt (as per Buffett, net debt = total liabilities – cash – receivables) currently stands at $2.5 billion, which is 2.5 times the current market capitalization of the stock and 11 times the annual funds from operations and hence it is excessive. It is also worth noting that interest expense currently consumes nearly all the operating income of the trust and the leverage ratio (Net Debt to EBITDA) stands at an eye-opening 7.2, far above the normal range of 3.0-5.0.

Office Properties Debt Metrics (Investor Presentation)

Source: Investor Presentation

Moreover, Office Properties has material debt maturities every year until at least 2027. On the bright side, thanks to its decent payout ratio of 50%, its defensive business model, which generates 64% of rental income from investment grade tenants, and the expected recovery of its business from the pandemic, the trust is likely to be able to defend its dividend for the foreseeable future. Nevertheless, in the unlikely scenario of a prolonged recession, the dividend will come under great pressure and will probably be cut.

Final thoughts

Office Properties is offering a nearly 10-year high dividend yield of 11.0%, which seems to have a meaningful margin of safety in the absence of a severe recession. Therefore, the stock is attractive for those who are confident that the economy will remain in good shape in the upcoming years. On the other hand, in the unlikely event of a fierce recession, the dividend is likely to come under pressure due to the high debt load of the REIT. Nevertheless, even if Office Properties cuts its dividend by 50%, it will still be offering a 5.5% dividend with a wide margin of safety.

Be the first to comment