necati bahadir bermek/iStock via Getty Images

Lesaka Technologies, Inc. (NASDAQ:LSAK) is expected to benefit from the recent acquisition of competitors, and has a massive target market. With other investment advisors, I am also optimistic about the future free cash flow of LSAK mainly from 2024. In my view, transactions may bring economies of scale, more products, and more exposure to new sectors, which will likely lead to revenue growth and free cash flow generation. Yes, there are some risks from the current level of debt, covenant agreements, and failed acquisitions. However, the company remains too cheap at its current market price.

Lesaka: Large Market Opportunity

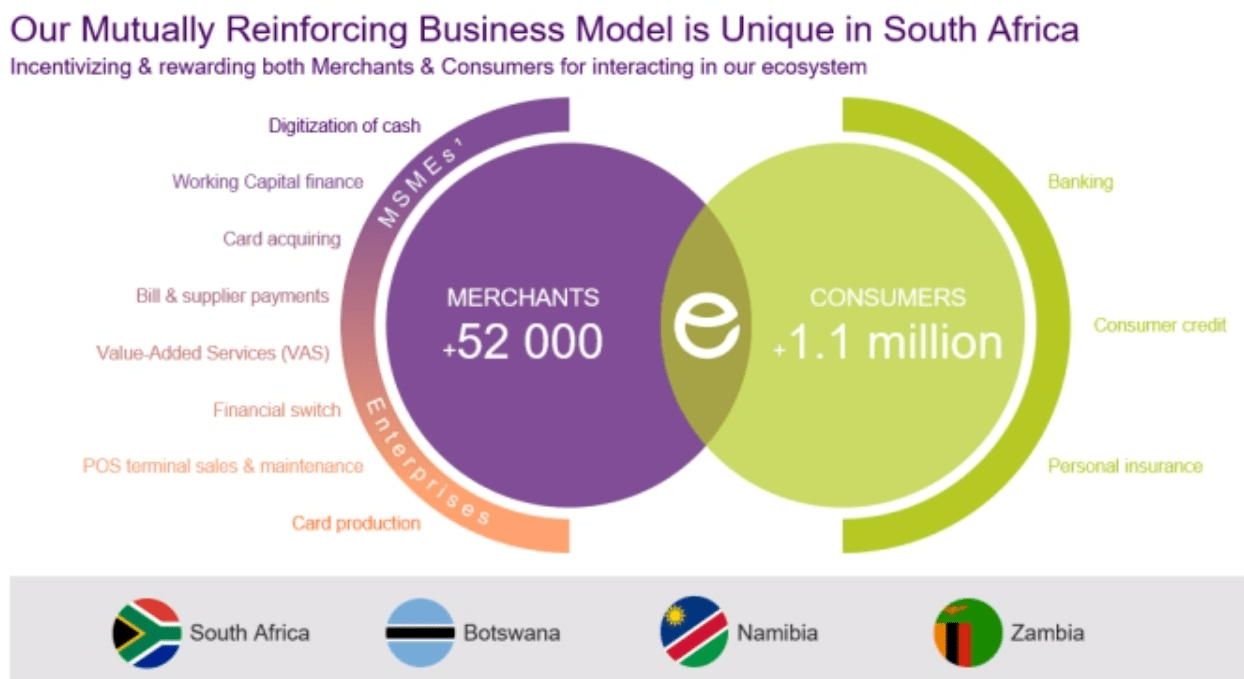

Lesaka offers merchants and consumers in Southern Africa a fintech platform with cash management, payment, and financial services. The company targets a massive number of merchants and consumers, and the list of products is overwhelming.

Source: Annual Report

I think that the market opportunity is massive. The most relevant is that South Africa is a cash-based economy. Close to 59% of the total number of transactions is executed by cash. I believe that products like those of Lesaka will most likely be innovative in the country.

It is also worth noting that the company holds a small amount of the target market. Hence, there is significant room for improvement in terms of revenue growth. The following words are from the annual report:

We currently have just over 1.1 million active account holders which represents approximately 4% share of our total addressable market. Source: Source: Annual Report

Investment Analysts Believe That Lesaka Will Deliver, From 2024, Positive And Growing Free Cash Flow

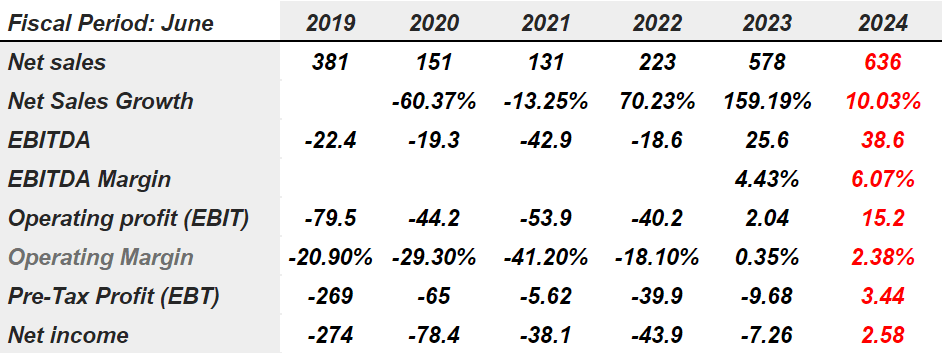

I believe that things are going to get much better for shareholders. Other analysts seem to agree with my vision. Estimates distributed by advisors include 10% sales growth in 2024, 159% sales growth in 2023, and an EBITDA margin close to 6%. Finally, 2024 net income would stand at $2.58 million.

Marketscreener.com

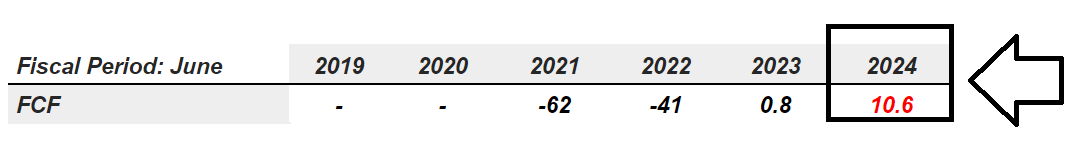

In my view, the most relevant estimate from analysts is the free cash flow. The expectations include significant free cash flow in 2023 and 2024. I believe that the stock demand will increase as soon as investors do notice the incoming increase in free cash flow.

Marketscreener.com

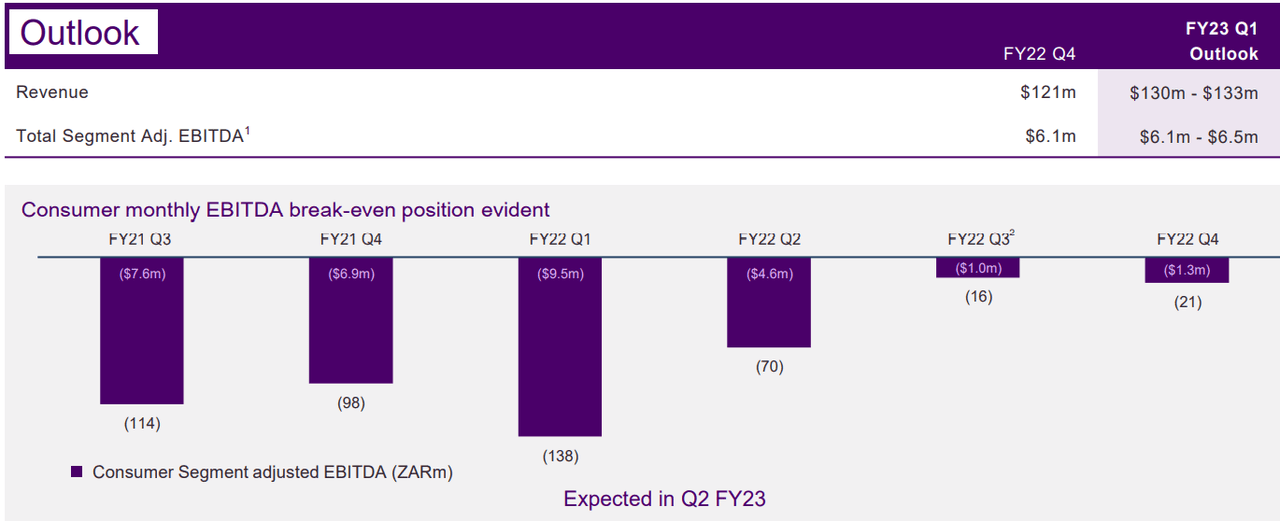

I didn’t see Lesaka’s outlook for the full year 2023 and 2024. However, I would note that management expects significant increase in both the EBITDA margin and revenue growth in 2023 Q1. If the EBITDA margin increase continues in 2023, I would say that the expectations of Lesaka would be aligned to those of investment analysts.

Source: Presentation

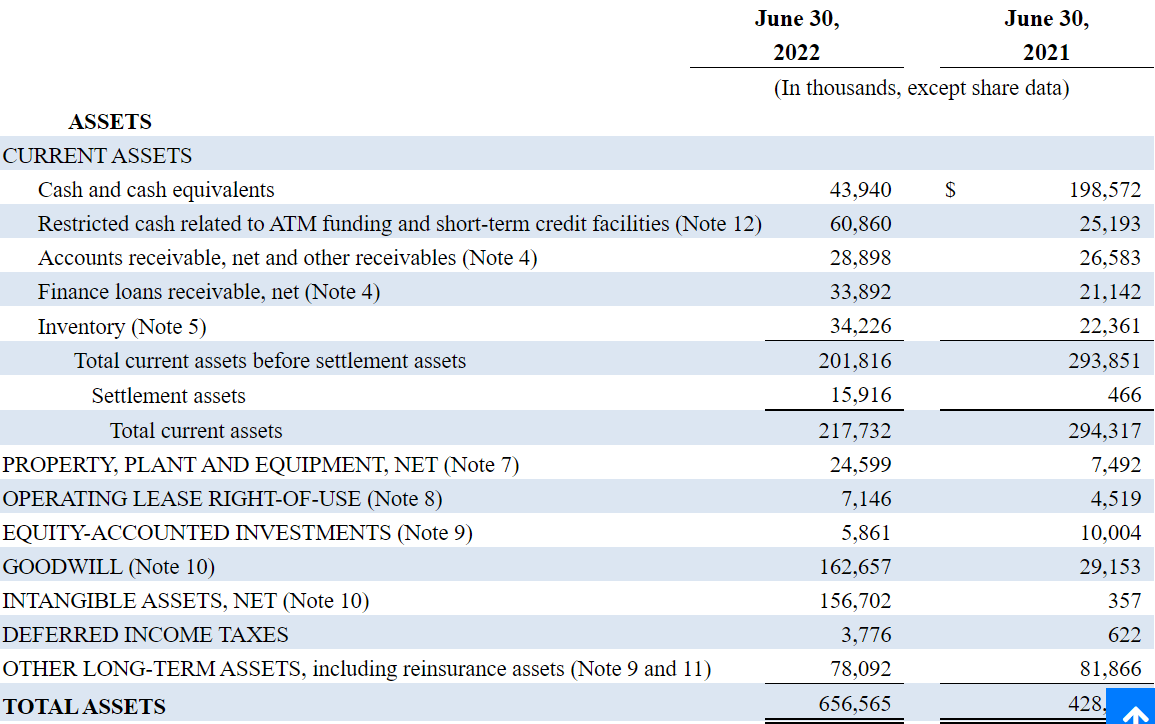

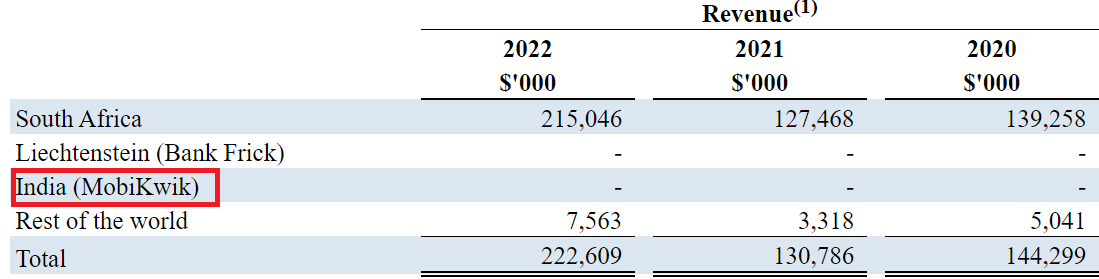

Balance Sheet

As of June 30, 2022, Lesaka reports $43 million in cash, goodwill worth $162 million, intangible assets of $156 million, and total assets worth $656 million. The asset/liability ratio stands at around 2x, so the balance sheet looks in good shape. With that, let’s note that impairment of goodwill or intangibles could occur, which could rapidly lower the asset/liability ratio.

Source: Annual Report

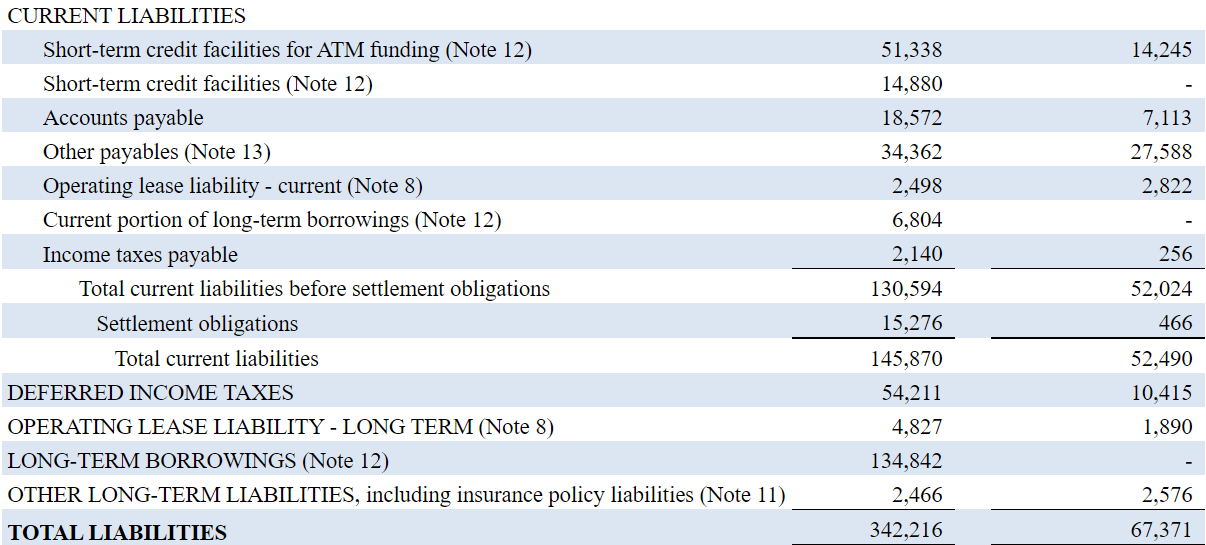

Long-term borrowings stand at $134 million, and short-term credit facilities stand at close to $66 million. I believe that the net debt/forward EBITDA would stand at close to 3x-4x. In my view, Lesaka’s net debt does not seem worrying if net sales and free cash flow growth continue in the near future.

Source: Annual Report

Source: Presentation

My Base Case Scenario Implied A Valuation Of $4 Per Share

In my view, the recent acquisitions will likely bring new products and access to new sectors in South Africa. The recent acquisition of Connect Group during the year ended June 30, 2022 is a good example of new markets and products. More target markets will likely bring more economies of scale, more revenue, and perhaps FCF margin expansion.

Through the introduction of a suite of solutions and technologies targeted at the MSME merchant sector where we were previously under-represented, we can address the needs of approximately 1.4 million informal and approximately 700,000 formal MSMEs in South Africa. Source: Annual Report

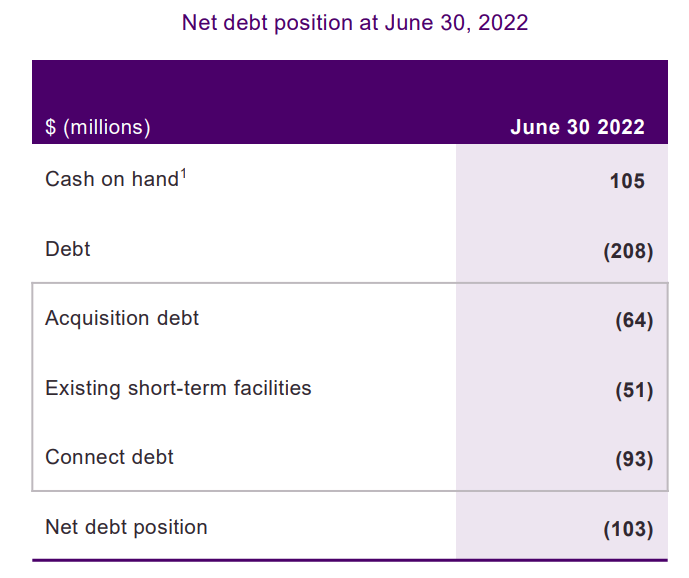

I believe that Lesaka could obtain significant revenue traction through the acquisition of entities outside South Africa. Let’s notice that the presence of Lesaka in the rest of the world is quite small, which is a pity. In my view, if the know-how accumulated in South Africa is working, it may work in other territories like India, South America, or other parts of Africa.

Source: Annual Report

Finally, in my view, management will benefit significantly from an increase in communication about its new products to merchants. I believe that many merchants in South Africa and other regions may not be using the company’s products because they are not aware of their existence. Digital wallets, financing of working capital, or cash availability could make a lot of good to certain merchants:

On the merchant side, less than 8% of merchants have access to formal credit and less than 4% of informal merchants can accept digital payments. And for consumers, approximately 20% of the estimated 26 million South African consumers in LSM 1-6 have access to credit and savings and a significant majority of the approximately 12 million permanent grant recipients require immediate cash withdrawals of their grant. Source: Annual Report

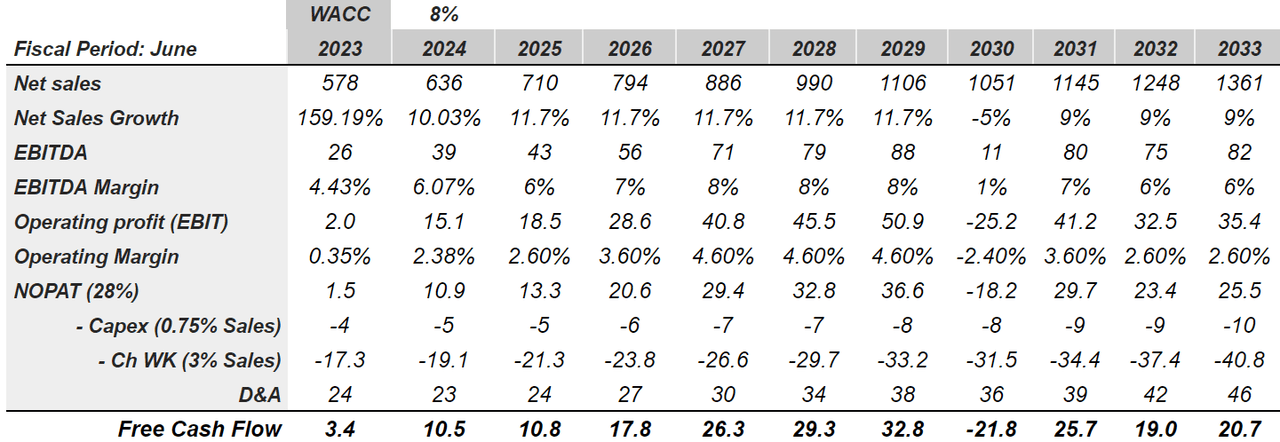

Experts in the assessment of markets believe that the payment processing solutions market size could increase at a CAGR of 11.7% from 2020 to 2027. In this case scenario, I used these figures for the sales growth of Lesaka:

Fortune Business Insights, published this information in its latest report, titled, Payment Processing Solutions Market Size, Share Forecast, 2027. The report further mentions that the market stood at USD 48.60 billion in 2019 and is likely to exhibit a CAGR of 11.7% between 2020 and 2027. Source: With 11.7% CAGR, Payment Processing Solutions Market Size

With sales growth of approximately 11% from 2025 to 2029, growing EBITDA margin, and effective tax of 28%, I obtained 2033 NOPAT close to $26 million. I also used capital expenditures around $4-$10 million and changes in working capital around $17 million and $40 million. The free cash flow would grow from $3 million in 2023 to around $20-$21 million in 2033.

Author’s DCF Model

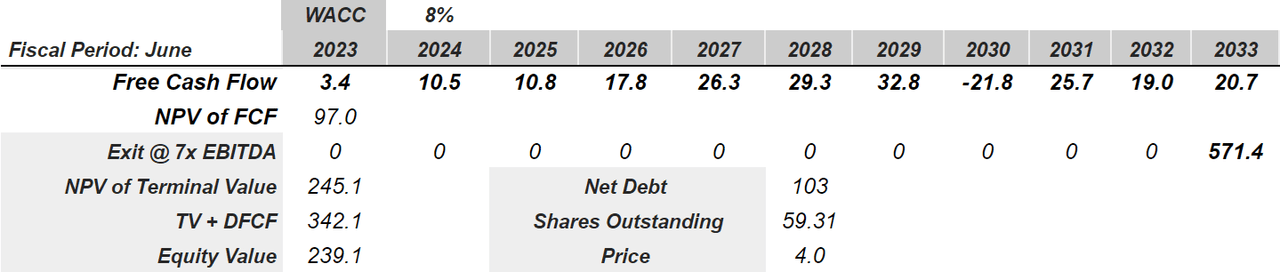

I also assumed a discount of 8%, which I consider reasonable for a company doing business outside the United States. With the cited discount, the net present value of future FCF from 2023 to 2033 would stand at $97 million. I also assumed an exit multiple of 7x EBITDA, which seems reasonable for a business with sales growth around 9% and EBITDA margin of 6%. My results include an equity value of $239 million and a fair price of $4 per share.

Author’s DCF Model

My Worst Case Scenario Would Imply A Valuation Of $1.13 Per Share

In my view, if the company’s expectations and synergies expected from the acquisition of Connect are not realized, market participants may sell their stakes. In the worst case scenario, equity researchers may lower their price targets, which would lead to a decrease in the stock price:

Our expectations regarding Connect’s business and prospects may not be realized, including as a result of changes in the financial condition of the markets that Connect serves. In addition, there are risks associated with Connect’s operations, including the risk of reduced cash settlements through Connect’s vault infrastructure or higher cash losses, lower than expected growth in Connect’s value-added services, lower than expected customer acquisition rates or higher than expected customer churn, lower than expected levels of loan advances or higher credit losses and slower than expected growth in card transactions. Source: Annual Report

The company signed several covenant agreements, which may lower the number of options for management. Acquiring new targets may be a bit difficult if bankers don’t accept new transactions. Besides, management may not be able to be as aggressive as in the past, which may lower future revenue growth. The company discussed some risks and also talked about its indebtedness in the last annual report:

These borrowings contain customary covenants that require Lesaka SA to maintain a specified total asset cover ratio and restrict the ability of Lesaka, Lesaka SA, and certain of its subsidiaries to make certain distributions with respect to their capital stock, prepay other debt, encumber their assets, incur additional indebtedness, make investment above specified levels, engage in certain business combinations and engage in other corporate activities. Source: Annual Report

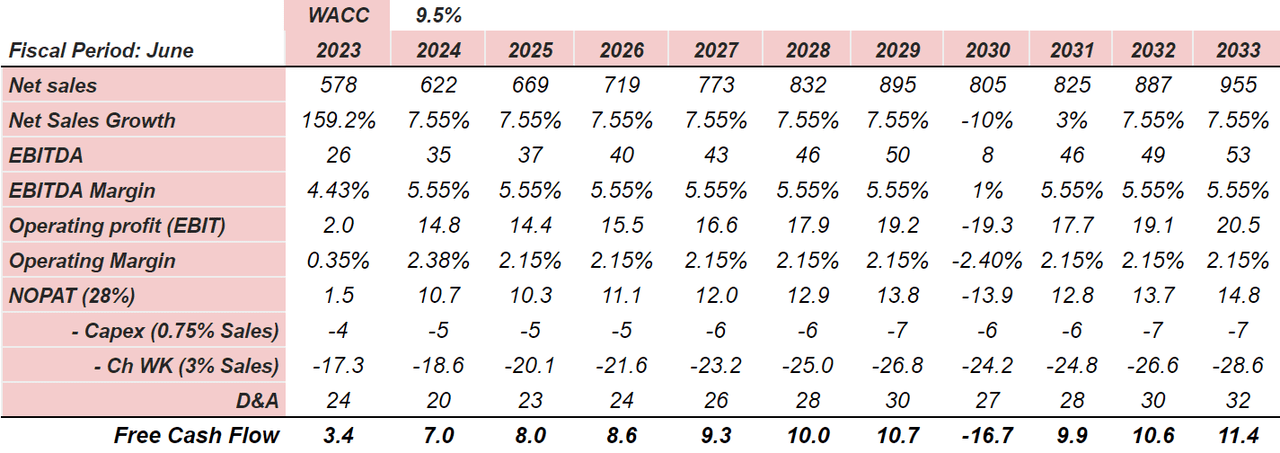

If we assume sales growth close to 7.55% and EBITDA margin close to 5%, 2033 FCF would stand at close to $11.4 million. Note that I didn’t include any increase in sales growth or EBITDA margin. The free cash flow wouldn’t increase as much as in the previous case scenario.

Author’s DCF Model

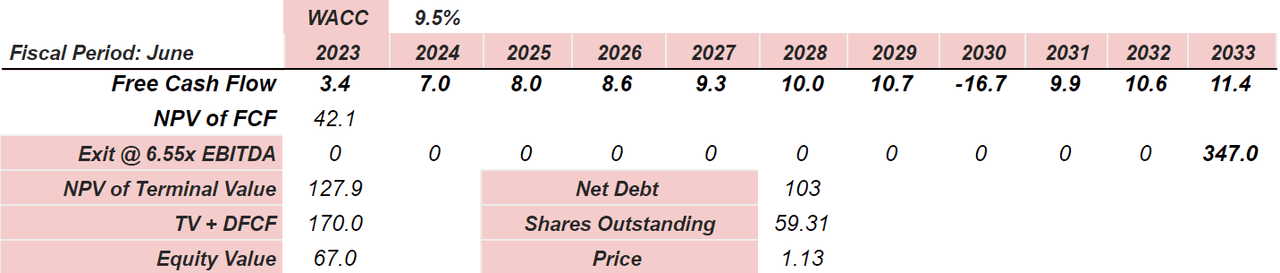

With a discount over 9.5%, the net present value of future FCF from 2023 to 2033 would be close to $41 million. Finally, with an exit multiple of 6.55x, the implied price would be $1.13 per share.

Author’s DCF Model

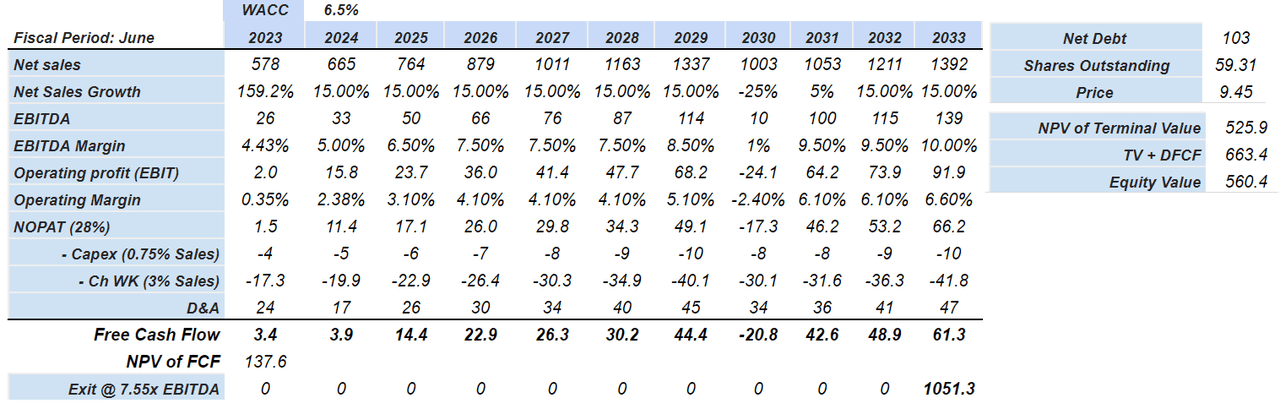

The Best Case Scenario Resulted In A Valuation Of $9.45 Per Share

Under this scenario, I assumed Lesaka would likely use new free cash flow to reduce its long-term debt. As a result, some of the covenant agreements may no longer apply, and management may acquire new targets. Let’s keep in mind that I am optimistic in this case.

Under my best case scenario, Lesaka would acquire other businesses in South Africa, which would bring significant sales growth and EBITDA margin growth. I assumed that bankers will offer a significant amount of financing for new acquisitions, and synergies expected will be obtained. Let’s note that M&A is one of the most relevant growth strategies revealed by Lesaka:

Acquisitions are an integral part of our new growth strategy as we seek to expand our business and deploy our technologies in new markets in Southern Africa. Source: Annual Report

I assumed sales growth of 15% from 2024 to 2029, growing EBITDA margin, and growing operating margin. My results included free cash flow growth from $3.43 million in 2023 to $61.31 million in 2033. Also, with an exit multiple of 7.55x EBITDA, the equity value would be close to $555-$560 million, and the fair price would stand at $9.45 per share. Yes, in this case, I am quite optimistic with some of my figures. I wouldn’t expect the stock price to go beyond $9.45 in the near future.

Author’s DCF Model

My Takeaways

Lesaka recently acquired another competitor, so many people, in my view, are expecting the results from the merger to see the reaction in the market. With that being said, I believe that the market opportunity and the expectations from other investment advisors justify a position in the stock. Under my own financial model, further new products and acquisitions, internationalization, and economies of scale from the existing acquisitions could imply a valuation of $9.45 per share. Even considering the risks from failed acquisitions and debt levels, I believe that Lesaka remains appealing at its current share price.

Be the first to comment