HJBC

The United States 12-Month Natural Gas Fund, LP (NYSEARCA:UNL) (“the Fund”) is an exchange traded fund (“ETF”) organized as a limited partnership. UNL’s investment objective is to track a benchmark of short-term natural gas futures contracts.

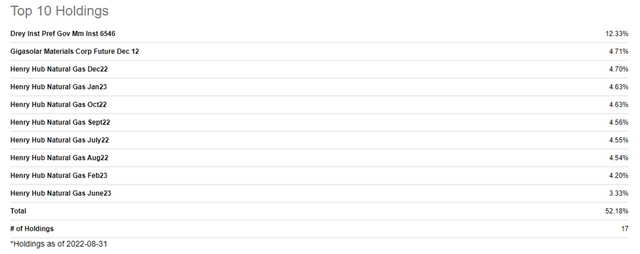

In its SEC filing, the Fund is a portfolio of contracts as follows:

The Benchmark Futures Contracts are the futures contracts on natural gas as traded on the New York Mercantile Exchange (the “NYMEX”) that is the near month contract to expire, and the contracts for the following 11 months, for a total of 12 consecutive months’ contracts, except when the near month contract is within two weeks of expiration, in which case it will be measured by the futures contract that is the next month contract to expire and the contracts for the following 11 consecutive months. When calculating the daily movement of the average price of the 12 contracts, each contract month is equally weighted.

The largest holdings as of end-August were:

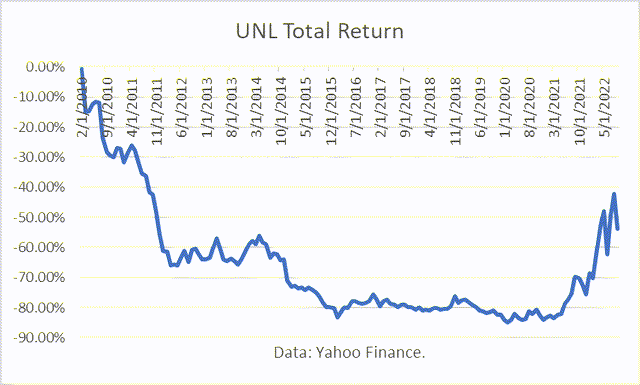

Total return for UNL in the year-to-date has been 80%. That compares favorably to a 22% loss in the S&P 500 (SP500TR).

But since inception in 2010, UNL has lost about 54% of its value.

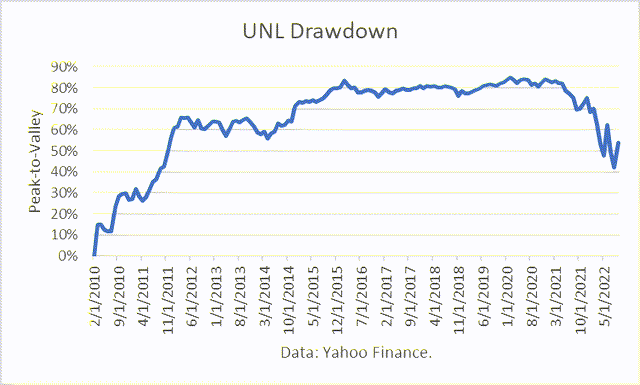

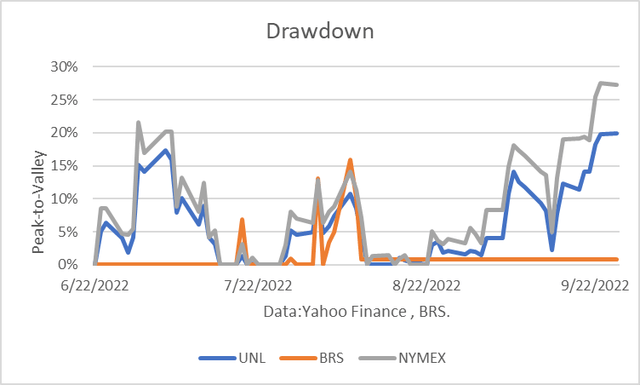

The Maximum Drawdown (“MD”) over the period was 85%, which is unacceptably high for a long-term investment. I view the MD as the primary risk measure because it quantifies how much an investor could have lost from its peak valley. Investors often exit positions when losses exceed risk tolerances, locking in the loss.

May Article Review

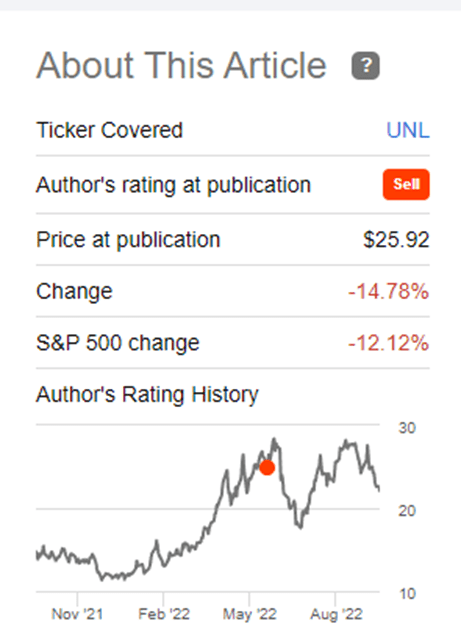

In May 31, 2022, I published an article on Seeking Alpha, UNL: Likely To Become Overvalued This Summer. In the prior 12 months, UNL’s value had soared over 200%, but my analysis showed that UNL would likely become overvalued during this past summer, which was a bold prediction, given the surge and trading environment at the time.

The UNL price sank soon after the article appeared, rebounded, and has since fallen again. On balance, the UNL price had fallen 14.78 % since the article, as of this writing.

Seeking Alpha

Market Fundamentals

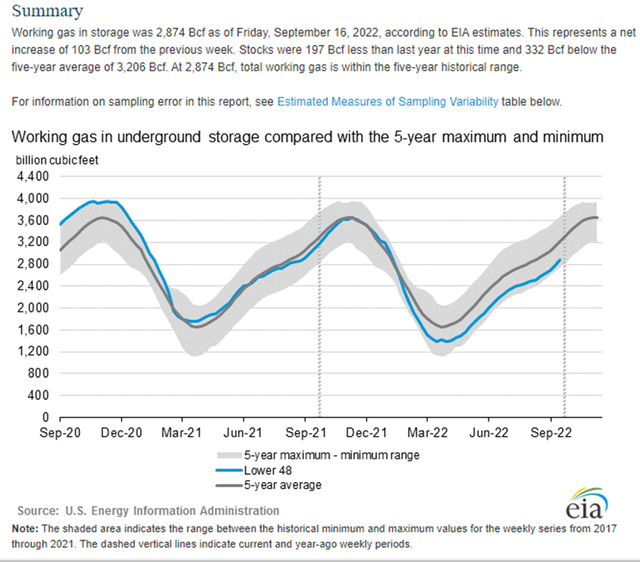

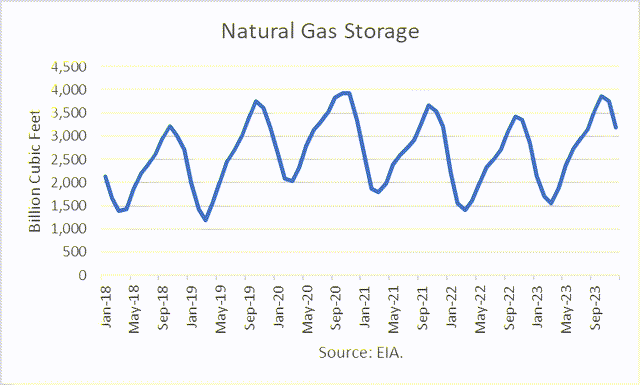

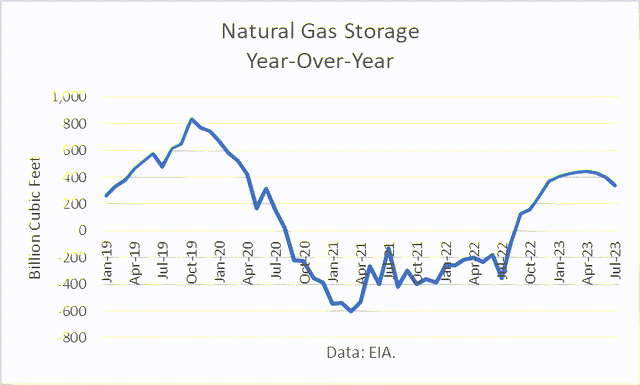

My thesis was based on a moderation in the natural gas storage deficit. And the deficit has been narrowing, based on the weekly storage estimates reported by the EIA.

Looking forward, the EIA projected natural gas monthly storage estimates in its September Short-Term Energy Outlook (“STEO”). In my May article, I discussed their model in some detail and my confidence in their methodology.

I calculated the year-over-year (“YOY”) monthly changes to storage. I found that in January 2023, the YoY storage deficits are predicted to be surpluses.

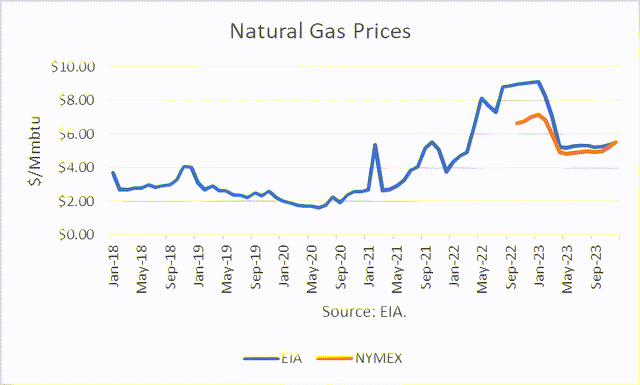

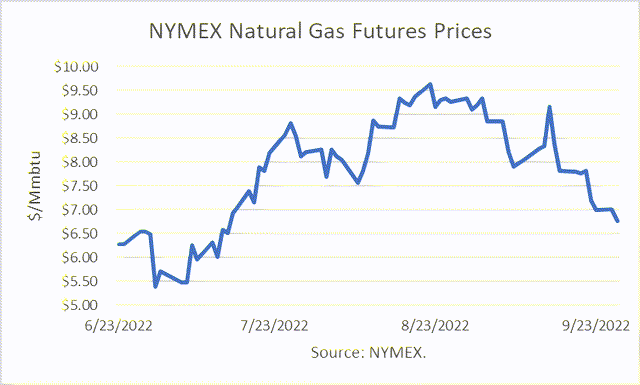

As a result, the EIA projects that natural gas prices will peak in January 2023 at $9.10/mmbtu. However, the NYMEX natural gas futures prices (second nearby month) peaked at $9.65 on August 22nd and has fallen since. Furthermore, NYMEX futures prices are lower than the EIA projections in the nearby months and reflect a major decline into next spring and summer.

Natural gas prices in Europe have spiked to around ten times the value of US prices due to the EU’s dependence on gas supplies from Russia and Russia’s threat to withhold supplies to Europe due to sanctions by NATO. Most recently, three leaks on the Nord Stream 1 and 2 pipelines that carry natural gas from Russia to Germany were discovered. Denmark believes “deliberate actions” caused big leaks.

Despite the price disparity between the U.S. and EU, and financial incentive to ship NGL to Europe, the potential NGL exports are limited by infrastructure constraints. It doesn’t matter how large the price spread, U.S. exports are limited.

BRS Trading Results

As I previously explained in another article, I commenced trading in a futures market account on June 23rd. I have had many other oil futures trading accounts going back to 1980, when I began trading NYMEX heating oil (“HO”).

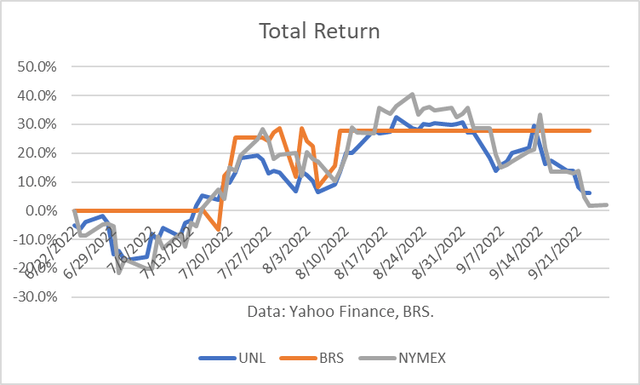

The market has been highly volatile and challenging. I captured a profit of 27.6 % through September 27th, against a loss in NYMEX crude oil futures prices (“NYMEX”) of about 1.6 % and a gain in UNL of about 3.8%.

The Maximum Drawdown of the BRS strategy was 16% over the period. That compares favorably to a 30% MD for NYMEX and 22% MD for UNL.

The BRS profit was achieved in three long trades:

- Bought NYMEX at $7.37 July 18 and sold at $7.77 on July 20.

- Bought NYMEX at $7.75 July 21 and sold at $8.19 on July 22.

- Bought NYMEX at $8.16 July 28 and sol at $8.23 on Aug 10.

Conclusions

UNL is an ETF that provides investors with exposure to natural gas futures prices without the need for a futures market account. However, the long-term return has been negative and the maximum drawdown excessive. It is not an attractive long-term investment.

In the short term, natural gas futures prices are highly volatile, and so it is only useful to sophisticated traders. I wrote back in May that I assessed UNL as over-priced and it did come down in price.

Since then, the natural gas storage deficit has improved. More importantly, the EIA forecast shows a surplus beginning in January. Therefore, UNL and natural gas futures prices should drop in the months ahead.

Be the first to comment