Michael Vi/iStock Editorial via Getty Images

LendingClub (NYSE:LC) dramatically changed its business model with the early 2021 closing of its Radius Bank acquisition, which combined the LendingClub marketplace with a branchless digital banking platform. The acquisition lowered the company’s cost of capital by now being able to fund high-yielding unsecured credit loans with low-cost deposits, as opposed to being reliant on warehouse lines, securitization, and unsecured debt like most non-banks. The LendingClub marketplace is an attractive flywheel for bringing consumers that are looking to consolidate and/or reduce the cost of their debt, and introducing them to lenders. By arranging these transactions, LendingClub generates fee revenues, but now it can also grow its own balance sheet by retaining more loans, leading to dramatic growth in net interest income. Mr. Market has bashed the stock as just another FinTech, but this is a uniquely profitable and growth investment opportunity for those willing to take a longer-term perspective.

LC has 4 million members that have worked with the company to lower their cost of credit over the years, and it has originated over $70B of loans. The origination mix is 50% new and 50% existing members, and roughly half of the new members have returned to the company within 5 years, so the experience is generally pretty good. The company estimates that repeat members have 3 times the lifetime value of first time borrowers, given the low acquisition costs. The average income is over $100K with FICO’s above 700, but they also have a lot of debt. The bank is now a vertically integrated direct-to-consumer digital marketplace with the ability to serve a broad range of customers. The bank is not burdened with an expensive legacy branch portfolio, and often its first transaction with a customer is the lucrative process of originating a loan. There is a lot of potential for future cross-selling into checking accounts, mortgages, auto loans, etc. While the unsecured personal loans are very profitable and high-yielding with an average yield of 15.22% in Q1, LendingClub will certainly have to keep diversifying into other lesser-yielding asset classes, which have lower capital requirements. Regulators demand that banks can handle downturns in various asset classes, which is why diversification is favored, with higher capital requirements on activities that have higher loss rates. The company is able to grow its capital base via retaining earnings, which can then be reinvested at a uniquely high ROE for the banking sector.

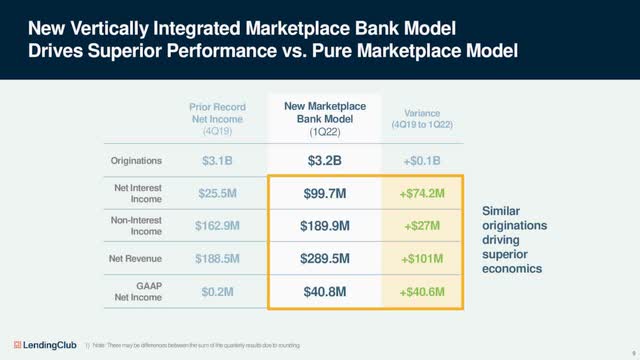

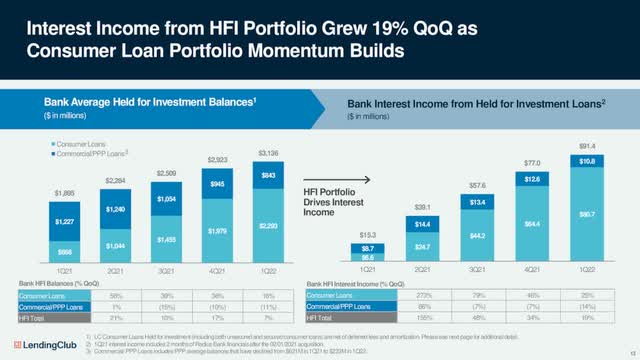

LC Investor Presentation

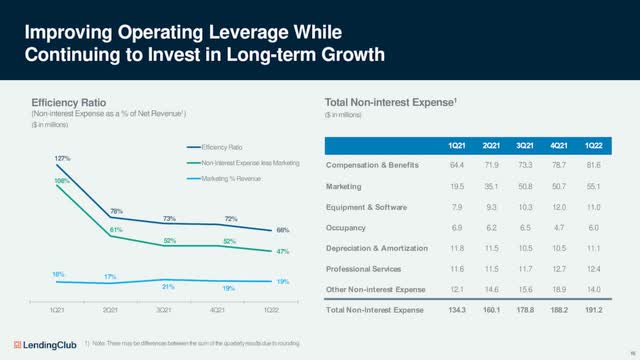

The above slide from LendingClub’s Q1 investor presentation shows the power of the new business model. On a similar level of originations, the company produced $40.6MM more in net income, and $74.2MM more in net interest income. This was mostly due to keeping more loans on the balance sheet and collecting the interest income, which offers a recurring revenue stream of LendingClub. It is important to note that due to the recent CECL accounting changes, LendingClub and other banks must reserve for the expected losses over the lifetime of its loan portfolio. This is a very conservative accounting regulation, which frontloads losses, while the earned net interest income shows up in the financial statements over the life of the loan. As economic conditions change, so will the reserves of course, but historically LendingClub has seen very good underwriting, especially during the Pandemic when people prioritized payments of their personal loans. Total non-interest expense of $191.2MM in Q1 almost equaled non-interest income of $189.9MM, so the net interest income growth really flows to the bottom line. This creates enormous operating efficiency leverage, and there is still a lot of room for improvement on that front.

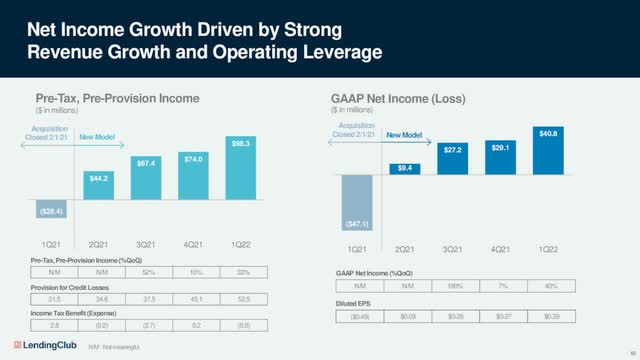

LC Investor Presentation

LendingClub is in the very early innings of its transformation, and I don’t think Wall Street really appreciates all the benefits of the business model. Pre-tax-pre-provision income is showing rapid growth and that is following through to the bottom line. Marketplace originations drive Marketplace revenue, which includes origination and servicing fees. After doing this for many years now, LendingClub is continuously refining and improving its data and analytics related to underwriting. The growing provision for credit losses is a result of strong loan growth and CECL accounting. I’d argue that the underlying economics are more attractive than what is reflected in GAAP income, as in Q1 the company provisioned $52.5MM for retail loans, when total charge-offs were only $9MM. The allowance for credit loan losses as a percentage of held-for-investment consumer loans increased to 6.6% from 6.4%.

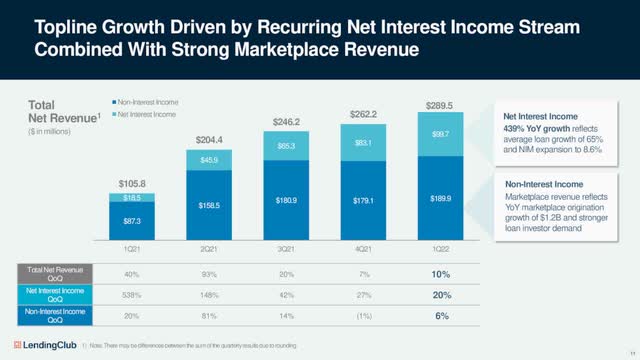

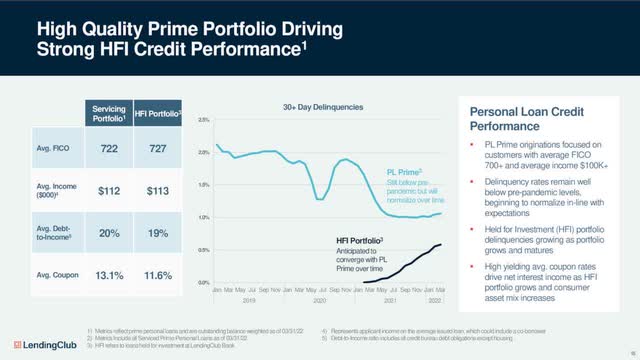

LC Investor Presentation

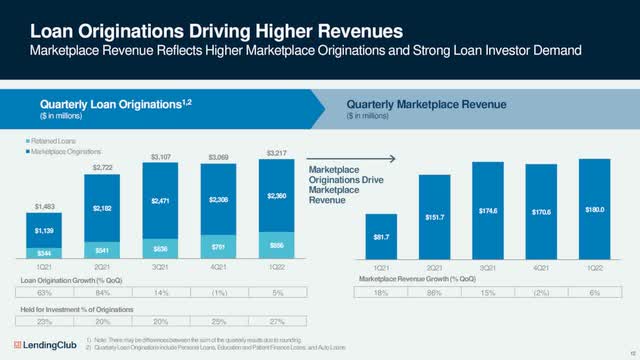

The company plans to grow its auto refi and finance loans for the Consumer business, but the relative contribution to earnings will remain small compared to personal loans. Outside of Consumer, the company expects to grow commercial loans, excluding PPP, modestly. Commercial loans are typically secured by cash flow or collateral and offer good credit diversification. LendingClub plans to retain approximately 20-25% of its originations for the remainder of the year, which decreases short-term fee revenues, but produces more long-term income.

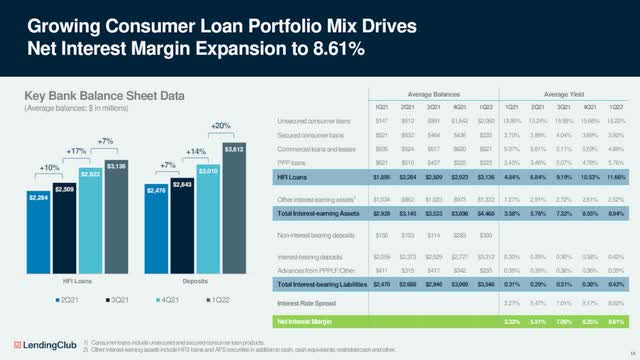

LC Investor Presentation

On April 27th, LendingClub reported an exceptional 1st quarter that dramatically exceeded guidance targets. Net revenue was $289.5MM, well above the guidance of $255-$265MM, which was up 10% over the 4th quarter’s record number, and up 174% YoY. Expenses were only up 42% YoY. GAAP net income was $40.8MM, compared to guidance of $25-30MM. This was up 40% sequentially, net interest income of $100MM was up a staggering 439% YoY. The story is revenue growth, operating leverage, and a lower cost of funds. LendingClub’s first quarter net interest margins was 8.6%, up from 3.3% a year ago. Deposits were up 68% to $4.0B. The average bank loan portfolio grew 65% YoY to $3.1B. Pre-tax pre-provision profits were $98MM, up $24MM or 33% sequentially.

I love covering banks and have done so for over a decade, and I can tell you that these aren’t normal metrics. It is an exciting business model with extraordinary long-term potential if the company can keep originating enough loans with solid underwriting. Credit losses are likely to increase, especially with the onset of a likely recession, but LC has plenty of yield and fee revenues to work with to maintain ample profitability. The loans the bank is keeping on the balance sheet are primarily prime loans with an average FICO rating of 727. In Q1, this portfolio generated 34% of total revenue, and I’d expect that figure to keep increasing.

LendingClub exited Q1 with a strong balance sheet, exhibited by a CET of 16%. Tangible book value grew to $792MM, up from $752MM at the end of 2021. Book value excludes the company’s net deferred tax assets of roughly $210MM, comprised of $140MM federal and $70MM of state deferred tax assets. With LendingClub producing more robust and consistent profits, they should be able to release these reserves, which will accelerate book value growth further, along with organic retained earnings.

LC Investor Presentation

LC Investor Presentation

LC Investor Presentation

LC Investor Presentation

LendingClub raised its revenue, earnings, and origination outlook. For Q2, the company expects to grow revenues to $295-$305MM, up 44-49% YoY. Net income is forecasted to be $40-$45MM. Origination guidance for the year is between 13-13.5B and revenue for the year is $1.15-$1.25B. GAAP net income for the year is expected to be $145-$165MM, and management has historically been quite conservative in its estimates. At a recent price of $11.83, LendingClub has a market capitalization of $1.21B. LendingClub is trading at just 7 or 8x this year’s earnings, despite its enormous growth potential. This is just way too cheap. As long as the company can keep credit under control, I believe the stock should double over the next 12-18 months, as the market starts focusing on what the 2023 and 2024 earnings picture looks like.

Be the first to comment