izusek/E+ via Getty Images

Gogo Inc. (NASDAQ:GOGO) is an inflight internet company which provides its services to business aircraft. With a possible recession on its way, the travel industry could decline due to less spending. The airline industry could see less flights due to higher gas prices, which would mean that Gogo’s services could not be in as high of demand. Firms will also be less likely to send employees on business flights, as they will be forced to cut staff or spending during a recession. Workers getting laid off will also likely decrease Gogo’s potential customers, as less people will have the money or reasons to take flights. The negatives Gogo will face during a recession paired with Gogo’s current share price is why I rate GOGO stock a Sell.

Gogo’s Fundamentals Are in a Weak Position Despite a Strong Earnings Report

Over the past 5 years, Gogo’s revenue has decreased drastically. In 2017, Gogo generated $699.09 million in revenue. This dropped down to $335.72 in 2021, mostly due to decreased travel caused by pandemic issues. Despite this drop in revenue, Gogo has maintained an incredibly strong gross margin of 69.56% in its most recent annual report. Furthermore, the company’s net income margin is also very strong at 45.5%. Therefore, the major issues with the company’s income statement is its revenue growth.

As for the company’s balance sheet, Gogo has work to do. Gogo currently has about $160.6 million in cash. This dropped majorly since 2020 when the company held about $435.3 million in cash. Despite this drop in cash, the company is able to maintain an acceptable current ratio of 1.4 because of generally low current liabilities. As for debt, some investors may be concerned. Currently, Gogo has about $888.5 million in total debt, and adjusts to $727.9 million in net debt. This could be a problem for Gogo if revenue cannot grow in future periods as the company’s Net Debt/EBITDA ratio is 4.4.

Gogo also recently reported first quarter earnings which came in better than expected. The company reported an EPS of $0.18, beating estimates of $0.13 and 1Q21 earnings of -$0.07. Gogo also beat revenue estimates for the quarter. Analysts were expecting revenue to come in at $73.87 million, but the company was able to generate $92.75 million. Gogo’s recent outperformance of expectations may cause some investors to want to jump into the stock. However, possible future developments could cause decreased traveling and spending, causing the demand for Gogo’s services to see major declines. This could cause future reports to miss analyst estimates and cause the stock to drop.

A Recession Would Lead to Decreased Traveling and Spending

During recessions, many companies drastically reduce their spending and budgets for travel. During the 2001 and 2008 recessions, there were huge dips in travel expenditures followed by recovery periods. Another recession would likely cause another large drop in spending on travel and would potentially take years for the industry to recover from it. Gogo would be directly impacted as less companies would be willing to spend on travel and utilize the company’s services. The company’s top line could struggle and possibly not achieve the revenue growth it desperately needs to see. With Gogo’s revenue and cash on a large decline over recent years, a recession is the last thing the company needs.

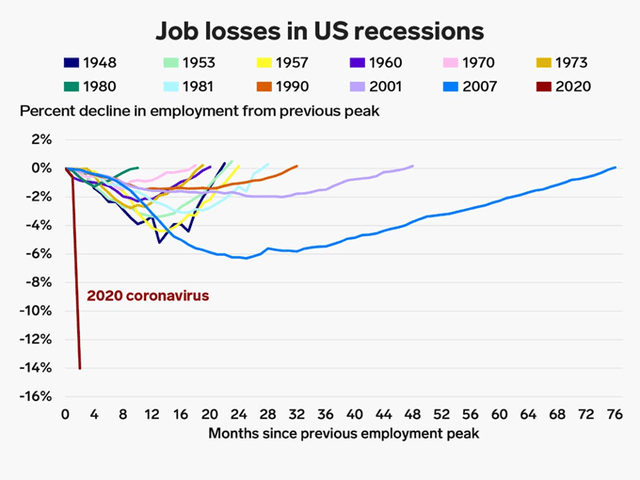

Furthermore, companies may lay off workers during a recession, meaning there will be less people traveling for business purposes and using Gogo’s services. Recessions often lead to mass unemployment and leave millions without a job. The 2-year span from December 2007-2009 saw the unemployment rate rise from 5% to 10% and over 15 million people being unemployed.

Job Losses in U.S. Recessions (Bureau of Labor Statistics, Via FRED)

Companies are already beginning to lay off workers. The tech sector saw 16,000 workers laid off in May, proving the uncertainty in the market with a possible recession developing. Gogo will likely have less customers in the upcoming future with less people in the workforce. Even if a firm does not cut its workforce, it will still likely decrease its spending during a recession. Cutting costs could mean that firms will not be sending their employees on work flights which will also lead to less people using Gogo’s services. Whichever route firms choose to take during a recession, Gogo will likely be negatively impacted from the decision due to less demand for its services.

Rising Gas Prices Will Impact Gogo Severely

Gas prices are soaring as the U.S. national average hit $5 for the first time in history in early June. These record highs in gas prices can be attributed to many factors, such as the Ukraine-Russia conflict. The increase in gas prices does not appear to be slowing down, as JPMorgan analysts have predicted $6 per gallon nationwide before the Fall. This rise will increase the cost of business flights. Rising prices cause lower demand, meaning less business will purchase flights. This directly leads to lower usage of Gogo’s services and will directly hurt the company’s top line.

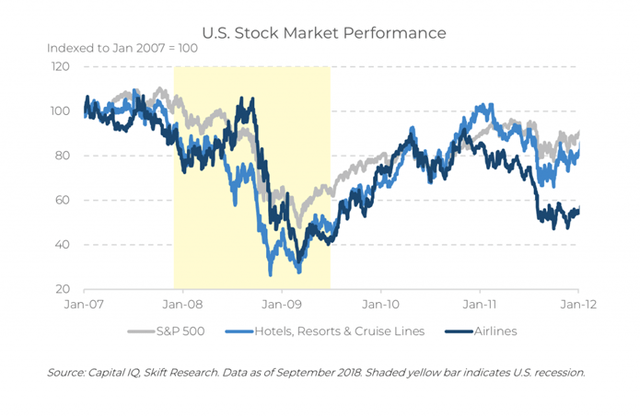

Airline stocks lost a collective $24 billion and 68% of their values due to the increase in fuel prices and the impacts of the market downturn during the Great Recession. The airline industry will likely suffer during recessions meaning less flights and once again, less demand for Gogo’s services. This will likely cause severe harm to the company’s fundamentals and drop the share price.

U.S. Stock Market Performance (Capital IQ, Skift Research)

Upcoming Risks With Gogo

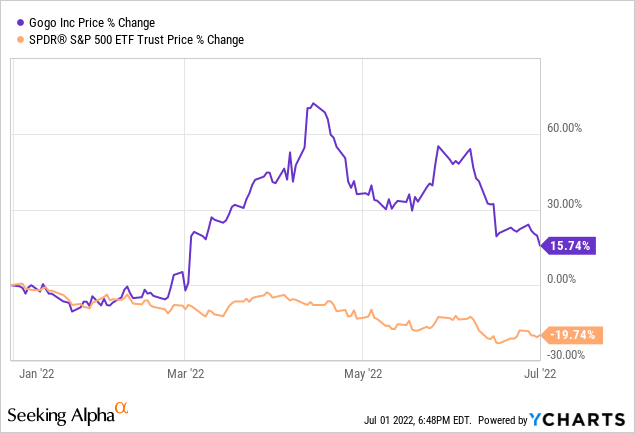

Gogo’s biggest risk is once again a possible upcoming recession, which could eliminate much of the demand for the company’s inflight internet services. Inflation and the rise of fuel prices are a constant risk to the company, as this will directly impact the airline industry and could leave Gogo with less viable consumers. Gogo stock is currently greatly outperforming the market, but the trend is that the share price is on the decline. The stock still has value, but Gogo has risks of losing much of this value if a downturn occurs. Also, the company has a large amount of debt, which could be troubling for Gogo during times of uncertainty. These risks urge me to believe that Gogo is not a reliable stock, especially due to the negatives that the company will face if a potential recession does come. A recession is not a certainty, but it is very conceivable and poses many risks to Gogo.

Valuation

Gogo’s share price is up almost 16% YTD which can be partly attributed to the rising demand for traveling after the Covid-19 pandemic. This may cause many investors to want to jump into the stock. However, the company does not appear to have a bright future with a possible recession coming and the stock seeming to be overvalued.

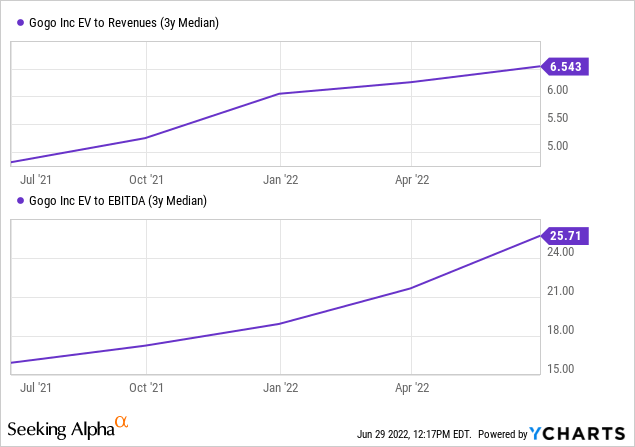

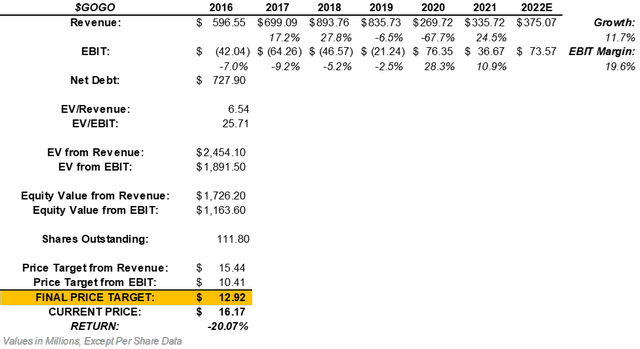

The company’s revenue growth has been inconsistent in the past 6 years; however, the typical growth rate appears to be 11.7%. Using this typical growth rate, Gogo’s expected revenue for the next fiscal year could be $375.07 million. The company has also seen a typical EBIT margin of 19.6%, which can be multiplied by the estimated revenue of $375.07 million. This forecasts Gogo to generate $73.57 million in EBIT in the upcoming fiscal year. After multiplying these projections by its 3-year medians for EV/Revenue and EV/EBIT multiples, we can come to the company’s expected enterprise value.

After adjusting the company’s projected enterprise values for net debt, we can find Gogo’s projected equity value from revenue and EBIT. Dividing the equity values by the current number of shares outstanding and averaging the price targets calculates a final price target of $12.92. This means GOGO stock could return a downside of about -20.07%.

Valuation of GOGO Stock (Created By Author)

The Takeaway For Investors

A recession could be on the way which will have multiple negative consequences on Gogo. The travel and airline industry could also decline as fuel prices are skyrocketing to record highs due to constricted supply. Companies will likely begin laying off employees and cutting spending, which is already occurring in major companies, leading to less usage of Gogo’s services. This will likely harm the company’s revenue growth, which is the most major improvement its fundamentals need to see. Because of all of this and the stock price appearing to be overvalued, I will apply a Sell rating.

Be the first to comment