Kanizphoto

Recommendation

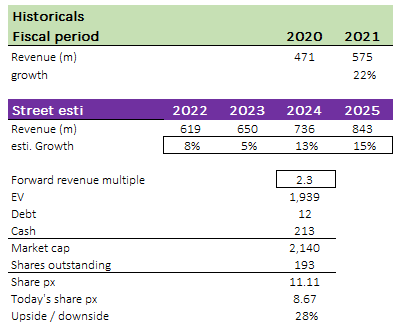

I believe LegalZoom.com (NASDAQ:LZ) has 28% upside. Many SMBs face difficulties navigating the complex and often confusing legal and compliance systems in the United States, and the cost of hiring a lawyer can be prohibitive. LegalZoom aims to make the process easier and more affordable by streamlining procedures and offering its services on a national scale.

Business

LegalZoom.com is a US-based online service that offers legal and compliance services. Services such as company formation and amendment, trademark and copyright applications, tax filing, and permit acquisition are offered.

SMBs are not legally trained

Every year, a lot of people start small businesses, and I believe this is due to enablement tools that have made it possible to launch a digital company from scratch in a matter of days. In addition, with the proliferation of lead-generation platforms and the gig economy, a person can launch a business in a matter of hours through freelance work.

Many family-run businesses fail because their owners did not consider the legal and financial repercussions of their choice to incorporate. It is crucial because choosing a business structure is the first step in setting up a company. The default legal status of a business owner who does not choose a different legal structure is that of a sole proprietor, which results in unlimited liabilities.

Unfortunately, the United States’ legal and compliance system is notoriously murky and convoluted, making it tough for regular citizens to get the help they need to avoid legal trouble and pay their taxes in full and on time. When it comes to legal and compliance requirements, it can be especially difficult for small businesses to navigate on their own due to intersecting, potentially conflicting, and ever-changing guidelines. Even if these smaller companies were interested in tackling these complexities, the cost would be out of reach. As for small businesses, the hourly rate that lawyers typically charge can add up to a significant sum.

Lagging pace of digitalization in legal services

Legal services have lagged behind the online transformation of other service sectors, such as accounting, taxes, marketing, and payments. According to LZ S-1, online provision of legal services will be around 8% in the US in 2020. In my opinion, the immense ambiguity of the law and regulatory landscape in the United States is to blame for the legal industry’s lack of online penetration. This makes it hard for an online platform to obtain scale with use cases that are relevant and geared to each local municipality.

Offering these services on a national scale would be subject to regulatory scrutiny in all 50 states and more than 3,000 individual counties due to the complexity and ambiguity of the rules and regulations governing those who are not licenced attorneys but who offer legal solutions. To provide a proper online service, a lot of time, energy, and effort would need to be put into monitoring, identifying, and implementing modifications to the law, forms, and processes.

As such, LZ becomes useful in this context. Its product streamlines convoluted legal and compliance procedures, making life easier for the company’s clients. The LZ platform simplifies the process of submitting paperwork to regional, state, and federal authorities after a customer has made a purchase by asking them a series of questions designed to streamline the process. To put things in perspective, it might take a small business offline a couple of hours to find a good attorney when they go to form a business entity. Comparatively, LegalZoom’s approach to business formation is optimised for speed (LZ claims under 15 minutes in its S-1) and is increasingly performed on mobile devices.

LZ product has been proven to be feasible

In order to be compliant, online service providers need a lot of resources, as was previously stated. The issue is that having access to the proper tools is only half the equation; operational experience is also crucial. LZ has spent over 20 years learning the ins and outs of the legal systems in all 50 states and more than 3,000 individual counties across the United States. Over the years, LZ has filed millions of pieces of paperwork on behalf of clients with local, state, and federal government offices across the United States.

As a result of LZ taking care of the ever-evolving laws and deadlines, clients are free to concentrate on operating their businesses. In addition, LZ fulfilment teams have strong relationships with many of these agencies and connect with many of them on a daily basis since LZ is a substantial filer of business formation documents as well as other documents with these agencies. While this may not provide LZ with a huge edge over the competition, it does allow them to stay apprised of any developments. In addition, LZ now provides subscriptions for legal counsel, tax services, and other compliance-related needs in all 50 states. This, in my opinion, speaks volumes about LZ’s ability to successfully expand across the country.

Strong position in the value chain

LZ is often the first business advisor a start-up works with because of their prime spot at the beginning of the company’s life cycle. By delivering solid business formation services, LZ has earned the confidence of small businesses that they can rely on them for other equally important requirements (thereby enabling LZ to expand after landing each business). In the legal and compliance space, for instance, LZ can use both first-party solutions like tax and third-party solutions like e-discovery to gradually grow their product offering. I have faith that as LZ grows, they will be able to use the confidential information amassed at the outset of the company to create better goods and services for its clientele. This is an advantage of size that I believe will increase as LZ expands, as they will have more information at their disposal than their smaller competitors.

Integrating with attorneys

Most people would rather have an attorney’s help than try to figure out the law on their own. However, the vast majority of online services are either entirely self-help oriented or do not provide any form of access to legal counsel. When available, this type of service typically acts as a middleman between clients and lawyers, with only the barest minimum of network integration to guarantee a constant level of professionalism on both sides.

It’s not a simple task, and that’s the rub. In order to provide legal services on a national level through a legal plan, a substantial financial outlay is required. The underlying work is time-consuming and includes things like finding law firms with licences in each state, making sure the plans offered are appropriate for local regulations, and keeping up with plan administration. LZ claims that it took them seven years from when they first began offering their service until they were able to provide coverage in all 50 states through their group of attorneys. That means a new player would have to either acquire LZ or spend at least 7 years developing a comparable system (since there are new laws).

3Q22 suggests LZ is focusing on profits

LegalZoom continued to outperform expectations in the third quarter, reporting both higher revenues and higher earnings. The company also forecast higher revenues and EBITDA in the fourth quarter. Despite management’s continued expectation that the number of new businesses will remain low through 2023, LZ will continue to develop, integrate, and scale its existing and prospective product lines. Although I have lowered my growth rate expectations due to more SMB headwinds, I still maintain a bullish outlook because of the company’s increased investment in product innovations, subscription revenue growth, and profitability.

Valuation & model

LZ is 28% undervalued, according to my model. Due to the current poor macroeconomic environment, I expect LZ’s revenue growth to decelerate in FY23. Revenue should recover and grow in FY24 as we enter a recovery and growth environment.

LZ is currently trading at approximately two times forwards revenue. I’d like to emphasize that this is close to an all-time low, and any mean reversion would represent massive upside. Assume LZ continues to trade at 2.2x revenue in FY24, increasing the stock’s value by 28%.

Author’s own calculations

Risks

Economic downturn leading to a recession

Customers of small businesses are especially vulnerable to the ups and downs of the economy, which can have a detrimental impact on both the rate at which new businesses are founded and the rate at which existing ones are shut down. Results for the quarter could be volatile in the short term due to all of these factors.

Getting on the wrong side of the law

Since LZ is dealing with legal matters, credibility is essential. Customers and potential buyers may lose faith in the LZ brand if it becomes embroiled in or linked to a scandal.

Summary

In my opinion, the share price of LZ has 28% upside. Many SMBs struggle with the United States’ legal and compliance systems due to their complexity and the high cost of hiring a lawyer to help them. By standardizing processes and making their offerings available on a nationwide scale, LegalZoom hopes to reduce the burden on consumers and lower costs.

Be the first to comment