imaginima

Earthstone Energy (NYSE:ESTE) management went on an impressive acquisition binge that made the company far larger than it was just two years ago. But such a “shopping spree” makes quarterly comparisons difficult. Mr. Market relies upon “a confused mind says no” to react to good news here until there are adequate comparisons available for the company as currently configured.

That means that Mr. Market is likely to look askance at more (and sizable) acquisitions in the future for the time being. The prevailing attitude is that management has what it wants. Now, it’s time to perform with those assets as advertised.

In theory, the performance demand should be straightforward because this management has built and sold companies before. In fact, this management is one of the few company builders that did not go broke during the five-year period from 2015-2020 that claimed a lot of company builders who were previously successful.

Acquisition Financial Strategy

Management used a combination of stock and debt to keep the debt ratio low. But the market needs to rely upon management’s statement about this because the company did not previously exist in the current form. That makes Mr. Market uncomfortable.

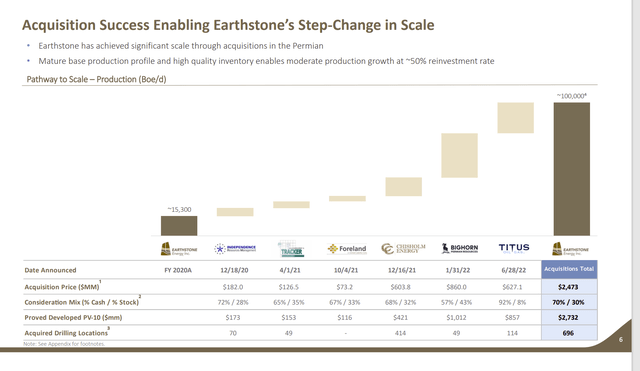

Earthstone Energy Two Year History Of Acquisitions (Earthstone Energy Earnings Conference Call Slides Third Quarter 2022)

Management has stated that the goal was to keep the consolidated debt ratio around 1. Mr. Market is keenly aware that any debt ratio calculation would likely be “pro forma” because of all the acquisition activity.

The problem with the “real” debt ratio is that the company was considerably smaller in the past. Therefore, the debt counts in the ratio calculation right away. But quarterly earnings replace previously reported earnings for the calculation over the next fiscal year.

An acquisition strategy at the brutal pace shown above has its own risks of assimilation because management has to gain some knowledge and experience of all the parts. To some extent, the management issues can be minimized by keeping the same personnel to run the acquisition after the combination completes.

However, synergies generally require combining some operations, and that can get tricky with so many acquisitions. Management needs to walk a fine line to make sure there is not a material “brain-drain” that sets back progress in the process of optimizing operations.

The result of all this is that the market has reasonable doubts about the situation. So, the stock price will likely trade at a discount as a kind of new issue until the market sees the success of the company as it is now configured.

Valuation

That means the current valuation is a statement about market doubts that will disappear if management is successful in running the “new” Earthstone Energy.

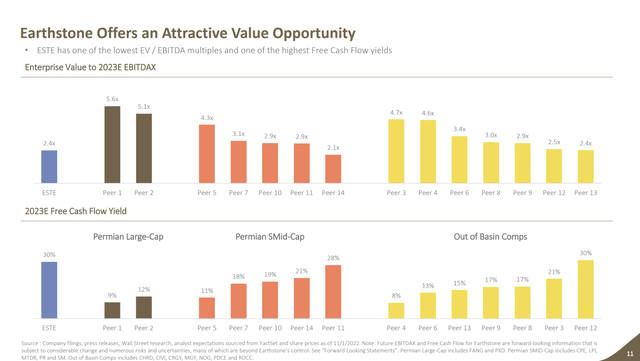

Earthstone Energy Value Comparison To Competitive Operators (Earthstone Energy Corporate Presentation November 2022)

Earthstone Energy does have some cheap valuation metrics, no matter the comparison. Given that management can choose the companies to compare values with, there still is a valid argument that there is considerable appreciation potential as long as management executes the strategy as expected.

For obvious reasons, the market considers the 2023 EBITDA guidance riskier than it would be with established companies in the comparison. That is going to be reflected in a risk discount readily available in the comparison above.

Given the experience of this management in building and selling companies, that discount should be overcome over time. The same goes for management’s statements about great acreage, leading margins, and all the other good stuff. The market wants proof of all this and more.

The current market is largely heading down, with a lot of losses from the “one decision stocks” that were thought to be safe. That means that Mr. Market will go overboard being safe because risk is now a big part of the calculation. Before the current stock market decline, it was more about “keeping up with the Joneses” in terms of competitive annual returns. In that sense, management has a bigger assurance and evidence hurdle to overcome than would have been the case a few years back.

Fourth Quarter 2022

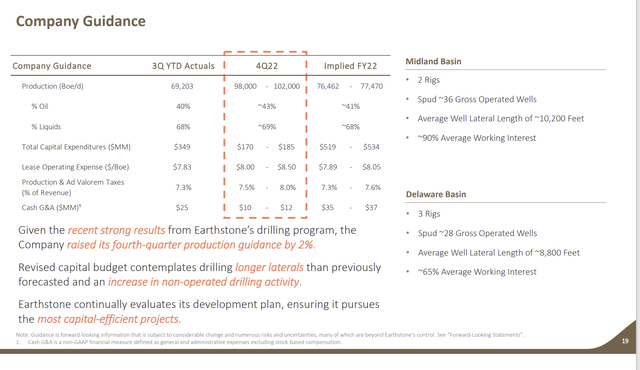

The company is raising its guidance for the fourth quarter based upon strong results. So far, things appear to be off to a good start. That has to be reflecting at least some of the prior experience that management has.

Earthstone Energy Fourth Quarter 2022, Guidance (Earthstone Energy Corporate Presentation November 2022)

The market is clearly looking for an indication as to how well all the acquisitions work together in one company. So far, so good. But it will take more than one quarter to prove to the market that the good news will last.

Oil prices have been in a downtrend lately. But the reasons for that downtrend appear relatively transient. Even with the recent downtrend in prices, those commodity prices are still high enough for decent profits. Mr. Market will in time realize that.

Management appears to be ready to prove just that and more to the market. Companies that command premium prices in an acquisition are companies with a history of superior profitability that allows an outperformance throughout the industry business cycle. The onus is now on management to keep the good news coming out and prove it can still successfully build a very profitable business.

The Future

Back when this company was formed through a reverse merger, investors paid considerably more for the stock than is the current price. The original formation of the company involved prices per share that was closer to $20 than it is to the current price.

On the other hand, I followed a lot of these companies of managements that were successful in the past building and selling companies. Many went bankrupt and those articles following those companies are under my profile for reference. This company made it through the 2015-2020 period when many did not because it kept the debt low.

Now, clearly, management is making a statement that there are better times ahead. Otherwise, all these acquisitions do not make any sense. Still, after all that has happened to the industry since 2015 (not to mention the competitor bankruptcies), the market has understandable doubts about this strategy of purchasing all these companies that instantly made the company far larger.

Logistics of such a shopping spree can be very challenging after the combination. Therefore, the market will wait for an appropriate history before there is anything close to a normal valuation.

Mitigating that waiting period is a very low debt load that allows for considerable flexibility “just in case”. Management also likely keeps the operating people in place to save some training experience and utilize the knowledge already in place.

This management has a lot of experience growing and selling companies. As a result, they survived a brutal five-year period that claimed a lot of competitors that used to successfully build and sell companies. The current challenges are likely to prove far easier than what happened in the past. The previous company record is very good (management has put it in past presentations several times). The fact that management survived 2015-2020 puts them in a select group. Because of that, I am likely to just wait to see the results because I suspect management knows what it is doing and is therefore likely to succeed by rewarding long-term shareholders yet again.

Be the first to comment