Slaven Vlasic/Getty Images Entertainment

Brief Overview Of Roku’s Q3 Report

In the aftermath of its Q3 earnings release, Roku’s (NASDAQ:ROKU) stock has displayed incredible amounts of volatility over the last couple of days. After being down by ~20% in the pre-market session, Roku opened at $44.50 (new 52-week low) on Thursday and then went on to rally by ~20% to close the day at $51.84 (just ~5% off of its pre-earnings price). While Thursday’s volatility was astounding, Roku saw yet another sell-off on Friday and closed the week under $50 per share. Considering broad market weakness, I think it is fair to assume that Roku could soon retest its 52-week low. Despite a drastic drawdown over the last 18 months or so, Roku’s stock is declining after earnings once again. Let’s analyze Roku’s Q3 report to see if these volatile moves are creating a buying opportunity.

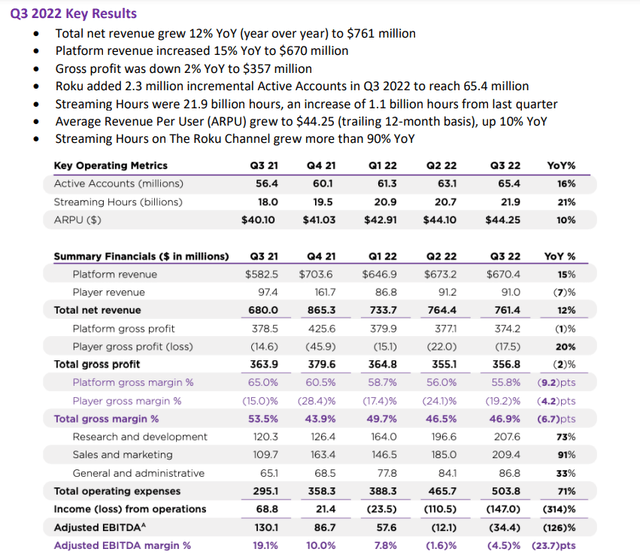

In Q3, Roku recorded revenues of $761M (+12% y/y), beating Street estimates of $693M and management’s guidance of $700M. The big beat on top line resulted from better-than-expected Platform (advertising) revenues, which increased 15% y/y and made up ~88% of total sales in Q3.

Now, the slowdown in Roku’s Player business continued with Player revenue of $91M, down ~7% y/y. However, this move was driven primarily by a -6% move in ASPs (average selling prices). In Q3, Roku added 2.3M net active accounts to reach 65.4M active accounts. Furthermore, Roku’s Streaming Hours rose to 21.9B (up 21% y/y), and ARPU improved marginally to come in at $44.25 (up 10% y/y). In my view, Roku is facing business headwinds due to ad pullback in an uncertain macro environment; however, the connected-TV giant’s underlying business KPIs are still improving, as evidenced by healthy growth in Net Active Accounts, Streaming Hours, ARPU, and Platform revenues.

Roku Q3 2022 Shareholder Letter

During the pandemic, streaming boomed, and streaming content aggregation platform Roku was a big beneficiary. As revenues rocketed higher, Roku went on a hiring spree coming out of the pandemic in 2021, with the company re-investing aggressively into subsidizing player sales, international expansion, and “The Roku Channel”. With operating expenses outpacing revenue and gross profit growth, Roku’s operating losses widened significantly in Q3.

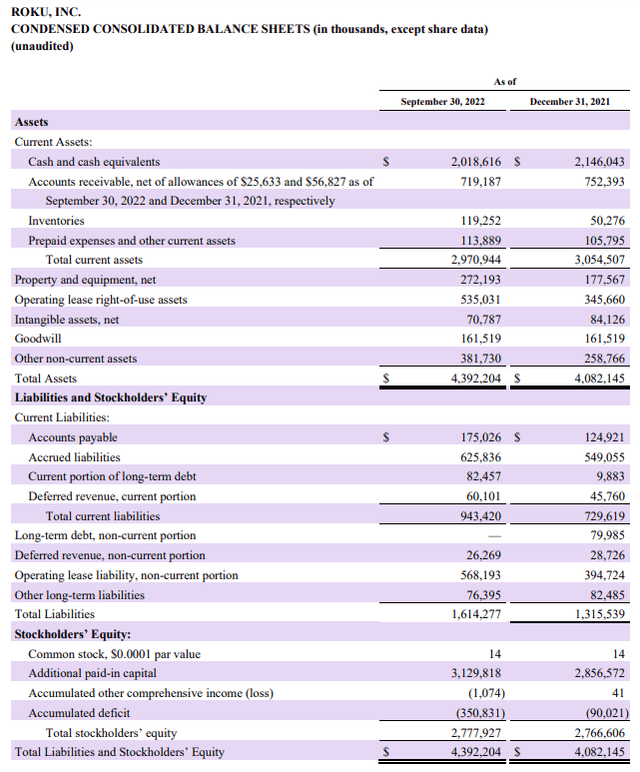

Now that Roku is launching its Smart Home products to expand its ecosystem, it is fair to expect operating expenses to grow faster than revenues. Hence, Roku’s adj. EBITDA and free cash flow are set to get worse in upcoming quarters. While unprofitable tech companies have lost favor in this market, Roku has a robust balance sheet to get through to the other end of this ongoing slump in the advertising business. With a net cash balance of $2B+, Roku has little to no liquidity risk.

Roku Q3 2022 Shareholder Letter

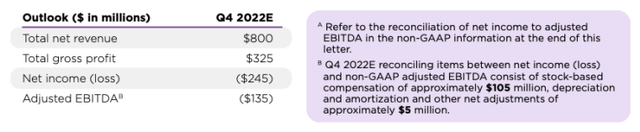

For Q4, Roku’s management guided for net revenue of $800M, which was well below Street estimates of $895M. In addition to a weak top-line guide, Roku’s management projected wider-than-expected losses, as shown below:

Roku Q3 2022 Shareholder Letter

While the market seems to have been shocked by Roku’s weak guidance, I am taking this guidance with a pinch of salt. Why?

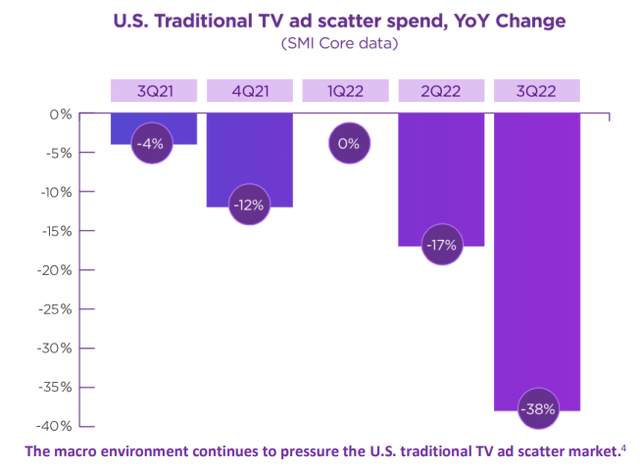

Roku’s management guided for Q3 revenues of $700M and adj. EBITDA of -$75M. Actual numbers came in at $764M and -$34M, respectively. On the call, management admitted that they have little to no visibility in Platform revenues due to a highly uncertain macroeconomic environment. In Q3, US traditional TV Ad Scatter market saw a decline of 38% y/y as macro pressures caused marketers to pull back on ad spending.

Roku Q3 2022 Shareholder Letter

Roku is exposed to the Ad Scatter market, and a slowdown in this market is hurting platform revenues at Roku. Since these headwinds are likely to persist for the foreseeable future, Roku’s financial performance is set to remain under pressure. However, I think the Q4 revenue guide of $800M is yet another kitchen sink guide that they could surpass with relative ease. This is what they did in Q3, and I wouldn’t bet against them repeating the trick in Q4. The weakness in Roku’s business is macro-driven and not idiosyncratic to Roku. Therefore, I see this sharp drop in share price as a buying opportunity.

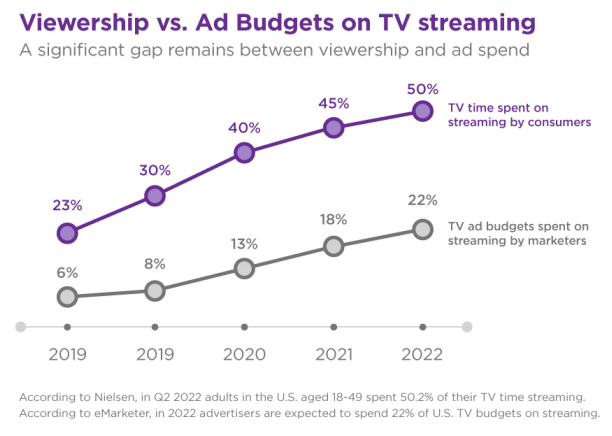

The long-term opportunity for Roku is still robust, with ad budgets still trailing the TV time spent on streaming and streaming still only just ~34% of TV time. Over the long run, streaming is likely to become the large majority of all TV time, and all TV ad spending will also need to follow eyeballs to connected-TV platforms like Roku.

Roku Q2 2022 Shareholder Letter

Roku is still the leading TV OS in the US, with nearly 35% of all TVs sold in the US in October being Roku TVs. Furthermore, Roku is expanding rapidly in international markets like Mexico, Canada, etc.

Overall, Roku’s Q3 results were strong, and Q4 guidance was weak (and probably sandbagged). While the macro headwinds affecting Roku’s business are temporary, they are set to persist over the foreseeable future. Hence, the near-term fundamental setup is far from ideal. However, Roku’s underlying business metrics (Net Active Accounts, Streaming Hours, and ARPU) are still improving through this challenging period. When the ad markets rebound (macro improves or just stabilizes), Roku’s business will come back with a bang! The long-term opportunity for Roku is very much intact, and there’s absolutely no doubt in my mind that Roku is going to be a large and profitable business by the end of this decade.

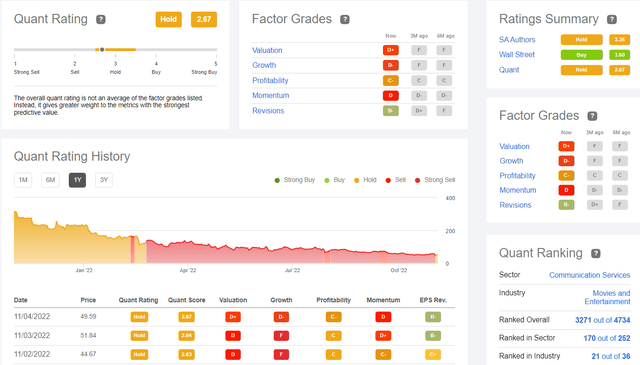

A Look At Roku’s Quant Factor Grades And Technical Charts

After several months of being rated a “Strong Sell”, Roku is now rated a “Hold” by SA’s Quant rating system. The change in Roku’s rating was driven by improvement in Valuation, Growth, and Revisions (somewhat offset by depletion in Profitability and Momentum grades). Now, we know that SA’s Quant Rating system is based on relative comps with industry peers, and so, Roku’s quant factor grade improvement cannot be relied upon as a bullish inflection point in the stock.

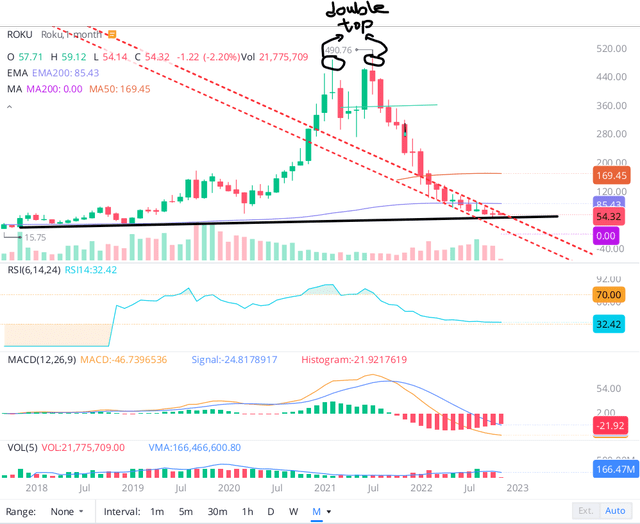

Let’s look at Roku’s technical chart to see if it is really at an inflection point.

After undergoing a catastrophic 90%+ decline in its stock over the last year or so, Roku is now trading at a multi-year trendline connecting previous major bottoms in the stock just as the stock gets close to being oversold on the monthly chart (RSI approaching 30). From a technical perspective, we should see strong support for the stock right here in the mid to high $40s.

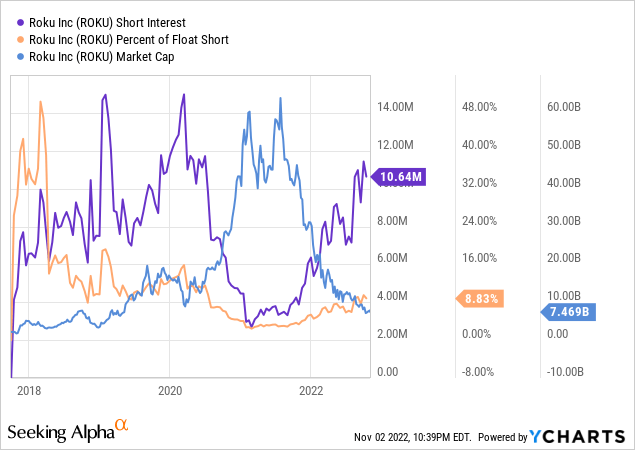

In addition to its multi-year trendline acting as a support, I think Roku’s short interest of 10.64M shares (9% of Float) is too high, and a short-squeeze (or an oversold bounce) cannot be ruled out.

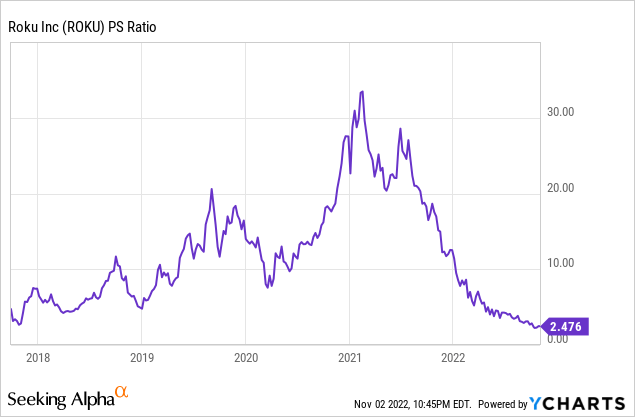

To further contemplate an investment in Roku, let’s consider Roku’s valuation (relative and absolute).

As you may know, Roku is now trading at its lowest-ever trading multiples, with a P/S multiple of ~2.5x (it’s even cheaper on an EV/S basis).

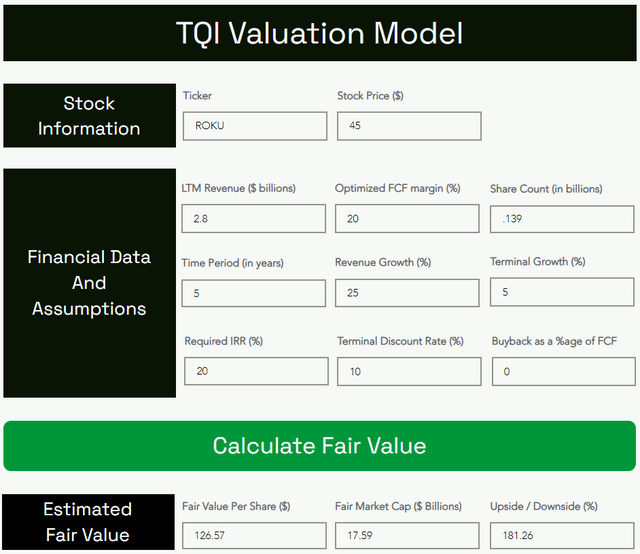

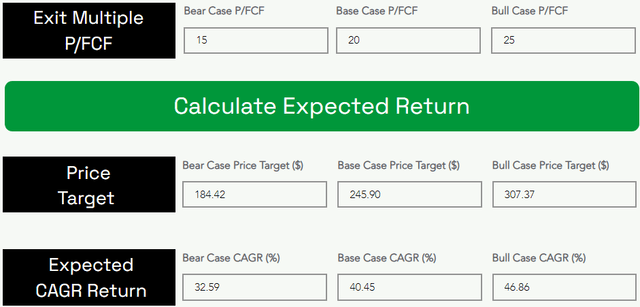

To evaluate Roku’s absolute valuation, we will use the TQI Valuation Model.

Roku’s Fair Value And Expected Returns

TQI Valuation Model (TQIG.org) TQI Valuation Model (TQIG.org)

According to TQI’s Valuation Model, Roku is worth $126.57 per share ($17.5B in market cap), i.e., it is currently trading at a significant discount to its fair value. Furthermore, the base case assumption of 20x P/FCF in 2027 resulted in a 5-yr expected CAGR of 40.45% for Roku. Since this expected return is far greater than our investment hurdle rate of 20% for growth stocks, I rate Roku a “Strong Buy” at current levels.

Final Thoughts

Roku’s business fundamentals could get worse over coming quarters as advertising headwinds are set to persist amid a weak macroeconomic environment. While the rising probability of a recession and Roku’s financial underperformance (or I would say lack of outperformance) are causing a capitulatory sell-off in the stock, I think the valuation moderation has gone too far, and the risk/reward from here is asymmetrically in favor of long-term bullish investors. With a 5-yr expected CAGR of 40%+, Roku is an opportunity of a lifetime!

Key Takeaway: I rate Roku a generational buy in the $40s.

In the past, I have laid out my bullish thesis for Roku doing ~$40B+ in advertising revenue by the end of this decade, and despite Roku’s share price action, I am still confident in my projections for Roku becoming a very large and profitable (monopolistic TV OS and connected-TV advertising) business. If you are interested in learning more about my original investment thesis for Roku, please refer to this note:

Thanks for reading, and happy investing. Please let me know if you have any thoughts, questions, or concerns in the comments section below or send me a direct message on SA.

Be the first to comment