klenger/iStock via Getty Images

Introduction

LCNB Corp. (NASDAQ:LCNB) is the holding above the LCNB National Bank, headquartered in Ohio where it operates 32 branch offices and a few dozen ATMs. As this bank is paying an attractive dividend representing a total dividend yield of in excess of 4%, I wanted to have a closer look to see if it would be a good fit for my portfolio.

Another record year in 2021

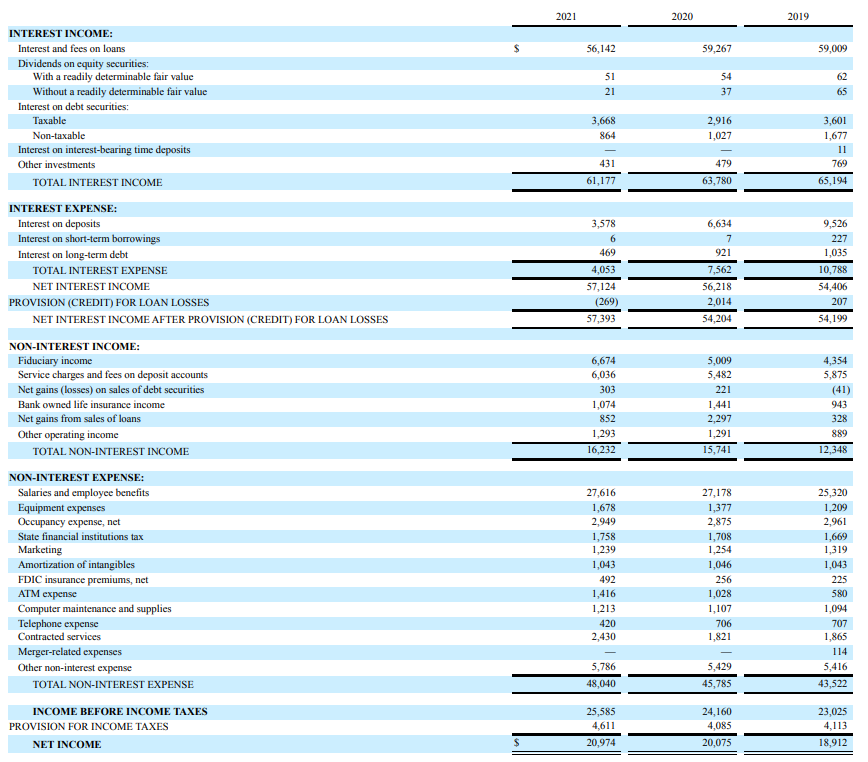

LCNB was able to post record earnings in 2021, handsomely beating the 2020 result which was already better than the 2019 result. That’s quite surprising as most banks had to record relatively high loan loss provisions in 2020 which weighed on the results for that year, but LCNB was able to keep the damage rather limited as it recorded a loan loss provision of just over $2M which is very low considering the total size of the loan book exceeds $1.3B.

As generally expected, LCNB saw its interest income decrease in 2021 but with a decrease of just $2.6M, the bank was able to mitigate the impact as the total interest income didn’t fall off a cliff. In fact, the net interest income increased as the interest expenses decreased by approximately $3.5M, which caused the net interest income to increase by almost $1M to $57.1M.

LCNB Investor Relations

The net non-interest expenses came in at just under $32M resulting in a pre-tax and pre-loan loss provision income of approximately $25M. The bank was also able to recoup some of the loan loss provisions it had recorded as it took back almost $0.3M which boosted the pre-tax income to $25.6M and resulted in a net income just short of $21M for an EPS of $1.66. That’s based on the average share count of 12.6M shares throughout the year but investors are cautioned the bank is aggressively continuing to buy back stock and as of March 8th, 2022, there were only 11.4M shares outstanding. If we would apply the current share count to the net income, the EPS would increase to in excess of $1.8, so that bodes well for the current financial year.

The balance sheet continues to expand, but the loan book is very geared towards commercial real estate

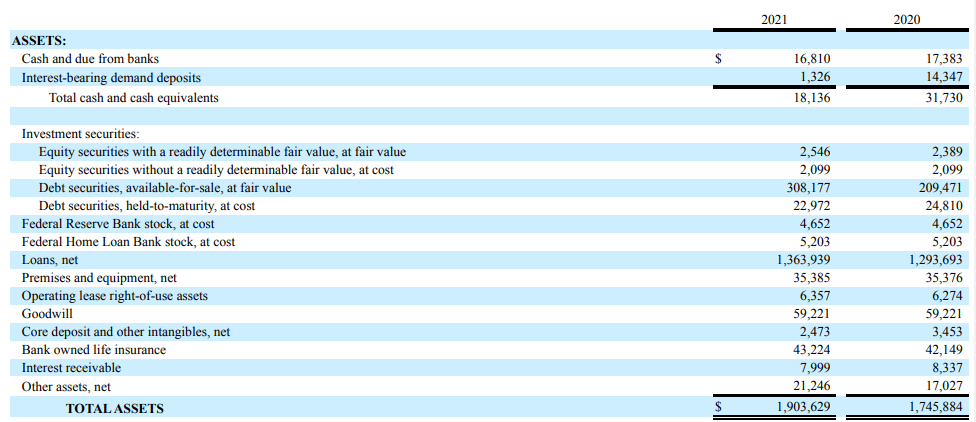

As I explained in my previous articles on smaller local and regional banks, it’s important to keep an eye on how the balance sheet is structured. In LCNB’s case, the total balance sheet contains just over $1.9B of assets, with approximately $350M held in cash and/or other liquid assets like debt securities.

LCNB Investor Relations

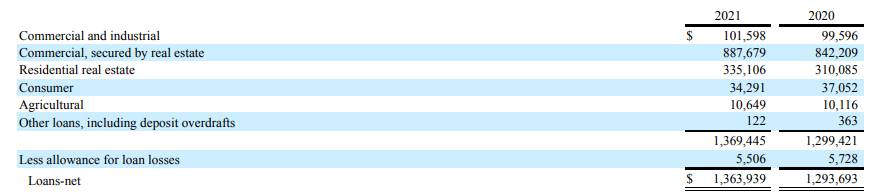

That’s fine, and my main area of interest is the loan book, which stood at $1.36B as of the end of 2021.

The breakdown of the loan book is actually pretty straightforward. About 65% of the loan book consists of commercial real estate, and that makes this bank rather CRE heavy.

LCNB Investor Relations

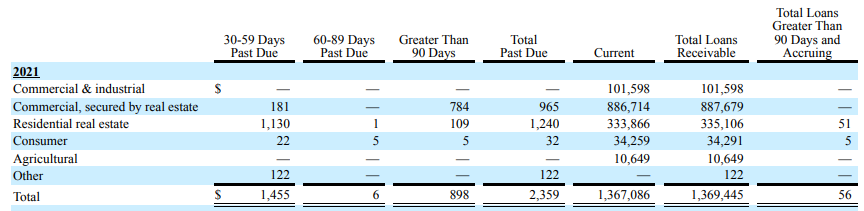

Surprisingly, the total amount of loan loss provisions remains very low at just $5.5M, which represents less than 0.5% of the total loan book. The explanation for this rather low provision is related to the exceptionally low ‘past due’ rate of the loan book. Although commercial loans and commercial real estate loans are perceived to be riskier, it looks like LCNB is doing a good job in keeping the risks limited. As of the end of 2021, only $2.36M in loans were past due. That’s less than 0.2% of the total loan book which means that even in the unlikely event the bank cannot recover a single dollar from any of the loans past due, the current amount of loan loss provisions is indeed sufficient to cover the losses.

LCNB Investor Relations

Unfortunately, LCNB hasn’t provided more details on the loan book as I would be very interested in seeing the average LTV ratio of the loans in the different categories.

Investment thesis

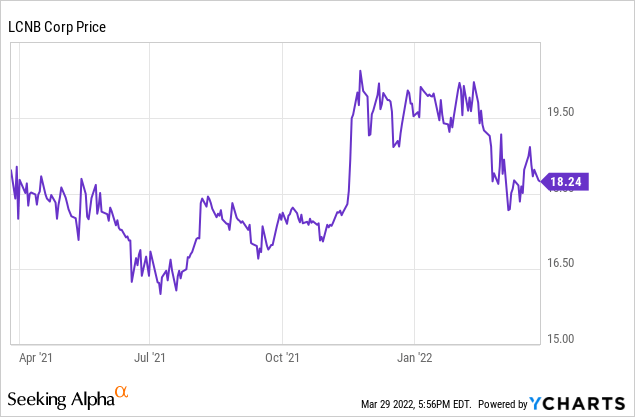

The lack of information on the actual LTV ratios is one of the main reasons why I’m not pursuing a long position in LCNB. The earnings are great and the dividend was recently hiked to $0.20 per quarter for a full-year dividend of $0.80 per share which works out to be 4.4% at the current share price.

I’m not a big fan of the overweight position of commercial real estate in the loan book and seeing how the bank is trading at approximately 11 times earnings and at a price of 1.25 times the tangible book value, I’m on the sidelines for now. Of course, the tangible book value is increasing at a pace of $0.70-0.85 per share per year as LCNB pays out just under 50% of its earnings. And as the share count continues to decrease, the bank will be able to retain a higher portion of its earnings.

I will keep an eye on LCNB, but I’m not going long at this time.

Be the first to comment