Diego Thomazini

This article was first released to Systematic Income subscribers and free trials on July 23.

Welcome to another installment of our CEF Market Weekly Review where we discuss CEF market activity from both the bottom-up – highlighting individual fund news and events – as well as top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the third week of July. Be sure to check out our other weekly updates covering the BDC as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

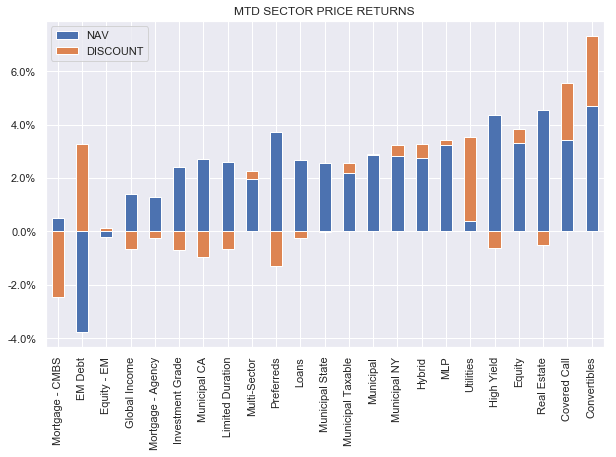

All CEF sector NAVs were up on the back of a positive trifecta of tighter credit spreads, lower Treasury yields and higher stocks.

Systematic Income

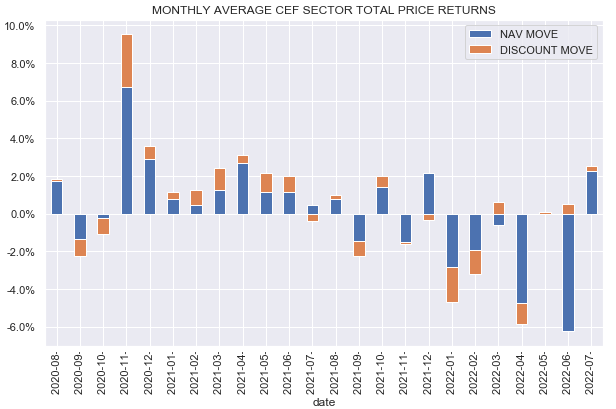

NAVs have recovered about a third of their June drop. Interestingly, discounts have been much more resilient – tightening for the third month in a row.

Systematic Income

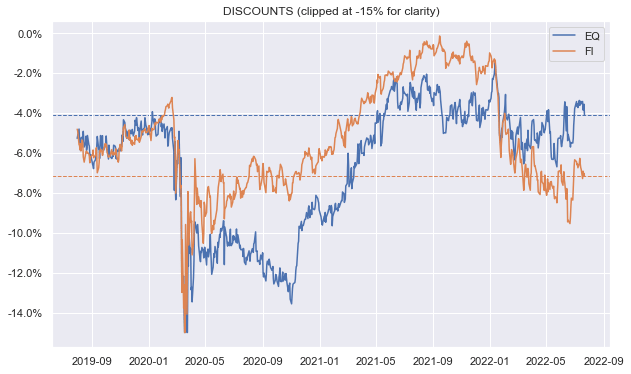

Equity CEF sector discounts continue to trade at more expensive levels relative to their fixed-income counterparts.

Systematic Income

Market Themes

Arguably the biggest driver today of credit CEF income levels (and by extension, eventually, distributions) is the impact of rising short-term rates on fund leverage costs. This is one of the key themes we have been discussing this year.

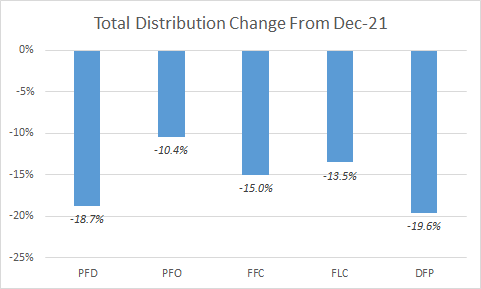

Not all CEFs adjust their distributions in line with their income levels but one fund family that does, and which can serve as a kind of income bellwether for a typical fixed-income CEF, is the Flaherty suite of preferred CEFs. Investors who keep an eye on the preferreds sector probably didn’t miss the recent announcement of another distribution cut across the suite, making it the fourth cut just this year.

The chart below shows the total amount of cuts since the end of last year.

Systematic Income

We discussed (FFC), and the rest of the 5 fund preferred CEF suite in a previous article earlier in the year where we said investors should expect distribution cuts from the suite and the total amount of cuts lines up fairly well with our expectation.

The Flaherty funds benefited largely from their lack of leverage cost and duration hedges which were a huge tailwind when both short-term rates and long-term rates moved lower over time. Obviously, this has all reversed very quickly. This year not only have the Flaherty funds underperformed the sector, but they also cut their distribution much larger than the broader sector as well.

There is nothing wrong with the funds themselves – they seem to generate decent alpha over time. However, they can’t swim against the current of the structural choices they have made in the fund and the shifting market tides. When the environment is favorable for their particular structural profile they benefit and when it’s not they don’t.

The key takeaway here is that investors should allocate to funds with a sense of how the current environment is evolving and whether it helps the given fund’s allocation profile or not. Allocating with a backward-looking approach can result in disappointment.

Market Commentary

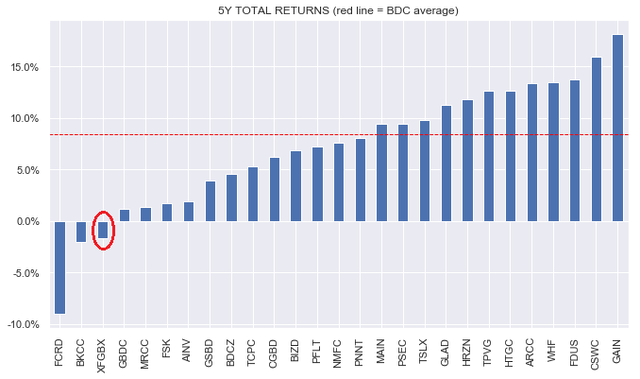

The First Trust Specialty Finance and Financial Opportunities Fund (FGB) came up on the service. Our view has consistently been to ignore the fund’s “attractive valuation” because of the very simple fact that its performance relative to the assets it holds has been exceptionally poor. So long as investors don’t link performance with valuation they are going to keep getting it wrong.

The fund’s return since inception is negative in total NAV terms. Its 5Y total NAV performance is -2% while the average BDC has delivered a return of 8% CAGR over this time.

There is no other way than to describe the fund’s performance as horrible. If you actually tried to underperform the BDC sector by 10% per annum we think you’d actually find it really hard to do. Needless to say no amount of “strong valuation” nonsense is going to solve a drag of 10% per year.

The fund has again deleveraged this year – a rinse-repeat kind of cycle – which repeatedly hacks off value from its portfolio. However, periodic deleveraging itself would not be enough – you’d need woeful security selection to boot to achieve such consistent underperformance.

There was a question about two Nuveen preferreds funds (JPS) vs (JPI). There are some marginal differences in percentage of retail holdings, credit quality and country allocation, however, in our view, there are two more important elements to consider.

One has to do with which fund family to allocate to in the sector and the other is whether to allocate to a perpetual or term fund. In the recent (PTA) article, we discussed some of the fund family considerations and the conclusion there was that the lack of leverage mandate (which has helped to avoid frequent deleveragings) and leverage cost / duration hedges made the Cohen suite fairly attractive.

Nuveen funds do look attractive on valuation basis but tend to struggle to deliver good performance due to their frequent deleveragings. For instance, they are going through a second deleverage in 2.5 years at the moment.

The only Nuveen fund that remains attractive in our view is JPI whose term profile overrides the broader Nuveen issues. The JPI discount is very likely to amortize to zero over 2 years, allowing investors to monetize around 2.5% of additional return per annum relative to the NAV. Nuveen has been very good at consistently offering investors an exit at the NAV either via termination or a tender offer.

Stance & Takeaways

The Fed’s increasing focus on bringing inflation lower and the consequent sharp rise in short-term rates keeps us focused, in part, on funds that have managed to fix their leverage costs. We continue to like funds such as (DMO), (PTA) and (JPI) which have full or partial hedges in place which should allow their income levels to remain more stable (or increase in the case of DMO) as the Fed keeps hiking.

Be the first to comment