NicoElNino/iStock via Getty Images

Editors’ note: This article is meant to introduce the new Marketplace service from Kennan Mell, Tech Investing Edge.

Tech Investing Edge is a new Marketplace service focused on long-term growth investing opportunities for investors with a 10-plus year time horizon. Over time, a company’s growth trajectory can only be understood qualitatively. I started this service because I believe that my experience working as an engineer in the tech sector gives me an edge in understanding high tech companies’ long-term growth potential.

My new service focuses on in-depth research on high tech fields. I will do monthly deep dives on complex topics like cybersecurity, blockchain, and under-the-radar software companies. I also will provide weekly coverage of market/tech news, share my real money portfolio, and provide timely buy/sell recommendations.

Why Tech Now?

The tech sector is currently very out of favor with investors. According to a Bank of America client survey, investors recently (February 2022) ramped up their underweight tech position to its largest level since 2006. With interest rates on the rise and inflation running rampant, nobody wants to own tech stocks right now and the market is in a state of extreme fear.

However, I believe that this fear is misguided. The best tech companies have strong pricing power, low input costs, and growth that outpaces inflation. Many of these companies also have defensive revenue streams and should be able to power through a potential recession in the coming years.

Despite this, nearly all tech stocks are selling off indiscriminately. The tech sector (NYSEARCA:VGT) as a whole is barely out of a correction for the year.

The informal “unprofitable tech index” represented by ARK Invest (NYSEARCA:ARKK) has performed even worse, down 27% year to date after an already negative performance in the previous year. That’s a historic crash.

We may have seen the start of a rebound in the past few weeks with both ETFs now well off their lows. As the market was bottoming, I was pounding on the table to buy tech stocks and shared that I was leveraging up part of my portfolio via TQQQ (NASDAQ:TQQQ) to take advantage of the selloff. This call returned 37% in just two weeks.

I was certainly lucky to make this call right when the market was bottoming since nobody can time the top or bottom of the market. But luck tends to come to those who do their research and maintain their conviction, and that’s what I aim to help Tech Investing Edge members with.

That said, investors are right to be concerned about some companies that are down 50%-80% in the past year. Just because a stock has fallen doesn’t mean it will go back up. Some companies will never return to their 2021 highs. And yes, some companies are still too expensive even after retreating from their highs.

But regardless of whether we’ve already exited this correction or will see another leg down, there are great tech and growth companies that are still underpriced. The best-of-breed companies will always bounce back in the end, even if they’ve sold off with the rest of the market today. I aim to use my hands-on experience to help Tech Investing Edge members separate these best-of-breed companies from the rest.

My first deep dive – which is already available to Marketplace members – is all about the cybersecurity industry. I break down all the details of the industry using knowledge I acquired from taking a masters-level cybersecurity course and working on developing secure applications. I then name six leading companies that I believe are better positioned than the rest of the industry. Morningstar’s target price for one of these six implies that it could nearly double in the next year alone. You can refer to my public article about the semiconductor industry for an example of what you’ll get with my deep dives.

Also available to Tech Investing Edge members is my list of five stocks to buy now, which I will update every month. The current iteration of the list includes the aforementioned cybersecurity company and two other rapidly growing mid-cap companies that I believe could have even more upside than cybersecurity stocks. The remaining two picks are safer blue chips that will still be appealing to less risk-tolerant investors, since I aim to make my service relevant to as many investors as possible and diversify my portfolio.

My Approach

My underlying investment thesis is that the three high tech industries of AI, robotics, and genomics will drive decades of exponential growth in our increasingly digital economy. Current investment themes based on this thesis include:

- Cloud computing

- SaaS

- Cybersecurity

- Semiconductors

- E-commerce

- FinTech

- Cryptocurrency

- Digital advertising

Tech Investing Edge

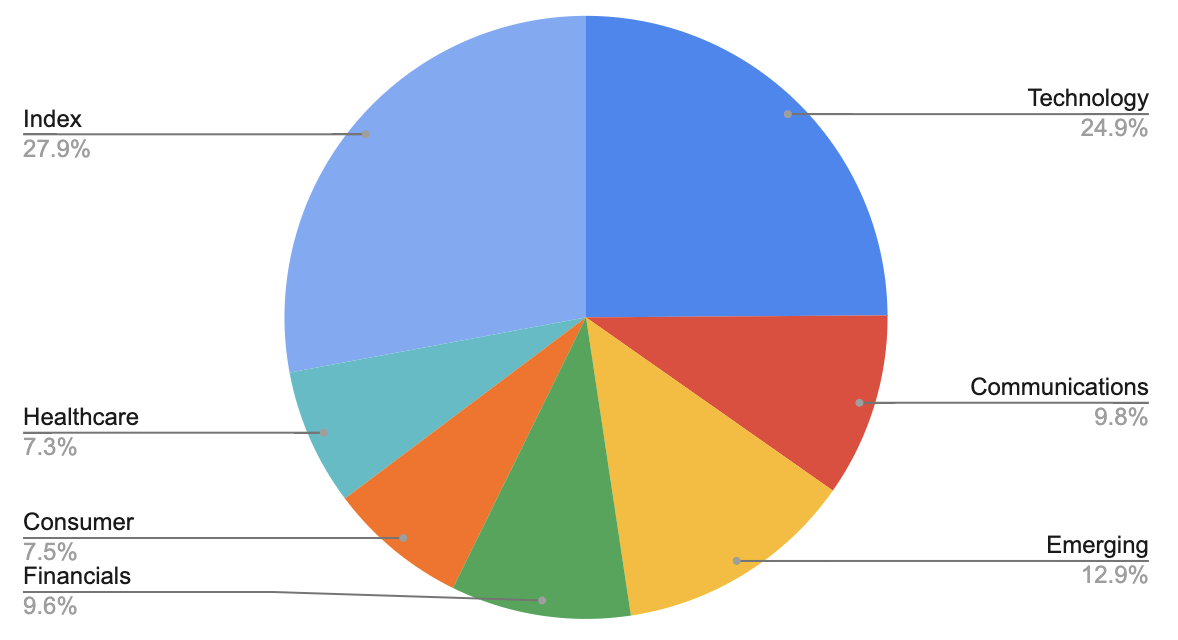

The above chart shows how these investment themes translate into my real money portfolio’s sector allocations in April 2022. While my portfolio is currently very tech heavy, I also manage risk with diversified exposure to other sectors and value stocks.

My stock picks are informed by my experience studying and working in high tech fields. My degree in computer engineering included formal training in machine learning, robotics, cybersecurity, digital circuits, and other relevant areas. I’ve worked at prestigious tech companies including Google, volunteered at a biotech research lab, used many leading SaaS platforms, and independently developed and published multiple high tech products such as iOS apps.

Beyond my personal experience, my strategy has been shaped by studying some of the best investing and business minds like Peter Lynch, Clayton Christensen, Burton Malkiel, and Ray Kurzweil. The service is named after Peter Lynch’s investment advice of using your “edge” based on your personal experience. Although my personal strategy is probably on the riskier end of what these people would approve of, my service provides multiple model portfolios for people with various risk tolerances.

My approach differs from that of well-known growth funds like ARK Invest because I believe that both disruptive and sustaining innovators can generate alpha. My primary focus is on beating the market by avoiding companies at risk of disruption, rather than focusing only on the highest growth disruptors regardless of valuation. Although I’m not opposed to owning high multiple stocks, I also recognize that the best investments that return 10x or more usually come from a combination of growth, shareholder returns, and multiple expansion.

This critical aspect of my approach allowed my real money portfolio to hold up much better than other high growth funds during the recent market selloff. While most high growth funds like ARKK are trailing the indexes by double digits, my portfolio is actually outperforming the Nasdaq 100 year-to-date.

What A Subscription Gives You

As a member, you can expect:

-

In-depth monthly research on high tech ideas.

-

Weekly coverage of earnings and other tech stock news.

-

My favorite stocks to buy each month.

-

Qualitative and quantitative stock rankings.

-

Three model portfolios and my real money portfolio, where I invest over $250,000 of my own money in my ideas.

-

Additional details about my investing strategy.

-

A chat room and more.

The Current Opportunity

Right now is a great time to be buying best-of-breed tech and growth companies, and it’s also a great time to try out Tech Investing Edge.

We are in the midst of many life changing revolutions in cloud computing, AI, genomics, robotics, cryptocurrency, and more. These revolutions are not going away, but many investors have lost conviction in them after the recent selloff, even though this selloff was largely based on short-term concerns and lofty starting valuations. With those lofty valuations largely reset, long-term investors should jump for joy at the chance to buy best-of-breed companies at fair value or even a discount today.

If you want to learn more about these growth areas from somebody with deep technical knowledge about them, see my favorite stock picks, and find the conviction to take advantage of the current contrarian opportunity in tech. Then I hope you’ll try out my service.

If Tech Investing Edge sounds interesting to you, now is a great time to sign up. The first few members will get a lifetime discount. The normal cost is $449 per year, but the first 15 people who sign up will get a permanent discount so that they only pay $299 per year. There’s even a two-week free trial, so you can make sure you like the service before paying. Click here to get started!

If you’re reading this via Seeking Alpha’s mobile app, to try this service right now, go to seekingalpha.com and enter “Tech Investing Edge” in the site search to visit the Marketplace Service checkout page.

Be the first to comment