Imgorthand

Though it may not seem like an attractive space to many, the swimming pool industry does have a certain appeal about it. After all, nothing quite beats lounging by the poolside or taking a nice swim on a hot day. One company dedicated to meeting the demands of pool owners and potential pool owners is Latham Group (NASDAQ:SWIM). In recent years, growth for the company has been impressive on the top line. Profits have been somewhat mixed but generally positive. On top of this, shares of the enterprise are trading at incredibly cheap levels, both on an absolute basis and relative to similar companies. Because of all of these reasons, I have decided to rate the business a ‘buy’ at this time.

Testing the waters

According to the management team at Latham Group, the company operates as the largest designer, manufacturer and marketer of in-ground residential swimming pools in three key markets. These would be North America, Australia, and New Zealand. Although the company is fairly small with a market capitalization of $665.3 million as of this writing, it does have a long operating history spanning more than 65 years. In addition to providing in-ground pools, the company also offers a wide array of other related products such as pool liners and pool covers.

One thing that seems to have really propelled the company’s growth in recent years has been its decision to focus on servicing the homeowner directly. The company has done this using a digital and social marketing strategy that has changed how homeowners by their pools. This stacks up against the traditional business-to-business model that has been employed by competitors forever. Although the company has historically focused on manufacturing traditional swimming pools, it has started to move in the direction of pushing fiberglass pools. This follows an acquisition that the company made in 2019 of a business called Narellan, which at the time was the largest manufacturer of fiberglass pools in Australia. Although this is a major priority of the company because of the many benefits, such as faster and easier installation, lower costs, higher quality and aesthetics, and more, the company does also still provide offerings that include carbon fiber, Kevlar, Concrete, and vinyl. The business also claims to be the largest replacement liner manufacturer in the North American residential in-ground swimming pool market and it also is a major player for pool covers.

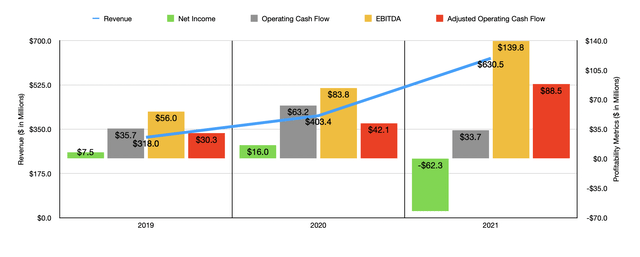

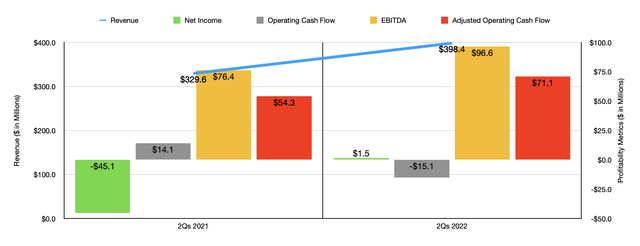

The fundamental picture of Latham Group has been quite impressive in recent years. Between 2019 and 2021, sales of the company skyrocketed from $318 million to $630.5 million. The 56.3% increase in net sales that the company saw between 2020 and 2021 were driven in large part by a $171.7 million increase associated with volume and a $55.4 million increase attributable to higher pricing. Growth for the company has continued into the current fiscal year. Revenue in the first half of the 2022 fiscal year came in at $398.4 million. This represents an increase of 20.9% over the $329.6 million reported just one year earlier. Pricing changes really impacted sales this time, with the company experiencing upside from price increases in the amount of $69.7 million. Despite this increase in pricing, the firm saw only a modest drop in product volume, with that decline hitting sales to the tune of just $0.9 million.

On the bottom line, the picture has been more volatile. Net income rose from $7.5 million in 2019 to $16 million in 2020. But then, in 2021, the company generated a net loss of $62.3 million. Similar volatility can be seen when looking at operating cash flow. After rising from $35.7 million in 2019 to $63.2 million in 2020, that metric fell to $33.7 million last year. If, however, we were to adjust for changes in working capital, the picture would look far better, with the metric climbing from $30.3 million to $88.5 million over that three-year window. A similar trend can be seen when looking at EBITDA. According to management, this figure came in at $139.8 million in 2021. That’s significantly higher than the $56 million generated in 2019. so far this year, profitability has shown some signs of improvement. The company went from generating a net loss of $45.1 million in the first half of 2021 to generating a profit of $1.5 million the same time this year. Operating cash flow went from $14.1 million to negative $15.1 million. But if we adjust for changes in working capital, it would have risen from $54.3 million to $71.1 million. A similar improvement could be seen when looking at EBITDA. That metric rose from $76.4 million in 2021 to $96.6 million at the same time this year.

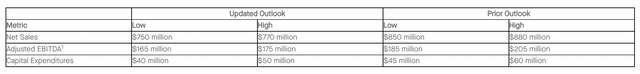

For the 2022 fiscal year as a whole, management is forecasting further growth. However, that growth has been revised lower rather significantly. Previously, management thought that sales would come in at between $850 million and $880 million. Now, that has been pushed down to between $750 million and $770 million. Even at that midpoint though, it would translate to a year-over-year increase of 20.5%. Earnings per share guidance has not been provided, nor has guidance when it came to operating cash flow. But management does expect EBITDA to come in at between $165 million and $175 million for the year. Prior guidance called for this to be between $185 million and $205 million. Assuming the same year-over-year change for operating cash flow is what we are expecting to see from EBITDA, we should anticipate a reading for the year of $107.6 million. It’s also worth noting that management remains committed to buying back additional stock even in spite of these downward revisions. In mid-May of this year, the company approved a stock repurchase program authorizing it to buy up to $100 million worth of shares over the next three years. In the latest quarter alone, the company purchased over 2 million shares for a combined $15 million.

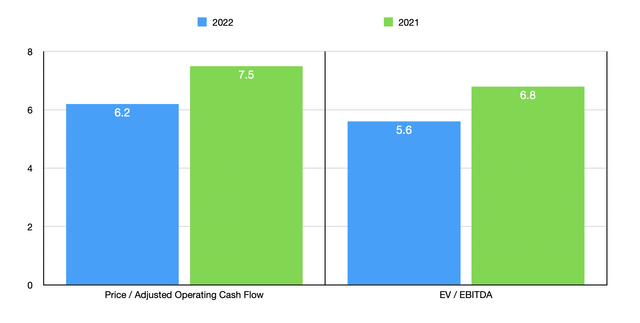

While these downward revisions are disappointing, they still do translate to a company that looks very cheap. On a forward basis, the company is trading at a price to adjusted operating cash flow multiple of 6.2 and at an EV to EBITDA multiple of 5.6. These numbers are both lower than the 7.5 and 6.8, respectively, readings that I get if we used 2021’s results. As part of my analysis, I also compared the company to two similar firms. On a price to operating cash flow basis, these companies traded at multiples of 18.3 and 22.6, while using the EV to EBITDA approach would give us multiples of 11.8 and 13.8. In both scenarios, Latham Group was the cheapest of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Latham Group | 6.2 | 5.6 |

| Leslie’s (LESL) | 22.6 | 11.8 |

| Pool Corp (POOL) | 18.3 | 13.8 |

Takeaway

At this moment, I do believe that Latham Group offers investors significantly attractive prospects. Yes, management did revise down expectations for the current fiscal year. However, shares of the enterprise still look incredibly cheap at this moment, even though some fundamental figures have not been as great as I would like them to be. All things considered, I do believe that this low pricing, especially relative to similar firms, warrants a ‘buy’ rating at this time.

Be the first to comment