bjdlzx

(Note: This article was originally posted in the marketplace newsletter April 3, 2022 and has been updated as needed)

There has been a whole lot of talk about how the hedging program is holding back progress at Laredo Petroleum (NYSE:LPI). The third quarter report has not gotten here yet and the comments have already begun. Therefore, I am digging out one of my “classic” replies to the situation. All one has to do is look at fiscal year 2020 when all the hedged companies followed the unhedged companies down despite the sizable hedging profits at the time. Those hedging profits did not matter to the market nor do the current hedging losses.

Individual investors seemed to be far more concerned with hedging issues than do institutional investors even though stock price history demonstrates otherwise for the industry as a whole. Generally, such an opinion does not fare well in the actual stock price performance. Historically, hedging has been seen by the market as a zero-sum game. Therefore, as the industry recovery progresses, the hedged companies often have higher valuation measures to make up for the hedging losses as compared to the unhedged group.

Obviously though, one issue does not dominate because there are a lot of things that go into valuation. So, there can be other reasons for underperformance. Generally, a consistently applied hedging program is not one of them.

Most analysts view hedging as non-recurring. Therefore, the benefits of cash flow received in fiscal year 2020 when prices “went through the floor” were categorized as non-recurring. Otherwise, the hedging crowd would have had far higher prices than was the actual case. There is no future value attached to a consistent hedging program.

What investors need to realize is that the same forces that drove stock prices down despite the great hedging results in fiscal year 2020 throughout the industry are the same forces that will eventually recognize the hedging losses are non-recurring.

Similarly, any hedged company can out-drill the hedging coverage during a time of high industry prices (like the current time). The increase in cash flow is so tremendous that the wells tend to payback in a few months. Even service cost inflation rarely dims that type of outlook.

Some companies, like Antero Resources (AR) manage to find stronger markets than the markets upon which the hedging is based. Winter storm Uri back during the big Texas freeze was an example of a lot of companies sending natural gas to market where they got fantastic prices. Those companies then settled the hedges and kept some fantastic profits despite the hedges. Antero Resources was one of those companies making (at the time unheard of) about $400 million in first quarter cash flow in fiscal year 2021 despite the hedging program.

Laredo Can Out-drill Its Hedges

Once the wells payback, the company is free to drill another well with that same money to obtain double the cash flow with the capital money. Because of that fact, the industry can rarely resist drilling more wells during periods of high pricing despite all the noise to the contrary. That low resistance typically brings about the next cyclical decline. Of course, the usual “bugaboo” is timing. Most investors want the benefits yesterday. But Mr. Market has his own schedule and will deliver the usual results in his own good time.

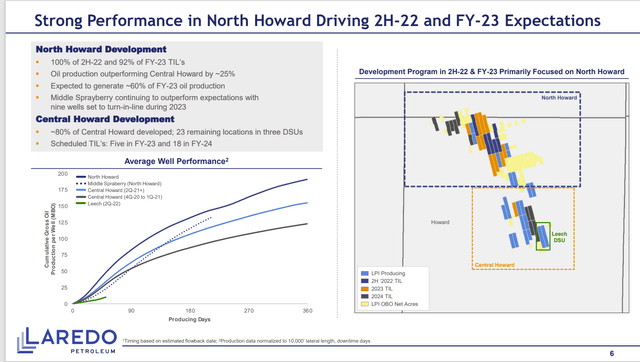

Laredo Petroleum Howard County Well Performance Hints At Huge Profitability (Laredo Petroleum August 2022, Investor Presentation)

The slides shown above demonstrate the profitability of these wells. Even if the price received for oil is $80, these wells are close to delivering $16 million at current prices just for the oil. The wells also produce some liquids and natural gas for still more money. Production costs are a small fraction of that revenue. Even a well cost of $7 million can be recovered easily in less than a year. This is very different from the company historical costs and likely not at all what Mr. Market expects from drilling results.

As a side issue, the market is concerned with the latest well package that considerably lags the other wells. Yet management will likely have plenty of prospects that offset such an outcome. Management will also review that package for potential corrective measures in the future. Despite the market concerns, it appears clear from the graph that management will meets its guidance overall which is based upon an average even if the latest package causes lower production until the next well package completes.

Since the company has a hedging program that is designed for the current financial strength rating, management can decide if they would want to drill more wells than the hedging program covers. Should that be the case, any of those wells would have an outsized impact on cash flow. That is because those wells have production that would receive current market prices without a hedging influence. It is unlikely to happen due to the market emphasis on lower debt ratios and returning capital to investors.

More Conservative Balance Sheet

Management is likely to concentrate on balance sheet improvement because they want a debt load that will be conservative even for industry downturns. But the current strong commodity price environment will allow for that to happen rather quickly.

No company hedges 100% of production for some obvious reasons (the first is that something could happen to prevent some production). Therefore, even with the current conservative hedging program, there is still about 20% to 30% of production that will benefit from the strong current prices. Since selling prices of skyrocketed to levels previously never thought possible, that exposure is going to be a huge cash flow benefit.

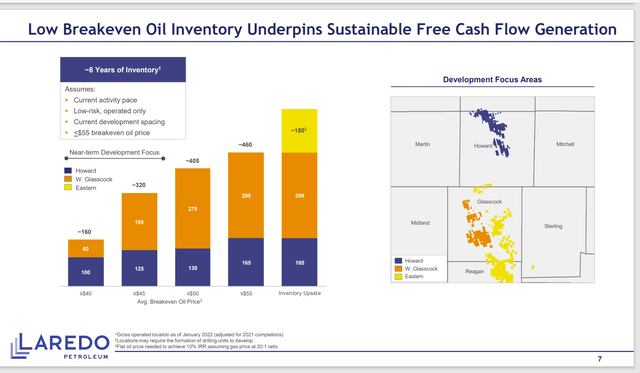

Lowering Corporate Breakeven

To reassure lenders of “guaranteed cash flow” it is very possible that management can protect any extra cash flow with some short-term hedges. The current lending atmosphere is not going to allow the “go-go” drilling of the past. But it may well allow some limited extra exposure that management may take advantage of. At current prices, it would not take a lot of extra drilling to make a large difference.

How Laredo Petroleum Is Lowering The Corporate Breakeven (Laredo Petroleum August 2022, Corporate Presentation)

The result is a lot of low-cost production (compared to the past) will be coming online without a whole lot of “fantastic” solutions needed from management.

The other thing is that management assumes that the natural gas price is about one-twentieth of the oil price and that other past relations hold. But companies like Tellurian (TELL) have allowed North America to join the world prices for both natural gas liquids and natural gas. Therefore, that historical price basis during times of low prices may not hold in the future.

Ethane, for example, services that rapidly growing plastic market. There were times in the past when ethane rejection was “par for the course”. What little ethane was sold was barely worth the effort. That is changing along with the ability to export to a far stronger world market. North American natural gas prices are unlikely to see some of the lows achieved during the rapid growth of the unconventional production in the near future as a result. Another result of this changing picture is the enhanced profitability of the legacy acreage that is not expected by the market.

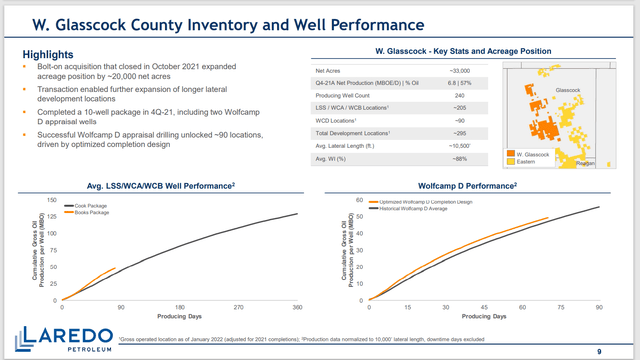

Laredo Petroleum Western Glasscock County Well Performance And Implied Profitability Data (Laredo Petroleum March 2022, Corporate Presentation)

Now these wells also generate more oil than is the case with the legacy acreage. But the percentage of oil produced is around the 40% range. Still, these wells are profitable enough to compete with the Howard County acreage for capital. Howard County will be emphasized though in the near future as those wells appear to be the most profitable. As is the case with all the acquired acreage, the wells payback very fast in the current environment.

The strategy is to hang onto the legacy acreage costs where possible with the new acreage while profiting from the improved production mix. This is leading to an increasing margin per barrel even with the conservative hedging program.

Earnings Effect

What has not been clear to many is the improvement in earnings this year. Before, the acquisitions, earnings would likely have increased into the teen’s dollars per share. The acquisitions have made $25 per share earnings possible. That figure could vary along with the selling prices because commodity prices in this industry are notoriously volatile.

The hedging program guarantees a predictable minimum cash flow to a certain extent. Some managements use that to justify capital expenditures. Others want the debt market to know that there is a certain cash flow minimal level no matter what happens. Regardless of the reason, many managements choose to hedge. The hedges will be conservative with higher debt levels. More risk will be undertaken as debt levels decline. The market has dealt with this for a long time. Individual investors often disagree.

However, the huge North American production decline in fiscal year 2020 due to the issues with the coronavirus demand destruction. That production now appears to have been mostly recovered. Most wells in the industry decline about 60% or more in their first year of production. So, there is a need to keep drilling to prevent what happened in 2020. Market and lender demands prevented that necessary drilling initially. Technology improvements appear to have offset at least some of that along with some financially strong companies that have announced growth plans.

Meanwhile, demand rebounded to unexpectedly strong levels. No economist saw that coming. Therefore, there will be a gap while the industry does the balance sheet repair strategy to undo the big losses of fiscal year 2020. Once that is accomplished, and it looks to be accomplished fast, then some combination of shareholder returns, and more drilling is likely to be on the agenda. This industry has a traditional weak spot for restraint during times of high prices the always brings on the next cyclical downturn.

In the meantime, expect this company to continue to surprise on the upside for the foreseeable future. The latest management appears to be far more in-tune with the market than the one that was replaced. It will take some time for Mr. Market to realize that. But once he does, this stock will likely reprice to far higher levels than is the case right now.

Be the first to comment