D-Keine

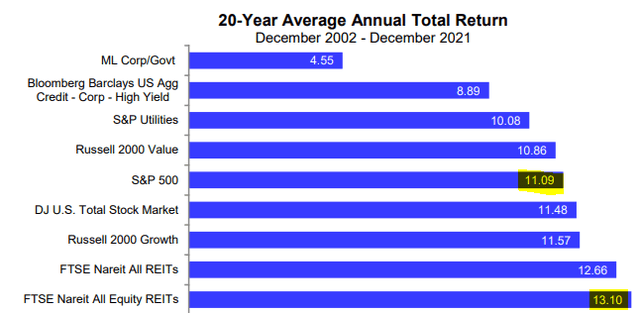

Historically, real estate investment trusts (“REITs”) have earned 13% average annual total returns and massively outperformed the rest of the market:

Yet, I am willing to bet you that most REIT investors didn’t earn returns that were anywhere close to 14%. Most probably didn’t even reach 10% average annual returns. It wouldn’t surprise me if the average individual investor earned just half of the returns of the sector.

Why is that?

Well, active investing can be very rewarding if you are skillful, but it can also be very punishing if you don’t know what you are doing. And unfortunately, based on the comments that I regularly read on Seeking Alpha, I suspect that most REIT investors really aren’t that skillful. REIT investing is at most a hobby for them, and most people haven’t made the effort to even learn the basics about the sector.

I think that most of these people should stick to a good REIT ETF (exchange-traded fund) like the Vanguard Real Estate ETF (VNQ). Just buy it regularly and hold it patiently. It won’t give you exceptional results, but it will give you average market returns, which have historically been quite attractive in the REIT sector.

But since I know that most of you won’t invest in an ETF (it’s too boring!), I wanted to write an article on my biggest lessons as a professional REIT investor who has dedicated his career to this. I am far from perfect and I am still learning something new every day, but from my 10+ years of REIT investing, I have learned some important lessons that I feel could help many of you.

In what follows, I discuss the 3 most important mistakes for you to avoid if you want to succeed as an active REIT investor:

Mistake #1: Worrying Too Much About Macro Headlines

Warren Buffett has famously said that he has never made an investment decision based on an economic prediction. Instead, he makes business predictions about what individual businesses will do over time and then compare that to what they have to pay for them.

Yet, if you read comment sections of REIT articles, you will see that the only thing that people talk about are interest rates, inflation, a recession, and other economic predictions and how they will impact REITs.

Just like Buffett, I think that this is a big mistake and people put way too much emphasis on macro-related topics that are highly unpredictable in the short run, and largely irrelevant in the long run.

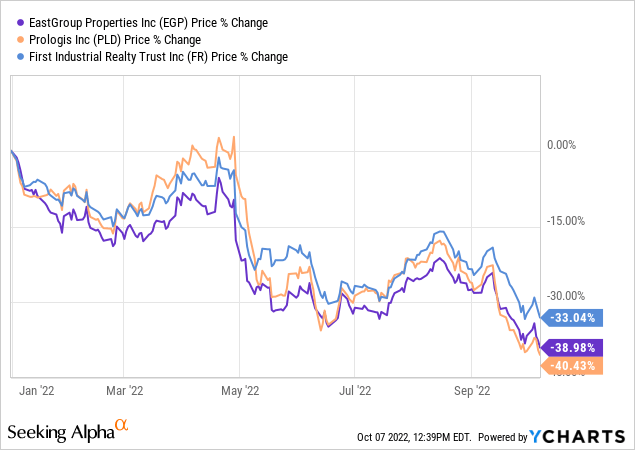

Today, as an example, investors fear that we could go into a recession and, because of that, they will avoid some REIT sectors that are perceived to be more cyclical. Industrial REITs like Prologis (PLD), First Industrial Realty Trust (FR), and EastGroup Properties (EGP) are down 30-40% year-to-date as investors fear that a recession could put an end to their growth.

But what these investors appear to ignore is that REITs, like other businesses, should be valued based on many decades of future expected cash flow. With that in mind, the impact of a 1-2 year recession should be minimal, but because investors focus too much on macro headlines, they will make the mistake of selling cheap and miss buying opportunities due to temporary macro concerns. The reality is that the best time to buy is when things are discounted due to macro concerns, and there are lots of such opportunities today.

Mistake #2: Misunderstanding The Impact of Rising Interest Rates

Another mistake that I see all the time is related to interest rates.

Somehow, investors have become convinced that if interest rates are rising, then REITs can only go down. They appear to think that interest rates are the #1 most important factor in explaining the performance of REITs.

But this is simply wrong.

It is wrong based on historic data and it is also wrong based on logic.

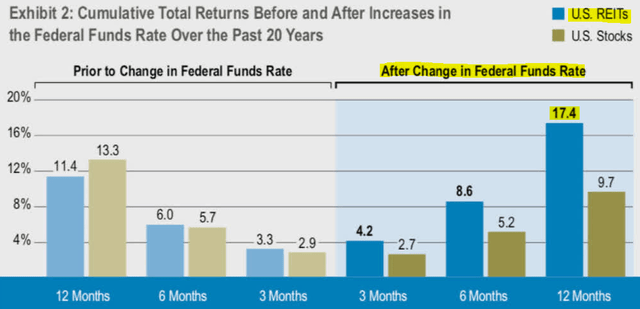

Historically, REITs have actually outperformed the rest of the market and generated high total returns during times of rising interest rates:

This may surprise you, but it is actually logical and even expected.

Interest rates are typically hiked because inflation is high and/or the economy is too hot – both of which are highly beneficial to REITs. They lead to rising rents and property replacement values, which are the best predictor of property values in the long run.

The positive impact of rising rents is typically greater than the negative impact of rising interest rates because most REITs have strong balance sheets.

Their debt-to-asset ratio is only about 35% on average, interest rates are fixed, and maturities are long at nearly 10 years on average. In many cases, rate hikes are not felt before a few years and by then, the cash flow will have grown and interest rates may have dropped back down.

To give you an example: EastGroup Properties has no debt maturities until 2026, but it is growing its funds from operations (“FFO”) per share by 10%+ annually by hiking rents and developing new properties. Its debt is low at just 20% of the balance sheet, so clearly, rising rates may not make a major impact. Yet, it is down 35% year-to-date because this appears to be the sole focus of investors.

Mistake #3: Thinking That High Yield = High Returns

Most investors perceive REITs as dividend investments and fail to realize that REITs are actually total return investments.

As a result of this misconception, investors will commonly pick REITs with higher dividend yields, thinking that this will lead to higher returns over time, but in most cases, it is the opposite.

This misconception probably stems from the fact that REITs must pay 90% of their taxable income in the form of dividends. This has led investors to conclude that REITs cannot grow rapidly since they are not retaining much income, but this is actually wrong. What they ignore is that the rule is 90% of “taxable income,” which is typically much lower than the cash flow of the REIT due to non-cash depreciation.

The real payout ratio based on cash flow is commonly closer to 60-70%, and there are many REITs that have payout ratios as low as 40-50%. A lower payout ratio results in a lower dividend yield, but it also results in faster growth as the REIT is able to reinvest this cash.

Lower-yielding REITs have historically outperformed the higher-yielding ones in most cases. They enjoy more financial flexibility because they get a steady stream of cash that they can reinvest and they are therefore less dependent on the public equity markets. Moreover, since the REIT retains the cash (instead of paying it to you), your returns are more tax-efficient since whatever the REIT retains isn’t taxed.

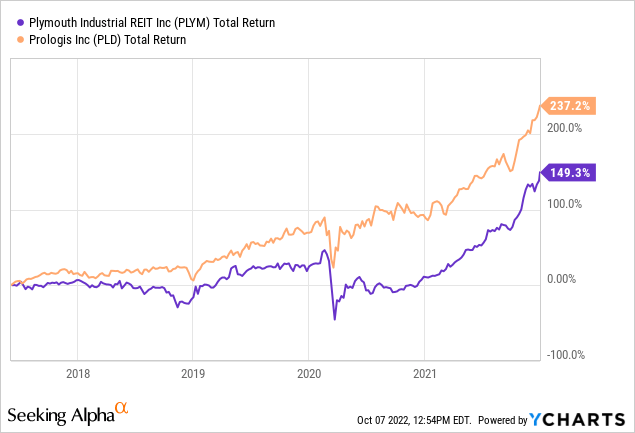

Here is an example of a high-yielding REIT (PLYM) versus. a lower-yielding REIT (PLD):

The lesson here is that REITs are total return investments, not dividend investments. The dividend is just one factor among many others to consider, and it shouldn’t be an important factor if you are a total return investor. In most cases, the majority of the returns will come from growth and appreciation, and not from dividends.

Some exceptions exist, of course, and that’s what we are seeking at High Yield Landlord. We look for undervalued, higher-yielding REITs that are able to grow at a good pace all while paying high dividends. This is the best of both worlds.

A good example would be W. P. Carey (WPC), which yields nearly 6% and has guided for 7% FFO per share growth. That gets you to a 13% total return without even accounting for additional upside from multiple expansion.

Bottom Line

These are the three most important mistakes that REIT investors make:

-

They focus too much on macro headlines, which causes them to invest in the wrong REITs at the wrong time.

-

They misunderstand the impact of rising interest rates and miss opportunities because of it.

-

They favor higher-yielding REITs when in reality, they should look for the right balance of yield and growth to maximize total returns.

I have made many costly mistakes to learn these lessons, but you don’t have to make the same mistakes.

Be the first to comment