piranka

If London is a watercolor, New York is an oil painting.” ― Peter Shaffer

Today, we go across the pond to look in on a concern that has grown via several acquisitions that were made at somewhat lofty levels. The subsequent 70% decline in the stock has landed it square in Busted IPO territory. The shares have picked up some recent insider buying meriting a further analysis which follows below.

Company Overview:

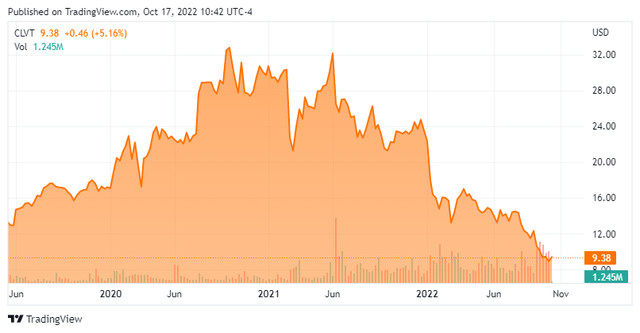

Clarivate Plc (NYSE:CLVT) is a Jersey Island domiciled and London headquartered provider of information and analytic products to over 50,000 customers in ~180 countries, including the top 30 pharmaceutical concerns. It operates primarily on a subscription or re-occurring contract model, providing ~17 products to academia, government, life sciences, healthcare, and intellectual property verticals. With roots back to 1951, Clarivate was the intellectual property and science division of Thomson Reuters (TRI) until 2016, when it was spun out to private equity firms Onex Corporation and Baring Private Equity Asia. The company went public when it was merged into special purpose acquisition company Churchill Capital in May 2019, with its first trade as a public concern executed at $13.89 per share. The stock currently trades around $9.50 a share, equating to a market cap of $7.11 billion.

A use case example of Clarivate’s offerings would be an analyst at a biotech firm looking to evaluate the competitive clinical landscape for a specific disease indication for which his employer has developed a potentially novel treatment. To assess the patentability of the firm’s compound and its potential for success vis-a-vis other ongoing programs, the analyst can access Clarivate’s substantial intellectual property and clinical trial databases.

Clarivate derives its revenue through subscriptions; recurring contracts for specific products, data, or projects; or random orders for products or services, which it deems ‘transactional’. The recurring revenue has a >90% retention rate.

Growth Through Acquisition

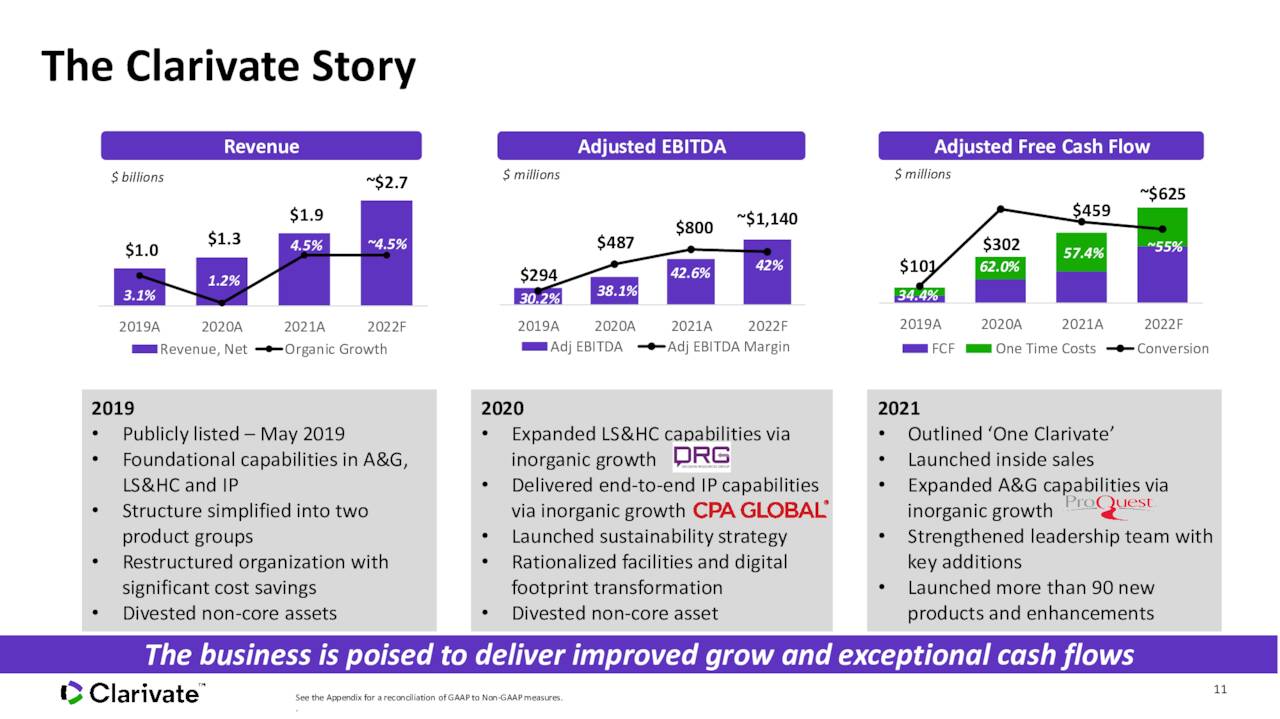

After being purchased by private equity, the company, under the leadership of recently retired CEO Jerre Stead, embarked on a series of acquisitions to augment its portfolio and leverage cross-selling opportunities. Three of the deals – all executed after going public – are noteworthy. First, it bought Decision Resources Group (DRG), a provider of data and analytics to the healthcare industry, for a total consideration of $965 million ($906 million cash) in February 2020. In October of the same year, the company purchased CPA Global, a provider of intellectual property software, for an aggregate price of $8.54 billion, consisting of the issuance of 218.3 million shares and the assumption of CPA’s $2.1 billion debt. Then, in December 2021, Clarivate acquired ProQuest, a software, data, and analytics provider to academia, for a total consideration of $5.0 billion, consisting of $3.96 billion in cash and the issuance of 46.9 million shares.

Reporting Segments

The company analyzes its operations through two segments: Science and Intellectual Property [IP]. The Science division consists of two subunits: Academic and Government (A&G), which was significantly bolstered with the purchase of ProQuest; and Life Sciences, which benefitted from the onboarding of DRG. A&G boasts a database of more than 2.1 billion citations and ~187 million indexed records, while Life Sciences’ catalog includes 495,000 clinical trial records. The Science segment generated 1H22 Adj. EBITDA of $326.4 million on revenue of $868.6 million, representing 61% and 64% of the company’s totals, respectively. The balance of those metrics is derived from IP, which houses the CPA acquisition. Its database of over 100 million patent publications from 59 patent offices represented 92% of all patents published globally in 2021. IP produced 1H22 Adj. EBITDA of $210.3 million on revenue of $480.2 million. Approximately 55% of Clarivate’s top line is derived from the Americas, 26% from the EMEA, and 19% from Asia Pacific.

Management believes its information and analytic products have a total addressable global market of $100 billion.

Stock Price Performance

Having paid essentially 4.6x, 14.2x, and 5.7x trailing twelve-month revenue for DRG, CPA, and ProQuest (respectively) – all of which were growing revenues organically in the single-digits – it isn’t difficult to ascertain why the market has fallen out of love with Clarivate, which is down 70% from its all-time intraday high of $34.79 set in June 2021. Even with all the cross-selling potential and cost savings synergies – estimated at ~$280 million – to be realized from its acquisitions, it’s hard to justify the prices paid even with solid Adj. EBITDA margins (39.8% in 1H22) and significant cash flow generation in a good tape. Furthermore, Clarivate was not aided by an accounting error that triggered a restatement of its financials (announced near YE21) that did impact GAAP earnings but not Adj. EBITDA. Nor was the company abetted by two downward revisions to its FY22 outlook in 2022. As such, the company’s stock currently trades at 2.6x FY22E revenue of $2.73 billion.

2Q22 Earnings & Outlook

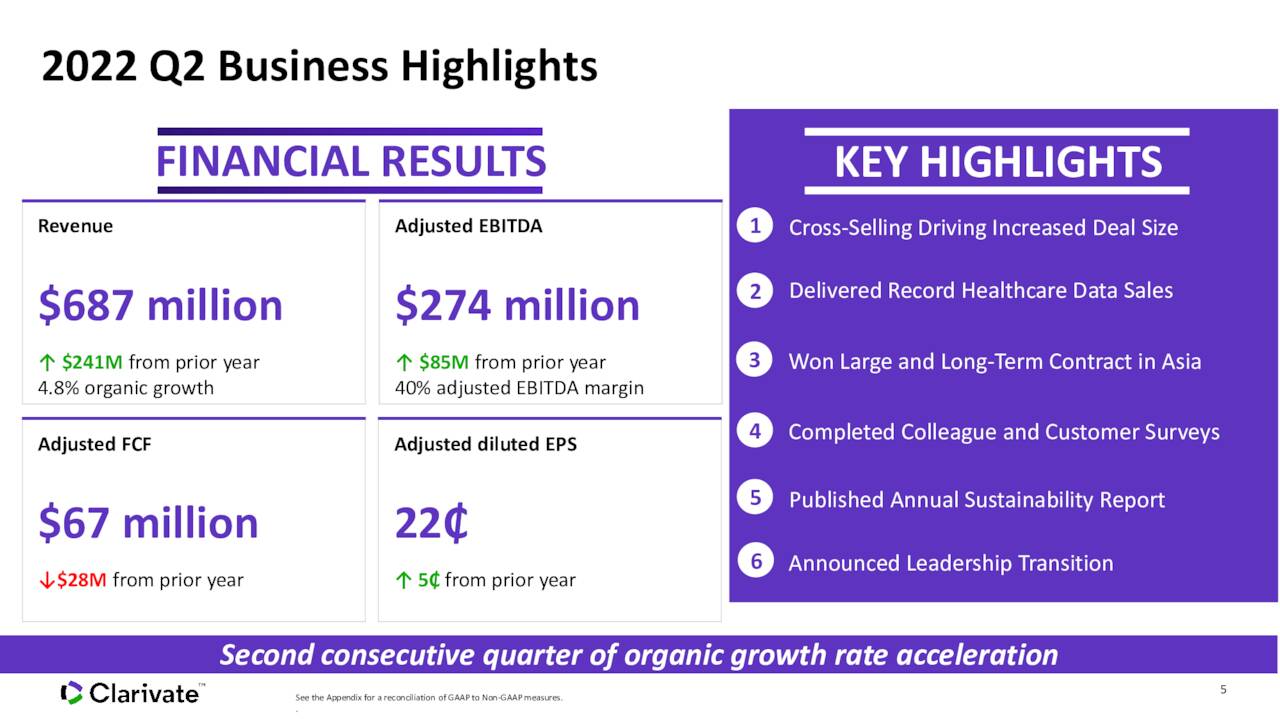

The second revenue forecast revision was announced concurrent to its 2Q22 financial report of August 9, 2022. Clarivate posted earnings of $0.22 per share (non-GAAP) and Adj. EBITDA of $274.4 million on revenue of $686.6 million versus $0.17 per share (non-GAAP) and Adj. EBITDA of $189.0 million on revenue of $445.7 million in 2Q21. The bottom line was $0.02 a share better than expectations while the top line was $4.3 million shy. Although these metrics represented gains of 29%, 45%, and 54% (respectively), on an organic basis revenue only grew 5% year-over-year while Adj. EBITDA margins declined 240 basis points to 39.9%.

August Company Presentation

Subscription revenue increased 67% to $407.4 million, driven by the acquisition of ProQuest. Also a beneficiary of ProQuest was transactional and other revenue, which jumped 87% to $168.0 million. Recurring revenue, which was bolstered by the acquisition of CPA, fell 2% to $112.0 million.

Owing to its broad geographical diversification, 2Q22 revenues were negatively impacted $26 million versus 2Q21 due to foreign exchange translations while Adj. EBITDA was affected $21 million.

August Company Presentation

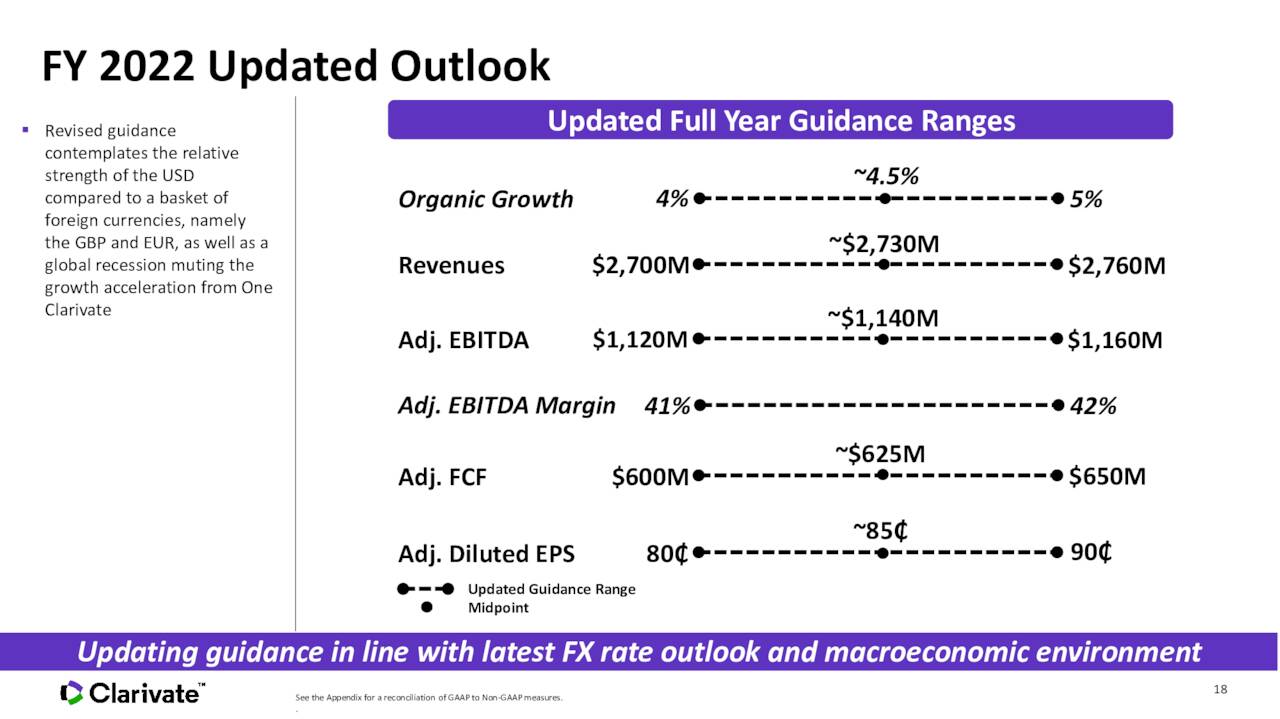

To account primarily for these currency headwinds, management was compelled to lower its FY22 outlook for a second time in 2022. Based on range midpoints, it lowered FY22E EPS from $0.88 to $0.85, Adj. EBITDA from $1.19 billion to $1.14 billion, and revenue from $2.84 billion to $2.73 billion. Approximately $70 million of the $110 million downward revision to its top line was due to forex, with the balance from suspending its business in Russia and a slower overall macro environment.

August Company Presentation

On this news, shares of CLVT fell 11% to $12.87 in the subsequent trading session and have continued their 16-month decline.

Balance Sheet & Analyst Commentary:

Also part of those downward revisions was a $75 million drop in adjusted free cash flow from $700 million to $625 million. This is somewhat concerning as its balance sheet reflects debt of $5.5 billion from its acquisitions and cash of $359.7 million (as of June 30, 2022) for net leverage of 4.5 based on FY22E Adj. EBITDA. The company is also obligated on $1.4 billion of 5.25% mandatory convertible preferred stock that converts in June 2024. Clarivate does have additional liquidity of $568.7 million under a revolving credit facility. High leverage notwithstanding, the company announced a revised $100 million stock repurchase program in February 2022, under which it has bought 10.7 million shares of CLVT through June 30, 2022, leaving ~$825 million on its authorization.

Until February 2022, the nine Street analysts following Clarivate had been unanimously bullish with five buy and four outperform recommendations. After the company’s first downward revision to its FY22 forecast, Barclays and Citi lowered their recommendations to Hold and their price objectives to $16, which is where the median target currently stands. On average, they expect Clarivate to generate earnings of $0.85 a share (non-GAAP) on revenue of $2.72 billion in FY22 – essentially in line with company guidance – followed by $0.94 a share (non-GAAP) on revenue of $2.8 billion in FY23. Over the past month, four analyst firms including Morgan Stanley have reiterated Buy ratings. Price targets proffered ranged from $13 to $17 a share.

Board member Andrew Snyder, representing the interests of Cambridge Information Group, saw the recent weakness as a buying opportunity, acquiring 259,396 shares at an average price of $11.60 on September 14-15th. In total, Cambridge owns 25.7 million shares, for a 4% interest.

Verdict:

It is interesting to note that the board elects to repurchase shares over retiring its debt, despite its relatively high leverage. Part of the rationale for this capital allocation is the fact that after giving effect to swaps (some of which were effectuated after June 30, 2022), effectively 68% of its debt is fixed rate and currently averages a very manageable 4.4% interest rate with almost all of it maturing between 2026 and 2029.

That said, the market is reminding the board on an almost daily basis (recently) that its stock is overvalued. It now trades at a P/E ratio on FY23E EPS of 10, a price-to-FY23E sales of 2.25, and an EV/FY22E Adj. EBITDA of just under ten. These are reasonable valuations, but they are not eye-popping cheap either. Even though this is a good defensive stock in a very uncertain economic environment, the valuation isn’t yet compelling enough and as such, we will elect to stay on the sidelines, becoming more constructive near $7.50.

Paris is a woman but London is an independent man puffing his pipe in a pub.”― Jack Kerouac

Be the first to comment