RiverRockPhotos

My Investment Thesis

Antofagasta plc (OTC:ANFGF), a large copper producer with assets in Chile, looks overvalued relative to its peers in terms of valuation multiples, key operating metrics, and prospects – the risk-reward ratio seems to be not on the side of a potential investor. At the same time, Turquoise Hill Resources Ltd. (NYSE:TRQ), a more diversified company with a low valuation and a global footprint, is a much better buy at current share price levels with a dividend yield of over 13% per annum.

General Bird’s-Eye View

In my opinion, we should always keep the demand side and the efficiency of its satisfaction in mind when making investments. This applies to all industries, and mining is a prime example.

We are dealing with a sector where there is one big consumer – the Chinese economy, which currently consumes more than half of the world’s copper and steel supply – that sets the tone for all other players and forces the supply side to be more flexible.

In recent years, this largest copper consumer has relied on supplies from Chile – more than 35% of the total in 2020, according to GlobalTimes. But times are changing – we see the growth of the Chinese economy slowing down year by year and the credit crunch in the country gaining momentum. Given the transport times from Latin America, it is much more profitable for China to turn to its nearest neighbors – Russia and Mongolia. It is simply faster and cheaper – the main thing is that they have sufficient volumes. Here I think it is important to understand 2 points:

- Due to the overheated real estate market, environmental problems, and overall growing social instability in the country, the CCP will most likely continue to put pressure on its local producers to curb production in order not to further inflame an already hot market.

- The neighboring countries I mentioned are actively developing new mines/projects that will create additional supply for China. Possibly cheaper than from Chile.

On the first point, everything is more or less clear – it indirectly tells us something about the decline in Chinese demand in the medium term (1-3 years). In the long term, however, there will be demand – the “green” energy transition, as well as the electrification of transport, require huge amounts of copper, steel, nickel, and other metals.

The second point is more interesting – let’s dwell on it in more detail.

Russian Udokan Project

Udokan is actually the biggest copper deposit Russians have discovered to date – it’s an open-pit project in the Zabaikalye Territory in Russia (Far East) really close to China’s borders. According to NS Energy Business data, this project has JORC resources of 26.7 million tons of copper. With the copper resources Udokan contains, it’s the largest copper deposit in Russia and one of the largest in the world.

But the most important thing is that production in this field is set to start very soon – in 2023 (the 1st stage of Udokan Copper’s metallurgical complex will have an annual capacity to produce 135,000 tonnes of copper). The bulk of these volumes is likely to go directly to the People’s Republic of China. Udokan uses environmentally friendly hydrometallurgical technology and is seeking to build a green supply chain, relying mostly on renewable energy sources. This should be important for the Chinese government, which is actively fighting environmental problems.

Russian domestic production has always been export-oriented – there are too many minerals in the bowels of the world’s largest country to use them exclusively domestically. Growing copper demand in Asia and trade restrictions against the Russian metals in the EU encouraged the country’s copper producers to increase sales to the Asian markets. Moreover, domestic demand dropped sharply because components that are normally supplied by Western countries were missing. And so it turns out – the only way for the mined volumes is to the east, and the launching production at a new field (Udokan) practically on the border of the direct sales market will make it possible to increase exports to China many times faster. But as we recall, China may need somewhat less copper in the coming years than it does now – so it turns out that cheaper Russian copper will replace other analogs – especially Chilean ones (after all, they currently account for most of the total volume of copper imports in China).

Mongolian Oyu Tolgoi Project

Being a combined open pit and underground mining project in Khanbogd sum (about 50 miles away from the Chinese borders), Oyu Tolgoi has 2P reserves of 24.03 billion pounds of Cu, 10.59Moz Au, and 74.88Moz Ag. It’s being developed and managed by Turquoise Hill Resources since 2010 – the company has a 66% stake in this project (the other 1/3 is owned by the Government of Mongolia). 51% of TRQ is owned by Rio Tinto (RIO, RTNTF, RTPPF) – one of the biggest mining companies in the world.

Oyu Tolgoi is actually one of the biggest gold and copper mines in the world and has the potential to produce more than 500,000 tonnes per annum ((tpa)) following improvements in 2027, according to Minning-Technology.com. To understand the size and potential of the deposit, it is sufficient to refer to the official information from Turquoise Hill:

Oyu Tolgoi has the potential to operate for approximately 100 years from five known mineralized deposits. The first of those (the Oyut deposit) was put into production as an open-pit operation in 2013.

A second deposit, Hugo North (Lift One), is under development as an underground operation and is scheduled to begin sustainable production in 2022. The other three deposits, Hugo North (Lift Two), Hugo South and Heruga, are not yet scheduled for development.

Source: From Turquoise Hill’s website

Rio Tinto’s role in this project is remarkable – the recent news of an additional $400 million in interim financing to fund the ongoing development of the mine project looks like a quick step for RIO towards a full takeover of TRQ. I would remind you that TRQ has received an offer from RIO to sell the rest of the company for $26.6 per share – but that was still an unresolved issue.

Preliminary Conclusions

So what intermediate conclusion can we come to after all the above?

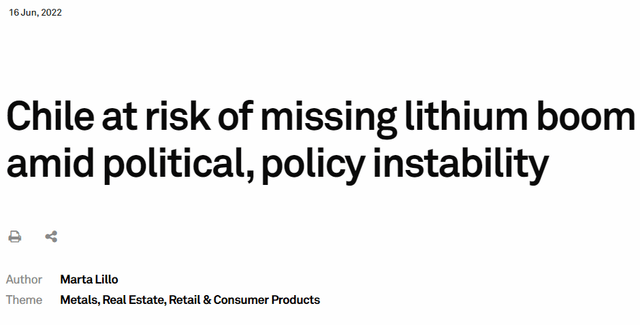

For me personally, it is clear that China will not need the same amount of copper in the next few years as it does now, but demand is unlikely to fall significantly. Therefore, it is more profitable for the country to consider cheaper and more accessible sources of raw materials – Russia and Mongolia seem to be the most suitable substitutes for copper supplies from Chile, whose remoteness and political tensions bring a kind of uncertainty to trade relations.

Therefore, I propose to focus attention on the brightest representatives of the potential winners and outsiders who are very likely to do better and worse compared to the global copper mining industry (respectively).

Antofagasta Is An Outsider

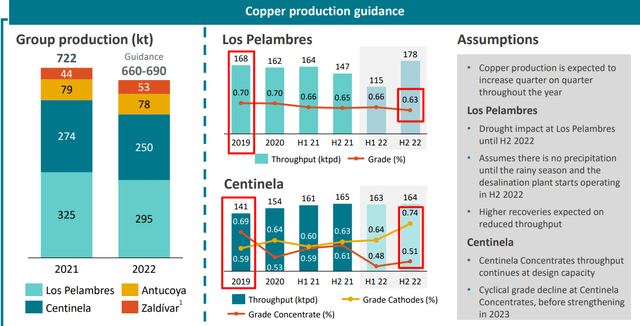

First, not only does this heavy industry giant have all the assets in Chile, but also the efficiency of production is declining – the main field (Los Pelambres, about 44% of total production) shows a strongly stagnating grade, especially compared to the years before COVID.

Antofagasta’s IR materials, author’s notes

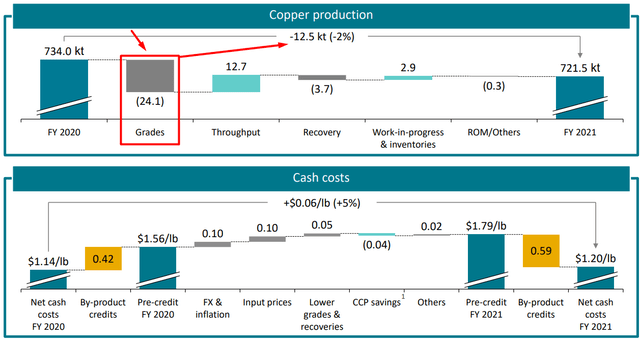

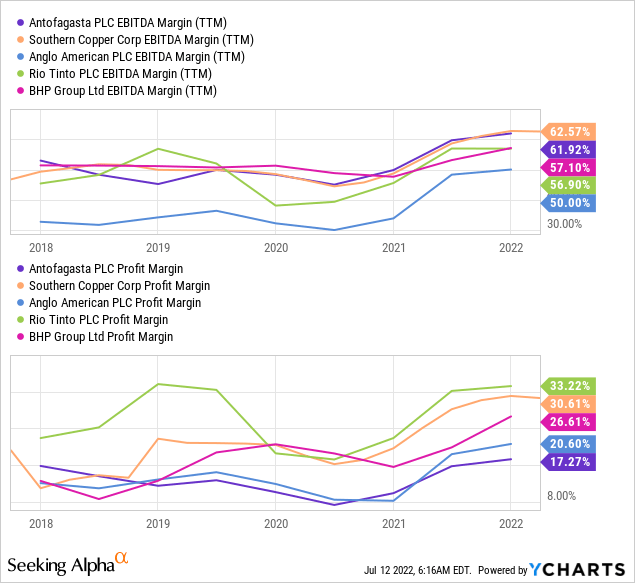

If copper prices continue to fall, the company’s additional production volumes will not be sufficient to maintain its current net profit margin, which is already significantly lower than that of its competitors, due to low grade.

Antofagasta’s IR materials, author’s notes

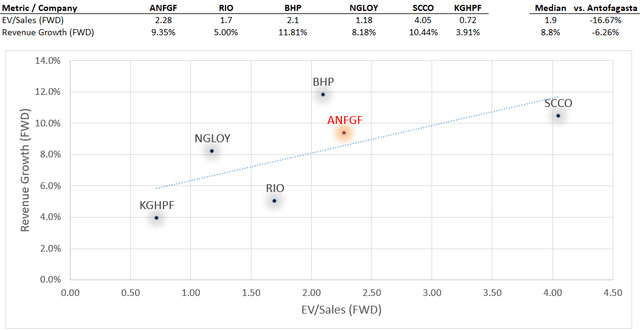

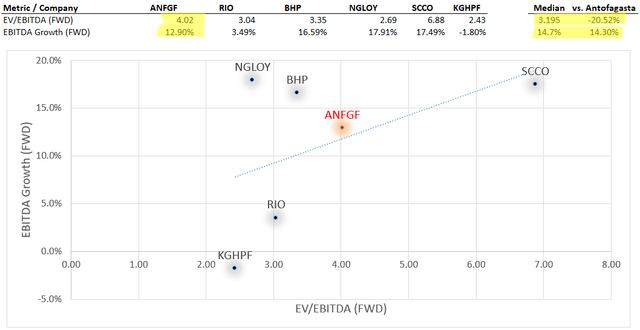

Secondly, it seems to me that Antofagasta is rather overvalued given its declining ore grade – this becomes clear when we look at the comparative valuation tables based on Seeking Alpha’s data:

Author’s work, based on Seeking Alpha’s data Author’s work, based on Seeking Alpha’s data

The ANFGF points in the charts above are mostly in the middle, but it is important to understand the specifics of the comparison – we are comparing Antofagasta with more diversified companies from Western countries, whose assets are mostly not tied to a specific developing country, which means they carry less risk.

Given Chile’s country risk and low ore grade, as well as the macroeconomic shifts in global copper and metals trading described earlier, I, therefore, conclude that Antofagasta is likely to underperform its sector, at least in the medium term.

Turquoise Hill Resources Is A Winner

TRQ, on the contrary, has every chance of making the maximum profit for itself if the scenario of China switching to Mongolian and Russian copper becomes a reality.

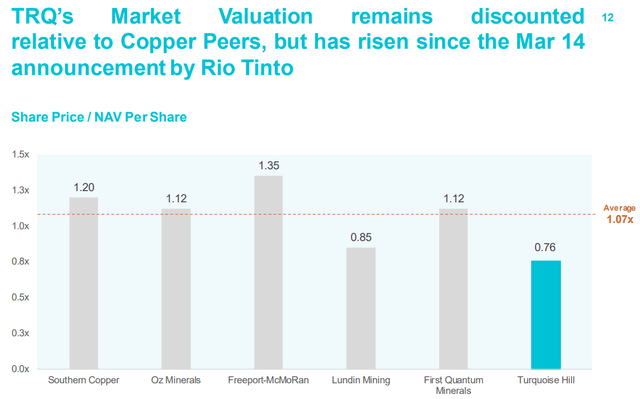

I have already partly stated my buying thesis above – Rio Tinto, which is more than 18 times the size of TRQ, can make an offer that will seem even more attractive to shareholders than originally proposed. But even at $26.6 a share, TRQ looks like a great arbitrage opportunity, with a very likely yield of > 7% (at yesterday’s closing price). However, the reasoning of SA fellow contributor Chris DeMuth Jr. in his article of 8 July 2022 seems much more realistic to me:

In US$, a reasonable bump for TRQ would be to at least $30 and probably closer to $35 per share in cash (I’d offer $30 as the bidder and ask $35 as the seller; both should be willing to meet in the middle).

I think the recent news of additional funding for the company speaks to the seriousness of RIO’s intentions. If Chris is right and the two parties agree on a mid-price, say $32.5 per share, then TRQ is currently trading at a discount of >30%.

Why should RIO overpay? Because, according to management, TRQ’s valuation has increased since the last RIO proposal:

To be fair, the ore grades of TRQ’s mines have also declined since 2021. However, in my opinion, RIO is unlikely to get past the Mongolian assets – they are too conveniently located and there is too much potential for further development of these fields.

Risks To My Thesis

One of the biggest risks in buying copper producers at the moment is the price of the underlying, which signals recessionary sentiment in the market.

Copper has lost one of its most influential cheerleaders, after Goldman Sachs Group Inc. chopped its near-term price forecasts in anticipation of a sharp slump in consumer spending and industrial activity as Europe’s energy crisis deepens.

Goldman’s analysts have been among the most bullish voices on commodities, and warned that copper in particular could become one of the tightest markets ever seen. But with investors selling the metal in droves and prices now 40% below the bank’s expectations, the bank is warning that the slump could still have much further to run.

Source: Bloomberg

Against this background, the more diversified companies – RIO, BHP, etc. – appear much more stable than TRQ.

On the other hand, Antofagasta could, on the contrary, rise much more than TRQ if its deal with RIO falls through.

Takeaway

Despite all the risks, it seems logical to me to gradually diversify China’s imports – for example, Chile’s share of total copper trade turnover may fall, while Russia’s and Mongolia’s shares will grow.

In such a scenario, overvalued mining companies with assets in Chile would be the clear underdogs (like Antofagasta), while undervalued copper producers from China’s northern neighbors would be the potential winners (like Turquoise Hill).

I, therefore, urge readers to think about shifting their investments from one company to another in order to maximize the potential return in the medium to long term.

Be the first to comment