kontrast-fotodesign/E+ via Getty Images

Investment Thesis

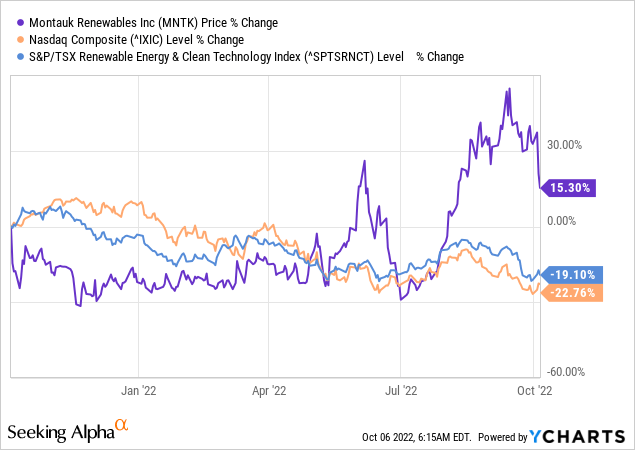

Montauk Renewables Inc. (NASDAQ:MNTK) is up almost 50% in the previous 52 weeks, with a YTD outperformance of over 30% to the market. This $2.2 billion entity is one of the largest players in the RNG space, a sector estimated to grow with a phenomenal CAGR of 44% from 2022 to 2028.

Montauk is a well-managed and strong player with a growing footprint in the market. It sports a healthy balance sheet, solid financial performance, and promising prospects. However, the stock price has surged to absurd premiums, which presents an opportunity for current investors to cash out and re-enter the company after market price adjustments.

I am bearish on the stock because of its valuation metrics, making it significantly more expensive than its peers. The market is likely to make price corrections, bringing it down to mean levels of $10 per share.

The Company

Montauk is a Pennsylvania-based renewable energy company competing in the Renewable Natural Gas (“RNG”) space, recovering and processing biogas from landfills and other non-fossil fuel sources. It develops, owns, & operates RNG projects to supply the transportation industry & produce Renewable Electricity (“RE”). Its operating portfolio includes 12 RNG and three Renewable Electricity projects in 6 states.

The company sources Landfill Gas (“LFG”) or Anaerobic Digester Gas (“ADG”) feedstock through long-term fuel supply and property lease agreements with biogas site hosts, then designs, builds, owns, and operates RNG conversion facilities or uses the processed biogas to produce RE. It sells this RNG and RE through long-term agreements while concurrently monetizing the federal and state renewable initiatives.

A glance at the RNG market as per Industry Research is quoted below:

Global key players in Renewable Natural Gas include Clean Energy Fuels (CLNE), Archaea Energy (LFG), etc. Global top 3 companies hold a share of about 30%. North America is the largest market, with a share of over 40%, followed by Europe and the Asia Pacific, with a share of about 40% and 15%. Regarding the product, Agriculture Type is the largest segment, with a share of about 60%. And in terms of application, the largest application is Gas Grid, with a share of over 50%.

Solid Performance

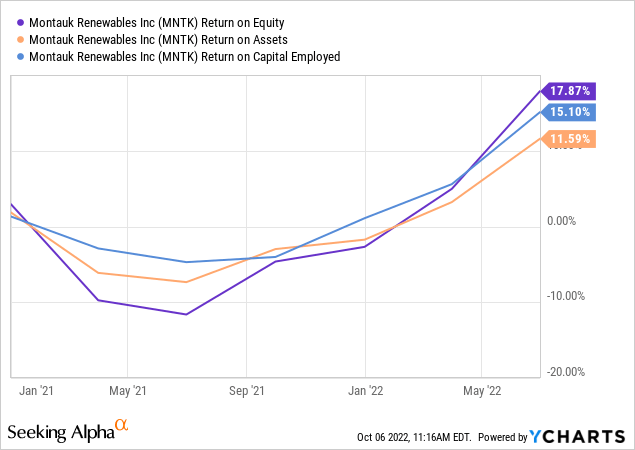

Despite being a post-pandemic company, Montauk has shown great initiative in generating promising results, with its TTM management effectiveness ratios blowing the industry medians out of the water, including a YoY ROE growth of over 5 times.

This optimized resource management is directly reflected in its growth and profitability metrics, with the company more than doubling its YoY revenue in the MRQ by selling off the entirety of its inventory and the majority of its Q2 production volume, leveraging the commodity pricing advantage.

The company is also securing its revenue’s sustainability by increasing its production, such as upgrading its Raeger facility, which is ideally expected to become commercially operational during H2 of 2023 and increase average daily production by 50%. Similarly, its Pico facility has more than doubled its YoY production volume in the first half of 2022 and is still undergoing improvements to accommodate a higher level of feedstock.

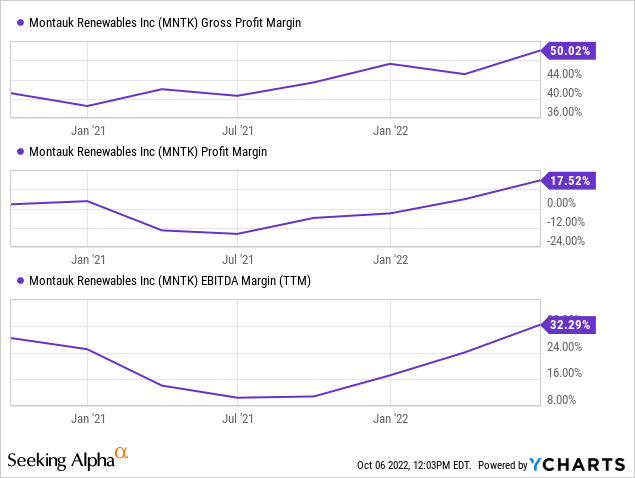

The company is also successfully translating this revenue growth into margin expansion, with its gross, operating, and net margins outperforming the sector medians by a prominent margin. Similarly, the EBITDA and adjusted EBITDA grew by around 4.5x YoY in the MRQ.

Additionally, Montauk is also successfully converting this revenue and profit growth into cash with a levered FCF margin of 11.3% and a 138% increase in cash from operating activities, resulting in over a 4x increase in cash held on its balance sheet.

As we advance, Montauk has forecasted its full-year 2022 RNG production volumes to range between 5.6 million and 6.3 million MMBtus and the RE production volumes between 188,000 and 208,000 MW hours. Concurrently, the associated revenues are expected to be $210 and $17.8 million at the midpoint.

The company has already secured commitments to transfer most of its Q3 inventory and production volumes with an average realized price of about $3.49, a 31% increase from July and a 3.25% increase from the MRQ prices. This will further accentuate MNTK’s revenue in the upcoming reports and increase the spread, bolstering profitability, meaning the company is well on its way to achieving its guidance targets.

Overvaluation

The company’s stock surged in response to its earnings released in August and peaked at over $20 per share in mid-September. Since then, it has been down about 25%, trading at about $15 per share. However, despite the recent steep slide, the stock is still trading at a forward P/E ratio of almost 40x and forward P/S of 9.7x, significantly more than double the sector medians.

Admittedly, the company’s upcoming earnings report and the full-year financial reports are expected to demonstrate a substantial YoY performance increment, with 2023 also expected to show operational augmentation in light of its new projects, but given that a significant portion of its growth is owed to the price advantage, the YoY financial performance is either likely to remain stagnant or fall concurrent to stabilization of market prices in response to the recessionary environment.

This pricing volatility risk makes the current premium over the share prices unworthy of the upside. At best, the premium offers a chance for investors to cash out their profits and re-enter the company at better valuations down the road, as we have recently seen the stock take a hit when the RIN pricing goes down.

Conclusion

Montauk renewables Inc. is a solid investment for green investors looking to enter the RNG space in the US. The company has a healthy balance sheet with strong growth prospects and solid profitability.

However, the inflated price tag makes the investment unworthy of potential investors. They would be better suited to keep a close eye on the stock and buy the security when the valuation metrics are more attractive. Even current investors should mull over the possibility of cashing out their profits and re-entering the stock when the market has stabilized the share price at around $10, which is the historical mean of the stock.

It is definitely possible for the stock to stay at these levels for the next few months because of the upcoming price catalysts, but the risks of a price downfall far outweigh the rewards.

For an understanding of the RNG market, I recommend reading the ISTJ Investor’s excellent recent publication.

Be the first to comment