pjohnson1/E+ via Getty Images

When it comes to food, few products have the same kind of widespread love for them that the potato does. The potato is used in countless food combinations as a staple product. And one of the companies dedicated to providing it in the form of value-added frozen products, is Lamb Weston Holdings (NYSE:LW). Unfortunately, in recent years, financial performance by the company has been somewhat mediocre. The good news is that sales are now experiencing a return to growth. But profits and cash flows have been mixed. If shares of the company were trading on the cheap, it may well be worth buying into. But given how the company is priced today, it probably is not any better off than being fairly valued. And if current estimates for the future hold true, the stock might be overpriced.

A mediocre performer

As I mentioned already, Lamb Weston Holdings focuses on producing, distributing, and marketing what it calls value-added frozen potato products. Not surprisingly, the company is headquartered in Idaho. And it makes its products available throughout North America. They do this not only on their own, but also with their joint venture partners who make it possible for the firm’s reach to expand to over 100 countries. When I mention that the company focuses on frozen potato products, it’s worth getting a little more detailed on what exactly the company offers. For the most part, its sales are made up of French fries.

Initially, you might think that a company dedicated to such a simple product would be structurally simple itself. But that couldn’t be further from the truth. At present, the business operates through four different segments. The first of these is the Global segment, which is responsible for providing its products throughout North America, as well as various international markets. Customers include the top 100 North American-based restaurant chains and international customers that consists of quick service and full-service restaurants, foodservice distributors, and even retailers. It is important to note that while the company does focus largely on frozen potatoes, it does offer other appetizers through this segment as well. During the firm’s 2021 fiscal year, this particular segment was responsible for 52.1% of its overall revenue and 37.6% of its profits.

The next largest segment is called Foodservice. Through this segment, the company provides its products throughout the US and Canada by selling to commercial distributors, smaller restaurant chains, and through non-commercial channels. This segment made up 27.7% of the company’s sales last year and accounted for an impressive 41.8% of its profits. Next, we have the Retail segment. This is responsible for the company’s consumer-facing frozen potato products that are sold mostly to grocery stores, mass merchants, specialty retailers, and more. Not only does the company sell under its own brands, it also sells under licensed brands such as Grown in Idaho and Alexia. This segment made up 16.4% of the company’s sales and 14.8% of its profits last year.

The final segment that we have is the Other segment. This includes the fairly small vegetable and dairy businesses the company has. Plus it also is responsible for reporting any gains or losses associated with mark to market adjustments that relate to commodity hedging contracts the company has before the time those contracts are settled. This segment accounted for just 3.8% of the firm’s sales last year and for 5.9% of its profits. In addition to these segments, the company also has multiple joint venture relationships. For instance, it currently holds a 50% interest in Lamb-Weston/Meijer, which manufactures and sells frozen potato products in Europe, Russia, and the Middle East. It also has a 50% ownership interest in Lamb Weston RDO, which operates a single potato processing facility in Minnesota with Lamb Weston Holdings itself providing all of the sales and marketing services to that joint venture in exchange for a service fee and some of the venture’s sales. And lastly, the company also has a 50% interest in Lamb Weston Alimentos, which produces and sells frozen potato products largely throughout South America.

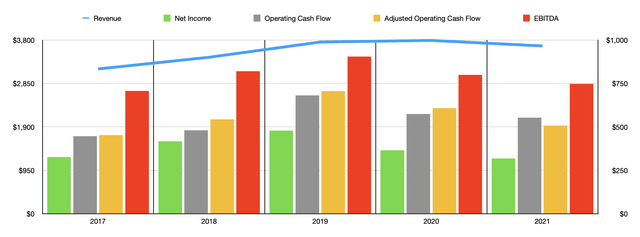

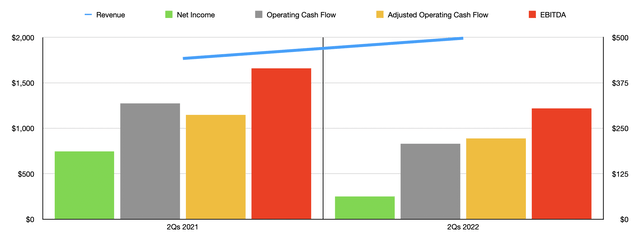

In recent years, the financial performance of Lamb Weston Holdings has been rather mixed. For instance, sales of the company increased consistently, rising from $3.17 billion in 2017 to $3.79 billion in 2020. But then, in 2021, sales dipped modestly to $3.67 billion. There were many factors to play behind this decline. But the single largest contributor was a 6% decline in volume that was partially offset by pricing and product mix increase of 3%. The good news for investors is that the drop in sales appears to have been short-lived. In the first half of its 2022 fiscal year, the company generated revenue of $1.99 billion. This represents an increase of 12.6% over the $1.77 billion reported one year earlier.

Even more volatile than revenue has been profitability. After peaking at $478.6 million in 2019, net income began a consistent decline, eventually hitting $317.8 million in 2021. Lower sales volume has been a contributor to some of this decline, as has higher manufacturing and distribution costs on a per pound basis. The weakness has not been limited to net profits alone. After seeing operating cash flow peak at $680.9 million in 2019, it too began a descent. By 2021, it had dropped to $553.2 million. Even if we adjust for changes in working capital, operating cash flow would have dropped during this timeframe from $705.3 million to $508.7 million. Meanwhile, EBITDA for the business would have declined from $904.3 million to $748.4 million.

Although revenue growth for the company has shown a recovery so far this year, the same cannot be said of profitability. Net income in the first half of the year totaled $62.3 million. That compares to a $186.2 million profit experienced the same time one year earlier. Operating cash flow declined from $318.8 million to $207.5 million. If we adjust for changes in working capital, it would have dropped from $286.8 million to $221.7 million. Meanwhile, EBITDA for the business declined from $415 million to $304.3 million. Even though the company experienced greater volume and benefited from higher pricing and product mix, it was hit by higher manufacturing and distribution costs on a per pound basis. This came as a result of double-digit cost inflation for many of the company’s inputs, including oils, grains, starches, as well as for things like transportation and packaging. These were costs the company was not able to really pass on to customers. Even though management expects sales growth to remain robust for the rest of this year, they did also say that margins will remain under pressure for the foreseeable future.

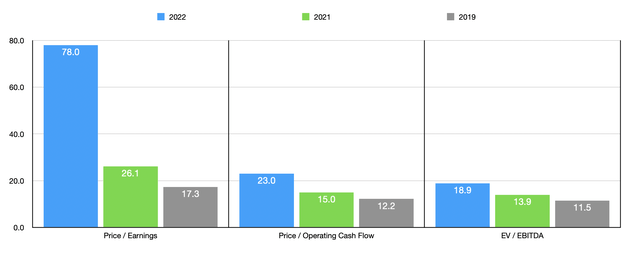

Operating under this assumption, it does become a bit challenging to price the company. For instance, if we assume that financial performance will eventually revert back to levels seen in 2019 or 2021, then shares of the company don’t look all that bad. For 2019, the company would be trading at a price to earnings multiple of 17.3. The price to operating cash flow multiple would be 12.2. And the EV to EBITDA multiple would be 11.5. Using the 2021 figures, these multiples would increase to 26.1, 15, and 13.9, respectively. If we annualize results for the firm’s 2022 fiscal year so far, then we would get net income of $106.3 million, operating cash flow of $360.1 million, and EBITDA of $548.8 million. This would imply multiples of 78, 23, and 18.9, respectively.

To put the pricing of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 6.3 to a high of 521.3. Using our 2022 figures, four of the five companies were cheaper than Lamb Weston Holdings. But if we use the 2021 results, only one was cheaper. Using the price to operating cash flow approach, the range would be 4.5 to 114.5. In this case, two of the five companies were cheaper than our prospect if we compare these firms to the 2022 estimates. But using the 2021 figures, only one would be cheaper. Meanwhile, using the EV to EBITDA approach, the range should be 3.3 to 102. In this scenario, for both the 2022 and 2021 options, two of the five firms should be cheaper.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Lamb Weston Holdings | 26.1 | 15.0 | 13.9 |

| Sanderson Farms (SAFM) | 6.4 | 4.5 | 3.3 |

| Cal-Maine Foods (CALM) | 521.3 | 114.5 | 102.0 |

| Hormel Foods (HRL) | 30.0 | 23.6 | 20.6 |

| McCormick & Company (MKC) | 34.9 | 31.8 | 25.3 |

| Flowers Foods (FLO) | 26.2 | 15.5 | 13.7 |

Takeaway

At this time, Lamb Weston Holdings strikes me as an intriguing company but a difficult one to value. The fact of the matter is that we don’t know how much longer the downturn in profits and cash flows will last. If these issues are not transitory, then shares of the business look quite expensive right now. On the other hand, a return to normalcy would result in shares probably being fairly priced or maybe being slightly undervalued. The way I see it, in the best case, upside for investors might be marginal. On the other hand, downside could be material. That leads me to view this as an unfavorable risk to reward opportunity at this point in time.

Be the first to comment