tiero/iStock via Getty Images

Co-produced with “Hidden Opportunities”

We often hear that investors should “buy low and sell high”. However, during a market correction (or bear market), investors rarely look at it as an opportunity to buy low like a holiday sale. Instead, investors panic like share prices will go down indefinitely and look to sell to “cut my losses”.

In reality, market volatility is a lot like heavy turbulence during air travel. While passengers and pilots don’t appreciate the plane’s unmanaged movements, everyone is generally aware that the aircraft and the passengers will most likely survive.

This is true for any portfolio when it experiences volatility. Whether upward or downward, investors panic and make poor decisions. Often, these decisions are made when investors have less confidence in their picks. They are not selling after seriously considering the real financial impacts to the companies they own. Instead, they are reacting to the price movement.

In the past four decades, we faced the crash of 1987, the DOT-COM crash of 2000, the Great Financial Crisis of 2008, the Global Pandemic and its after-effects. In addition to those, the financial markets have flown through a lot more turbulence in between with a “correction” every 1-2 years. Today, we struggle with yet another bout of stock-market turbulence, and it is critical to keep two investment rules in mind:

-

Never make trade decisions based on the news.

-

Design your portfolio so that short-term results don’t matter.

Let us look at what legendary investor Warren Buffett says.

“I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years.” – Warren Buffett

The near-term matters less when we invest for income; you can safely ignore market volatility and make purchases when the yields rise. With an income strategy, you are not buying with the goal of selling at a higher price. You are buying stock to receive a portion of the underlying company’s profits as dividends. The price of the shares doesn’t matter, the profitability of the company does.

Today, we discuss two robust picks with yields up to 8.3% from the energy sector. This vital sector is currently the cheapest in the market presenting a valuable opportunity. Let us discuss how to stay calm during this chaotic patch without further ado.

Pick #1: MMP, Yield 8.3%

Today, energy independence is a highly discussed topic. With serious negotiations on a global scale to source energy commodities, midstream companies are a critical asset to own. After all, commodities need to be stored and transported across geographic locations, no matter where they originated.

Income investors love the midstream industry, and today we discuss Magellan Midstream Partners (MMP), a high-quality midstream company catering to the refined products and crude oil needs in the U.S.

-

Refined Products – MMP operates a 9,800-mile refined petroleum products pipeline system with 54 connected terminals and 47mm barrels of storage capacity. This segment represented 77% of 2021 revenues.

-

Crude Oil – MPP operates over 2,200 miles of crude oil pipelines, a condensate splitter, and 37 million barrels of aggregate storage capacity. In 2021, this segment constituted 23% of consolidated revenues.

MMP is a master limited partnership that issues a schedule K-1 for tax purposes.

MMP cheaply trades at 11x EV/EBITDA compared to the 13-15x multiples of midstream peers. Management recognizes this undervaluation and has pursued aggressive share buybacks of ~$523 million worth of common stock in FY2021. MMP continues to have $700 million to pursue additional repurchases. Over 7% of MMP common units have been repurchased in the past two years, providing a significant boost to the distributable cash flow (‘DCF’) per unit and improving the distribution coverage. Remember, when an MLP buys back shares, it directly benefits shareholders. Think about a large pizza cut into six slices instead of 12; everyone gets a bigger portion!

MMP pays a 4.4% aggregate interest rate on its ~$5 billion long-term debt with no maturity until 2025. This provides the MLP with significant flexibility with its cash flow to pursue CapEx and capital return activities. The company has maintained consistent distribution increases for 20 years, and, currently, its $1.0375/share distribution presents a handsome 8.3% annualized yield. MMP’s 2021 distribution was 1.2x covered by its DCF. We expect this coverage metric to improve in 2022 as we face a challenging commodity supercycle fueled by geopolitical tensions and soaring global demand.

Pick #2: AY, Yield 5.1%

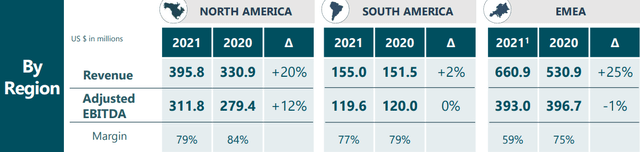

Growing the overall contribution of renewables is critical to accomplishing the goal of energy independence. Atlantica Sustainable Infrastructure (AY) owns a diversified portfolio of disruption-resistant and mission-critical renewable energy, efficient natural gas, electric transmission lines, and water infrastructure. The company’s renewables sector represented approximately 74% of 2021 revenue, with solar power being the most significant. AY owns, manages, and operates infrastructure in North America (United States, Canada, and Mexico), South America (Peru, Chile, and Uruguay), and EMEA (Spain, Algeria, and South Africa). (Source: Q4 Presentation Feb. 2022)

In 2021, AY revenues grew 20% YoY, while Adj EBITDA showed 12% growth. While YoY EBITDA margin decline is noticeable, it is essential to note that the company invested ~$480 million in 2021 to grow its asset base. The majority of these investments were made to fortify and expand operations in North America.

AY operates through long-term contracts with investment-grade rated partners, government entities, and other corporations. The company’s assets have a weighted-average remaining contractual life of around 16 years. This way, AY produces stable cash flows and sustains consistent dividend payouts.

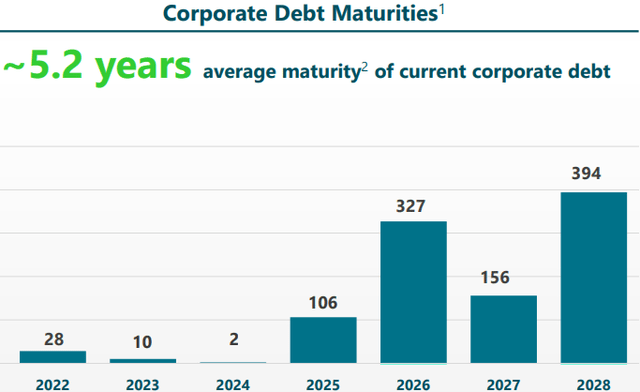

90% of AY’s long-term debt is fixed-rate or hedged, meaning the company will experience negligible impact from Fed rate hikes. Moreover, ~52% of AY’s Cash Available For Distribution (‘CAFD’) is indexed in some manner to provide a hedge against inflation. It gets better; AY has also utilized the low-interest rate climate to its advantage by lowering its net interest rate to 5.2% (down from 6.9% in 2020). AY’s average maturity of corporate debt is ~5.2 years, indicating the company’s tremendous flexibility with its cash flow for the near term.

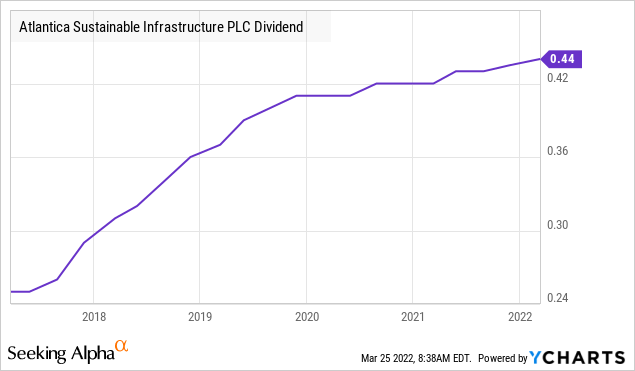

AY’s current quarterly dividend of $0.44/share reflects a 5.1% annualized yield. In five years, the company has had an impressive 12% CAGR dividend growth. AY guides 5-8% CAGR CAFD growth until 2025, meaning investors can continue to expect growing dividends for the next few years.

2021 CAFD of $2.03 covers the annual dividend 115%! Remember, CAFD is the component of Operating Cash Flow that is calculated after Capital Expenses are removed. This means the company is comfortable distributing this amount despite CapEx projects to expand its infrastructure. You would be relieved to know that 90% of AY’s CAFD is in U.S. Dollars, providing comfort during these times of geopolitical tensions.

AY is a solid dividend-growth pick in a sector that will continue to experience global political tailwinds for the foreseeable future. This is your chance to collect a well-covered 5.1% yield, and the opportunity won’t last.

Getty

Conclusion

When stock prices go up, investors feel increasingly confident. That confidence fades when stocks are in decline. Confidence turns to pessimism, and everything the bears say will start to make sense. Investors panic and try to get out before it is too late to either preserve whatever gains they have left or cut their losses and stay in cash waiting for the tide to turn.

This emotional roller coaster is time-consuming, mentally exhausting, and completely unnecessary. The world isn’t going to end. And if it does, you have larger concerns than your investment portfolio. If the businesses you are invested in are high-quality, they will survive and thrive through changing economic conditions.

There is no shortage of news surrounding financial institutions during the market’s bull and bear streaks. Soaring stocks get price upgrades, and plunging stocks get price downgrades. Remember, Wall Street analysts don’t work for you. Their price upgrades can quickly become harsh downgrades when the broader market declines, and they maintain no obligation to provide you with a trade recommendation at the right time.

“I’m not buying them because I think they’re going to go up the next day or the next week” – Warren Buffett

Investors like Warren Buffett look for a lot more than current events when they make their purchases. They look at buying a stock like buying a business.

Buying stocks for income makes your decision-making easier. You simply buy more of your quality, income-producing picks when they drop. Through the turbulent period, your portfolio collects dividends (yes, you can reinvest them to automate the “buy-the-dip”), and you can avoid a lot of the panic and stress that most investors go through trying to time the market.

Today, we discussed two picks with yields of up to 8.3% to help you manage this market turbulence. Both come from the deeply discounted energy sector and are solid dividend-paying companies. The best time to be an income investor is when markets panic. Discounted prices let you lock in high yields and ride the turbulence while getting paid in the process!

Be the first to comment