2d illustrations and photos/iStock via Getty Images

When it comes to the world of REITs, one of my favorite types of assets to look at are those related to the Billboard and digital signage industry. Beyond any doubt, one of the most attractive players in this market is Lamar Advertising (NASDAQ:LAMR). Despite experiencing pain as a result of the COVID-19 pandemic, the company has finally resumed growth and the future for the business looks bright. Over the past several months, shares of the company have dropped rather meaningfully, driven in large part it seems by fear regarding the broader economy. This comes even as the company’s top and bottom lines continue to improve. And given how cheap shares are looking now, it most definitely should be considered an attractive prospect for long-term, value-oriented investors who want a quality player in a simple and highly lucrative industry.

A sign to buy

Back in December of 2021, I wrote an article about Lamar Advertising. In that article, I recognized that recent performance by the company had been impressive and was indicative of a strong recovery following the COVID-19 pandemic. Although I said that shares were not exactly cheap on an absolute basis, I did say that they were cheap relative to other REITs. I also said that paying a price above what investors might normally pay could be worth it because of how high quality and operator this business is. All of this led me to rate the business a ‘buy’. But unfortunately, it looks as though I might have been too early in making that call. That is because, while the S&P 500 is down by 16.8%, shares of this billboard and digital signage company have generated a loss for investors of 20%.

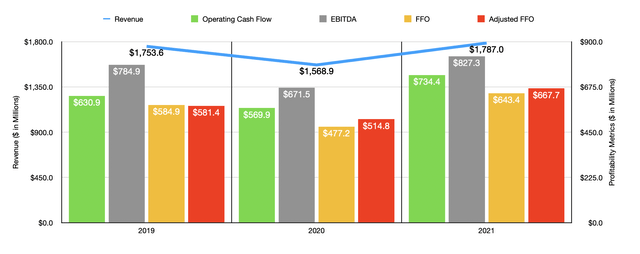

Author – SEC EDGAR Data

At first glance, you might think that this decline was driven by fundamental concerns. But that was not the case. In fact, the company has been doing exceptionally well. When I last wrote about the firm, we only had data covering through the third quarter of its 2021 fiscal year. Fast forward to today, and we have data covering through the first quarter of 2022. For the 2021 fiscal year as a whole, revenue came in at $1.79 billion. That represents an increase of 13.9% over the $1.57 billion generated in 2020. It was also marginally higher than the $1.75 billion reported for the 2019 fiscal year. This improvement came as demand for signage increased. On top of this, the company continued to acquire other billboards across the markets in which it operates, and it continued to invest heavily in digital signage. Though costly, digital signs do generate more revenue than traditional static signs.

Performance on the bottom line was also stronger in the 2021 fiscal year. Operating cash flow, for instance, came in at $734.4 million. That compares favorably to the $569.9 million generated in 2020. FFO, or funds from operations, increased from $477.2 million in 2020 to $643.4 million last year. On an adjusted basis, this metric grew from $514.8 million to $667.7 million. And finally, EBITDA increased from $671.5 million to $827.3 million. Clearly, the company ended the year in strength.

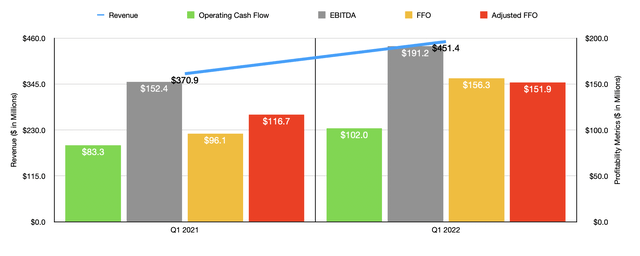

Author – SEC EDGAR Data

The great thing for investors is that this growth has continued into the current fiscal year. Revenue in the first quarter of 2022 came in at $451.4 million. That compares to the $370.9 million reported for the first quarter one year earlier. This 21.7% rise in revenue year over year was driven largely by an increase in billboard net revenues of $67.7 million. However, the company also benefited from higher transit net revenue and a slight improvement in logo net revenues. We don’t know exactly how much of this improvement came from digital billboards. But we do know that in that quarter alone, the company invested $13.3 million, or roughly 46.4% of its total capital expenditures, on this category. By comparison, traditional billboards only brought in capital expenditures of $8.1 million. Logos, transit, land and buildings, and operating equipment categories all came in substantially lower than either of these.

As revenue increased, so too did profitability. Operating cash flow rose from $83.3 million in the first quarter of 2021 to $102 million the same time this year. FFO grew from $96.1 million to $156.3 million, while the adjusted equivalent increased from $116.7 million to $151.9 million. And finally, EBITDA also rose, climbing from $152.4 million to $191.2 million. Another interesting thing that investors should note is that, earlier this year, management made another acquisition. This was of Burkhart Advertising, which owns over 1,500 billboard structures and 3,200 billboard faces, including 23 digital displays. It has operations in 38 counties across northern Indiana. We don’t know exactly how much management paid for this particular deal, but we might find out when they report their next quarterly results.

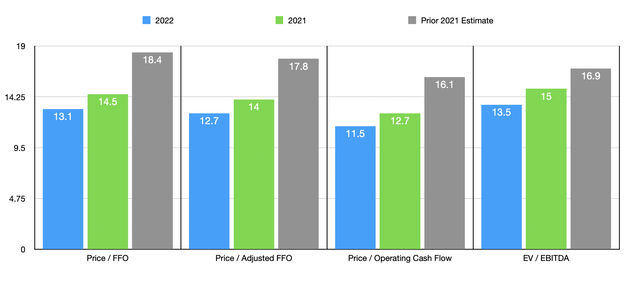

For the 2022 fiscal year, management currently anticipates adjusted FFO of between $7.20 and $7.35 per share. At the midpoint, this would translate to roughly $738.3 million. If other profitability metrics rise at the same rate that this should, then FFO should be $711.4 million, while operating cash flow should total $812.1 million. By extension, EBITDA should come in at around $914.8 million for the year. Using this data, we can easily value the company. The price to FFO multiple of the firm is currently 13.1 on a forward basis. This compares to the 14.5 reading that we get if we use 2021 results. On an adjusted basis, this multiple would be 12.7, down from the 14 that we get if we rely on 2021 figures. The price to operating cash flow multiple should decline from 12.7 to 11.5. And the EV to EBITDA multiple should drop from 15 to 13.5.

Author – SEC EDGAR Data

As you can see in the chart above, the 2021 figures right now are lower than when I last wrote about the firm. And I would argue that they are lower by a significant amount. I also, as part of my analysis, decided to compare the company to two similar firms. On a price to operating cash flow basis, these companies ranged from a low of 13.1 to a high of 20.2. Using our 2021 figures, we can see that Lamar Advertising is cheaper than either of them. Using the EV to EBITDA approach, the pricing was much closer at between 14.3 and 14.6. In this case, our prospect is slightly more expensive than its peers.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Lamar Advertising | 12.7 | 15.0 |

| Outfront Media (OUT) | 20.2 | 14.3 |

| Clear Channel Outdoor Holdings (CCO) | 13.1 | 14.6 |

Takeaway

Although the past few months have been rather painful for investors in Lamar Advertising, I do believe that the future for the company is bright. The company continues to grow and while it might experience some pain if the economy suffers, I see no reason why its long-term trajectory should do anything but increase. Add on top of this how cheap shares have gotten on an absolute basis, and I must reiterate my ‘buy’ rating, with conviction, on the company.

Be the first to comment