SHansche/iStock via Getty Images

Tidewater, Inc. (NYSE: TDW) remains a small but durable figure in the shipping and fleet industry. It has an impressive rebound with its revenue growth and margin expansion. Also, it now has a larger capacity after acquiring Swire Pacific Offshore. It has adequate resources to finance its expansion and repay its borrowings. Given the synchronized increase in profitability and liquidity, its operations remain sustainable.

Likewise, its stock price remains in an upward pattern. But, the potential undervaluation remains evident, making it cheap and reasonable. The upward momentum remains strong as income and growth prospects become more promising. However, port congestion does not show substantial improvement. It may disrupt its supply chain and limit its capability.

Company Performance

Tidewater, Inc. enjoys its safe and exciting voyage amidst pandemic disruptions. Its rebound and expansion become more evident. Its financial performance shows massive improvement after all the hullabaloos. Over the past decade, it has endured overcapacity that pulverized the shipping industry. Also, the unexpected changes in 2020 slowed down its recovery. But now, TDW is turning the tide of the shipping wars with its enhanced efficiency and capacity.

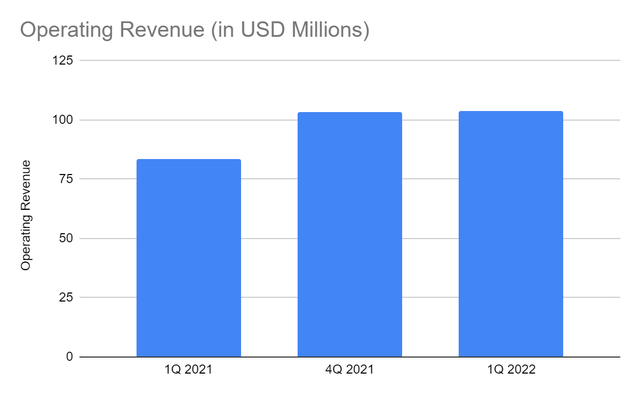

The operating revenue in the most recent quarter amounts to $105.73 million. It is a 24% year-over-year growth, one of the largest since the shipping market crash. Note that the increased inflows of fleets and vessels tightened the competition. As such, revenues among peers plunged, leading to massive net losses. And even Tidewater was not spared from the adverse impact. But over the years, recovery has started and persisted. Thankfully, the company capitalizes on acquisitions to sustain its rebound and growth. We can see its uptrend in the operating revenue while net losses had a consistent reduction. If not for the pandemic, Tidewater would have been in a better condition. Even so, it proves that the company remains resilient even if it is still on its way to recovery.

Operating Revenue (MarketWatch)

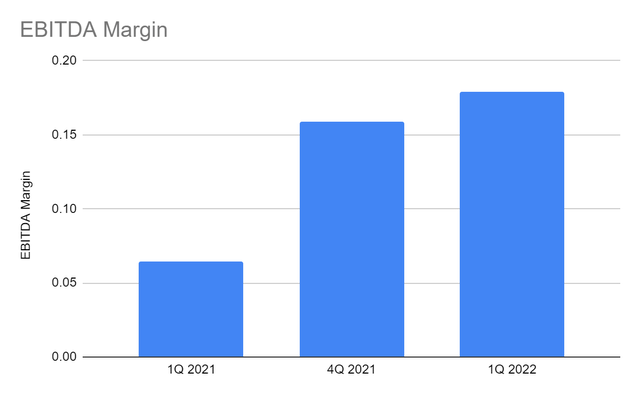

Even better, the company does not rely solely on its expansion and acquisition. It matches this move with its efficient asset management. As such, it keeps its costs and expenses relatively lower. Its EBITDA continues to increase. It shows that as TDW expands, it enhances its efficiency to generate more returns. Its $18.64 million EBITDA is more than thrice as much as its value in 1Q 2021. It leads to an EBITDA margin of 0.179, which is almost thrice as much as 0.065 in the comparative quarter.

Today, its efforts and strategies are paying off as revenues and margins rise further. With more businesses and customers going online, long-distance transactions are a new normal. Tidewater basks in the fruits of an upsurge in energy demand. It is more vital, given that the global economy is bouncing back. Also, geopolitical issues in some countries are leading to oil and fuel demand. But of course, it has to keep its operations intact. Efficiency must improve further as port congestion ensues.

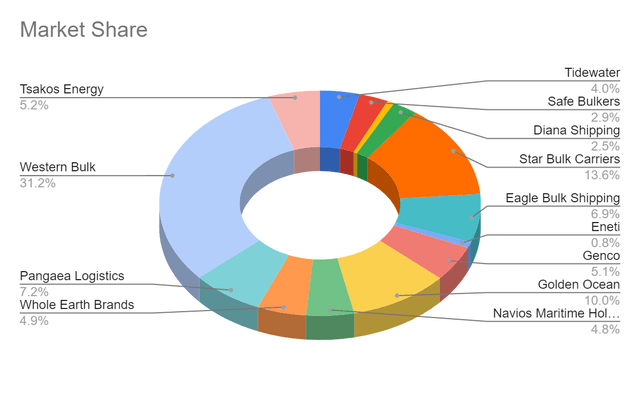

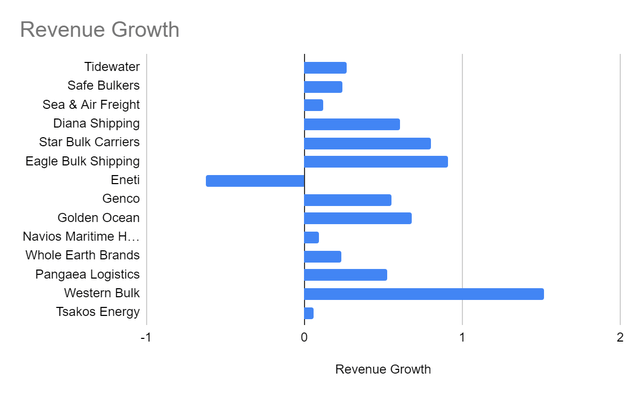

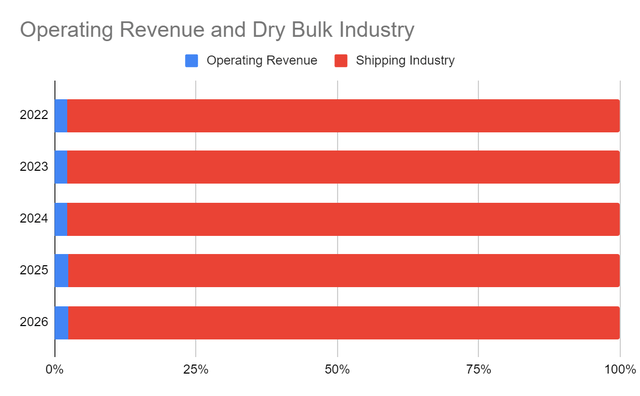

If we compare it to its peers, Tidewater is still a mid-sized company with only a 3.6% market share. Its revenue growth of 26% is way lower than the market average. But, it is better than many peers of its size. Notable peers include Whole Earth Brands (FREE) with 24%, Navios (NM) with 9%, and Tsakos (TNP) with 5%. With the addition of 50 new vessels, revenue expansion may speed up.

Market Share (MarketWatch) Revenue Growth (MarketWatch)

Moreover, it adheres to the Energy Efficiency Design requirements. It is timely and relevant, given the importance of climate finance in the industry. With that, Tidewater shows the capacity to balance efficiency and environmental sustainability.

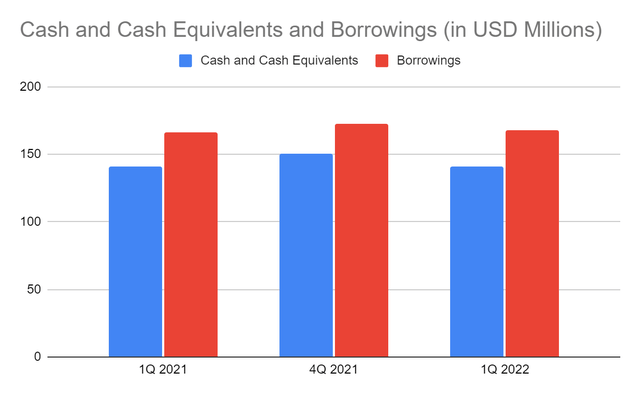

Tidewater May Sustain Expansion

Aside from its robust operations, Tidewater maintains sound fundamentals. These can be seen in its stellar Balance Sheet. The stable cash and borrowings tell a lot about its liquidity and sustainability. Note that the company just completed its acquisition of Swire Pacific Offshore. As such, it proves that it maintains efficient asset management. From 1Q 2021 to 1Q 2022, the percentage of cash to borrowings remains within 80-90%. Indeed, TDW balances both in financing its expansion while keeping its resources adequate.

Cash and Cash Equivalents (MarketWatch)

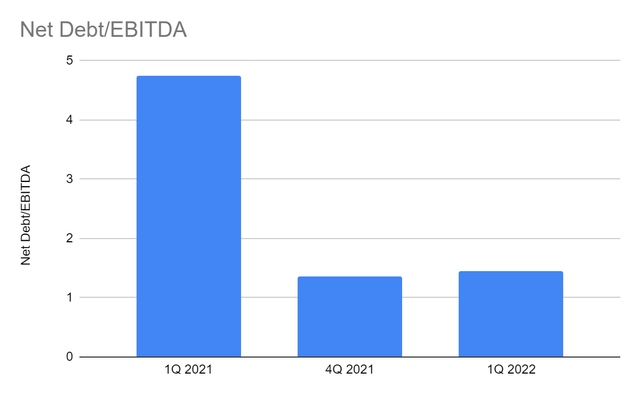

Its expansion appears fruitful as revenues and EBITDA margin increase. Note that TDW is capital and labor-intensive. So, it needs more resources to sustain its operations. Its Net Debt of $26 million and EBITDA of $17 million lead to a Net Debt/EBITDA ratio of 1.44x. It is lower than the maximum 3-4x ratio. It means that the company earns more than enough to cover its borrowings. Indeed, Tidewater benefits from its strategic management. It remains excellent with regard to the timing of its expansion and reinvestments. That is why it manages its cash and financial leverage very well.

Moreover, the easing of restrictions is helping the industry deal with port congestion. Although it may not have drastic changes this year, the impact may be visible in 2023. It allows the dry bulk and shipping industry to meet the increased market demands. The increased government spending on infrastructure may become a primary growth driver. Inflationary pressures may become another challenge, especially for those handling energy sources. But, the pent-up demand may continue, so scaling up is a must. Given all these, the shipping industry may reach $22 billion in 2030 with a CAGR of 5%.

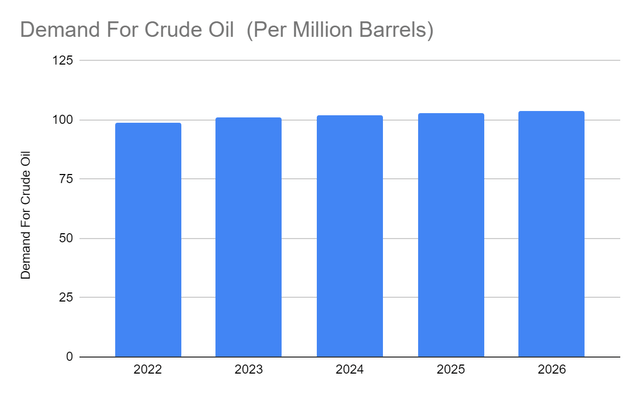

Likewise, TDW may expect better, given its timely M&A and efficient operations. It has 50 new vessels after the recent acquisition. Also, it is seeing an average day rate improvement in its vessel contracts at almost 30%. It may be an indication of its fundamental shift in supply and demand for vessels. The upward movement may continue as its operations expand and accelerate. So, market expansion and its increased operating capacity will help it adapt to the trend. Its move is timely, given the potential upsurge in demand for oil and fuel. In 2023-2026, it may bounce back and exceed pre-pandemic levels at 99-104 million barrels per day. It is logical as more businesses are reopening, and more people are travelling. Also, cross-border transactions may increase. All these aspects require more sources of energy. As such, it may become another potential revenue driver. For the next few years, I expect its operating revenue to increase to $390-496 million. It is in line with the average growth in recent years and the recent quarterly values.

Demand for Crude Oil (Statista) Operating Revenue and Shipping Industry Revenue (Author Estimation and GlobeNewswire)

Price Assessment

The stock price of Tidewater, Inc. continues to show a bullish pattern. But, in the last month, it has been moving sideways. The increase may remain sustainable, given the promising growth prospects. At $26.51, it still appears reasonable although it is more than twice as much as its starting price. That may be the reason why the stock price seems to be slowing down. Also, its current EV/EBITDA multiple of 14x suggests it is approaching its limit. It is above the ideal level of 10x and higher than its peers like Safe Bulkers (SB). To value it better, we may use the EV/EBITDA approach.

EV $1,140,000,000

Net Debt $26,700,000

Common Shares Outstanding $41,717,000

Stock Price $26.51

Derived Value $26.69

The derived value confirms the stock price remains fairly valued. But, it appears to be reaching its resistance level. Even so, it has more growth prospects to improve its valuation and push the price upward.

Bottomline

Tidewater, Inc. continued to emerge from its rock bottom. Its stable fundamentals and impressive performance promise more returns in the following years. Likewise, the stock price is moving upward although increases are slowing down recently. It remains undervalued, but it may only give an upside of 1-2% in 12-24 months. I recommend it as a buy but not at its current price. Investors must be more careful, given that it may be reaching its maximum value. Even so, it remains promising as its performance and the shipping industry expand. Investors must wait for a better entry point before making a position.

Be the first to comment