Spencer Platt

Many economic indicators have started to sour as a mix of adverse forces domestically and internationally impose themselves on the US economy. This has been the case since the end of the pandemic in 2021 brought about supply chain disruptions from a mismatch between supply and demand. However, one bright spot has remained.

Despite the rise of inflation, the decline in manufacturing new orders, slowing of consumption, and the decline in the housing market, the labor market has remained relatively unshaken. Notably, the bellwether labor market indicator, the unemployment rate, sits at a low 3.6% after a year-to-date decline of -0.4 ppts. This is slightly above the 3.5% reading in February 2020 when the economy was humming along normally enough. In 2022 alone, the US has added over 2.7 million jobs, much higher than the 903,000 added in the first 6 months of 2019.

However, there are early signs that Fed tightening and persistent elevation have started to impact the labor market which will likely lead to further deterioration in 2022.

Jobless Claims

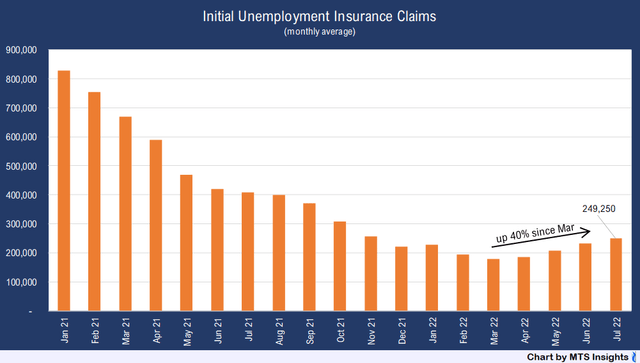

Everyone remembers the meteoric rise in jobless claims that occurred at the beginning of the pandemic as millions of individuals were either furloughed or left fully jobless as a result of businesses closing due to COVID. A record-setting 6.1 million jobless claims were made in April 2020, almost 10x the peak seen during the Great Recession following the 2008-2009 financial crisis.

Claims slowly fell back towards a more normal flow of claims at the end of 2021 and the beginning of 2022. At the end of Q1 2022, weekly claim totals were around 160,000-170,000 and were mostly out of the national focus as an economic indicator. However, that “bottom” in claims has been brief. Since April, weekly claims have risen back above 200,000 and averaged 249,250 in July, up 7.6% MoM from June.

The seven-figure-sized claims surge seen in April 2020 may have desensitized us from more normal increases that occur when the business cycle runs its course. This could be the start of a rise in unemployment insurance pointing to the beginning of a weaker labor market afflicted by Fed tightening.

Manufacturing Firm Hiring Expectations

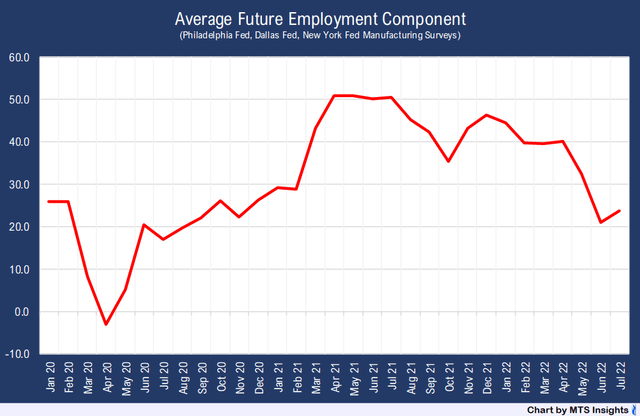

US firms’ employment plans are very important to the labor market outlook, and they have remained strong over the last year. From March 2021 to March 2022, the Future Employment indexes of three (New York, Texas, Philadelphia) of the major regional Federal Reserve manufacturing surveys were above 30 with some readings topping out above 50. The average of this index from 2015 to 2019 was around 25 for each of the surveys suggesting above-average labor demand in the period following the pandemic.

Evidence of that demand has started to wane with the Future Employment components falling in the last few months. The average of the three surveys fell from a peak of 50.4 in July 2021 to a more moderate but still strong 39.6 in March 2022. At the start of Q3 2022, the average of the Future Employment components came out to 23.7. Of course, a reading of above 20 is still a solid number, but it is down from the strength seen in 2021.

A similar trend can be found in the NFIB Small Business Economic Trends. The index tracking hiring plans over the next three months sat at 19 after a -7 pts decline in June. This is the lowest since February 2021. Most of the weakness is due to that large June drop that was likely a result of tighter financial conditions. Two 75 bps hikes in June and now July should point to further deterioration in small business hiring plans in July’s NFIB report.

Job Openings & Job Cuts

One of the most striking features of the strong post-pandemic labor market is the record-setting job openings. At its peak, the total number of job openings reached 11.8 million, more than 4 million higher than the previous peak set in November 2018. Labor shortages became another challenge that businesses had to deal with on top of transportation and sourcing disruptions. Alongside the shortages, higher wage growth set in which is another feature of a strong labor market.

While it’s likely going to take some time for job openings to come down to a level consistent with the “pre-pandemic” concept of normal, the descent has begun. In the May JOLTS report, the total number of job openings fell over -600,000 with manufacturing openings accounting for around -200,000 of the decline. US businesses are likely going to report a drop of the same magnitude, if not larger, in June if the manufacturing surveys’ observations about hiring plans are to be believed.

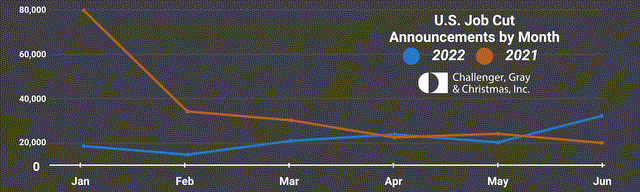

Challenger, Gray & Christmas, Inc.

The Challenger, Gray & Christmas Job Cut report aligns with the reversal trend seen in job openings. In the June edition, the Challenger report saw that Q2 2022 job cuts were the highest quarterly total since Q1 2021. In total, 77,515 job cuts were announced, an increase of 39% over the first quarter of 2022. The SVP of Challenger, Gray & Christmas had this to say:

“Employers are beginning to respond to financial pressures and slowing demand by cutting costs. While the labor market is still tight, that tightness may begin to ease in the next few months.”

Why Does it Matter?

The labor market is a very important piece of the Fed’s narrative on normalization. In the last three meetings (May, June, July), the following phrase has made it into the main press releases: “Job gains have been robust in recent months, and the unemployment rate has remained low.” This sentence is surrounded by statements describing the risks to the US growth outlook including inflation, the war in Ukraine, and supply disruptions. The Fed needs a bright spot to look to in justifying aggressive tightening. To some, a strong labor market would be the only buffer between a stable economy and an economy in recession.

If the labor market continues to weaken in Q3 and Q4, that bright spot will disappear and the Fed could shift towards a more dovish, gradual approach to normalization or even a downward adjustment in what the FOMC members see as the neutral Fed funds rate. The guiding light is in the Summary of Economic Projections. The median unemployment rate forecast only allows room for a 0.1 ppt increase in 2022 and a 0.2 ppt increase in 2023.

Hypothetically, an unemployment rate increase of a larger magnitude could prompt the Fed to have to update expectations and possibly its path on raising policy rates. Therefore, the indicators above should be closely watched in the next quarter as updates for July and August eventually are released. The Fed has officially moved to rate hike decisions made on a “meeting-by-meeting” basis which means it will also be following the data closely to track the weakening of the labor market.

Be the first to comment