Michael M. Santiago

There are plenty of EV companies to choose from, and we’ll mention several in this article, but we think very few have the necessary resources to reach critical mass, and the necessary technology and competitive advantages to succeed. In the end we expect only a handful of EV startups to join Tesla (TSLA) as successful full-scale EV companies, and we believe Rivian (NASDAQ:RIVN) has the best opportunity to do so. And contrary to Tesla, which we believe is currently overpriced, Rivian has a much more reasonable valuation in our opinion.

We are encouraged by what we see as solid execution on the part of Rivian, despite the challenges of supply chain disruptions and the impact of COVID, over the last year Rivian has launched its flagship vehicles, R1T, R1S, and EDV, as well as its direct-to-customer delivery and service operations. The production plant in Normal, Illinois has 150,000 units of annual capacity and the company is working hard to continue to ramp its supply chain and production to fully utilize this capacity.

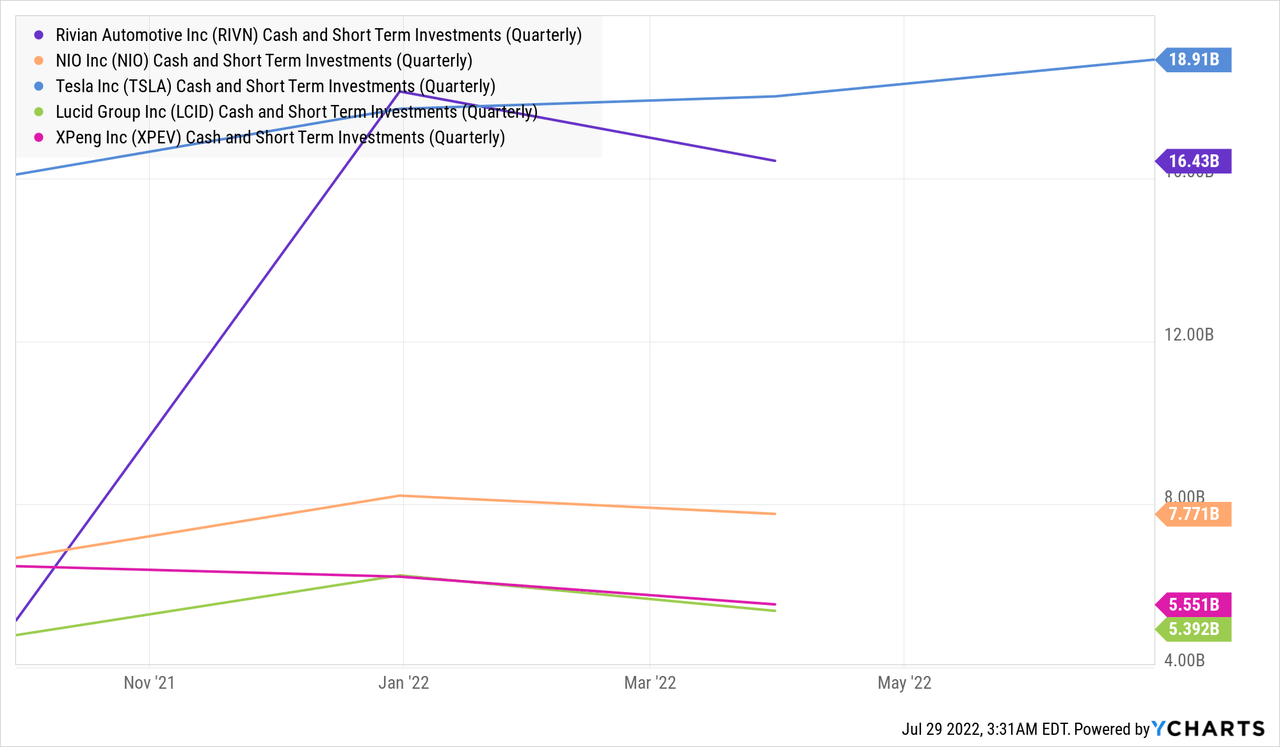

One of the main reasons we believe Rivian has the critical mass to succeed is not only their excellent product and technology, but that they were really smart in raising a very substantial amount at their IPO. Thanks to the $13.7 billion of gross proceeds from their IPO the company had a massive $17 billion of cash on its balance sheet as of March 31, 2022. The company believes this large amount of capital should probably be enough to support the 2025 launch and ramp of its R2 vehicle platform.

Competitive Advantages

We believe that Rivian is doing the right things to create long-term structural advantages in terms of both cost and product features by doing the hard work of developing the necessary hardware, software, and manufacturing capabilities. Other companies have taken the easier route of subcontracting a lot of the components or even the manufacturing. This makes it easier in the beginning, but longer term means a higher cost structure and less flexibility in terms of product development. A good example of a company that took the easier route is NIO (NIO), which partnered with an existing manufacturer to help build its cars. JAC is a major state-owned automobile manufacturer in China that currently manufactures the NIO vehicles in delivery, including the ES8, ES6 and EC6. By following this approach NIO was able to get to market a lot faster, but at the price of reduced flexibility and structurally higher production costs.

In contrast Rivian has taken an approach more similar to Tesla, vertically integrating a number of key aspects of the business including the full software stack, vehicle electronics and network architecture, self-driving and driver assist platforms, vehicle propulsion platforms, and battery systems and production.

Financials

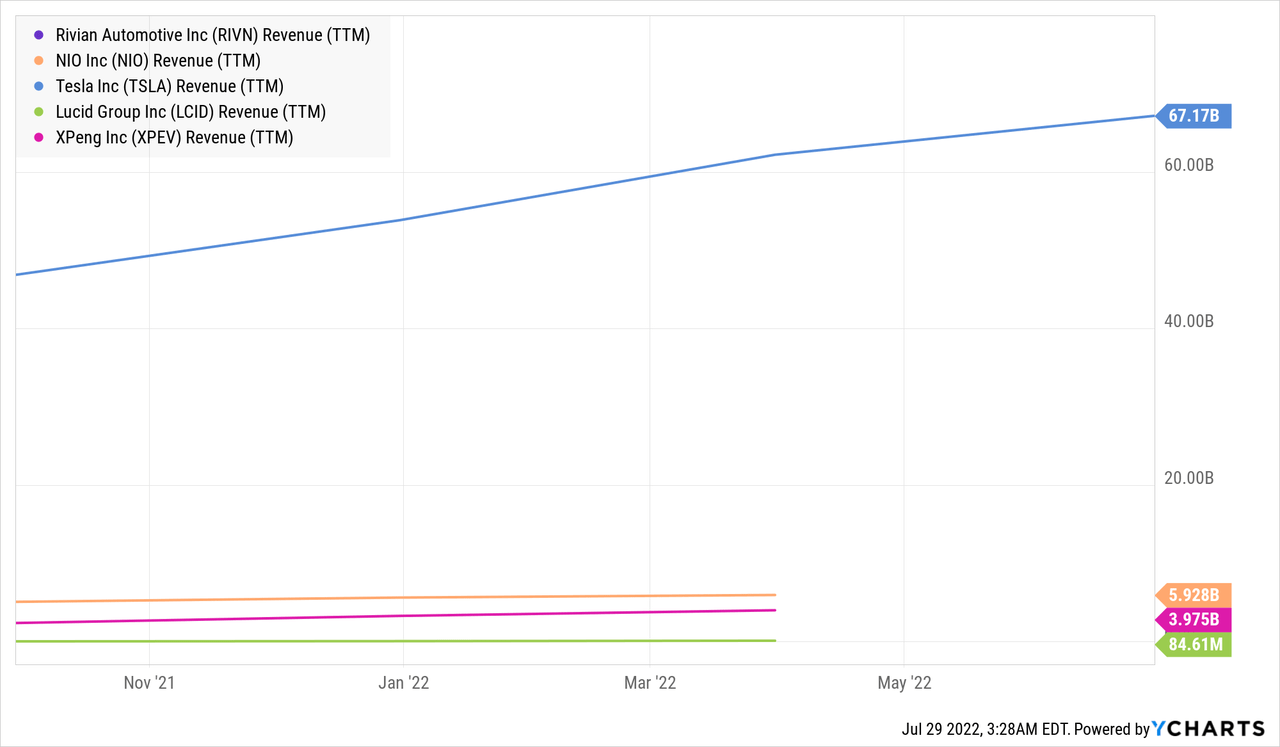

Looking at the financials, for the EV makers we are interested in, only Tesla, NIO, and XPeng (XPEV) have significant revenue of over a billion dollars at this time. Lucid (LCID) and Rivian are still very early in the ramp-up phase.

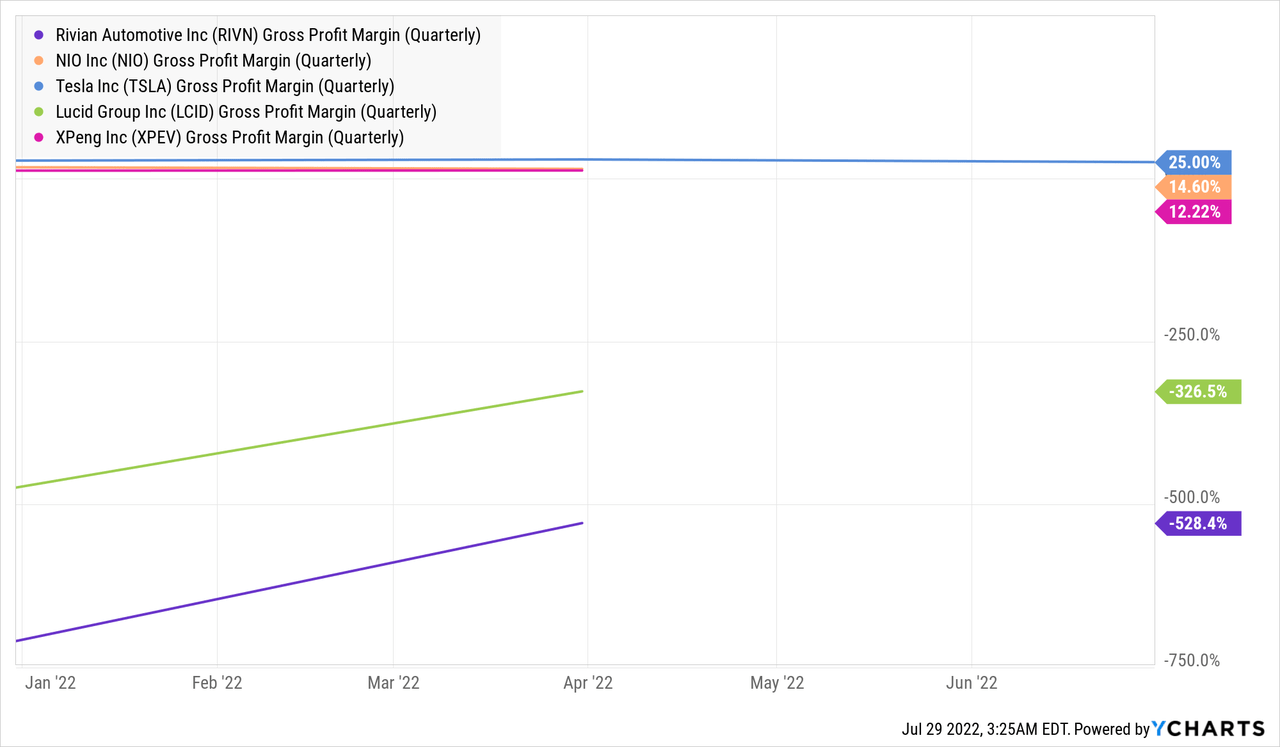

This results in significant factory sub-utilization that leads to very poor gross profit margins. As can be seen below, Tesla has the best gross profit margins of the group at ~25%, followed by NIO and XPeng at about half of Tesla’s. Lucid and Rivian have deeply negative gross profit margins, but are quickly improving as its factories start being better utilized. At this point we cannot really tell what the stabilized margins will be, but our expectation is that Rivian should have attractive gross profit margins given the strength of its brand and ‘from the ground-up’ technology it has developed.

Balance Sheet

The main reason we are optimistic about Rivian’s prospects is that it has massive capital available to it to execute on its strategy. When it comes to cash and short-term investments Rivian is close to Tesla, and significantly above the rest.

Valuation

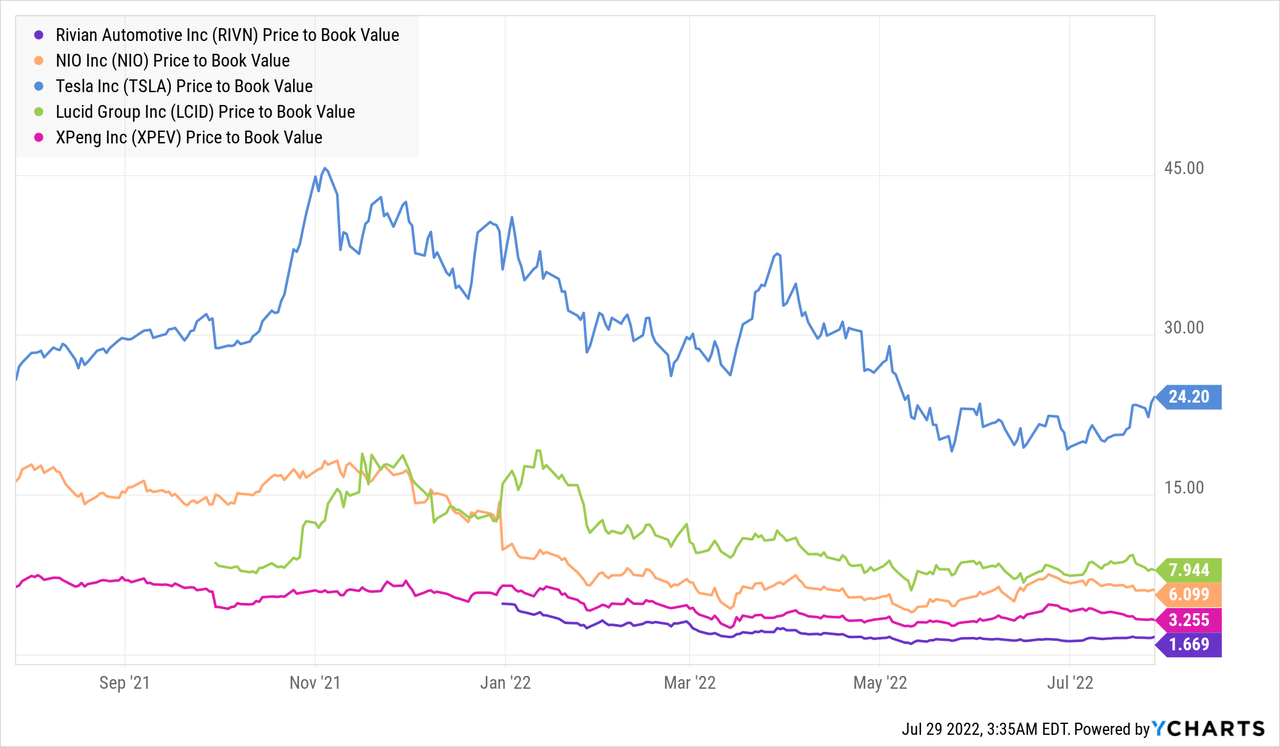

Given that Rivian is just starting to ramp-up sales and does not have meaningful revenue or earnings, we are using price/book to measure the valuation of the companies. Using this measure it is clear that Rivian is the cheapest in the group by a wide margin. Especially when considering that most of Rivian’s book value is made up of cash and short-term investments.

Risks

While there is a lot of potential with Rivian, there are enormous risks as well. It is still at a very early phase, and there is a lot of competition. It remains to be seen if the growth of the EV market can be sustained, and there are risks as well with the execution of the company’s strategy. Ramping up production in its Normal, Illinois facility, delivering compelling unit economics, and successfully introducing and ramping R2 are all critical to its long-term success. Things are certainly tough right now, with the company reportedly cutting its workforce by ~6%, but if it manages to execute on its strategy we believe it can be one of the successful EV manufacturers.

Conclusion

There is a lot to like about Rivian, and we believe it is one of the few EV companies that actually has the critical mass of capital and technology necessary to succeed in this tough industry. The company continues to grow demand with a backlog of over 90,000 R1 pre-orders and Amazon’s initial order of 100,000 EDVs. In its Q1 2022 shareholder letter the company reaffirmed its 25K 2022 annual production target. We believe that this is a positive sign that the company can execute on its strategy. It certainly has the potential to become one of the largest companies in the world, helping to drive the future of clean and sustainable transportation.

Be the first to comment