Sundry Photography

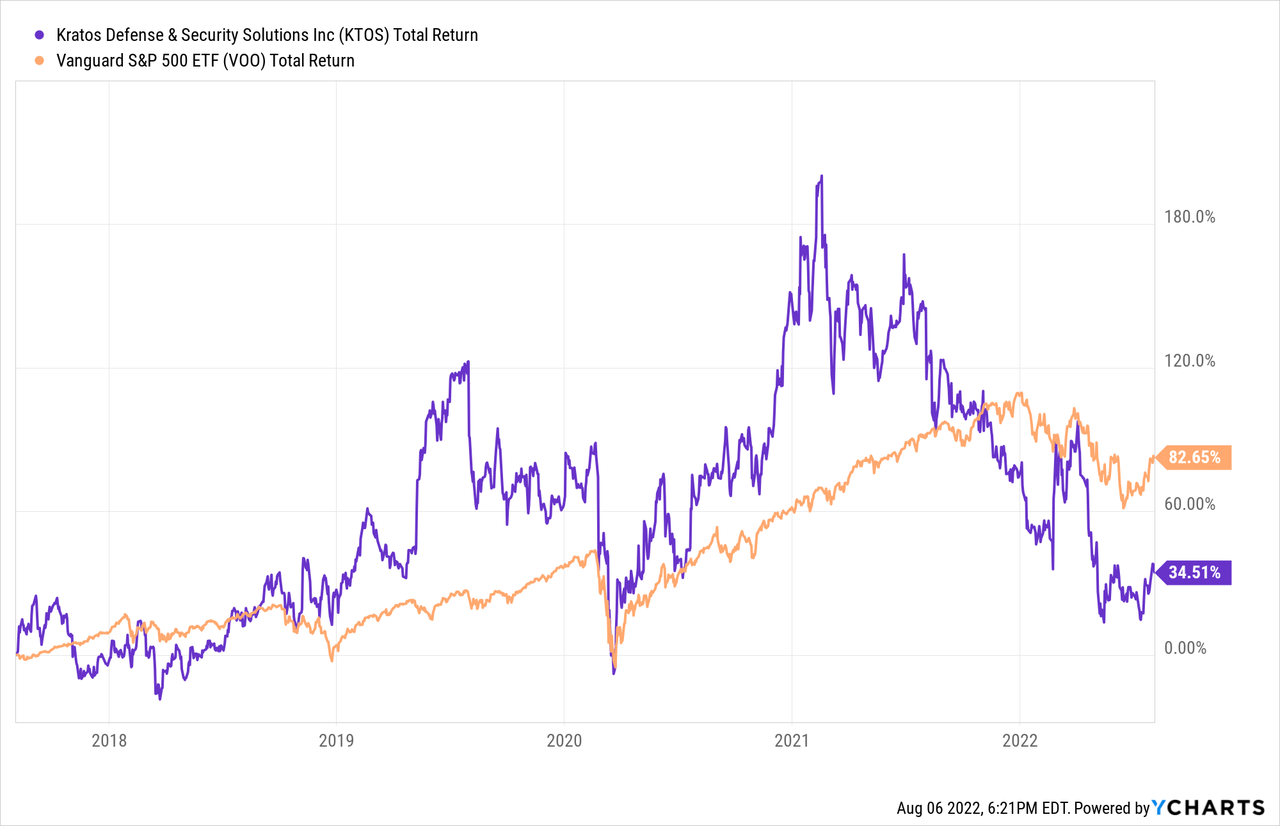

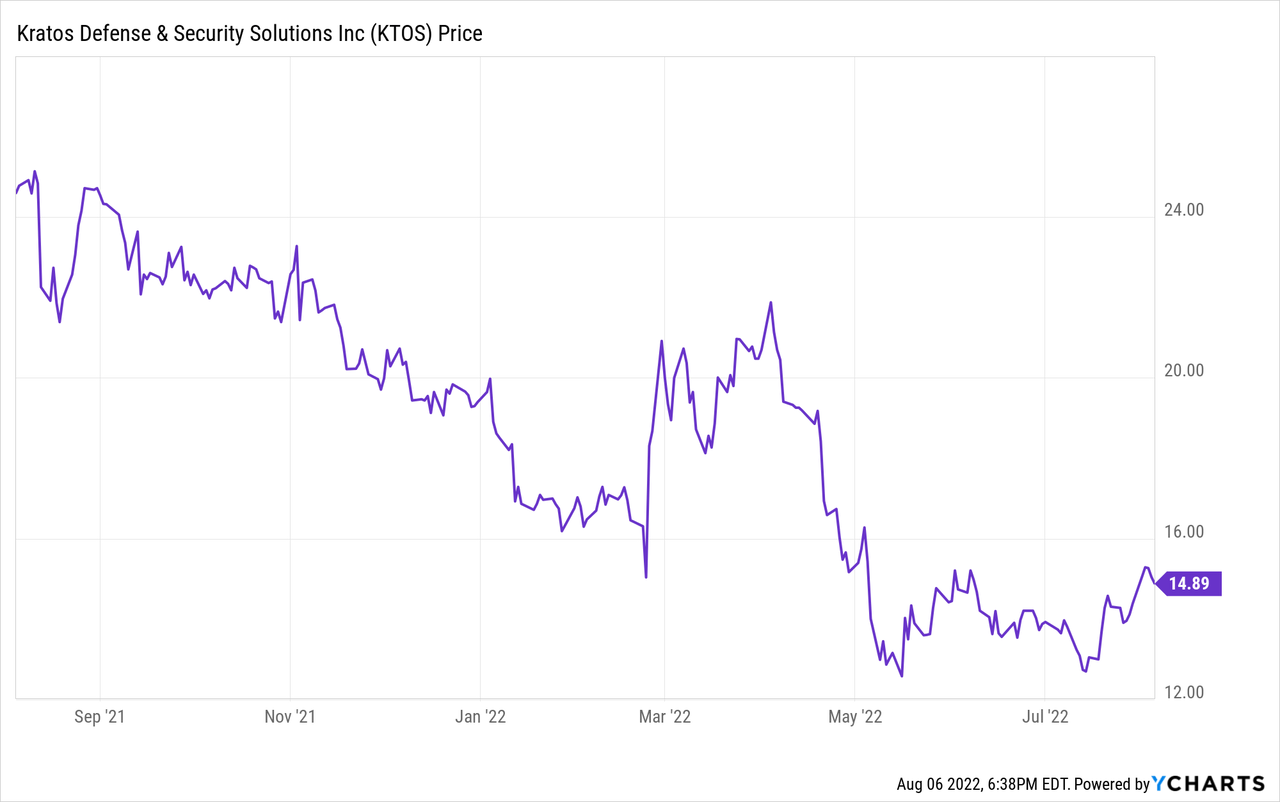

I have previously been bullish on my Seeking Alpha coverage of Kratos Defense & Security (NASDAQ:KTOS) and was no doubt influenced by ARK Investment’s heavy buying of the stock, the U.S. Department of Defense’s (“DoD”) pivot to an “over the horizon” strategy, and my general view that unmanned aerial drones had a great future. Indeed, at one point I owned stock in Kratos, but after several lack-luster quarters feel lucky to have gotten out of the stock with a small loss and before the bottom dropped out of it (see graphic below). Now that the price has dropped ~40% over the past year (and down over 50% from its high), I’ll take a fresh look at the company to see if there is a compelling reason to get back into the stock.

Investment Thesis

When I first looked at Kratos in February of 2021, the maker of unmanned aerial drones and security systems appeared to have the wind at its back (see my initial coverage of KTOS on Seeking Alpha here). The company had recently booked a slew of new orders, had a 1.8x book-to-bill ratio, and with a market-cap of only $4 billion, appeared to be ripe as a takeover candidate in a defense sector dominated by large-cap companies – some of which have a market-cap more than 25x that of Kratos.

The DoD’s pivot to an “over-the-horizon” strategy under the Biden administration appeared to be a ringing endorsement of Kratos’ business plan. Indeed, last week the Biden administration announced that Ayman al-Zawahiri, one of the perpetrators of the 9-11 attacks, was killed by two Hellfire precision guided missiles in Afghanistan’s capital of Kabul. The missiles used in the attack are believed to be the Hellfire R9X missile – nicknamed the “Flying Ginsu”. Note: Hellfire missiles are made by Lockheed Martin (LMT), Boeing (BA), and Northrop Grumman (NOC) and, to the best of my knowledge, KTOS does not manufacture Hellfire missiles or a competing rotating blade design. That said, note that all three of the large defense contractors just mentioned have market-caps in excess of ~$75 billion and could easily swallow a company like Kratos.

Meantime, Kratos was getting large institutional investment support (and free publicity …) by Cathie Wood’s ARK funds. Indeed, despite the big drop in the stock price, Kratos is currently the #2 holding in the ARK Space Exploration & Innovation ETF (ARKX). ARKX holds 1.77 million KTOS shares – that’s good enough for 8.0% weighting in the fund. In addition, Kratos is currently the #3 holding in the ARK Autonomous Technology & Robotics Fund (ARKQ) – which holds 6.70 million share of KTOS, also good enough for an 8.0% weight. In aggregate, the two ARK funds hold 8.47 million shares of Kratos. ARK’s strategy is to invest in transformative growth stocks with a 5-year time horizon and that can clear its growth rate hurdle of a 15% CAGR. All things being equal, a 15% CAGR means the stock should roughly double every 5-years.

So, let’s see how Kratos has been performing of late, if it has met the 15% CAGR rate hurdle, and what the company’s prospects are going forward.

Earnings

Kratos released its Q2 EPS report last week and it was a beat on both the top- and bottom-lines. Highlights included:

- Revenue of $224.2 million was +9% yoy

- Non-GAAP EPS of $0.07/share beat by $0.03.

- Adjusted EBITDA was $17.7 million.

- Corporate Book-to-bill ratio of 1.2 to 1.0.

Eric DeMarco, Kratos’ President and CEO, commented on the quarter, saying the company had “a current opportunity pipeline of over $9 billion” and that Kratos had:

… now received each of the three important, large new satellite related program awards we discussed in our Q1 2022 report, including contracts with Blue Halo and Intelsat, which we believe position Kratos for future organic growth and increased margins beginning in the second half of this year. We believe these awards are representative of the increasing customer acceptance of Kratos’ first to market, internally funded and developed, software-based OpenSpace virtualized family of products and we are now in pursuit of several additional, large, new satellite program opportunities.

In addition, DeMarco said:

Since our last report to you, the Air Force announced to Congress that the Skyborg Vanguard program, which includes Kratos’ Valkyrie (shown below), is now planned to be a Program of Record in 2023 and transition to acquisition. Additionally, Kratos’ tactical drone business continues to progress, including recent successful flights at the Burns Flat, Oklahoma range and other locations, and we are expecting to receive certain new tactical drone related contract awards in the second half of this year, including as related to Valkyrie.

Source: Kratos

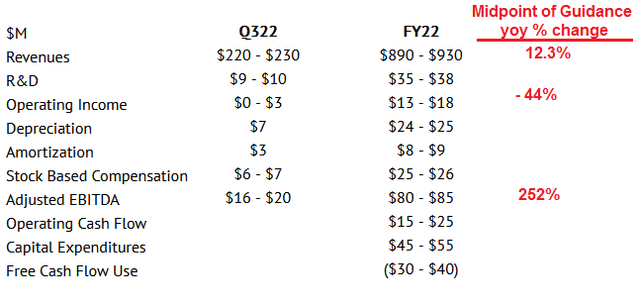

The company’s forward guidance for Q3 and FY22 is shown below. In red, I have compared the midpoint of FY22 guidance with FY21 guidance and shown the yoy percentage increase (or decrease):

As can be seen, the midpoint of FY22 revenue guidance is 12.3% above FY21 results, while the midpoint of FY22 operating income ($15 million) is actually below FY21’s $27.9 million. Adjusted EBITDA is the bright spot with the midpoint of guidance jumping 252% yoy.

Valuation

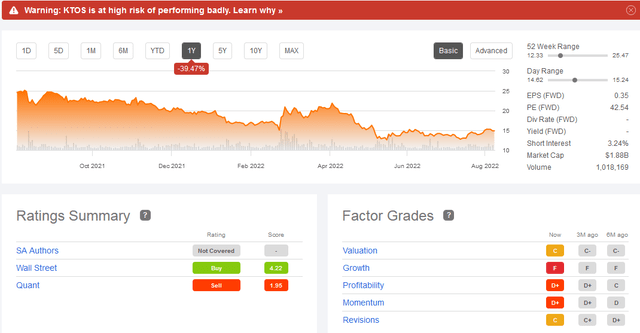

As shown in the graphic below, Kratos currently trades with a forward P/E of 42.5x (note that is based on adjusted EPS, not GAAP):

Note also that Seeking Alpha has flagged KTOS to be at “high risk of performing badly” due to its SELL quant rating and poor grades in terms of growth, profitability, and momentum.

With a market-cap of $1.88 billion, KTOS trades at a relatively large 22.8x times the midpoint of FY22 adjusted EBITDA ($82.5 million).

Risks

Note the Q2 EPS report included this gem: “Second quarter 2022 Operating Loss includes non-cash stock compensation expense of $6.3 million.” That means the executive team is receiving huge stock-based compensation packages even as ordinary shareholders suffer a large drop in the stock price.

KTOS ended Q2 with a relatively solid balance sheet: $293.8 million in long-term debt and cash & cash equivalents of $142.4 million.

KTOS is not living up to ARK’s 15% CAGR hurdle, at least not when it comes to revenue and earnings growth. That being the case, at some point ARK might be inclined to sell its relatively large stake of 8.47 million shares, which equates to an estimated 6.8% of KTOS entire float (123.75 million shares).

Upside risks include a possible acquisition of KTOS by a large defense supplier.

Summary & Conclusions

While I am still bullish on Kratos and the unmanned aerial drone market, and despite the near 40% drop in the stock price over the past year, I still think the stock is relatively overvalued. However, the stock does appear to be putting in a bottom here – so perhaps the worst is over. The best I can do is rate the stock a HOLD, but I have a feeling investors would find themselves much better off 3-5 years from now simply investing in a solid low-cost S&P500 fund like the Vanguard S&P 500 ETF (VOO).

I’ll end with a 5-year total returns chart of Kratos versus the VOO ETF and note that not only does KTOS does not pay a dividend, but the stock has given up virtually all the gains it made during the “COVID-19 easy money” bull market that started in 2020:

Of course, I know I am not making an apples-to-apples comparison here: Kratos is a growth play, while the VOO ETF is a broad market index. That said, when it comes to portfolio management, I tend to judge all new investments by comparing it to the S&P500. If an investor wants growth, even a company like Google (GOOG, GOOGL) appears to be a much better choice as compared to Kratos, and it generally has cleared ARK’s 15% hurdle, and ended Q2 with $125 billion in cash ($9.44/share) even after buying back $12.8 billion of stock during the quarter, generated free-cash-flow of $12.6 billion, and recently split the shares 20:1. Now THAT is a growth stock. As a result, Google remains my top mega-cap tech growth pick.

Be the first to comment