Spencer Platt/Getty Images News

Company Snapshot

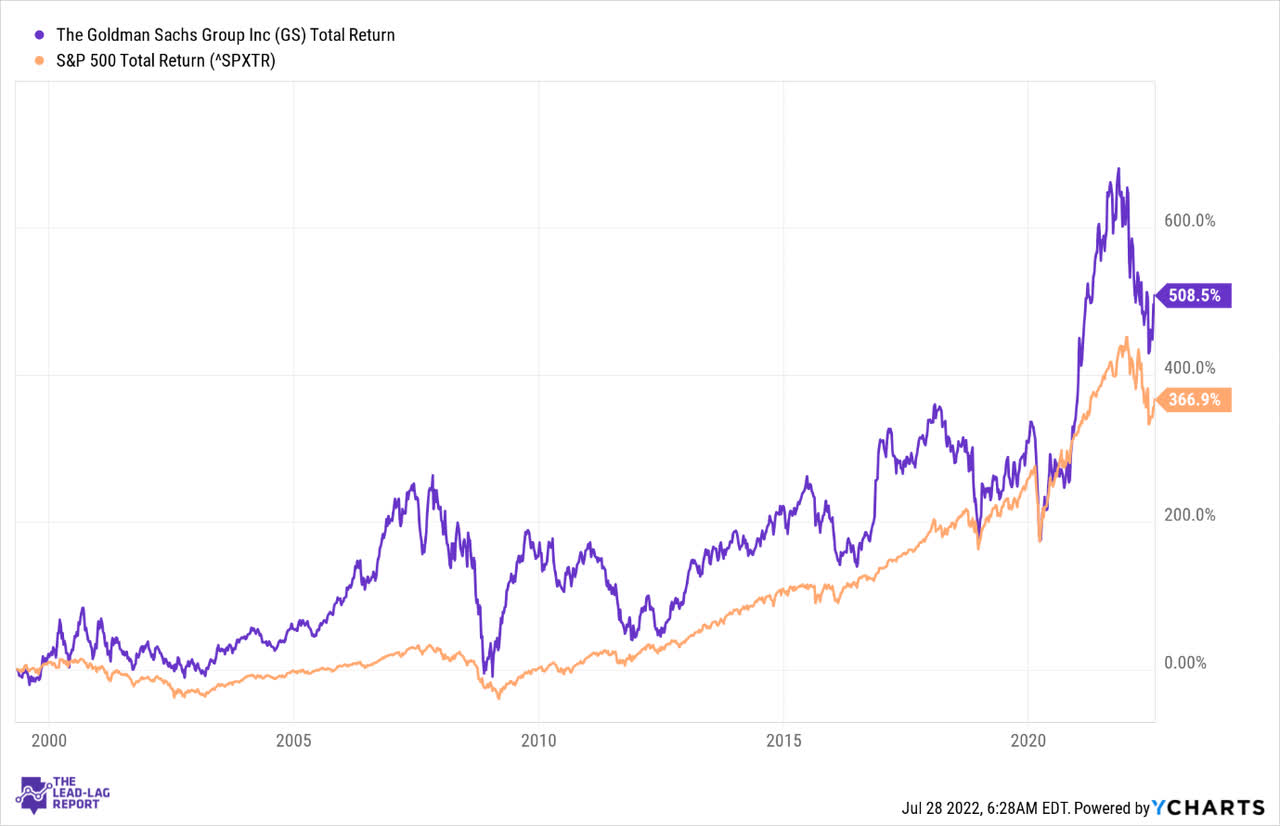

Goldman Sachs (NYSE:GS), is a Global Systemically Important Bank (GSIB) that operates under four broad divisions; Investment Banking, Global Markets, Asset Management, and Consumer & Wealth Management. Since it made its debut on the bourses in 1999, it has proven to be a very adequate source of alpha, comfortably outperforming the S&P500 by 1.38x, and doing so for long periods.

YCharts

GS Stock Key Metrics

Goldman Sachs recently came out with its Q2 results a few weeks back, beating street estimates on the top line and bottom line. Last month also saw the closure and announcement of the Fed’s stress test results. Whilst the Goldman story is such a diverse canvass, with varying sub-plots, I thought there were a few things worth highlighting from both these events.

Investment banking was something of a mixed bag; given the general state of the equity and debt markets, it was no surprise to discover significant weakness in Goldman’s underwriting businesses (aggregate underwriting which includes both debt and equity was down by 58% vs Q1, and 73% vs Q2 last year). However, what turned out to be a positive surprise within investment banking was advisory revenues, which actually improved from Q1 ($1.19bn vs $1.12bn in Q1). We are clearly not in an environment where you’ll see transformational deals, but it looks like there is still some appetite for strategic M&A. Having said that, I would be very surprised to see their advisory revenue run rate improve even further in Q3.

Whilst business conditions will likely remain challenged, it was encouraging to discover a drastic decline in compensation and benefits expenses (down 30% YoY and 10% QoQ). For H1 as a whole, compensation expenses are down by $3.5bn, and management has also spoken about their desire to slow down hiring and mitigate attrition trends going forward.

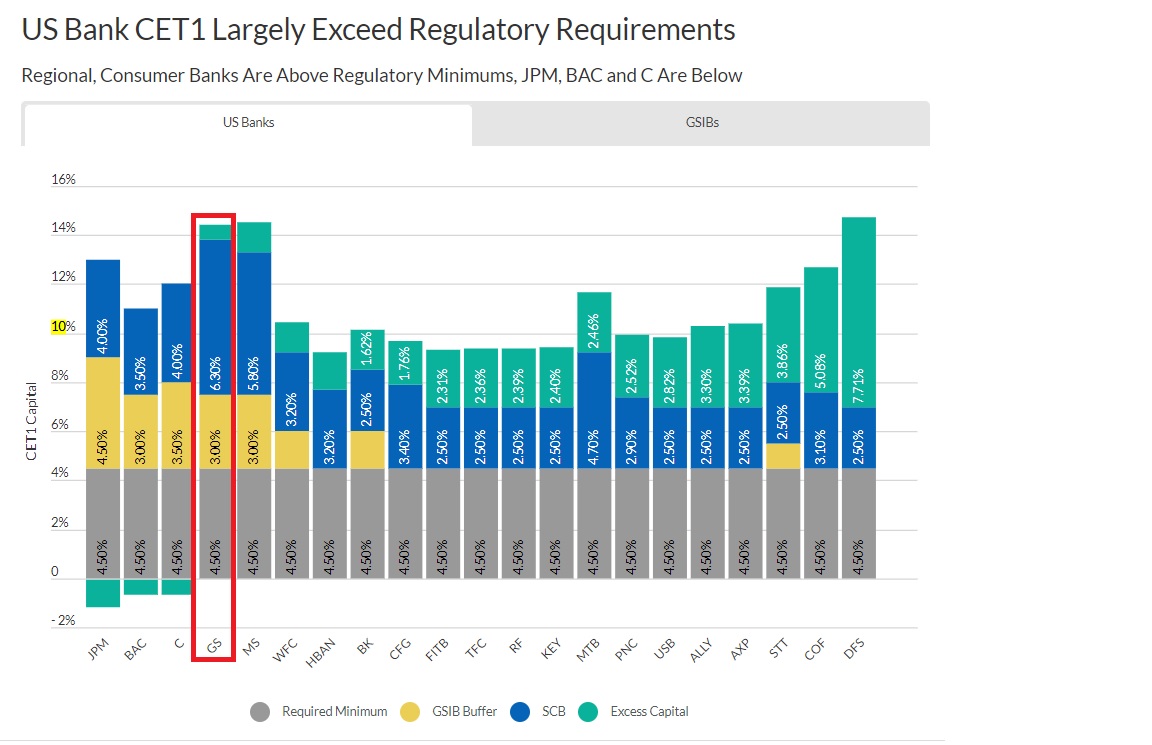

With regards to the Fed’s Stress test, a couple of things stood out. Out of all the banks, GS was the only bank to witness a decline in its stress capital buffer (SCB) from 6.4%, although it’s worth noting that these levels are still considered to be extremely elevated compared to the rest of the banking pack (typically within the 2.5-4% range).

Fitch Ratings

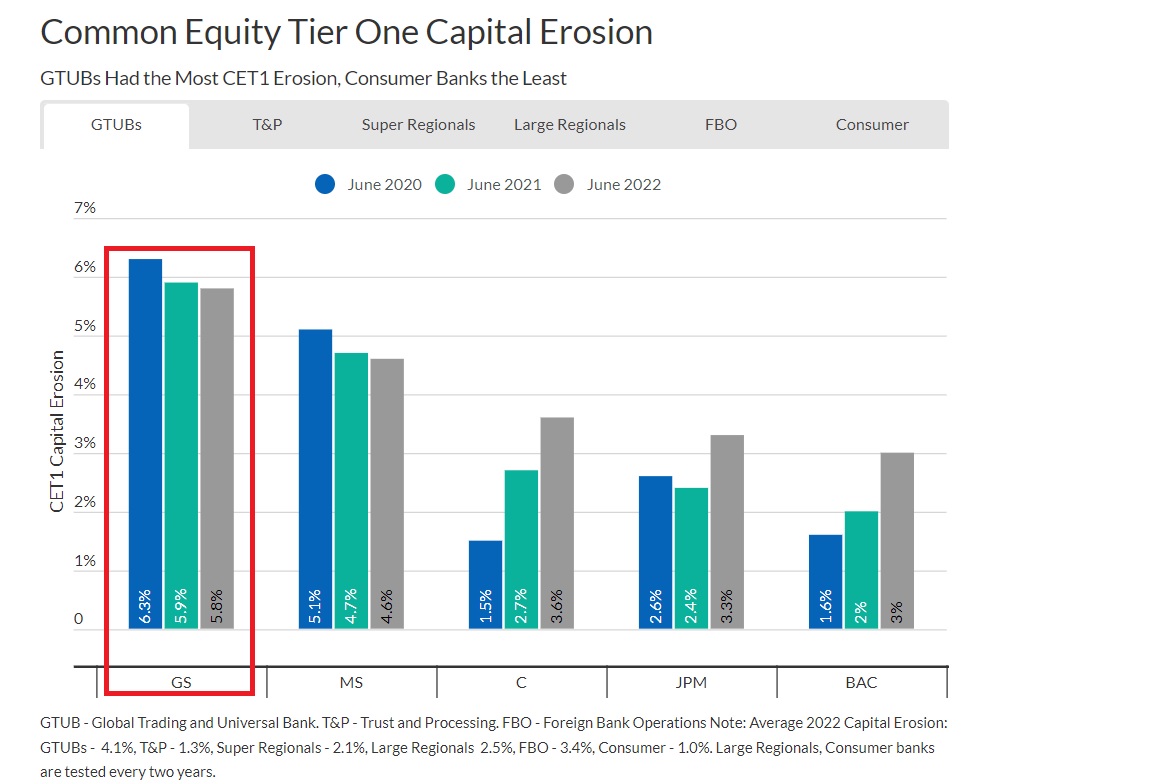

It was also estimated that under a severely adverse scenario, no other bank would face a greater hit on its CET-1 ratio than GS. Whilst that is indeed daunting to hear on the surface, the silver lining is that the impact would be marginally lower this year (5.8%) vs last year (5.9%).

Fitch Ratings

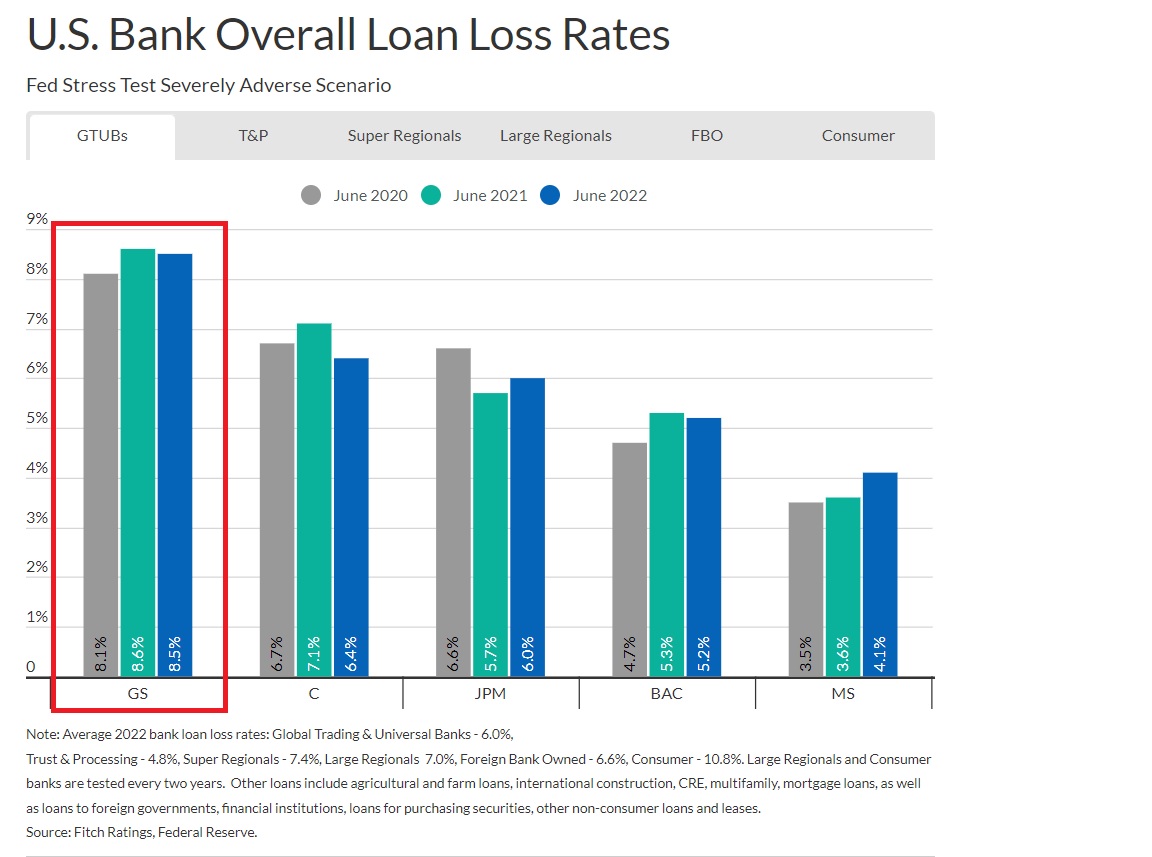

Also consider that under severely stressed conditions, GS could end up with the highest loan loss rates (8.5%) amongst its global trading peers.

Fitch Ratings

Whilst the stress test results highlight the innate riskiness of the GS business model, don’t dismiss the dividend profile on offer post these tests. I’d like to think that GS was particularly generous with its dividend hike, increasing its quarterly dividends by 25% (from $2 to $2.5). Some of you may say that the 25% hike isn’t particularly great, as it is more or less in line with the 5-year CAGR track record of 24.3%, and it is also lower than last year’s fantastic 60% hike (from $1.25 to $2), but I still believe it is something to behold, as most other banks (not only GSIBs) only hiked their dividends by 10% on average, with some even choosing not to bring through any hikes at all. Nonetheless, extrapolating the latest dividend numbers, investors can now pocket a very handy forward yield of 3%, which is substantially higher than GS’s own long-term average yield of 1.7%.

Separately, GS also deserves to be commended for the regularity with which it has been paying dividends; this has been going on for 22 years, whilst most other banks have only been doing this for 13 years or so.

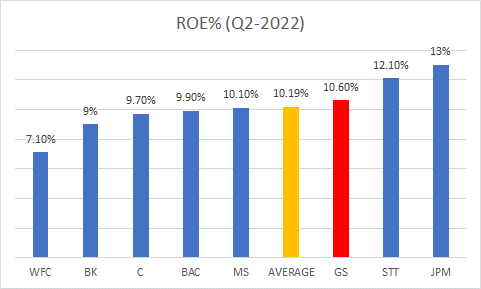

Then, before I move on to the valuations, I also felt it was important to understand if GS delivers ample bang for the buck for its shareholders, relative to the other GSIBs. Based on the most recent quarterly ROEs (Return on Equity), we can see that whilst it is not the best in the business, Goldman did a decent enough job, delivering a figure of 10.6%, slightly above the average of the peer set of 10.2%. It’s also worth noting that Goldman’s medium-term target (by 2024) is to get to ROEs of 14-16%.

Quarterly Reports

Having said that, in the short term, I suspect it would be challenging to get closer to that lower end of that target ROE range, as important segments such as underwriting and asset management remain subdued in a volatile market environment. Do also consider that the broad investment banking backlog has been sliding sequentially for two straight quarters now. Besides, a lot of investments and associated OPEX still need to be made to beef up the consumer division. Put another way, when your efficiency ratio (opex as a function of total net revenue), is trending up by around 740bps (GS’s H1-22 efficiency ratio came in at 62%), it’s always going to be difficult to generate ROE expansion.

Is The Goldman Sachs Stock Overvalued Or Undervalued?

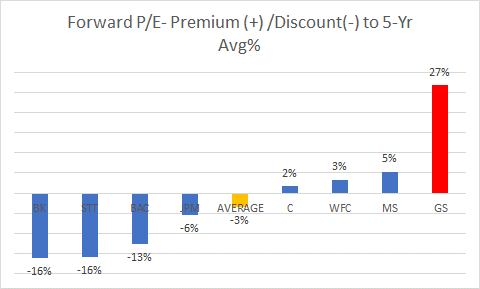

YCharts estimates for Goldman point to an annual FY22 EPS figure of $34.89, implying a hefty annual de-growth of 41%. This also translates to a relatively pricey (versus its 5-year average of 7.3x) forward P/E multiple of 9.3x, implying a premium of 27%.

YCharts

This forward P/E premium comes across as quite steep when you consider that its peers can be picked up at a discount of 3% on average.

YCharts

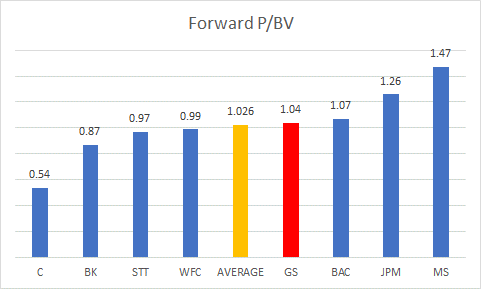

Then we shift to the forward P/BV which is the more appropriate valuation metric when gauging banks. According to Seeking Alpha data, the GS stock is currently trading at a forward P/BV of 1.04x, which represents a mid-single digit discount to its long-term average of 1.1x.

Seeking Alpha

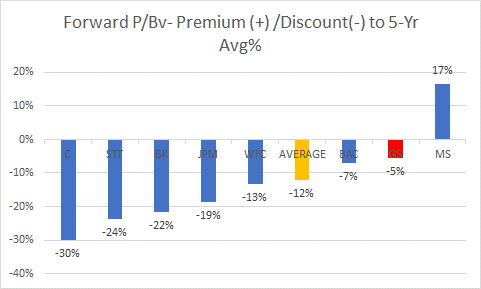

That discount is not hugely compelling when you consider that except for Morgan Stanley, all the other peers are available at more pronounced discounts to their long-term forward P/BV averages.

Seeking Alpha

Thus, to conclude this section, it’s fair to say purely on a valuation basis that Goldman’s stock isn’t the best bet around.

Closing Thoughts – Is GS Stock A Buy, Sell, Or Hold?

If one were to go with the views of the majority of the sell-side analyst community, GS’s stock comes across as a good investment opportunity at current levels. For added perspective, note that out of the 27 Wall Street analysts that cover the stock, 63% of them either have a ‘Buy’ or ‘Outperform’ rating, with the remaining 37% comprising of ‘Hold’ ratings, with no ‘Sell’ ratings whatsoever. The average analyst price target also works out to $391, implying potential upside of over 20% from current price levels.

In addition to that, you’d also be interested to note that the influential institutional investor cohort has been turning increasingly bullish on the stock; at the start of the year, only 428.4m shares of GS were owned by these institutions; at the end of last month, their stake had grown by 24% to reach 531.7m.

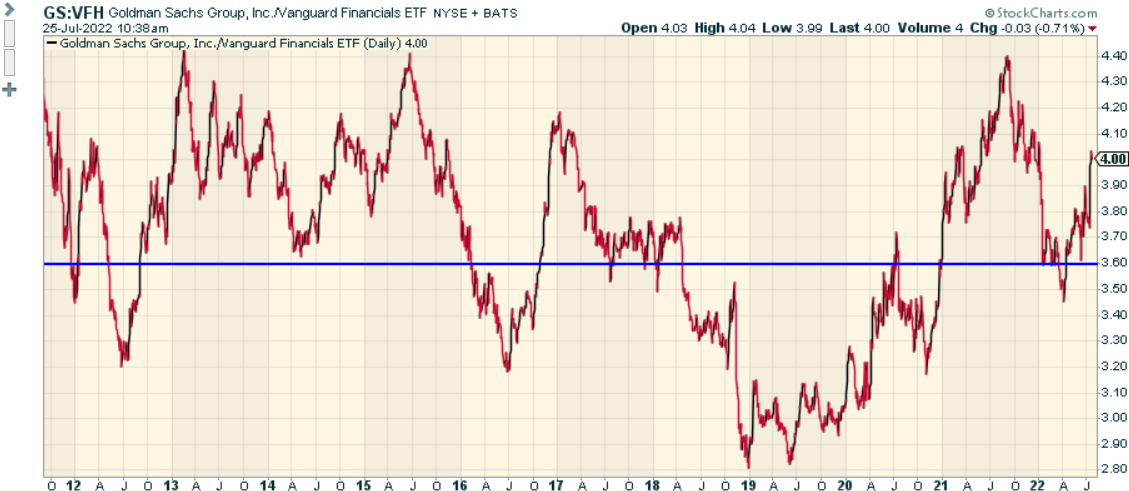

Despite the bullish positioning of the smart money, I would be disinclined to join them. As noted in the previous section, the valuation picture of GS isn’t overly compelling. Besides, whilst the stock’s yield facet looks attractive, one should also consider that in the current market environment, the bank’s core businesses will find it hard to flourish. Finally, also consider how GS’s stock is positioned relative to its peers in the financials space, as represented by the Vanguard Financials ETF (VFH). Whilst this ratio no longer looks overbought, it still trades well above the mid-point of this range, implying sub-optimal risk-reward for those viewing GS as a prospective rotational opportunity in the US financials space.

StockCharts

To conclude, a ‘Hold’ rating feels appropriate at this price point.

Be the first to comment